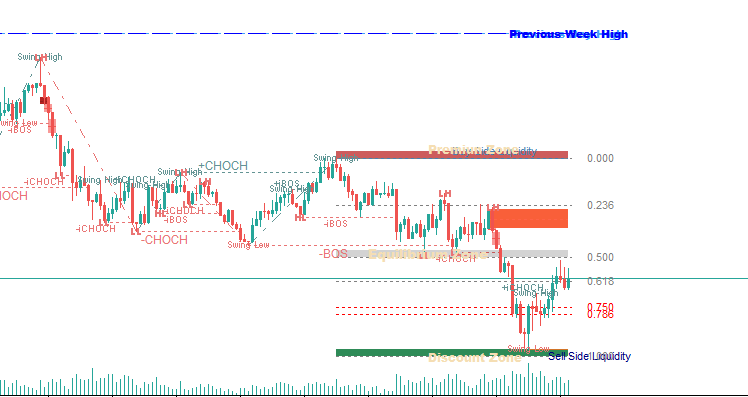

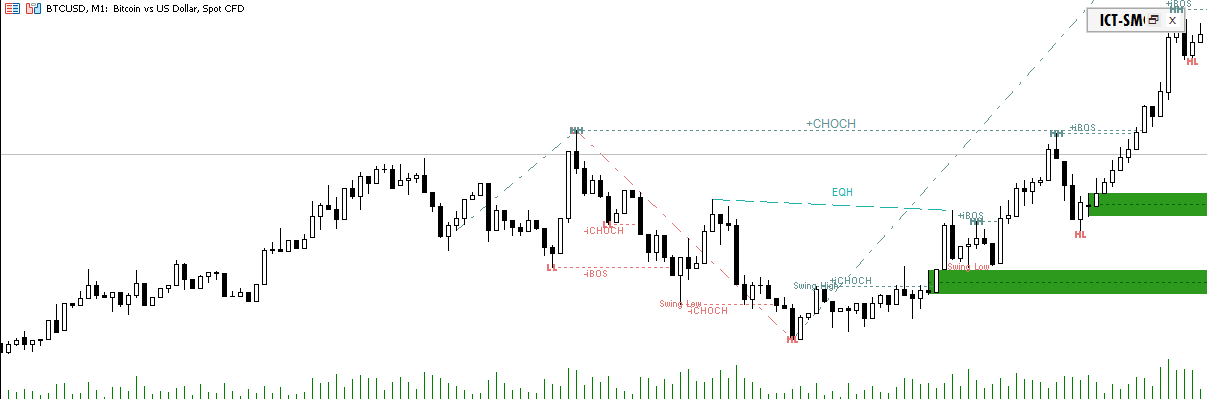

Equal low y Equal excessive

Equals are worth buildings that kind when two highs or two lows have just about the identical worth. These zones are sometimes interpreted as areas of liquidity or potential manipulation factors in evaluation based mostly on the ICT (Inside Circle Dealer) mannequin.

- Equal Excessive (EQH): Two highs with comparable costs.

- Equal Low (EQL): Two lows with comparable costs.

Parameters associated to Equal Highs and Equal Lows:

