Right this moment’s report options the Zweig Breadth Thrust, which was developed by the late, and nice, Marty Zweig. Zweig appeared usually on Wall Avenue Week, contributed to Barrons, printed The Zweig Forecast and wrote Successful on Wall Avenue in 1986. Amongst different issues, his timeless e book reveals us the way to “spot market tendencies early”. The Zweig Breadth Thrust doesn’t function within the e book, however I wholeheartedly advocate this e book for its enduring knowledge and market insights.

Right this moment’s report options the Zweig Breadth Thrust, which was developed by the late, and nice, Marty Zweig. Zweig appeared usually on Wall Avenue Week, contributed to Barrons, printed The Zweig Forecast and wrote Successful on Wall Avenue in 1986. Amongst different issues, his timeless e book reveals us the way to “spot market tendencies early”. The Zweig Breadth Thrust doesn’t function within the e book, however I wholeheartedly advocate this e book for its enduring knowledge and market insights.

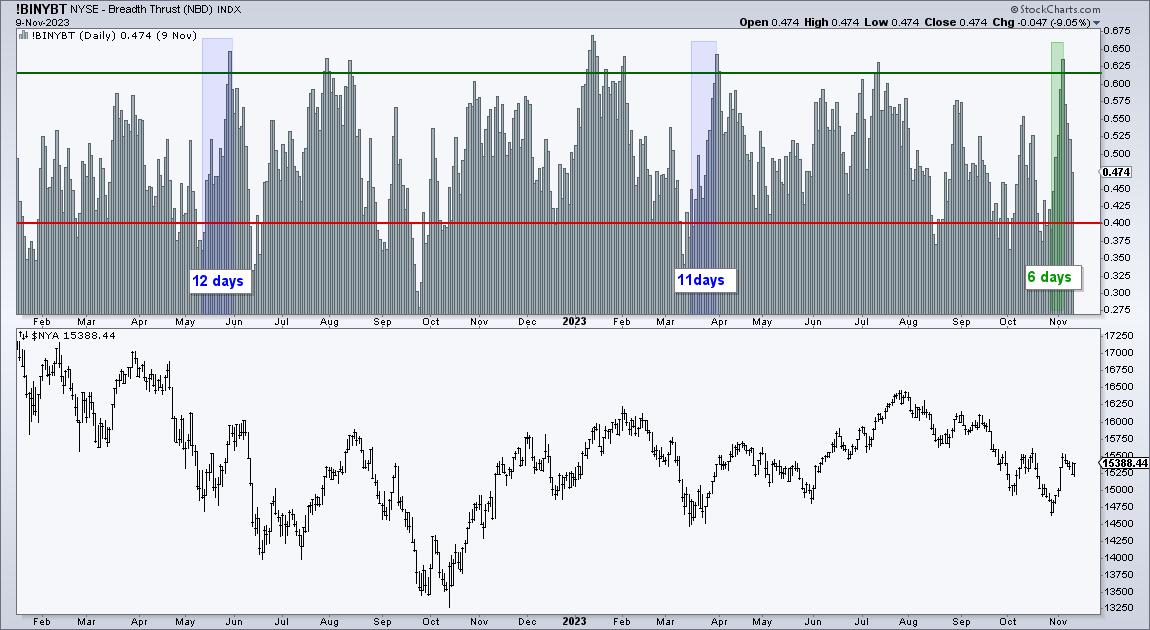

A Zweig breadth thrust triggered for NYSE shares in early November. I say NYSE shares as a result of Zweig used NYSE breadth for his thrust indicator. The indicator is the 10-day EMA of NYSE Advances divided by NYSE Advances plus NYSE Declines. The system comes from Greg Morris’ e book, the Encyclopedia of Breadth Indicators.

The chart under reveals the Zweig Breadth Thrust (!BINYBT) within the prime window and the NY Composite within the decrease window. The inexperienced shading reveals the indicator surging from under .40 to above .615 inside a ten day window (ending November third). The blue shadings present two indicators that simply missed the ten day cutoff. The Could surge took 12 days and the March surge took 11 days.

My analysis reveals the NYSE Zweig Breadth Thrust triggering six occasions since early 2009. Regardless of rare indicators, the rationale behind the indicator is stable. The indicator is designed to determine a deep dip with the transfer under .40. That is the setup. The sign triggers with an exceptionally sharp upside thrust after this dip (above .615). And, it should all occur inside 10 days. This implies it identifies an abrupt and sharp shift within the markets. These sorts of strikes typically happen at “V” bottoms, akin to March 2009 and December 2018.

One thing, nevertheless, is lacking. And people somethings are Nasdaq shares. I think Zweig used NYSE breadth as a result of he developed it when the large board (NYSE) dominated buying and selling. Issues have modified and the Nasdaq is the place to be proper now. A contemporary breadth indicator ought to embrace Nasdaq and NYSE shares, in addition to large-caps, mid-caps and small-caps. I’d recommend S&P 1500 shares for such an indicator.

TrendInvestorPro took the Zweig Breadth Thrust (ZBT) to the subsequent degree this week. First, we coded this indicator utilizing S&P 1500 shares (ZBT1500). Second, we quantified indicators with a backtest. ZBT1500 indicators are far more frequent and a sign additionally triggered on November third. Entry is simply half of the equation so I additionally added an exit situation based mostly on the Common True Vary (ATR). Click on right here to entry the total report at TrendInvestorPro.

////////////////////////////

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out development, discovering indicators throughout the development, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.