Nationwide Financial institution of Canada (TSX:NA) just lately delivered 1 / 4 that turned heads. With its latest blockbuster acquisition of Canadian Western Financial institution (CWB) lastly mirrored within the numbers, buyers are rightly asking: Is that this Canadian financial institution inventory a wise purchase for a long-term oriented portfolio in the present day, particularly looking over the subsequent three to 5 years? Let’s dive into the story unfolding at Nationwide Financial institution.

The $5 billion buy of CWB, introduced again in June 2024 and closed in February this 12 months, wasn’t simply one other deal. It was a strategic masterstroke, considerably boosting Nationwide Financial institution’s presence in Western Canada — a area the place it traditionally had much less muscle. The acquisition was a big step ahead within the acceleration of the financial institution’s home technique. The early outcomes are promising.

Nationwide Financial institution of Canada: Sturdy core efficiency meets acquisition enhance

Nationwide Financial institution of Canada is firing on all cylinders. Adjusted earnings per share (EPS) jumped 12% 12 months over 12 months to $2.85 for the quarter ending April 2025. Its market-leading return on fairness (ROE) of 15.6% is the envy of its friends. Revenue earlier than provisions for credit score losses and taxes surged 34% in the course of the previous quarter! This stellar efficiency wasn’t nearly risky buying and selling markets having an excellent run (although that helped); it mirrored strong natural development throughout private, industrial, and wealth administration segments.

Now, add CWB into the combination. Private and Business Banking income soared 25% 12 months over 12 months (4% organically excluding CWB). Wealth Administration income climbed 16%. The preliminary integration, in line with administration, is advancing “forward of schedule,” notably on price and funding synergies. The financial institution has already banked $27 million in synergies this previous quarter alone — a whopping 43% of its three-year goal already captured yearly! This early traction suggests the promised synergistic advantages of the deal are actual and doubtlessly achievable.

Capital confidence

Shopping for CWB did have an effect on capitalization. The financial institution’s widespread fairness tier-one (CET1) ratio, a key measure of a financial institution’s monetary energy, has dipped barely to 13.4% from 13.7%. Nevertheless, this capitalization stage stays strong, properly above regulatory necessities, and excessive sufficient to maintain the dividend development spree rolling.

Administration just lately highlighted future potential capital aid because the financial institution migrates CWB portfolios onto its extra superior threat fashions (Superior Inside Scores-Primarily based method, or AIRB), anticipated primarily in 2026. Whereas share buybacks are on maintain for now, with a concentrate on development and integration, a clearer capital return plan might be out by year-end.

Dangers and the highway forward: Persistence may pay

It’s not all easy crusing for the Nationwide Financial institution of Canada. The broader financial image holds uncertainty. World commerce tensions, excessive long-term rates of interest, and potential impacts from tariffs are recurring themes to look at. Whereas the financial institution emphasizes its “cautious method” and “prudent provisioning,” its credit score metrics, whereas manageable, did see some anticipated stress from absorbing CWB final quarter.

The large query mark for some buyers might be the financial institution’s stellar buying and selling income — can it final? Unstable market environments, just like the one seen early this 12 months, are supreme buying and selling environments, however efficiency ought to normalize going ahead.

NA inventory’s dividend delight

Revenue buyers, take word. Nationwide Financial institution boasts a strong 3.5% dividend yield. Extra impressively, it just lately introduced one other dividend hike in Could that marked its sixteenth consecutive annual improve. The financial institution inventory’s dividend payout ratio sits at a snug 42.2%, down from 43.2% a 12 months in the past, signalling sustainability and room for future development. This constant return of capital is a significant plus for long-term holders.

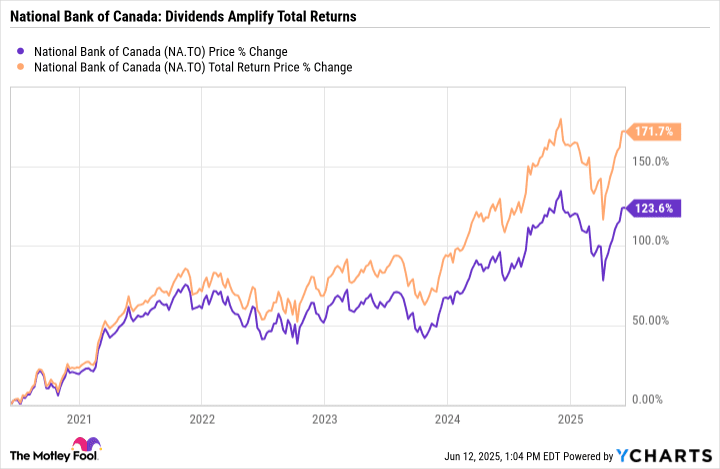

The financial institution inventory’s dividend amplified its complete returns from 123% to greater than 170% in the course of the previous 5 years.

Is Nationwide Financial institution of Canada inventory a purchase?

So, is Nationwide Financial institution of Canada inventory a purchase now? The financial institution inventory’s funding case seems compelling for buyers with a three- to five-year horizon. Shares seem pretty valued with a price-earnings-to-growth (PEG) ratio of 0.9. The CWB acquisition led to a strategic transformation that offers the financial institution a nationwide scale and a powerful Western platform in Canada. Early integration efforts are exceeding expectations, and up to date natural development displays the financial institution’s underlying energy and potential to proceed rising earnings and buyers’ capital.

A constantly rising dividend may amplify shareholders’ rewards.