There’s an outdated investing rule known as “purchase what you understand.” It was popularized by Peter Lynch, the legendary Constancy fund supervisor, who usually relied on the observations of his spouse and youngsters to identify traits earlier than Wall Avenue did.

For Canadians, that may imply one thing so simple as stopping at Tim Hortons on the way in which to work. You seize your Double Double, and whether or not you understand it or not, you’ve simply interacted with a publicly traded firm. Tim’s is owned by Restaurant Manufacturers Worldwide (TSX:QSR), which additionally occurs to be the mum or dad firm of Burger King, Popeyes, and Firehouse Subs.

There are many methods to gauge whether or not a inventory within reason priced. It will get simpler while you’re a big, worthwhile, dividend-paying title like QSR. An organization that throws off regular money move and pays a daily dividend provides you a baseline of high quality, which helps you to skip a number of the deeper forensic work on day one and begin with just a few fast, telling metrics.

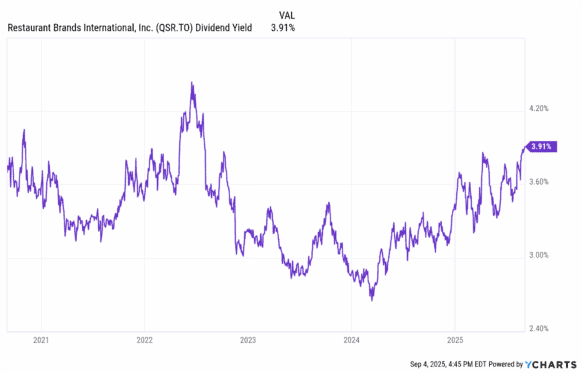

Checking for worth – dividend yield

Dividend yield is just dividends per share over the past 12 months divided by right now’s share worth. It’s nice for judging relative worth by time for a similar firm. All else equal, a lower cost or a rising dividend pushes the yield up; a better worth or a minimize pulls it down. Suppose numerator (dividend) over denominator (worth).

On QSR, the chart reveals a present yield round 3.9%. That sits towards the excessive finish of its five-year vary. In 2023, when the yield dipped towards the mid-2s, the inventory was pricier on this measure. When it spiked above 4% throughout 2022’s bear market, it was cheaper.

At present’s ~3.9% suggests QSR is extra enticing than it was in the course of the low-yield intervals, although not fairly as low-cost as these transient peaks above 4%. For income-minded traders, that’s a snug entry level for those who imagine dividend development continues.

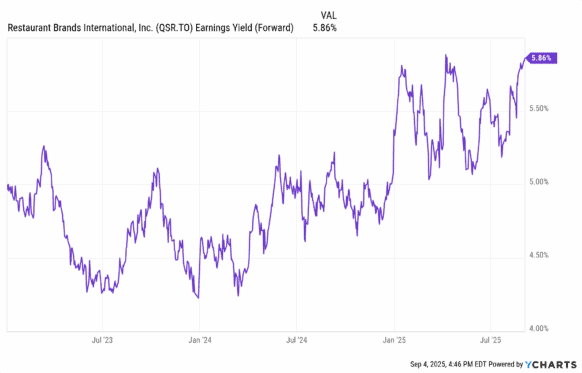

Checking for worth – earnings yield

Earnings yield just isn’t a money payout to you. It’s the inverse of the price-to-earnings (P/E) ratio and tells you ways a lot anticipated earnings you’re shopping for for every greenback invested. Ahead earnings yield makes use of next-12-months earnings-per-share (EPS).

The chart reveals QSR at about 5.9% right now. Flip that over and also you get a ahead P/E close to 17 (1 ÷ 0.0586 ≈ 17.1). For a world, franchise-heavy quick-service operator, that’s an inexpensive a number of. It implies an earnings yield premium of some share factors over short-term risk-free charges, with upside if the corporate grows same-store gross sales and retains opening franchised items.

A near-4% dividend yield and a ~6% ahead earnings yield level to QSR being honest to barely undervalued versus its personal current historical past. In case you anticipate regular dividend will increase and mid-single-digit EPS development, these beginning yields set you up for a stable total-return profile while not having heroic assumptions.

The Silly takeaway

QSR just isn’t a deep discount, however it doesn’t look costly both. With the dividend yield sitting close to 3.9% and the ahead earnings yield shut to six%, the inventory seems pretty valued to barely undervalued at present ranges. For a world operator with regular money move, a historical past of dividend development, and a sturdy model portfolio, that’s a good setup for traders looking for a mixture of revenue and long-term compounding.