Ray Dalio is likely one of the most well-known buyers alive. He based Bridgewater Associates, one of many world’s largest hedge funds, and pioneered the thought of constructing a portfolio that may carry out effectively in any financial atmosphere. His flagship creation? The All Climate Fund.

At its core, the All Climate Fund is a threat parity technique. It is a fancy approach of claiming it balances asset lessons not by how a lot cash goes into every one, however by how dangerous they’re. It sometimes combines shares, long-term authorities bonds, inflation-linked bonds, commodities, and gold in a approach that goals to deal with the whole lot from inflation to recession.

The catch? It’s advanced, costly, and off-limits to common buyers such as you and me. Fortuitously, a brand new ETF buying and selling on the Toronto Inventory Alternate (TSX) provides an identical idea in a easy, inexpensive package deal.

It’s known as the Hamilton Enhanced Blended Asset ETF (TSX:MIX), and it’s in contrast to most all-in-one ETFs in the marketplace. Right here’s why.

How MIX Works

MIX retains issues easy on the floor: 60% in U.S. shares (by way of the S&P 500), 20% in long-term U.S. Treasury bonds, and 20% in gold.

These property play very totally different roles. Shares drive long-term progress, treasuries are inclined to shine throughout financial slowdowns or deflation, and gold acts as a possible hedge throughout inflationary shocks or when monetary markets lose confidence.

As a result of these asset lessons don’t all transfer in the identical route on the identical time, the MIX portfolio technique advantages from low correlation, which helps scale back volatility.

Whereas MIX remains to be tilted towards progress by its fairness publicity, the addition of bonds and gold provides it a pure defensive layer. In situations during which shares fall, Treasuries typically rise. And when each shares and bonds battle, like in 2022, gold will help fill the hole.

How MIX Makes use of Leverage

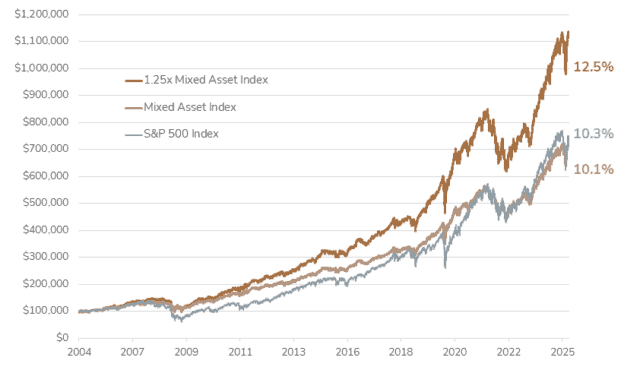

MIX makes use of leverage, however not within the aggressive approach you would possibly see in 2 timees or 3 occasions ETFs designed for day buying and selling. For each $100 in property, Hamilton borrows $25 extra, like a margin mortgage, and invests it again into the portfolio for 1.25 occasions leverage.

Which means the precise publicity isn’t 60/20/20. It’s 75% S&P 500, 25% Treasuries, and 25% gold, sustaining the unique asset weights whereas boosting the portfolio’s complete publicity by 25%.

Why does that matter? As a result of based on trendy portfolio concept, this strategy can theoretically ship related returns to a 100% inventory portfolio, however with decrease total threat, thanks to raised diversification.

How A lot Does MIX Value?

MIX expenses 0% in administration charges till April 30, 2026, and 0.35% after that. The underlying ETFs it holds are low-cost index funds, largely U.S.-based, so the embedded prices are modest.

However as a result of MIX makes use of leverage, the overall administration expense ratio (MER) will probably be increased than your typical all-in-one ETF, attributable to borrowing prices. That mentioned, Hamilton can borrow at far decrease charges than you’d ever get by your individual margin account, which helps hold the price of leverage rather more environment friendly than DIY buyers may replicate.

In brief, MIX provides a chic method to get publicity to shares, bonds, and gold in a single TSX-listed ETF, optimized for the lengthy haul, with a nod to the identical technique that made Ray Dalio a billionaire.