It is nearly inconceivable to name market tops and market bottoms utilizing primary technical evaluation instruments like worth and quantity. Do not get me flawed, that mixture is my favourite throughout trend-following intervals. However attempting to identify bearish reversals is tough when worth motion retains using increased and better. The identical is true in attempting to identify bullish reversals when costs hold transferring decrease and decrease. Perhaps that appears unconventional to hard-core technicians, however I consider it is the truth. Too many of us say “when this line crosses that line, then it will occur”. To me, that is following technical evaluation and carrying blinders. Simply my two cents.

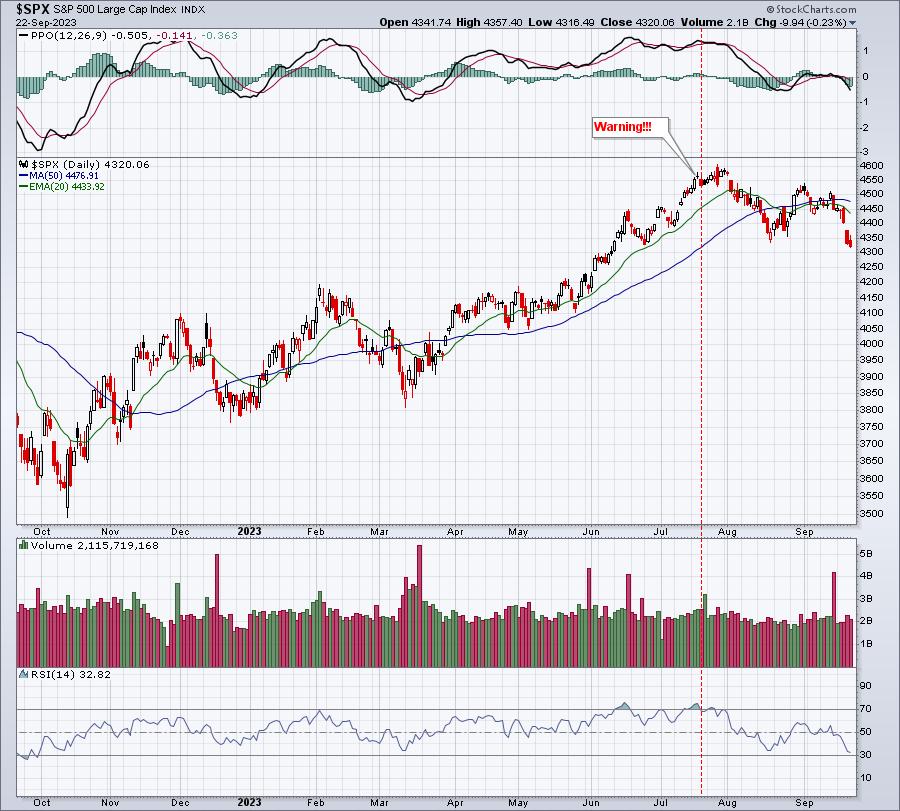

I take advantage of technical worth motion to substantiate what different indicators are suggesting. We get loads of indicators regularly – some short-term in nature, others long-term – if we’re solely prepared to hear. Whereas I have been bullish since June 2022, I do acknowledge short-term warning indicators that inform us that dangers of remaining lengthy have elevated considerably. In mid-July, I turned very cautious short-term and mentioned these indicators in a “Your Every day 5” episode that aired on July nineteenth. Let me pull up an S&P 500 chart, so you’ll be able to see the place U.S. equities stood once I fired this warning shot:

There have been a number of causes for the inventory market bulls to hit quicksand. Tesla (TSLA), a Wall Avenue darling and a favourite inventory of mine, instructed a attainable 20% drop. That decision aired the day of TSLA’s high and TSLA fell nearer to 30% in lower than one month. These indicators work and assist us to handle danger! As I all the time say, they do NOT assure future worth motion, however they make us conscious of accelerating danger and that is the way you make investments extra efficiently. Since that July high, I’ve inspired our EB members to tread very cautiously, no matter which means to every particular person member. To some, it is being in money. To others, it’d merely imply to keep away from leverage on the lengthy aspect. However this cautious interval is coming to an finish.

If you wish to see what was mentioned on July nineteenth and why I felt the inventory market was in short-term bother, try the Your Every day 5 recording on YouTube!

I completely LOVE when my indicators take the other view of the lots. And now that everybody believes we’re resuming the prior bear market, my indicators are saying HOGWASH. Might we proceed to proceed decrease? Positive. There are by no means any ensures with the inventory market. However I see indicators that recommend shorting is a VERY HIGH RISK technique, with these dangers rising daily. I am discussing one main motive why in our FREE EB Digest e-newsletter that will likely be printed early Monday morning, earlier than the inventory market opens. Should you’re not already an EB Digest subscriber, it is 100% free with no bank card required. Merely CLICK HERE and enter your title and e-mail deal with. I am going to talk about Purpose #1 to show bullish tomorrow morning. And I am going to additionally concentrate on different causes to be considering bullish ideas once I publish the EB Digest on Wednesday and Friday. Do not wait till it is too late. Examine them out NOW!

Completely happy buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Every day Market Report (DMR), offering steerage to EB.com members daily that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as properly, mixing a singular ability set to strategy the U.S. inventory market.