KEY

TAKEAWAYS

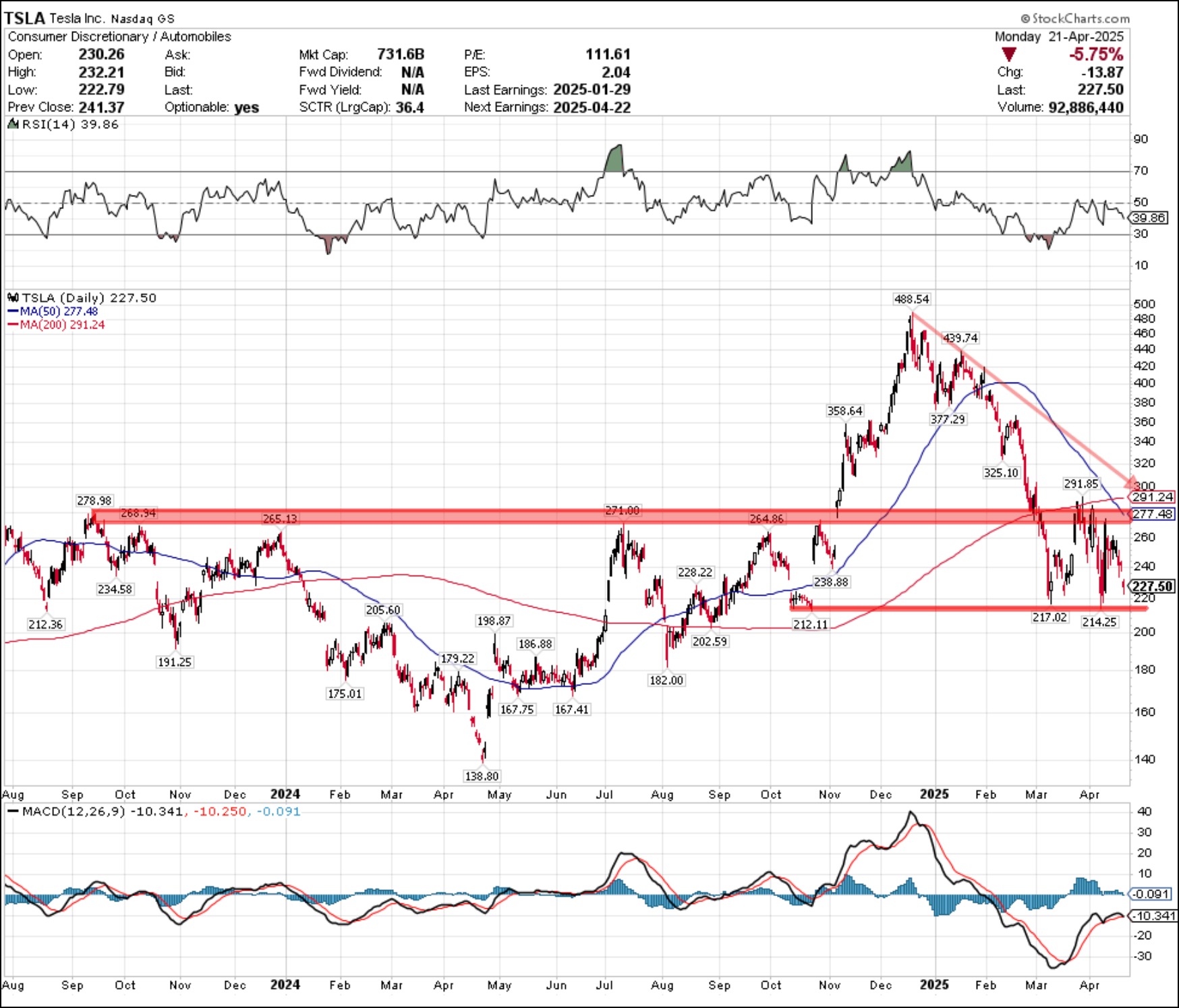

- Tesla’s day by day chart shows key help ranges to watch after the corporate experiences earnings.

- Service Now’s displaying indicators of a backside, which might imply a reversal relying on earnings outcomes.

- Look ahead to Alphabet, Inc. shares to hit particular help ranges, which might give merchants favorable danger/reward situations.

Tesla Inc. (TSLA)

Tesla, Inc. (TSLA) stays one of many world’s most unstable and mentioned shares, with Elon Musk’s political bent having made it a lightning rod of dialogue. Gross sales proceed to fall – particularly in Europe – and Musk’s private focus appears to be on many different areas. It is going to be attention-grabbing to see how the numbers look and what if any steering could also be given when Tesla experiences on Tuesday afternoon.

Technically, shares have made a full reversal since their post-election rally and now sit poised to maneuver once more. This isn’t an ideal-looking chart for the bulls, as key ranges of help have been breached, the near-term development is decrease, and the long-term development is a unstable mess.

FIGURE 1. DAILY CHART OF TESLA STOCK PRICE.

At present, there is a descending triangle in a near-term downtrend, with a flooring round $215. It has been examined twice and held, however every rally continues to be met with robust resistance. There may be extra overhead resistance and work to be carried out to get shares on the appropriate ascending observe.

Throughout a rally, there are three ranges the place sellers ought to take cost. The primary degree coincides with the present triangular downtrend line and outdated help, now resistance, which works again to its pre-election breakout round $270. Then there’s additionally the 200-day shifting common simply over $290. Lastly, there’s the downtrend from the current highs on the $300 degree.

Momentum favors the bears on any rally, and weak spot might plunge the inventory in direction of its August 2024 lows round $180. It isn’t a great danger/reward set-up going into the numbers. Each key momentum indicators — relative energy index (RSI) and shifting common convergence/divergence (MACD) — look like stalling, which makes this inventory one to keep away from regardless of all of the information it might trigger later this week.

Service Now (NOW)

ServiceNow, Inc. (NOW) shares have been decimated since reporting earnings final January. The software program firm, the fourth-largest firm within the iShares Tech-Software program ETF (IGV), seems to be to rebound when it experiences earnings after the shut on April 23.

Technically, current value motion is displaying indicators of a backside, and the chance/reward set-up is getting clear.

FIGURE 2. DAILY CHART OF SERVICE NOW.

The sell-off reached a crescendo after “Liberation Day” and snapped again to ranges that arrange a plan of assault as we go into this week’s earnings. Shares reached excessive oversold circumstances on each the MACD and RSI readings earlier than hitting current lows. Worth motion on the most important transfer decrease confirmed a divergence in each indicators, and did not affirm that final transfer down.

There are two bullish divergences after a extreme drawdown, which is a constructive. The Fibonacci retracement ranges from the start of the bull market to its current peak additionally present a constructive growth. The sell-off discovered help proper on the 61.8% “golden ratio” degree, which coincided with prior help going again to the lows of 2024.

Momentum is popping, a flooring appears to be obvious, and we have now one thing to reverse – all good indicators for a bull case. Whereas the strikes are fairly broad, targets to the draw back look to be set simply above $675.

To the upside, a easy imply reversion takes shares again to their declining 50-day shifting common simply above $865. If it breaks above there, look ahead to a take a look at of the 200-day shifting common, which is one other $60 larger.

When you have been to consider {that a} stable quantity is approaching Wednesday afternoon, because it has in all however one quarter going again to 2018 (final quarter they missed), then it might be entry level to seize the upside. Nonetheless, because it sits in the course of a variety, it is extra of a coin flip right here. At present, it seems to be as if we have now a sell-off that must be purchased and a rally that must be pale.

One factor we do know is that it will likely be attention-grabbing to see if the inventory can attempt to recapture its longer-term uptrend in a fairly difficult tape.

Alphabet, Inc. (GOOGL)

Alphabet (GOOGL) continues to make headlines because it offers with ongoing litigation in Washington and competitors from search engines like google and yahoo like ChatGPT. Shares have been underneath stress all yr and are at a fork within the street coming into their Thursday numbers.

FIGURE 3. WEEKLY CHART OF GOOGL STOCK.

We saved this weekly chart so simple as potential to point out this “fork-in-the-road” situation. On the finish of 2024, the chart accomplished a fantastic saucer backside sample and broke out. It virtually achieved its upside targets round $220, however fell simply quick.

Then it broke down.

After its preliminary breakout, GOOGL rallied and paused. Worth pale again to check outdated resistance after its preliminary leg larger. That degree of outdated resistance grew to become help, in textbook trend. Shares rallied from there to make new all-time highs; then, they failed once more.

Now, GOOGL sits at a key degree that was examined as soon as final week and held. Shares by no means closed beneath the important thing help space round $150. That units merchants up with a danger/reward situation that appears favorable, for now. Anybody shopping for the inventory right here has two ranges from which to chop their losses if value have been to interrupt down from right here.

Watch the current intraday lows at $140.50 after which the rising 200-week shifting common at $136. If it closes beneath there, it is best to exit the inventory and watch for a greater entry level.

To the upside, there’s clean crusing to the 50-week shifting common simply above $172. It could take a robust beat and information on this macro surroundings to push a lot larger, however the traces are set as we head into this busy week of earnings.