Power-related Commodities Lead, however Oil Appears to be like Susceptible

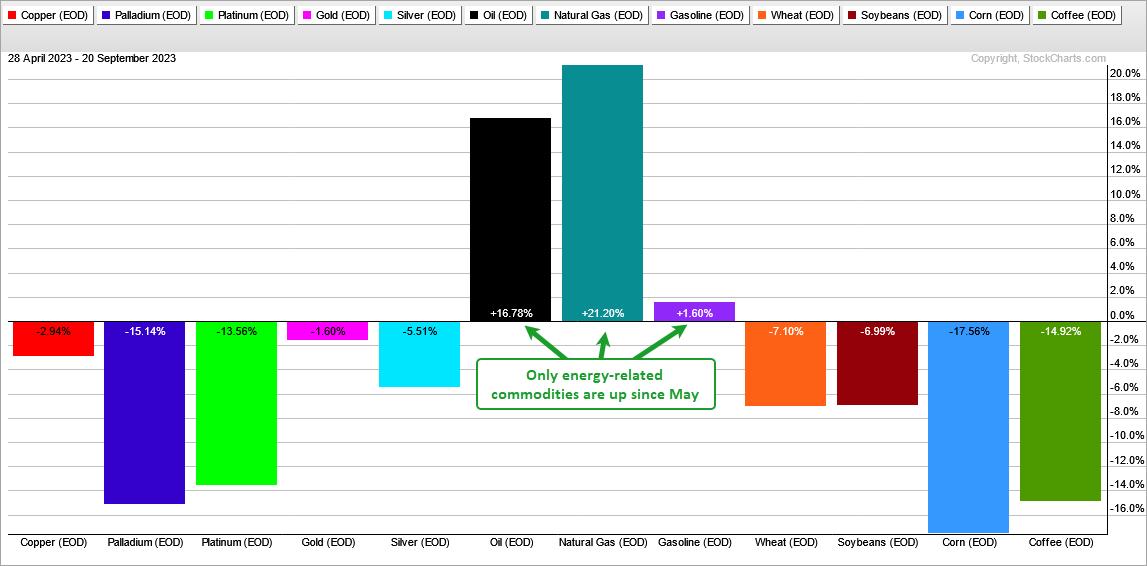

It has been a tough experience for many commodities this 12 months and particularly during the last 100 buying and selling days (since Might). Of the twelve spot costs I monitor, 9 are up and three are down. Treasured metals, base metals, lumber and grains are all down. The vitality advanced is the one gainer since Might. Oil is up over 15%. Despite the fact that oil is main, it hit an overbought excessive and appears weak to a pullback. This evaluation initially appeared in Thursday’s Chart Dealer report and video.

As an apart, there’s an outdated saying that the remedy for top oil costs is excessive oil costs. In different phrases, demand will wane as costs climb and provide will finally exceed demand. The identical is probably true for inflation. The remedy for top inflation is excessive inflation. Demand will wane as costs climb and shoppers in the reduction of on spending. This drop in demand is what is going to finally remedy inflation.

The chart beneath exhibits USO turning into overbought in July-August and much more overbought in September. . Sure, there’s overbought after which there’s OVERBOUGHT. RSI exceeded 70 in late July and early August. That is the backyard selection overbought studying. It then exceeded 80 in mid September. This creates an exceptionally overbought situation that would result in a pullback.

The place would possibly USO discover help? USO was up some 37% from the June low to the September excessive. A 50% retracement of this transfer would prolong to the 70 space. The blue shading marks a previous resistance zone within the low 70s and that is additionally a goal for a pullback. Taken collectively, I’d counsel a zone within the 70-73 space for a pullback.

I lined USO and two vitality ETFs in Thursday’s Chart Dealer report and video. This report summarized the bearish proof for shares and put forth draw back targets for SPY and QQQ. Three bearish inventory concepts have been additionally offered with draw back targets. Click on right here to study extra and acquire rapid entry.

The TIP Indicator Edge Plug-in for StockCharts ACP has 11 indicators to reinforce your evaluation and buying and selling. These embody the Development Composite, Momentum Composite and ATR Trailing Cease. Click on right here to study extra.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering alerts throughout the pattern, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.