Technique B is knowledgeable buying and selling system constructed on Momentum Worth Motion rules, designed to function through the most worthwhile phases of the market — impulsive value actions.

In contrast to methods that try and extract income from market noise, Technique B focuses on what really issues:

👉 figuring out and driving sturdy directional strikes, the place nearly all of market income are generated.

An Impulse Is a Results of Liquidity, Not Randomness

Worth impulses don’t happen randomly.

They’re the results of liquidity inflows or outflows and emerge when a massive market participant completes a section of place accumulation or distribution.

Throughout these moments, imbalance zones are shaped — sharp directional value strikes described in Wyckoff’s idea, which stays one of many foundational frameworks for understanding market construction and participant conduct.

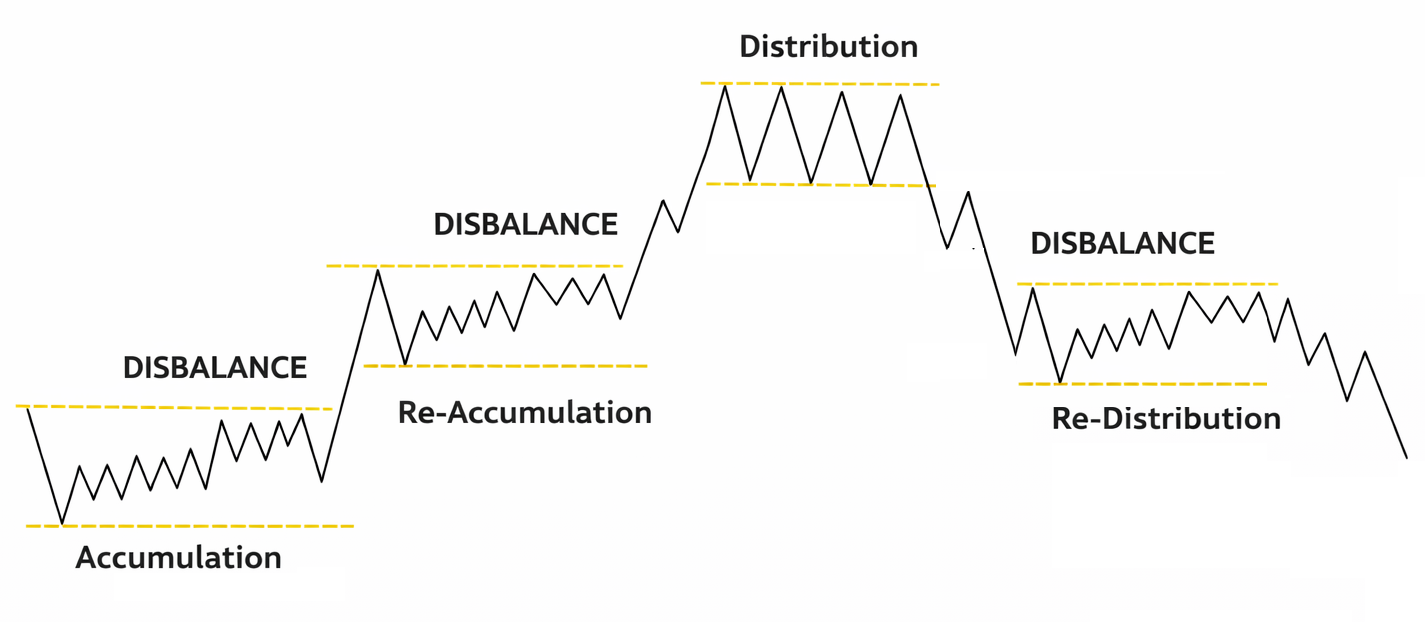

The Wyckoff Market Cycle

In response to Wyckoff idea, the market strikes by three key phases:

Accumulation — value is held inside a variety whereas massive gamers construct positions

Re-accumulation — a pause inside an present development earlier than continuation

Distribution — positions are regularly unwound in a variety earlier than a section shift

Between these phases, imbalance seems — resulting in highly effective development actions.

Wyckoff market cycle diagram:

How Technique B Offers with Market Noise

Momentum and Worth Motion techniques can not utterly keep away from market noise.

False impulses and short-lived strikes are an inherent a part of any market.

Technique B doesn’t try and predict the market.

It operates on possibilities, accepting that some impulses will inevitably turn into false.

Throughout range-bound phases, the market is usually characterised by:

short-term impulses with out continuation,

news-driven spikes,

liquidity grabs based on Sensible Cash ideas,

elevated value randomness.

In such circumstances, Technique B might expertise sequences of dropping trades —

that is regular conduct for momentum-based techniques.

The important thing precept is easy:

👉 one sturdy development is sufficient to compensate for intervals of noise, stagnation, and false entries.

How Technique B Applies Momentum and Worth Motion

The cryptocurrency market — particularly Bitcoin — is properly fitted to Wyckoff-based evaluation:

clearly outlined market phases,

prolonged accumulation and distribution ranges,

sturdy impulsive breakouts between zones.

Technique B is designed to seize two forms of actions:

1️⃣ Medium-term impulses inside ranges

2️⃣ Lengthy-term traits between main market phases

On this system, an impulse acts as a set off for development formation, not the ultimate goal.

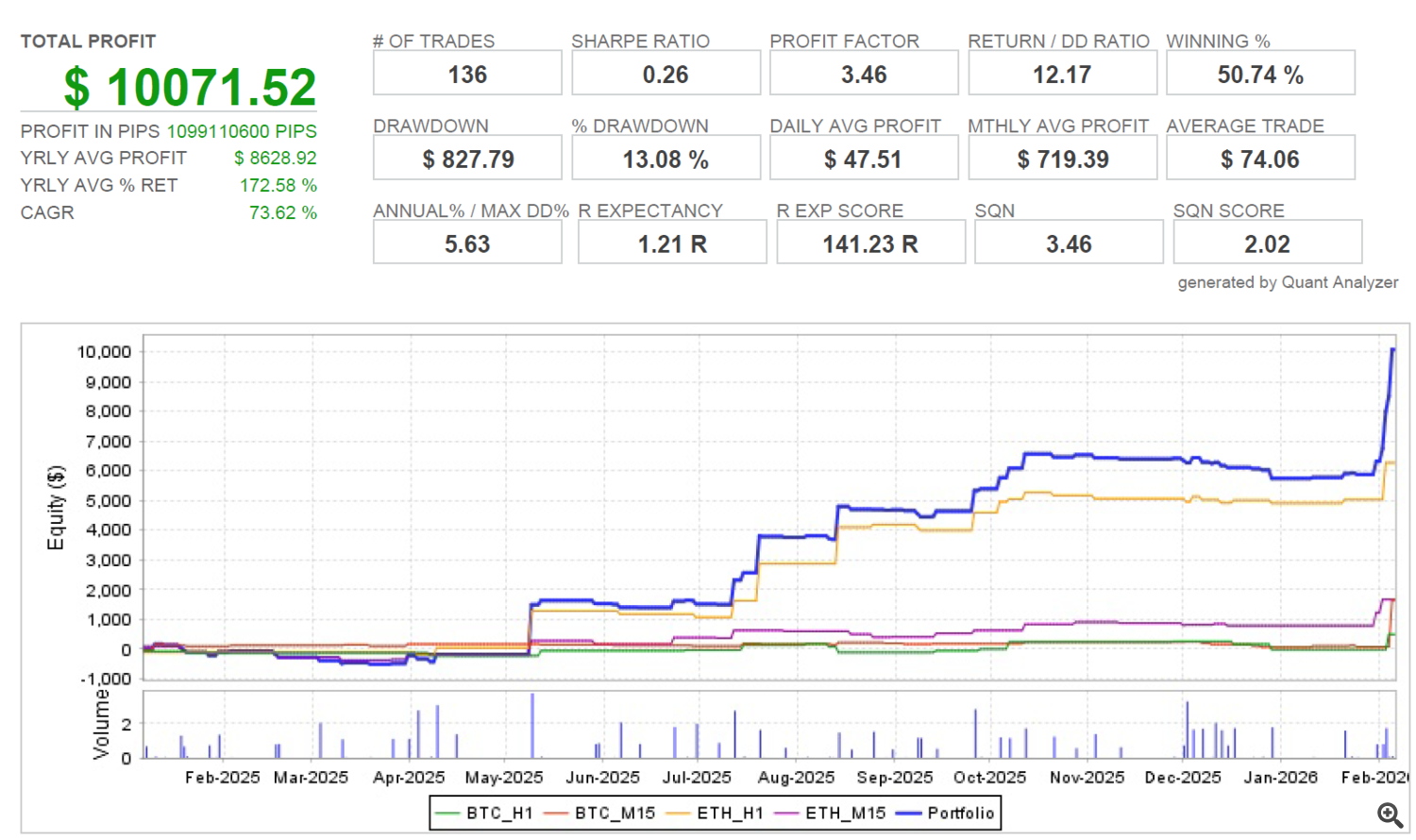

Actual Technique B Efficiency Over Time

The fairness curve and statistics of Technique B for 2025 and early 2026 clearly reveal how a momentum-based strategy performs in actual market circumstances.

📊 2025 — A Vary-Sure Market

➡️ Because of this, the portfolio achieved roughly 100% return in 2025.

🚀 January 2026 — When the Impulse Issues

In January 2026, the crypto market entered a section of sturdy imbalance:

a pointy Bitcoin transfer from the 80–90k space right down to 60k,

preceded by a transparent impulsive transfer.

Technique B was capable of enter and comply with this development.

➡️ In lower than one week, the system generated round 90% revenue,

which is akin to the complete efficiency of 2025.

Drawdowns Are A part of the Technique, Not a Flaw

The November–December 2025 interval was marked by:

sideways value motion,

a number of false impulses,

a short lived drawdown.

For momentum-based techniques, this conduct is anticipated and unavoidable.

Such methods ought to by no means be evaluated over brief time home windows.

A single sturdy development:

offsets intervals of stagnation,

compensates dropping streaks,

defines the long-term efficiency of the technique.

Who Technique B Is Designed For

Technique B just isn’t a system for every day income.

It’s a instrument for merchants and traders who:

✔ perceive market cycles

✔ settle for ready intervals

✔ prioritize Threat / Reward over excessive win charges

✔ concentrate on long-term consistency reasonably than short-term noise