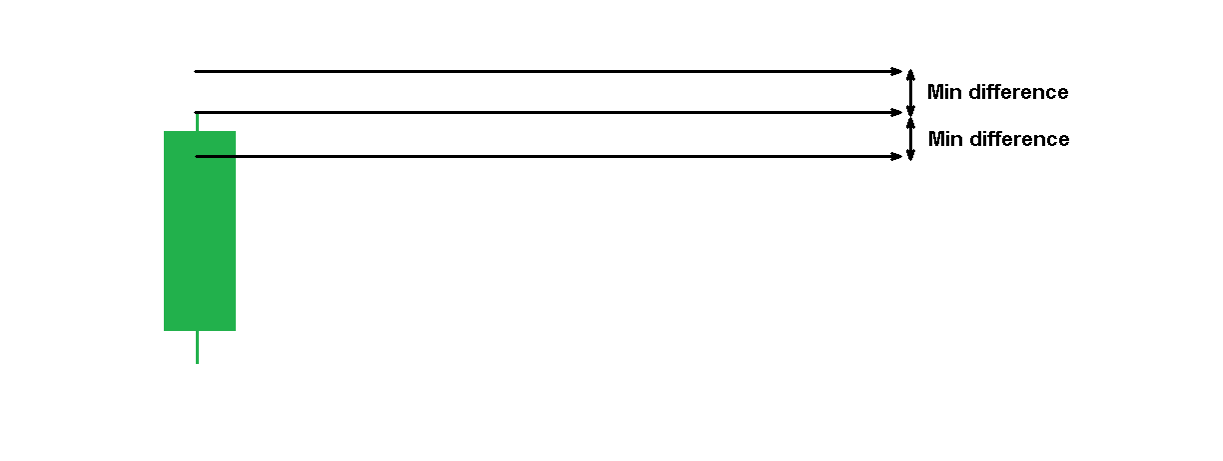

- “Select the mode for the distinction between swings: “: This parameter defines how the minimal allowed distinction margin, in factors or atr (utilizing a multiplier), between two highs or lows is calculated in order that they are often thought of “equal”.

- “Atr multiplier or distance in factors”: Worth to calculate the minimal allowable margin. If the “Select the mode for the distinction between swings:” parameter is “By Atr,” the atr multiplier should be entered; in any other case, the minimal distance in factors should be entered.

- Because it’s unlikely that two candles could have precisely the identical excessive or low, this parameter creates a variety across the first detected level. The configured worth is added and subtracted from that first worth, thus producing a tolerance interval.

As seen within the picture, a variety is generated; if the second excessive (or low) falls inside that vary, it’s thought of that there’s an Equal Excessive (EQH) or Equal Low (EQL), respectively.

select the colour of the equal excessive (textual content and line):

Select the colour of the textual content and the road that may mark the equal peak.select the colour of the equal low (textual content and line):

Select the colour of the textual content and the road that may mark the equal low.

Line Fashion Equals:

Line type for equals. See submit: Forms of strains in MT5.

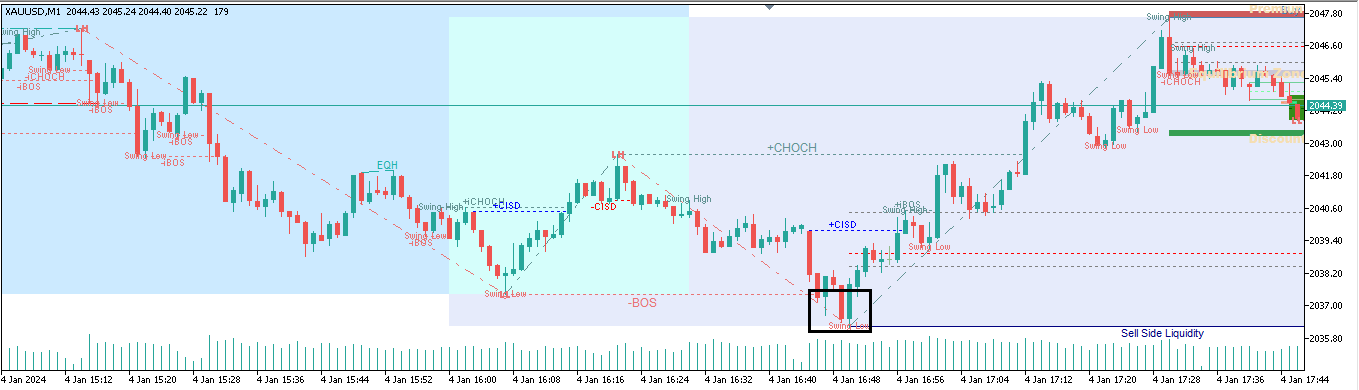

CIDS

The CISD idea comes from the ICT method and represents a construction that mixes:

- A liquidity sweep over an essential space (important highs or lows).

- A subsequent impulsive breakout from the candle that generated mentioned sweep.

This sample means that you can determine potential factors of manipulation and modifications in worth route.

Cisd Configuration:

- bullish cisd shade: Select the colour to signify a bullish CISD.

- bearish cisd shade: Select the colour to signify a bearish CISD.

