In the event you commerce utilizing Good Cash Ideas (ICT), you’re possible obsessive about Order Blocks and Honest Worth Gaps. However there’s a hidden gem in worth motion that many merchants overlook: The Suspension Block.

On this article, I’ll clarify what a Suspension Block is, why most merchants fail utilizing them, and the “Golden Secret” to filtering out 80% of false alerts.

1. What’s a Suspension Block?

A Suspension Block is a selected 3-candle formation that signifies a momentary pause in institutional order move earlier than a continuation or reversal. Not like an ordinary Order Block which is usually simply the “final down candle,” a Suspension Block entails particular worth gaps between the open and shut of consecutive candles. It represents a zone the place worth is “suspended” and is extremely prone to be revisited.

Bullish Situation: Value rallies, leaving a selected hole construction. When worth returns to this zone, we count on a violent response upward.

Bearish Situation: The other happens for promoting alternatives.

2. The Downside: Why do they fail?

In the event you open any chart (e.g., M15 or M5), you will note dozens of potential blocks. In the event you attempt to commerce all of them, you’ll blow your account. The market is stuffed with noise. A block on M5 would possibly look good, but when it contradicts the H1 or H4 construction, it would get smashed.

3. The Answer: The “Golden” Overlap Rule 🟡

That is the game-changer. The key to excessive win-rate setups is Multi-Timeframe Confluence.

It’s best to solely commerce a Suspension Block if it exists inside or overlaps with a block from a Larger Timeframe (HTF).

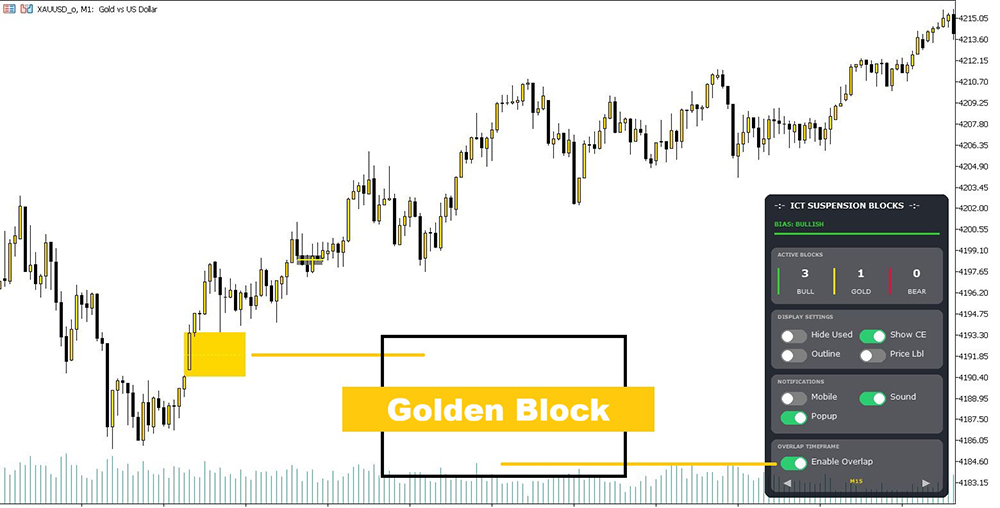

When these two align, we name it a “Golden Block”. These zones act like magnets for worth and maintain vital institutional orders.

4. The Technique: Tips on how to Commerce It

Right here is a straightforward step-by-step framework to commerce these zones:

Step 1: Establish the Bias Earlier than in search of blocks, ask your self: Is the market Bullish or Bearish? You may decide this by wanting on the H4 construction or utilizing a dashboard software.

Step 2: Look ahead to the “Golden” Setup Don’t commerce each inexperienced or crimson field you see. Look ahead to a Golden Block to type within the route of your bias. This confirms that the upper timeframe helps your commerce.

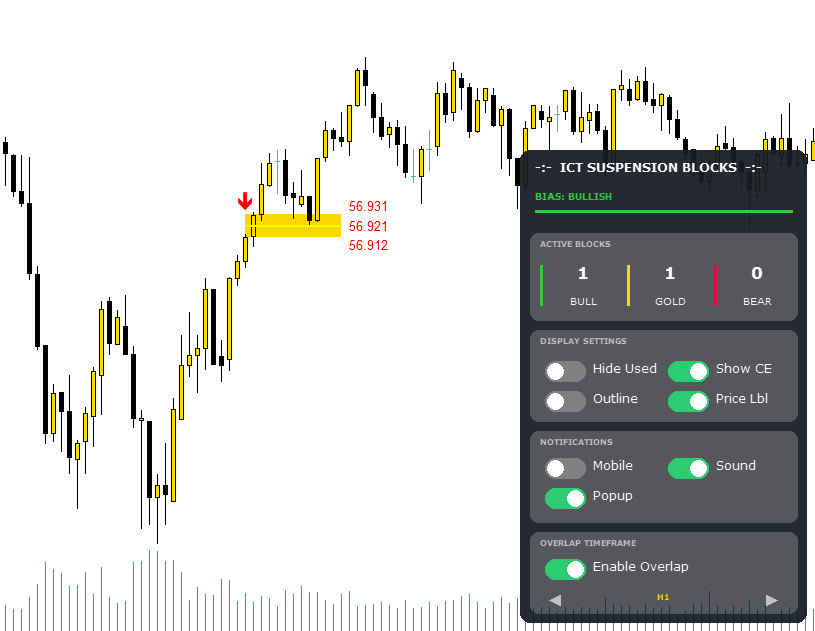

Step 3: The Entry (Sniper Mode) Place your Restrict Order on the fringe of the block. For even increased precision (and tighter Cease Loss), use the CE Line (Consequent Encroachment), which is the precise 50% midpoint of the block.

Step 4: Invalidation If a candle physique closes beneath a Bullish block (or above a Bearish one), the setup is invalid. Get out. Don’t hope.

5. Handbook vs. Automated

You may practice your eyes to identify these 3-candle patterns after which manually verify the H1/H4 charts for overlap. It really works, however it’s time-consuming and vulnerable to human error.

To resolve this, I developed a software referred to as ICT Gold Sweeper. It routinely detects these patterns and runs a background scan on increased timeframes. If it finds an overlap, it routinely turns the block GOLD 🟡 so you recognize precisely the place to commerce.

Conclusion

Cease buying and selling each assist and resistance stage. Give attention to High quality over Amount. By filtering your trades utilizing the Golden Overlap rule, you align your self with the “Good Cash” move.

Need to do that technique in your chart?

🚀 Obtain the Primary Model (Free): [ICT Suspension Blocks FREE]

💎 Get the Full “Gold Sweeper” System (with Golden Overlap & Alerts): [ICT Gold Sweeper PRO]

Completely satisfied Buying and selling!