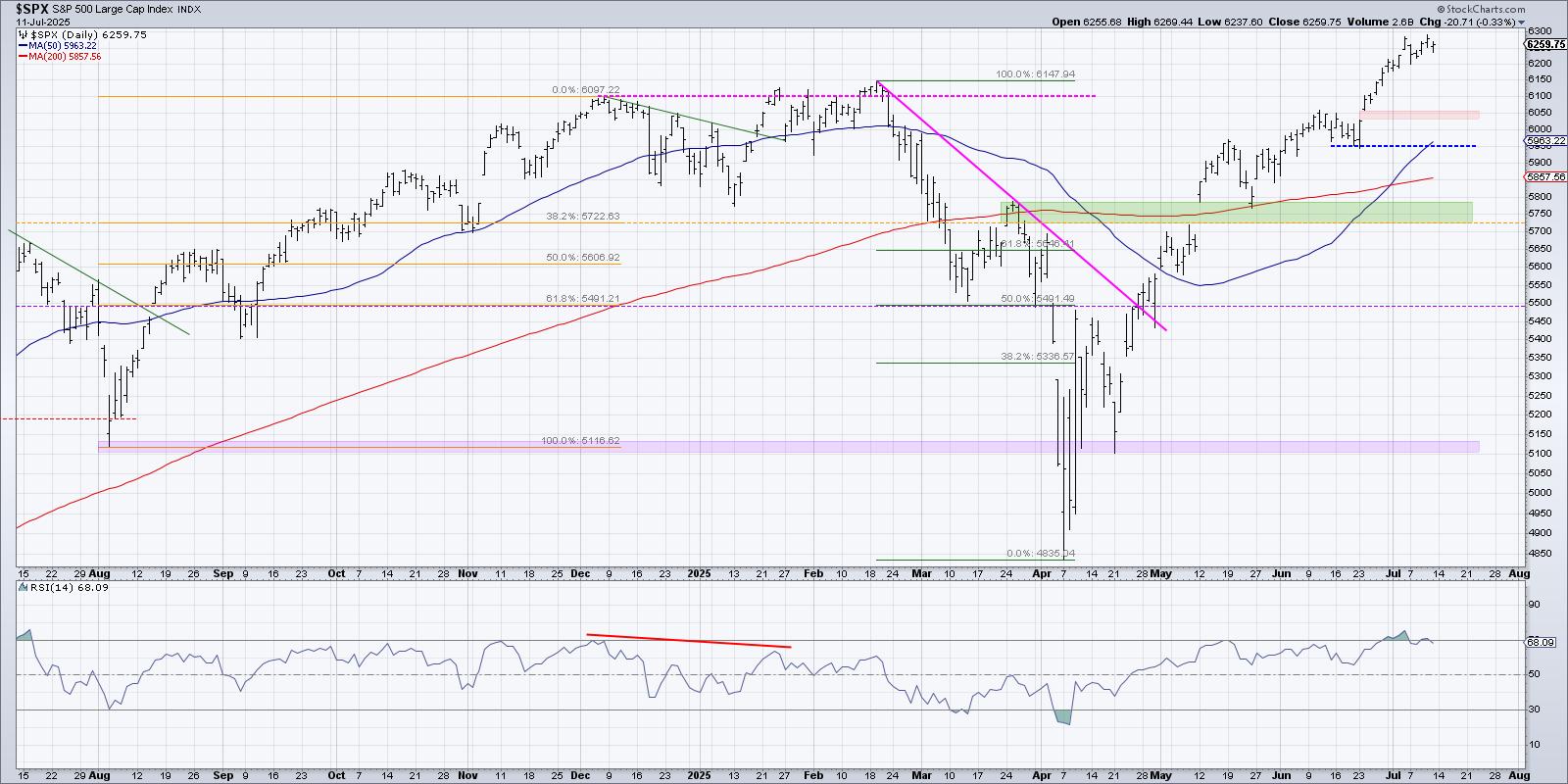

The S&P continues to push increased, with the fairness benchmark virtually reaching 6300 this week for the primary time in historical past. With so many potential macro headwinds nonetheless surrounding us, how can the market proceed to mirror a lot optimism? Then again, when will bulls get up and understand that this market is clearly overextended and rotate considerably decrease?

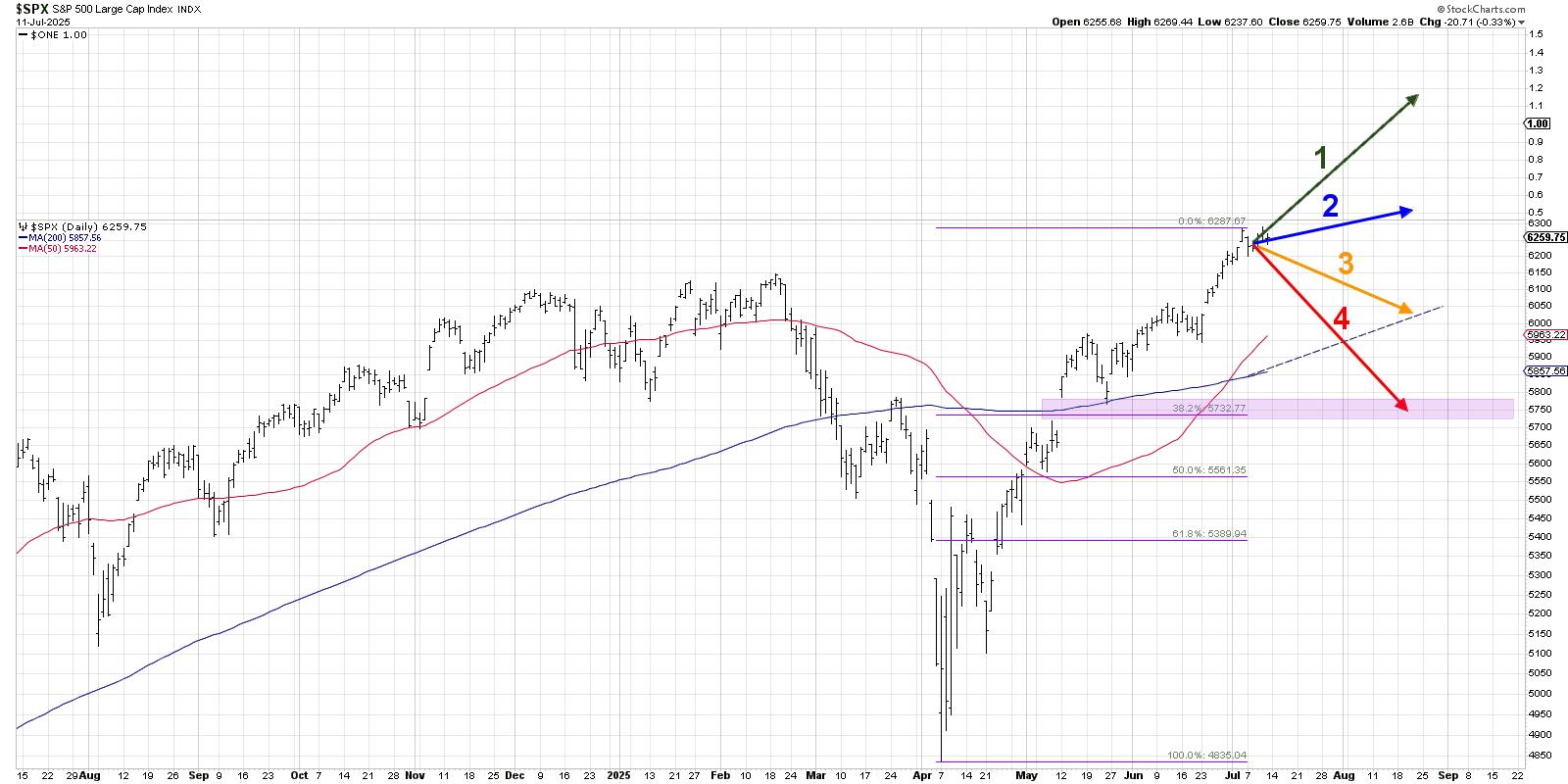

With the S&P 500 as soon as once more attaining new all-time highs, and with Q2 earnings simply across the nook, I assumed it will be an ideal time to revisit an train in probabilistic evaluation. Mainly, I am going to lay out 4 totally different situations for the S&P 500 index between now and late August. Which path do you see because the almost certainly and why? Watch the video, try the primary situations, after which solid your vote!

By the way in which, we final ran this analytical course of on the S&P 500 again in Might, and take a look at which situation really performed out!

And bear in mind, the purpose of this train is threefold:

- Take into account all 4 potential future paths for the index, take into consideration what would trigger every situation to unfold when it comes to the macro drivers, and overview what alerts/patterns/indicators would affirm the situation.

- Resolve which situation you’re feeling is almost certainly, and why you assume that is the case. Do not forget to drop me a remark and let me know your vote!

- Take into consideration how every of the 4 situations would affect your present portfolio. How would you handle danger in every case? How and when would you’re taking motion to adapt to this new actuality?

Let’s begin with essentially the most optimistic situation, with the S&P 500 index persevering with the current uptrend section to retest all-time highs by June.

Possibility 1: The Tremendous Bullish Situation

Essentially the most bullish situation would contain the S&P 500 persevering with the same trajectory that we have seen off the April low. Progress continues to dominate, tariffs stay basically a non-issue, volatility stays decrease, and the market strikes onward and ever upward!

Dave’s Vote: 10%

Possibility 2: The Mildly Bullish Situation

What if the uptrend continues, however at a a lot slower fee? The “mildly bullish situation” would imply the S&P 500 most likely tops out round 6300-6400 however does not get any additional. Maybe a management rotation emerges, and know-how shares begin to pull again as traders rotate to different sectors and themes. Lack of upside momentum from the most important progress names slows the uptrend in a giant method.

Dave’s vote: 30%

Possibility 3: The Mildly Bearish Situation

Perhaps “the highest” is already in, and though July is historically a robust month, we see a corrective transfer into August that brings the S&P 500 right down to the 200-day shifting common. Bulls and bears would most likely really feel fairly vindicated right here, as bulls would see this as a wholesome pullback, and bears would see this as a critical get up name for traders.

Dave’s vote: 45%

Possibility 4: The Very Bearish Situation

We at all times want a doomsday situation, and right here we’ll describe how the S&P 500 might return right down to retest the Might worth hole. If Q2 earnings season turns into all about corporations reflecting on a considerably unfavourable affect from potential tariffs, and traders start to not simply complain about overvalued shares however really begin promoting in consequence, we might definitely see a draw back transfer to retrace about 38.2% of the April to July uptrend section.

Dave’s vote: 15%

What possibilities would you assign to every of those 4 situations? Take a look at the video under, after which drop a touch upon which situation you choose and why!

RR#6,

Dave

PS- Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any method symbolize the views or opinions of every other individual or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps lively traders make higher selections utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main consultants on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra