In case you open the chart of the worldwide gold ounce and go to the each day timeframe, you will note that previously week, it has been capable of play the function of a powerful help for gold by opening at round $1975, which is the place the 50-day shifting common has been for a very long time. On Tuesday, the market went up barely after which fell once more to round $1977 because of bearish stress.

Gold was capable of climb up not solely above the $2000 stage but additionally as much as across the essential $2050 stage throughout Wednesday and thursday because of weak financial reviews and dovish choices by Federal Reserve officers.

Final week’s occasions of gold within the foreign exchange market:

Final Monday, December eleventh, 2023, the worldwide gold ounce, which had began its day and week at $2004, fell to across the essential $1975 stage. The largest cause for this decline was the crucial Non-Farm Payrolls (NFP) report launched on that very same day.

In keeping with the most recent reviews from the US Bureau of Labor Statistics (BLS), it was revealed that non-farm payrolls within the US elevated by 199,000 in November. This quantity was increased than each the 150,000 reported within the earlier month and the anticipated 180,000. Different particulars of this report confirmed that the unemployment fee decreased from 3.9% to three.7% throughout this era, whereas the annual wage inflation measured by modifications in common hourly earnings remained at a gradual fee of 4%.

Lastly, the labor pressure participation fee elevated from 62.7% to 62.8%, and instantly after the discharge of this report, the US greenback index gained power and have become stronger in opposition to its opponents. In consequence, the worldwide gold worth started to say no and moved in the other way of the greenback’s upward development.

Then got here Tuesday, the day when the market was ready for an essential report on the US Shopper Value Index (CPI). As you already know, the CPI is without doubt one of the most vital drivers affecting the market and monetary belongings equivalent to gold and the greenback. The Federal Reserve officers at all times think about it of their choices.

The US Bureau of Labor Statistics reported that the US inflation fee, which is set by modifications in client costs, decreased by 3.1% in November. It’s price noting that this determine was introduced following October’s 3.2% determine, which was precisely according to analysts’ predictions.

Moreover, the annual internet inflation fee, or Core CPI, which excludes meals and vitality, was additionally introduced on the similar 4% determine.

The month-to-month and internet month-to-month inflation charges have been additionally introduced at 0.1% and 0.3%, respectively.

Then Wednesday got here, the identical day that the market was ready for the essential CPI, when the forecasts had introduced the determine of 0.2, however the identical earlier determine was introduced as 0.

As well as, the month-to-month producer worth index, which was -0.4, was declared zero, simply as predicted.

You will need to know that the greenback and gold didn’t react to this report, and the explanation was that all the market was ready for the assembly of the Central Financial institution of America officers.

The essential issue that precipitated the flight of gold costs was the dovish statements by Federal Reserve officers concerning the beginning of the rate of interest discount course of. Policymakers not solely signaled the tip of contractionary insurance policies or rate of interest hikes but additionally introduced that the Federal Reserve intends to scale back rates of interest 3 times, or 75 foundation factors, in 2024.

Federal Reserve Chairman Jerome Powell introduced that he and his colleagues have efficiently achieved their purpose of reaching a 2% inflation fee and can achieve this with out inflicting a recession. This assertion and resolution by Federal Reserve officers precipitated the 10-year Treasury bond yield to drop from 4.21% to three.94%, inflicting the worth of the US greenback index to fall to round 102.43, its lowest stage prior to now 4 months. Powell added that his colleagues are discussing and contemplating the timing of beginning to cut back rates of interest and that what is essential to us is Do not make the error of maintaining rates of interest excessive for too lengthy.

On Thursday, the market was eagerly awaiting essential central financial institution conferences of Switzerland, England, and Europe, however as predicted, no vital modifications or occasions occurred, and charges remained unchanged. The largest distinction between the Financial institution of England and the Federal Reserve was the tone of their presidents. In contrast to Federal Reserve Chairman Andrew Bailey, Financial institution of England Governor Mark Carney said that because of persistent inflation, we’re prone to hold rates of interest excessive for an extended interval. Carney’s tone was perceived as hawkish by the market and precipitated the pound to strengthen in opposition to the greenback.

