KEY

TAKEAWAYS

- SPY and QQQ surged above their 200-day SMAs this week.

- The sign is bullish, however susceptible to whipsaws.

- Chartists can cut back whipsaws with smoothing and sign filters.

SPY and QQQ crossed above their 200-day SMAs with huge strikes on Monday, and held above these long-term transferring averages your entire week. The V-Reversal was extraordinary and SPY appears short-term overbought, however this cross above the 200 day SMA cross is a bullish sign for crucial market benchmark. Regardless of a bullish sign, long-term transferring averages are trend-following indicators and you will need to set real looking expectations.

***** That is an abbreviated model of a analysis report masking the 200-day SMA, efficiency enhancements and a twist for QQQ. Latest studies at TrendInvestorPro lined the V-Reversal, the Bottoming Course of and an Exit Technique for the Zweight Breadth Thrust. Click on right here to take a trial and get fast entry. *****

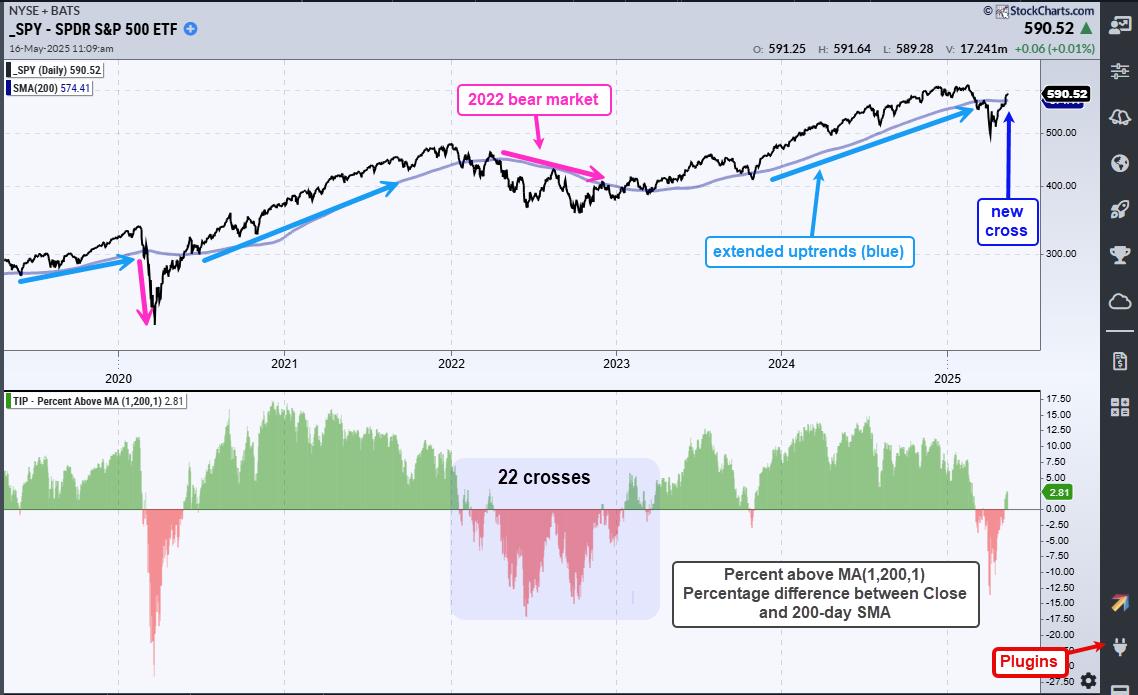

The chart beneath reveals SPY with the 200-day SMA (blue). This 200-day cross captured two huge uptrends since 2020 and foreshadowed the bear market in 2022. Despite the fact that these three alerts look nice, there have been loads of whipsaws alongside the best way. SPY crossed the 200-day SMA 141 occasions since 2005, which averages 7 crosses per 12 months. Averages could be misleading as a result of some years have extra crosses than others. SPY didn’t cross its 200-day in 2021 and 2024, however there have been 22 crosses between January 2022 and March 2023.

The indicator window reveals % above MA (1,200,1) to higher spotlight these crosses. It turns constructive (inexperienced) with a bullish cross and destructive (pink) with a bearish cross. The values are the proportion distinction between the shut and the 200-day SMA.

There is no such thing as a such factor as an ideal indicator. Development-following indicators are nice at catching huge traits, however they’re additionally susceptible to whipsaws (failed alerts). Whipsaws are merely the worth of admission for a trend-following technique. We should take the great (huge traits) with the dangerous (whipsaws). Because the chart above confirms, trend-following works over time as a result of one good pattern pays for the whipsaws.

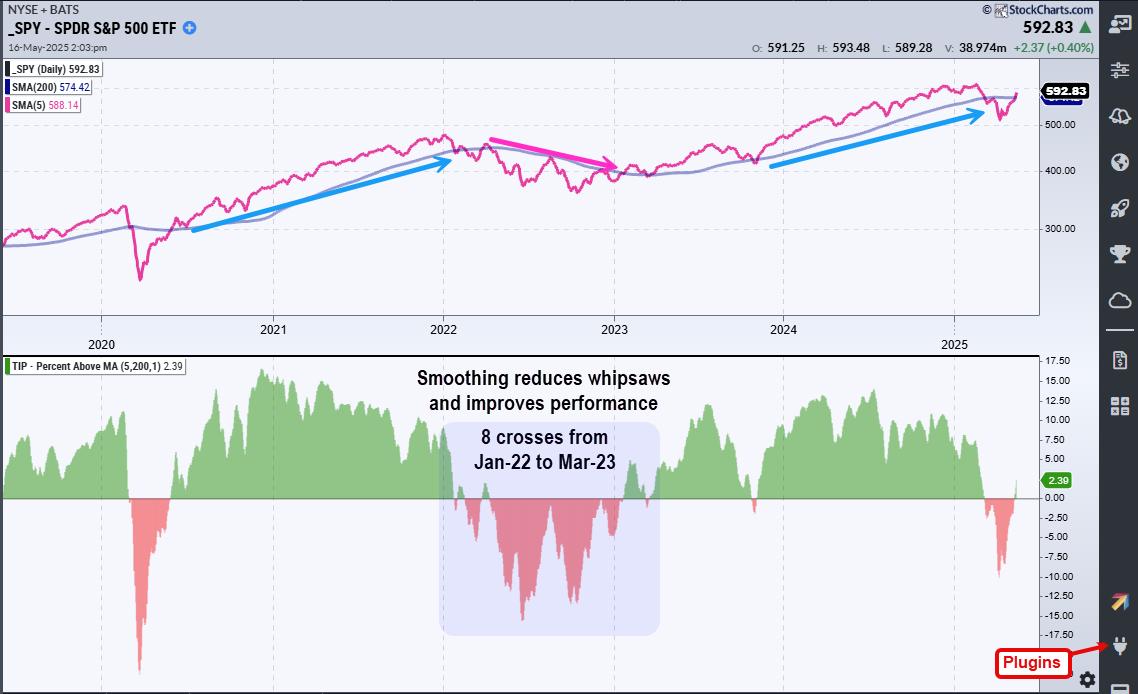

Chartists can enhance 200-day SMA alerts with a little bit smoothing. For instance, use a 5-day SMA as an alternative of the shut. Since 2005, the 5-day SMA crossed its 200-day SMA 55 occasions, which averages out to three per 12 months. Fewer alerts means fewer whipsaws. Additionally observe that this smoothing generated greater returns and decrease drawdowns.

The chart above reveals the SPY with % above MA (5,200,1). This indicator captures the proportion distinction between the 5 and 200 day SMAs. As a substitute of twenty-two crosses between January 2022 and March 2023, the 5-day SMA crossed the 200-day SMA simply 8 occasions. This indicator is a part of the TIP Indicator Edge Plugin for StockCharts ACP.

We will cut back whipsaws much more by including a sign filter. This subsequent part will cowl sign filters and efficiency metrics for SPY. We then present how different ETFs carry out and add little twist to enhance efficiency for QQQ alerts. This part continues for subscribers to TrendInvestorPro. Click on right here to take a trial and get fast entry.

////////////////////////////////////////

Select a Technique, Develop a Plan and Comply with a Course of

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Writer, Outline the Development and Commerce the Development

Wish to keep updated with Arthur’s newest market insights?

– Comply with @ArthurHill on Twitter

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering alerts inside the pattern, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.