KEY

TAKEAWAYS

- Chartists can slender their focus listing by standards to search out leaders.

- ETFs must be in long-term uptrends and present relative energy.

- A defensive ETF is rising above the pack with a latest breakout.

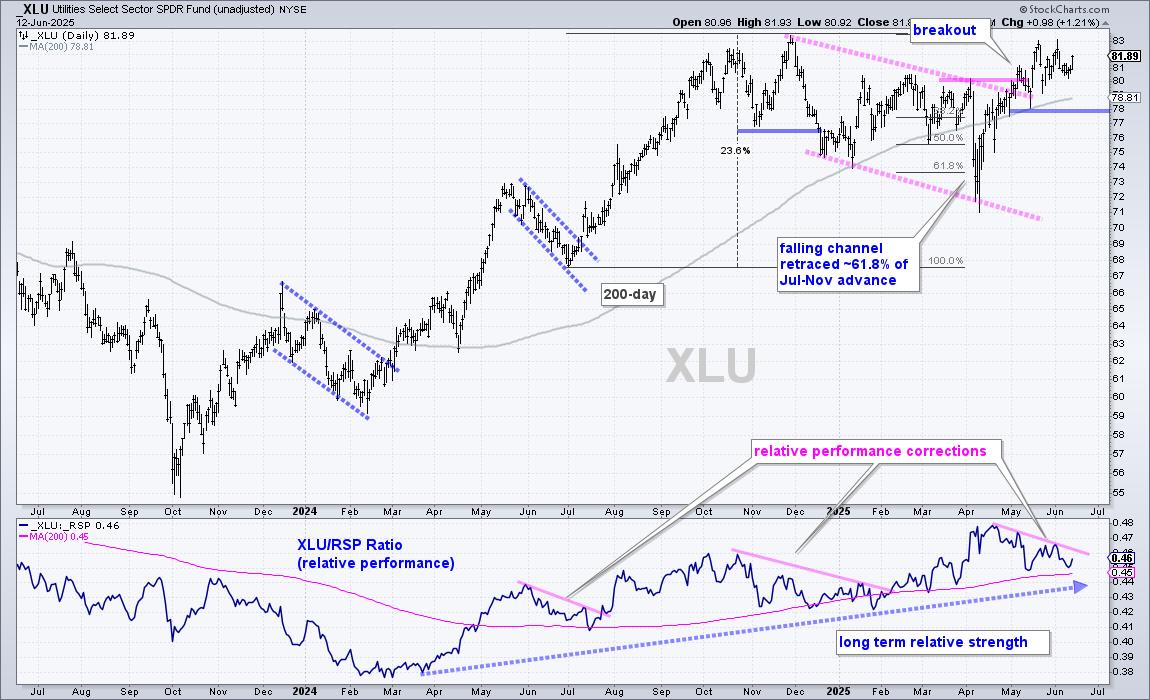

Three sectors stand out, with one sporting a latest breakout that argues for larger costs. At the moment’s report will spotlight three standards to outline a number one uptrend. First, worth must be above the rising 200-day SMA. Second, the price-relative must be above its rising 200-day SMA. And eventually, leaders ought to commerce at or close to 52-week highs. Let’s evaluate the Utilities SPDR (XLU) to see the way it stacks up.

The CandleGlance charts under present the highest 5 sectors and SPY. I’m rating efficiency utilizing Quick Stochastics (255,1). Stochastic values replicate the extent of the shut relative to the high-low vary over the given interval. 255 buying and selling days is round 1 12 months. An ETF is at a 52-week excessive when the worth is above 99 (XLK) and an ETF is close to a brand new excessive with a worth above 90 (XLU). The CandleGlance charts present XLK, XLI and XLU with values above 90, which suggests the are close to new highs.

***********************

TrendInvestorPro is following the breakout in XLU, the bull flag in GLD, a small wedge in AMLP, a breakout in XLP and extra. We additionally coated trailing cease alternate options for the pennant breakouts in some key tech associated ETFs. Click on right here to be taught extra and acquire quick entry.

***********************

Now let’s flip to cost motion. XLU is buying and selling above its rising 200-day SMA. Thus, the long-term pattern is up. XLU additionally broke falling channel resistance in early Could. The pink traces present a falling channel that retraced round 61.8% of the July-December advance (23.6%). Each the sample and the retracement quantity are typical for corrections inside an even bigger uptrend. The early Could breakout alerts a continuation of the long-term uptrend and new highs are anticipated. The Could lows mark first help at 78. A detailed under this stage would warrant a re-evaluation.

And eventually, let’s measure relative efficiency utilizing the price-relative (XLU/RSP ratio). The decrease window reveals the price-relative in an uptrend for over a 12 months and above its 200-day SMA since early March. This reveals long-term relative energy. The pink trendlines present relative efficiency corrections when XLU underperformed for brief intervals. XLU is at the moment experiencing an underperformance correction as a result of the broader market surge from early April to early June.

TrendInvestorPro is following the breakout in XLU, the bull flag in GLD, a small wedge in AMLP, a breakout in XLP and extra. We additionally coated trailing cease alternate options for the pennant breakouts in some key tech associated ETFs. Click on right here to be taught extra and acquire quick entry.

//////////////////////////////////////////////////

Select a Technique, Develop a Plan and Comply with a Course of

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Writer, Outline the Pattern and Commerce the Pattern

Wish to keep updated with Arthur’s newest market insights?

– Comply with @ArthurHill on Twitter

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering alerts throughout the pattern, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.