After the essential choices of the central banks of Switzerland, England, and Europe, gold continued its upward development to across the essential $2050 stage. On Thursday, the market was ready for retail gross sales and weekly jobless claims reviews from the US. All of those reviews have been higher than economists’ predictions and precipitated the greenback to strengthen out there. For instance, internet retail gross sales within the US, which have been predicted to drop from zero to unfavorable one %, surprisingly elevated by two %. The weekly jobless claims report, which was anticipated to lower from 221 to 219, surprisingly introduced a lower of 202,000.

Lastly, the final working day of the week arrived, and the one essential report for the greenback and gold was the Buying Managers’ Index (PMI) for companies and manufacturing, which was higher for the previous and worse for the latter than market predictions.

there will probably be no vital information for the greenback and gold on Monday, December 18th. The one essential information on Tuesday would be the launch of Canada’s Shopper Value Index (CPI). On Wednesday, the market will probably be ready for the UK’s CPI report and the US Convention Board Shopper Confidence Index. Thursday will convey essential information for the US, together with the ultimate Gross Home Product (GDP) report and the weekly jobless claims report. Lastly, on the final working day of the week, the market will probably be ready for the essential Private Consumption Expenditures (PCE) report for the US. It’s anticipated to be a quiet week with little volatility.

Weekly Technical Evaluation of Gold:

In case you check out the each day gold chart, you will see that final week’s worth flooring was $1,973 and its ceiling was $2,047. The worldwide gold ounce rose about 0.75% final week, bringing pleasure to market bulls.

The RSI indicator on the each day timeframe is presently trending down in direction of the important thing stage of fifty and exhibiting a price of 53. This means that gold has misplaced its upward momentum and additional corrections will not be surprising.

Essential help ranges for gold:

If gold begins to say no, its first essential help stage will probably be $2,010. If market bears push it beneath this stage, the following essential help stage will probably be $1,990. Lastly, if gold falls beneath this stage, the following vital help stage will probably be $1,970.

Essential resistance ranges for gold:

If gold will increase in worth, its first essential resistance stage will probably be $2,040. If market bulls push it increased than this stage, the following essential resistance stage will probably be $2,060. Lastly, if gold surpasses this stage as nicely, the following vital resistance stage will probably be $2,080.

Lastly, we’ve compiled some statistics from Wall Avenue analysts for you:

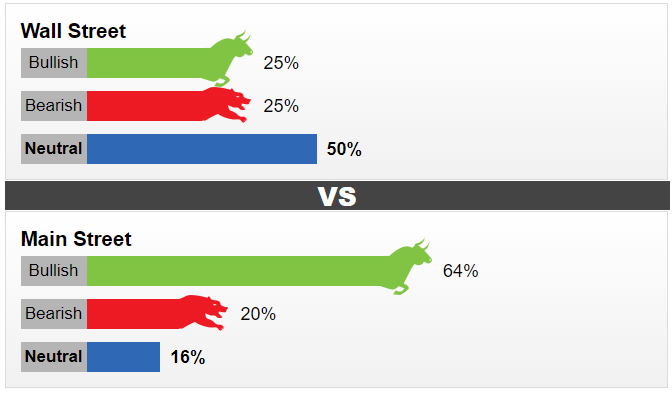

This week, 12 analysts participated in a survey on gold. three consultants (25%) predicted a rise in gold costs for the approaching week, whereas three different analysts (25%) predicted a lower in costs. The remaining six analysts (50%) have been impartial on gold for the upcoming week.

Market analysts have various opinions on the outlook for gold costs within the upcoming week, however total, there are balanced indicators with the potential of a rise in worth.

Causes for optimism:

1. Lower within the worth of the greenback and reduce in bond yields: These two elements historically assist enhance the worth of gold.

2. Seasonal demand: From Christmas to Valentine’s Day, there may be excessive demand for bodily gold, which may help enhance its worth.

3. Central financial institution purchases: Central banks proceed to purchase gold, which might have a optimistic impression on its worth.

4. Market expectations: Many market individuals anticipate the Federal Reserve to decrease rates of interest within the close to future, which might additionally assist gold.

Causes for warning:

1. Contradictory statements from the Federal Reserve: Some Federal Reserve officers have made conflicting statements about financial insurance policies, which might create uncertainty out there.

2. Potential strengthening of the greenback: The US greenback index might strengthen within the quick time period, which might put stress on gold costs.

3. Brief-term correction: The latest upward development in gold costs might expertise a short-term correction.

Conclusion: