The S&P 500 posted its worst month up to now this 12 months, with a 4.9% decline that is pushed the year-to-date returns for this benchmark index virtually in half. With elevated rates of interest that could be with us for some time, buyers have pushed shares decrease, in a transfer that has over 10% of large-cap shares effectively into oversold territory. We’re speaking about names resembling McDonalds (MCD), Boeing (BA) and Blackrock (BLK), to call just some.

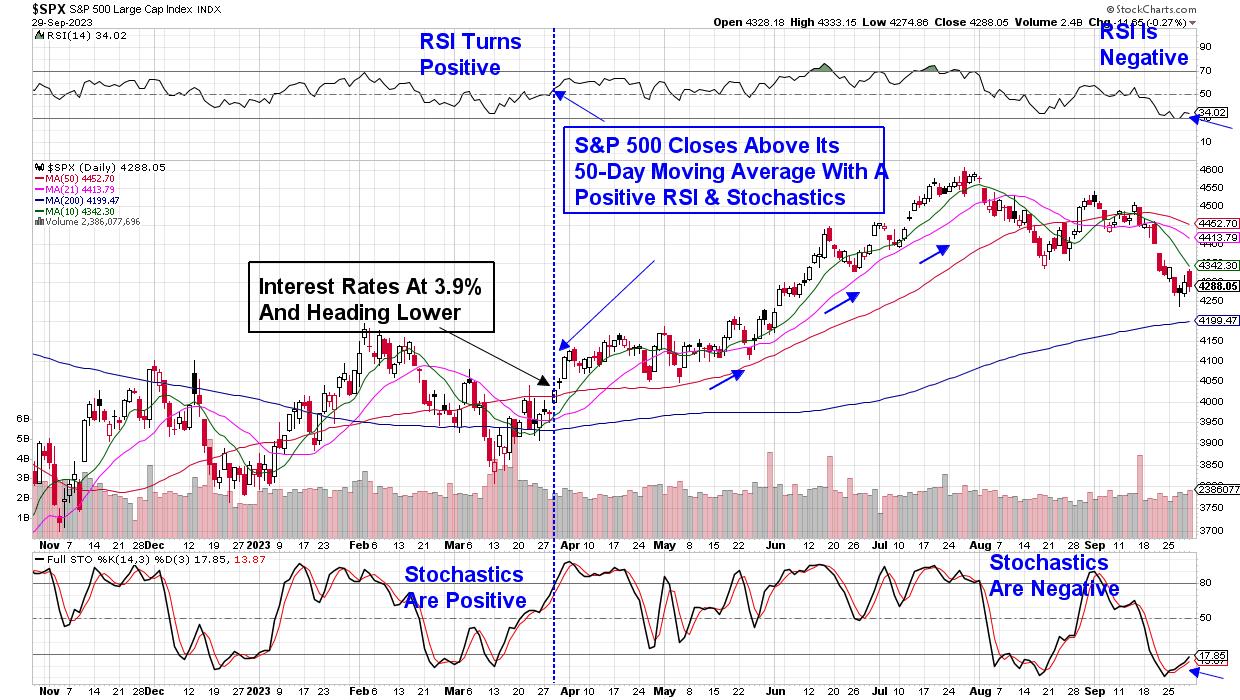

The present downtrend within the markets was signaled by an in depth under the 50-day transferring common on heavy quantity earlier this month, which was coupled by a transfer of the RSI and Stochastics into detrimental territory. Additional weak spot adopted, with information that the Fed is anticipating an elevated rate of interest state of affairs for longer than anticipated, pushing shares even decrease.

DAILY CHART OF THE S&P 500 INDEX

Above is a day by day chart of the S&P 500, and highlighted throughout March of this 12 months are the important thing traits that must happen earlier than we’re again in an uptrend. To start, we’ll want this index shut above its 50-day transferring common, coupled with a constructive RSI and Stochastics. Whereas this will likely seem removed from probably happening, a multi-day rally in mega-cap names resembling Microsoft (MSFT) and Alphabet (GOOGL), which led us out of the March pullback, would go a really great distance in sparking a reversal.

Outdoors of value motion on the chart of the S&P 500, we’ll must see rates of interest pattern decrease from their present place. In the course of the mid-March downtrend reversal, the yield on the 10-year Treasury observe was trending decrease and closed under the widely-watched 4% degree after a lower-than-expected CPI report hinted at decelerating inflation. An identical drop in rates of interest will probably be a key wanted improvement to get buyers again into these markets and at present, the 10-year Treasury now stands at 4.6%.

At MEM Funding Analysis, we’re looking out for the markets to pattern increased going into year-end nevertheless, close to time period, we might even see additional weak spot heading into subsequent week at the least. Whereas the key indexes rebounded from midweek lows, a continuation rally into Friday was reversed, in a sign that the short-lived rally try had ended. Friday’s intraday reversal adopted information {that a} federal authorities shutdown is more and more doubtless on Sunday after Home Speaker McCarthy’s funding proposal was rejected. A closure of the federal authorities could be detrimental for the markets.

With investor sentiment remaining largely detrimental over the close to time period, we view this is a perfect time to construct out your watchlist for once we return to a extra bullish interval. For individuals who’d prefer to have rapid entry to my extremely curated watchlist, in addition to be alerted to when it is secure to get again into the markets, use this hyperlink right here. My report has been very profitable in figuring out market management as soon as the markets flip constructive as effectively, and I look ahead to sharing my insights with you.

I hope you’ve an amazing weekend!

Warmly,

Mary Ellen McGonagle

Mary Ellen McGonagle is knowledgeable investing advisor and the president of MEM Funding Analysis. After eight years of engaged on Wall Road, Ms. McGonagle left to grow to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with massive names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Be taught Extra