Enbridge (TSX:ENB) inventory is probably going a cornerstone funding in lots of retirement portfolios geared in the direction of passive revenue. For buyers seeking to maintain the dividend development inventory for the long run, the futuristic query as we glance towards 2030 goes past ENB inventory’s juicy 6.1% dividend yield to give attention to the pipelines large’s strategic pivot. Enbridge is now not only a “pipeline firm”; it’s quickly remodeling into North America’s largest pure fuel utility and a burgeoning clear vitality energy participant.

Here’s what the subsequent 5 years appear to be for Enbridge, based mostly on their newest 2026 steering and long-term strategic outlook.

The forecast: Enbridge by 2030

Administration’s most up-to-date steering for Enbridge targets 5% annual development in earnings earlier than curiosity, taxes, depreciation and amortization (EBITDA) and distributable money move (DCF) by way of the top of this decade.

Utilizing Enbridge’s confirmed 2026 steering as a baseline and making use of administration 5% compound annual development fee (CAGR) goal, here’s a potential monetary snapshot for 2030:

| Monetary Metric | Steering for 2026 | Estimated 2030 Worth | Remark |

| Adjusted EBITDA | $20.5 billion | $24.9 billion | Primarily based on mid-point of 2026 steering |

| Distributable Money Move (DCF) per Share | $5.90 | $7.17 | Primarily based on mid-point of 2026 steering |

| Dividend Per Share | $3.88 | $4.72 | Dividend yield (on in the present day’s value) grows to 7.4%. Payout fee stays sustainable at 66% of DCF. |

The longer term stays unsure, and precise outcomes will range.

The EBITDA development engine by way of 2030

Enbridge inventory’s income, earnings, and money move development engine has shifted gears. Whereas liquids pipelines (oil) stay the money cow, development drivers for the subsequent 5 years embody pure fuel and renewable vitality.

Following large acquisitions of U.S. fuel utilities, Enbridge holds a gradual, regulated earnings base in a geographic area experiencing demand development as energy technology utilities reply to rising electrical energy demand as power-hungry synthetic intelligence (AI) information centres sprout. Enbridge’s fuel transmission community is inside 50 miles of practically half of its forecasted demand, positioning the corporate within the neighborhood of needy clients.

Furthermore, development in liquefied pure fuel (LNG) exports from North America acts as one other income and earnings development driver for Enbridge whose infrastructure connects with quickly rising LNG export amenities on the Gulf Coast.

A stellar 5-year funding plan

Enbridge has moved right into a “self-funding” mannequin and will now not must subject dilutive fairness to develop. The corporate expects to take a position about $10 billion yearly with out tapping into fairness markets.

With a backlog of about $35 billion in secured capital for tasks coming on-line by way of 2030, Enbridge’s excessive development visibility is enticing for long-term buyers seeking to purchase and maintain the dividend development inventory past 2030.

ENB’s strategic shifts and new dangers

Enbridge is diversifying its pipelines enterprise and increasing right into a super-energy utility because it aggressively invests in lower-carbon alternatives, together with photo voltaic farms, offshore wind, and renewable pure fuel (RNG), and hydrogen. The brand new tasks could alter its funding threat profile by 2030.

Whereas diversification lowers ENB inventory’s carbon threat, it introduces execution threat. Constructing offshore wind farms and carbon seize hubs could possibly be technically extra complicated and fewer confirmed (for Enbridge) than laying pipelines. Traders ought to be careful for potential value overruns in these newer distinct enterprise traces.

ENB inventory’s potential funding returns by way of 2030

Given a 6.1% beginning dividend yield for 2026 and a possible dividend development fee of three% to five% yearly by way of 2030, Enbridge inventory could possibly be a strong complete return generator over the subsequent 5 years. The inventory presents a possible 11% annual complete return profile over the subsequent half decade, holding its valuation multiples fixed.

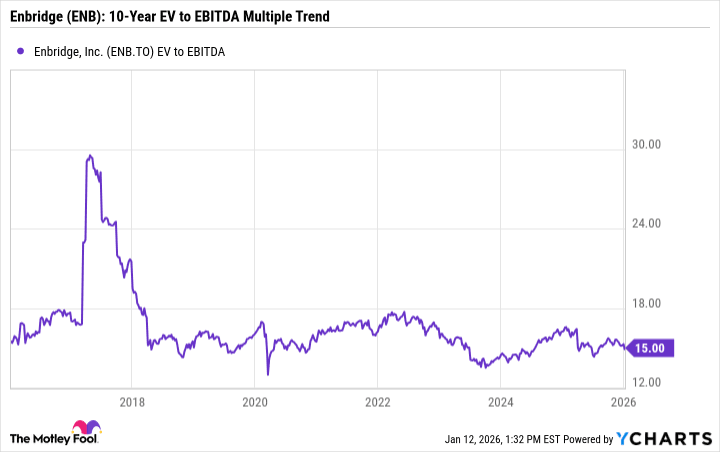

Enbridge’s enterprise value-to-EBITDA (EV to EBITDA) a number of has been vary certain since 2018.

ENB EV to EBITDA information by YCharts

Whereas rate of interest dangers will proceed to linger as Enbridge refinances maturing debt obligations, the dividend development inventory seems enticing for brand new long-term-oriented cash proper now.

In 5 years, Enbridge will seemingly be a bigger, and extra diversified utility-like inventory with sturdy dividend yields that nourish revenue seekers’ money move cravings.