Celestica (TSX:CLS) is a Canadian development inventory that has mesmerized buyers with market-beating performances over the previous three years, with greater than a 2,100% acquire. The tech inventory took a breather late final 12 months, however CLS may take off on one other rally in 2026 following administration’s current outlook updates.

Some development shares are constructed on hype and hole guarantees. Others are constructed on actual income contracts, money flow-positive operations, and enterprise operations positioned precisely on the intersection of the world’s strongest development megatrends. Celestica inventory is within the latter camp, and right here’s why it might do properly for growth-seeking buyers this 12 months.

Celestica: A {hardware} accomplice for a rising AI megatrend

Toronto-based Celestica is a expertise options firm that designs, manufactures, and ships the {hardware} that powers the trendy digital economic system. Information centre servers, synthetic intelligence (AI) networking switches, communications tools, and cloud infrastructure are a few of its income strains. Its purchasers, which embody the world’s largest hyperscalers, have dedicated a whole lot of billions into constructing AI infrastructure over the following three years, and the corporate lately upgraded its outlook for 2026.

Whereas the market remains to be debating which AI software program firms will win the income and earnings development race, Celestica is quietly shovelling the picks and shovels to all of them, making boatloads of money from AI-related offers.

CLS inventory’s development observe report

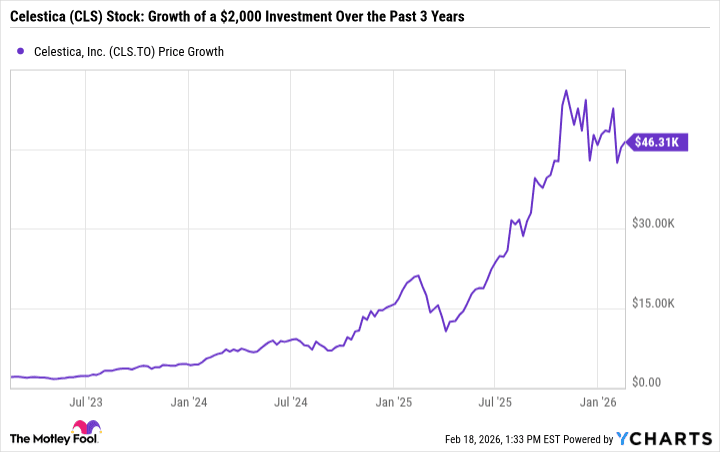

Efficiency is the place Celestica inventory will get genuinely thrilling. A $2,000 funding in CLS inventory three years in the past could be price roughly $46,200 in the present day.

However right here’s what issues much more than the previous: Celestica’s income development is accelerating.

In 2025, Celestica reported income of US$12.4 billion, up 28.5% 12 months over 12 months and beating its personal steering. Internet earnings surged by 94.5%, powered by increasing working leverage and a surge in its high-margin Communications section — the division that serves hyperscale information centre prospects straight.

Celestica’s working margins are enhancing. Income is thrashing estimates. And the corporate is elevating steering.

In a current earnings replace in January, Celestica raised its income steering for 2026 from $16 billion to $17 billion and elevated its adjusted earnings per share (EPS) steering from $8.20 to $8.75. This steering implies a 37% annual income development fee and a 44.6% sequential enhance in EPS for 2026! Income and earnings development is accelerating, and administration’s outlook is supported by “anticipated stronger buyer demand….”

The worldwide AI spending spree is ongoing, and Celestica is on the epicentre by means of its connectivity and cloud options (CCS) section, which has turn into a sustainable development engine for the enterprise. The corporate has been deepening relationships with its prospects, successful long-term contracts and increasing its product design capabilities. This might imply stickier revenues, higher working margins and widening moats with each new information centre constructed.

Why a $2,000 funding in Celestica inventory is smart proper now

Regardless of a current run, Celestica inventory nonetheless trades a ahead P/E of 31.6, and a ahead price-earnings-to-growth (PEG) ratio of 1, which means shares fetch an inexpensive worth given the enterprise’s earnings development potential.

Now, some buyers may take a look at a CLS inventory that has already gained greater than 2,100% over three years and surprise in the event that they missed the boat. The priority is truthful, however Celestica’s run nonetheless has some momentum. The AI information centre spending spree could prolong for an additional 5 years, Celestica’s income development fee is accelerating nonetheless, and the corporate nonetheless has scale benefits to capitalize on.

Furthermore, administration has a demonstrated observe report of delivering on and exceeding its monetary targets.

With $2,000 to put money into February 2026, you’d be shopping for into an organization that trades at an inexpensive a number of relative to its earnings development trajectory. That’s a uncommon valuation provide within the AI infrastructure house, the place many pure-play software program names commerce at nose-bleed valuations.