Though the market stayed flat on a week-on-week foundation, the previous 5 buying and selling periods confirmed all potentialities of the market persevering with with its corrective retracement. Within the earlier technical notice, it was categorically talked about that India VIX had closed at a precariously low stage, and that had left us weak to profit-taking bouts. On Thursday, because the markets noticed a robust profit-taking wave, VIX surged over 12% solely to come back down the opposite day. The buying and selling vary was narrower; the Nifty oscillated within the 274.55 factors vary earlier than closing flat with a minor lack of 35.95 factors (-0.18%) on a weekly foundation. The month-to-month efficiency remained robust; regardless of coming off from the excessive level of the month, the headline index gained 384.50 factors (2.00%) in September.

We’ve got a four-day brief buying and selling week developing; Monday is a buying and selling vacation on account of Gandhi Jayanti. The Nifty has violated the essential 50-DMA on the each day charts which at the moment stands at 19629. When the index tried to stage a technical rebound on Friday, it ended up closing slightly below this essential stage which now acts as a resistance after getting violated on a closing foundation. That is essential from a technical standpoint; nevertheless, the Nifty has shaped a decrease high and decrease backside on the weekly charts. This reveals a continuation of corrective retracement after the emergence of a possible high at 20222 ranges. IndiaVIX, regardless of coming off sharply from its excessive seen on Thursday, nonetheless ends 7.43% increased at 11.45 as in comparison with the earlier week.

The primary buying and selling session on Tuesday will see the markets aligning themselves with the worldwide markets that might have traded on Monday. A tepid begin to the week is anticipated; the degrees of 19790 and 19850 are anticipated to behave as resistance. The helps are prone to are available in at 19500 and 19370 ranges.

The weekly RSI stands at 60.72; following a bearish divergence earlier, it now stands impartial and doesn’t present any divergence towards the worth. The weekly MACD is bullish as of now however it’s on the verge of displaying a destructive crossover. A spinning high occurred on Candles; it displays the indecisiveness of the market contributors.

The sample evaluation of the weekly chart reveals a simplistic image; whereas the each day chart has some technical occasions on it, the weekly chart simply reveals a continuation of retracement following the creation of the highest at 20222 ranges. If the present retracement continues, we may even see the Nifty drifting in direction of the 20-week MA which is positioned at 19252 adopted by the essential sample assist of 19000 ranges.

All in all, there are larger possibilities of the technical construction getting defensive within the markets. Whereas we may even see some catchup being tried by Banknifty within the occasion of any technical rebound taking place, we are going to see low beta and defensive house like PSE, PSU Banks, IT, Pharma, and FMCG/Consumption doing nicely. It’s strongly advisable that leveraged exposures must be stored at modest ranges; extra leverage must be averted. Retaining in thoughts that volatility could improve sporadically and intermittently, a defensive and cautious outlook is suggested for the approaching week.

Sector Evaluation for the approaching week

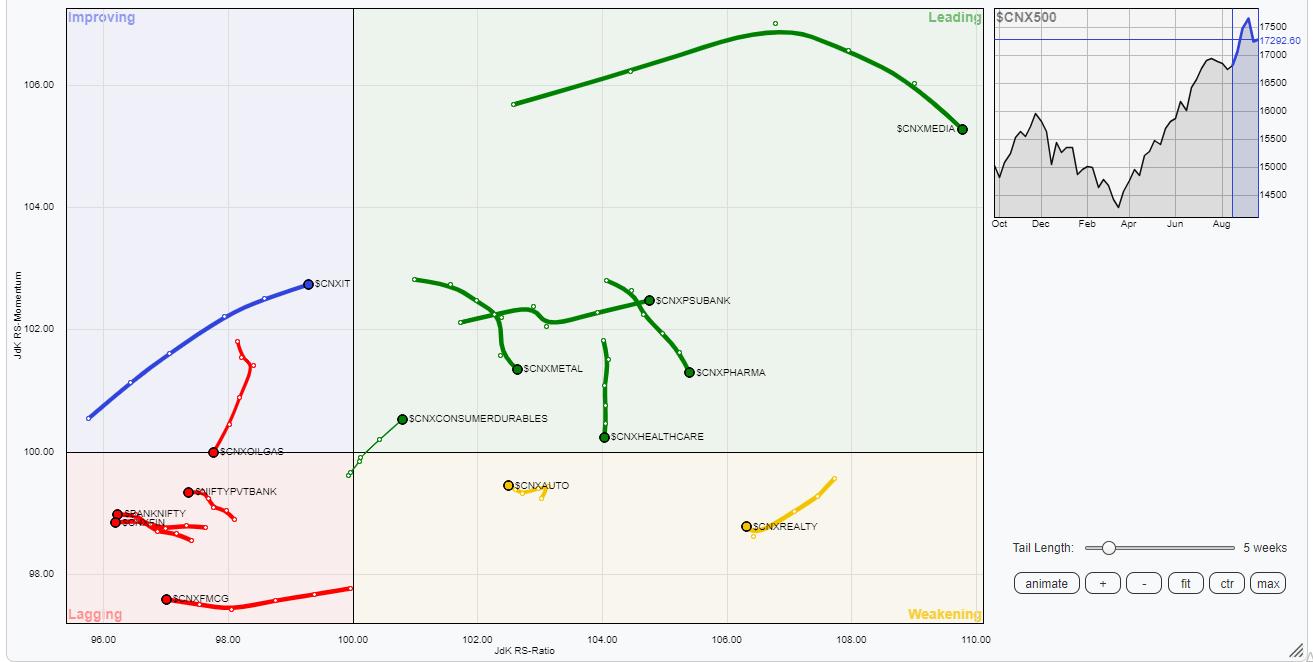

In our take a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that Nifty Vitality, Midcap100, Media, PSUBank, Steel, PSE, Pharma and Infrastructure indices are contained in the main quadrant of the RRG. Out of those teams, Steel, Pharma, Media, and Vitality look like giving up on their relative momentum and will contribute much less to the relative outperformance. Nevertheless, whereas the opposite sectors could proceed to comparatively outperform the broader markets.

The Auto and Realty indices are contained in the weakening quadrant and are seen mildly trying to enhance their relative momentum.

The Consumption and FMCG indices are contained in the lagging quadrant displaying delicate enchancment of their relative momentum. In addition to this, the Monetary Providers and Banknifty proceed to languish contained in the lagging quadrant.

The Nifty Providers sector index has simply rolled contained in the bettering quadrant. Together with this, the IT and Commodities sectors are additionally contained in the bettering quadrant and will higher their relative efficiency towards the broader markets.

Necessary Notice: RRG™ charts present the relative power and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Each day / Weekly Market Outlook” — A Each day / Weekly E-newsletter, at the moment in its 18th yr of publication.