In algorithmic buying and selling, there’s a persistent fantasy:

the upper the Win Charge, the safer and extra dependable the buying and selling system.

In actuality, this is among the most harmful misconceptions — particularly in the case of long-term investing and portfolio-based buying and selling.

Most methods with an especially excessive Win Charge (80–95%) are scalpers or short-term methods with low and even adverse Danger-Reward, which suggests they’re essentially working in opposition to mathematical expectation.

Let’s break down why.

1. Mathematical Expectation Is the Core of Any Buying and selling System

Any buying and selling technique may be diminished to a easy components:

Anticipated Worth (EV)

EV = (WinRate × Common Revenue) − (LossRate × Common Loss)

The important thing takeaway is straightforward:

Win Charge alone is meaningless if Danger-Reward is under 1.

Instance 1 — A “Stunning” Scalping System

End result:

9 × 1 − 1 × 10 = −1

Regardless of a really excessive Win Charge, the system is unprofitable.

Instance 2 — A Pattern-Following System

End result:

Fewer trades, fewer feelings — considerably higher long-term efficiency.

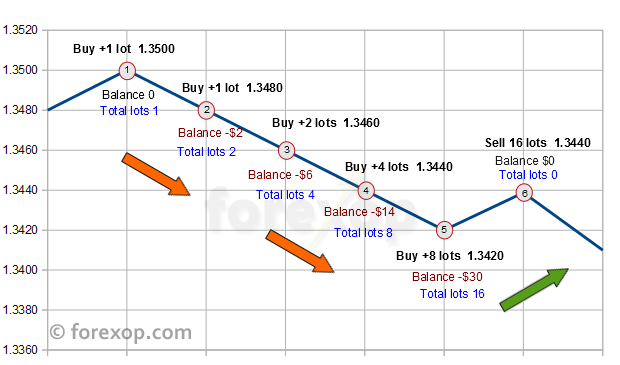

2. Why Excessive Win Charge Creates an Phantasm of Stability

Techniques with very excessive Win Charge normally share the identical traits:

Such methods:

typically look spectacular over quick intervals

fail throughout regime shifts or irregular market circumstances

behave like a time bomb — secure till a single occasion destroys months or years of income

This isn’t investing.

It’s adverse expectancy buying and selling masked by psychological consolation.

3. Why Pattern and Value Motion Are Structurally Extra Strong

Pattern-following and Value Motion methods are constructed on a essentially totally different logic:

losses are accepted rapidly and managed

income will not be artificially capped

the system advantages from value asymmetry and market enlargement phases

Key benefits:

optimistic mathematical expectancy

adaptability to totally different market regimes

no dependence on ultra-precise entries

Necessary precept:

The market doesn’t owe you a excessive Win Charge.

It owes you sufficient motion to cowl your losses and generate asymmetry.

That’s precisely what trend-following methods are designed to seize.

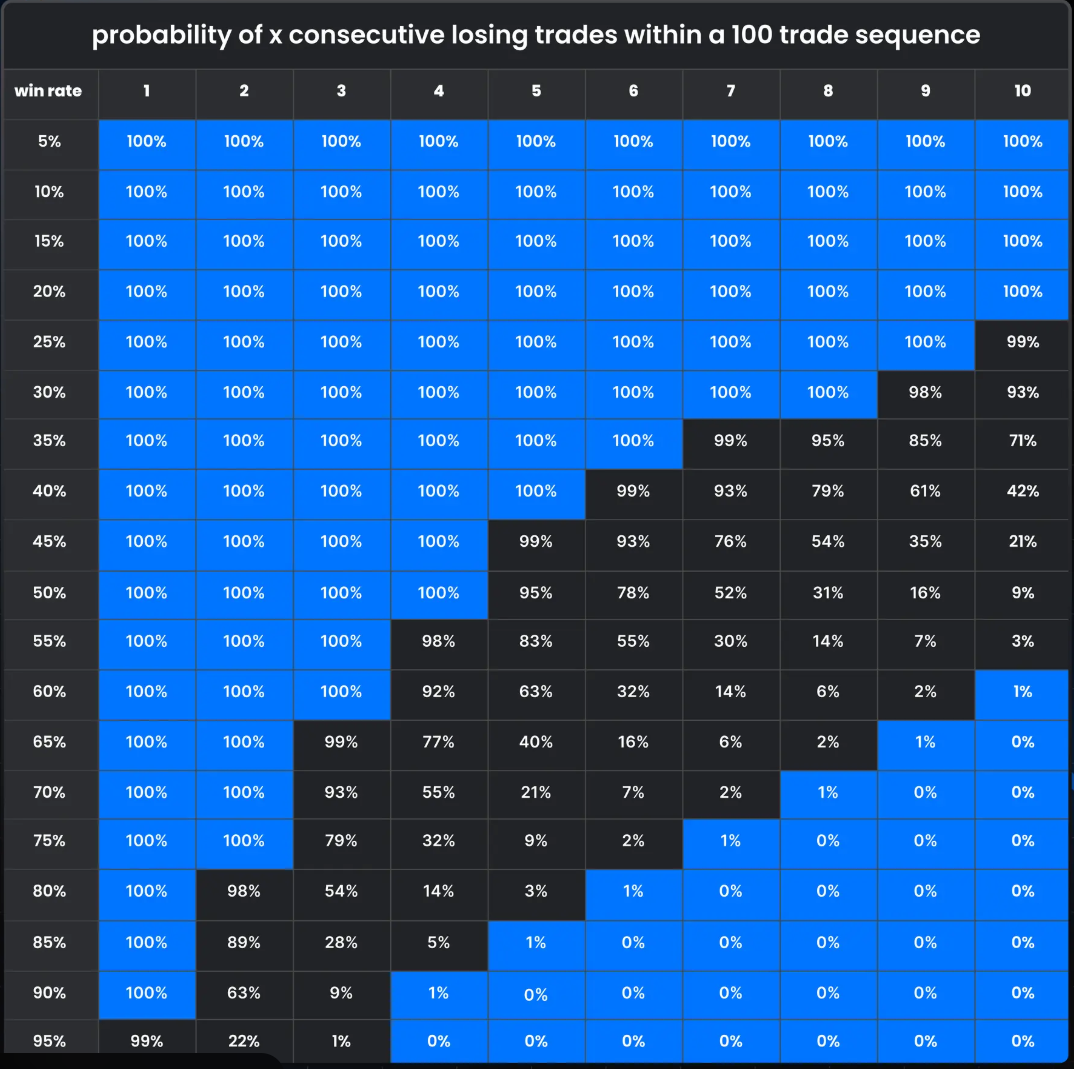

4. Danger-Reward as a High quality Filter

A excessive Danger-Reward ratio robotically:

protects the buying and selling account

reduces the influence of dropping streaks

improves long-term statistical stability

Structural Comparability

| Parameter | Excessive Win Charge Scalper | Pattern / Value Motion |

|---|---|---|

| Win Charge | Very excessive (80–95%) | Average (30–50%) |

| Danger-Reward | < 1 | 2–6 |

| Drawdowns | Uncommon however deep | Managed |

| Market sensitivity | Very excessive | Low |

| Appropriate for investing | ❌ | ✅ |

5. Examples of Excessive Danger-Reward Techniques

In follow, this method is carried out in methods resembling:

One core logic — a number of asset lessons.

Minimal overfitting on account of working with course and construction, not market noise.

6. Why These Techniques Are Higher for Portfolio Buying and selling

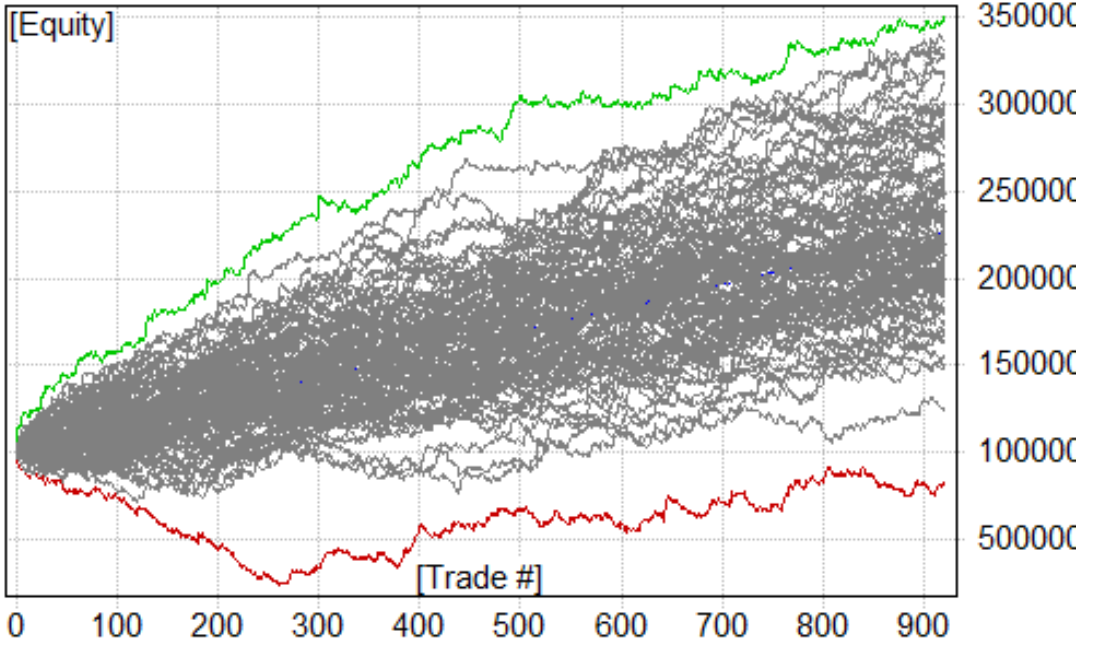

Pattern-following methods with excessive Danger-Reward:

mix properly with one another

have low entry correlation

produce smoother fairness curves over lengthy horizons

This makes them:

appropriate for long-term investing

efficient constructing blocks for diversified portfolios

relevant on each netting and hedging accounts

Conclusion

In easy phrases:

Excessive Win Charge appeals to psychology.

Excessive Danger-Reward satisfies arithmetic.

Markets don’t reward merchants for being proper typically.

They reward merchants who make extra when they’re proper than they lose when they’re improper.

That’s the reason trend-following and Value Motion methods stay

some of the sturdy and sustainable approaches for long-term buying and selling and funding.