What simply occurred? AMD has gained CPU market share over the previous quarter throughout desktops, laptops and servers. The report comes from PC {hardware} market analysis agency Mercury Analysis, who has break up the ends in two classes: income share and unit share.

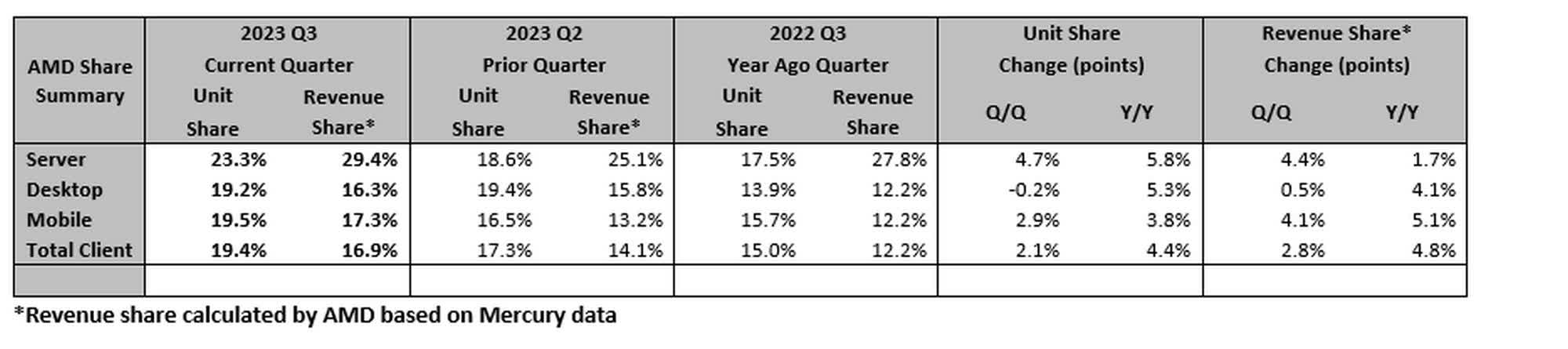

In response to Mercury Analysis (through Tom’s {Hardware}), AMD gained 5.8 p.c unit share in desktops, 3.8 p.c in laptops, and 5.8 p.c in servers. By way of income share, Crew Crimson gained 4.1 p.c in desktops, 5.1 p.c in laptops, and 1.7 p.c in servers. The report doesn’t point out opponents by identify, however the international PC business solely has one different main CPU provider, Intel, which has a serious stake in all of the market segments.

Whereas Intel and AMD make x86 processors for PCs, Qualcomm provides Arm-based SoCs for Home windows notebooks, however its market share is minuscule by comparability. So, whereas the report would not say something concerning the market share of Intel or Qualcomm, it’s honest to imagine that almost all of AMD’s beneficial properties got here at Intel’s expense.

Based mostly on this information, AMD believes its desktop market share was at 19.2 p.c in Q3 2023, a 5.3 share improve from the 13.9 p.c share throughout the identical interval final 12 months. Within the laptop computer market, the corporate’s estimated market share was 19.5 p.c, up from 15.7 p.c throughout Q2 2022. Within the server market, AMD garnered a 23.4 p.c share, up from 17.5 p.c throughout the year-ago quarter.

The report attributes AMD’s sturdy displaying to its 4th-gen EPYC and Ryzen 7000-series processors, each of which have been launched over the previous 12 months. It’s fascinating that the Ryzen 7000 lineup has been such successful for AMD, because it requires a complete platform improve to socket AM5 and DDR5 reminiscence. As compared, Intel’s Thirteenth- and 14th-gen Raptor Lake processors nonetheless use the identical LGA 1700 socket as its Twelfth-gen Alder Lake CPUs, and help each DDR4 and DDR5 RAM, which means folks do not need to put money into new motherboard and RAM to leap to the most recent platform.

The worldwide PC market is beginning to present indicators of restoration after a number of quarters of destructive development. Over the previous few months, gross sales confirmed a marked upsurge, because of elevated shopper exercise for the back-to-school season. With the vacation season now in full swing, gross sales ought to stay sturdy for PC OEMs, which is nice information for chipmakers like Intel and AMD.