- swing assortment interval. this to determine liquidity zones: This parameter defines the variety of candles required to determine a swing. These swings are utilized by the indicator to mark excessive or low areas that might be manipulated. For extra data on how swings are recognized, see the next submit:

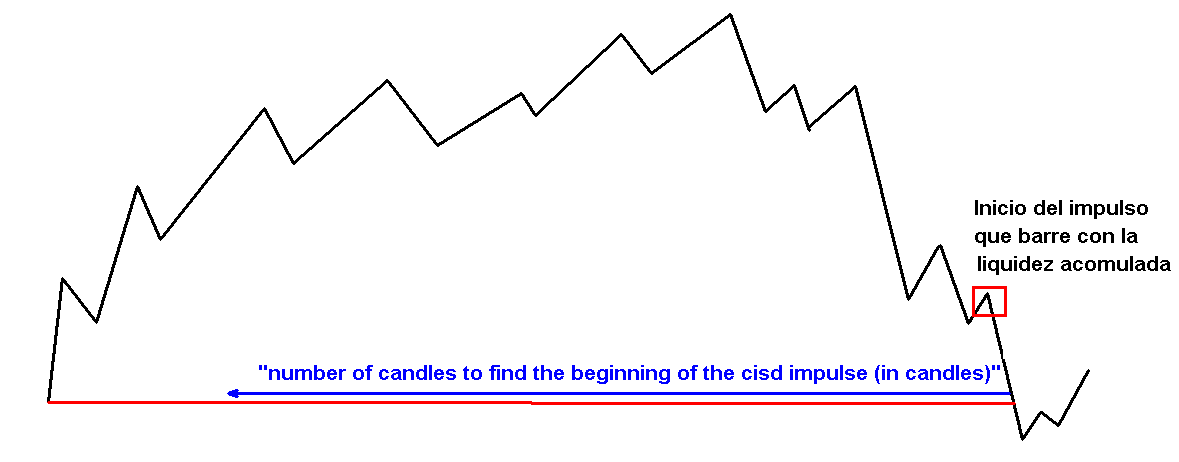

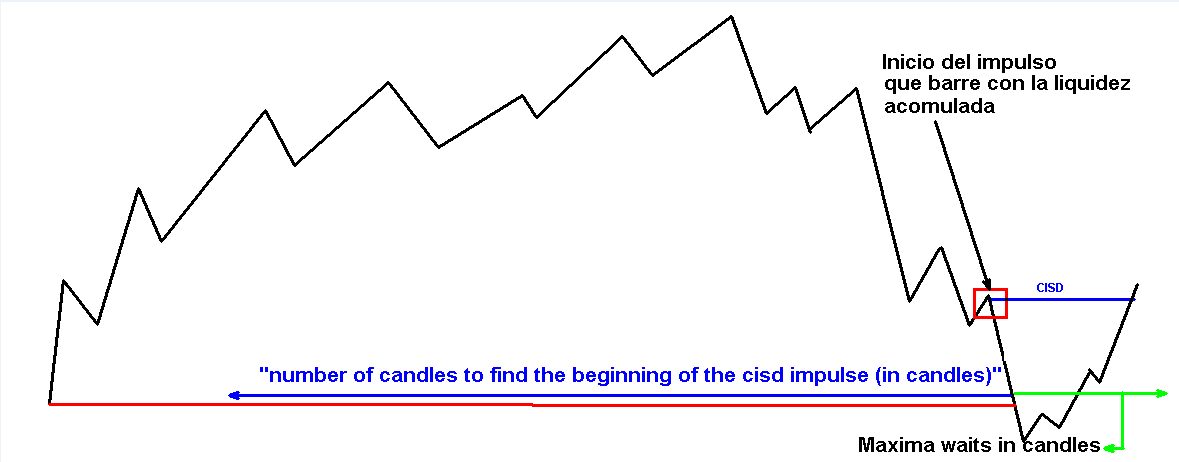

https://www.mql5.com/en/blogs/submit/762662 - variety of candles to seek out the start of the cisd impulse (in candles): Defines what number of backward candles will likely be analyzed to seek out the beginning of the impulse that generated the liquidity sweep.

As seen within the picture, the parameter “variety of candles to seek out the start of the CISD impulse (in candles)” signifies the variety of candles that will likely be used to seek out the start of the impulse that began with this liquidity sweep.

The decrease this worth, the larger the chance that the CISD will seem earlier. Nevertheless, this could cut back the reliability of the breakout as a development continuation.

Values larger than 20 don’t make a noticeable distinction. It is suggested to take care of a variety between 15 and 20 for balanced outcomes.

- most anticipate taking liquidity from a swing (in candles): This parameter defines the utmost variety of candles the indicator will anticipate manipulation to happen on a beforehand recognized swing. It is suggested that you just additionally improve this parameter proportionally as you improve the worth of the “variety of candles to seek out the start of the cisd impulse (in candles)” parameter. A rule of thumb is to set this worth between three and 4 occasions the worth of the earlier parameter to make sure an ample detection margin.

- Maxima waits in candles: This worth represents the utmost wait allowed (in variety of candles) for a full-bodied near happen above or under the purpose that originated the motion (liquidity sweep).

Within the instance picture, the inexperienced line represents the tolerance band inside which the candle should shut for the CISD to be legitimate.

- If the worth of this parameter is excessive, larger tolerance will likely be granted, permitting extra flexibility for the closure to happen.

- Conversely, a low worth will cut back that tolerance, making the situation stricter and subsequently harder to detect a CISD.

OTE:

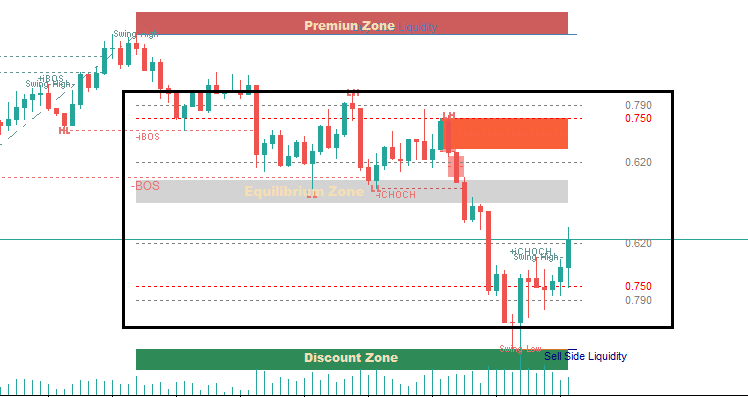

The OTE (Optimum Commerce Entry) is an idea throughout the ICT mannequin that helps determine optimum entry zones. Its graphical illustration is much like the Fibonacci retracement, however with sure changes at key ranges.

A very powerful degree throughout the OTE is 0.750, thought of the best level for executing a high-probability entry.

Parámetros generales del OTE:

- Ote Line Fashion: Choose the road type that will likely be used to plot the OTE ranges. See the submit: Forms of strains in MT5.

- Ote foremost line shade: Defines the colour of the OTE’s key degree. For instance, within the earlier picture, this degree was represented by a purple line.

- Ote secondary line shade: Colour for use for the secondary ranges of the OTE. Within the reference picture, these ranges are grey.

- Extension of the ote line (candles): Units the variety of candles used to increase the OTE strains. By default, this worth is normally 1.

- Ote ranges separated by “,”: Defines the OTE ranges to be drawn. These needs to be entered as a comma-separated checklist. Guidelines:

All ranges should be separated by commas, with out areas.

Right instance: “0.790,0.750,0.62”

To assist the indicator determine the first OTE degree, the specified worth should be preceded by the “&” image.

Instance: “0.62,0.75,&0.80”

On this case, degree 0.80 will likely be thought of the important thing degree.

Moreover, a number of key ranges might be marked by including the “&” image to every one you need to spotlight.

Instance with 2 key ranges. (“Ote ranges separated by “,” “ = “0.790,&0.750,&0.62”)

Fibonacci instance. (“Ote ranges separated by “,” ” = “0.0,0.236,0.50,0.618,&0.750,&0.786,1.00,1.272,1.618,2.618,4.236”)

Promote:

Purchase: