EUR/USD: Correction is Not a Development Reversal But

● The dynamics of the EUR/USD pair prior to now week have been atypical. In a normal state of affairs, combating inflation towards the backdrop of a robust financial system and a wholesome labour market results in a rise within the central financial institution’s rate of interest. This, in flip, attracts traders and strengthens the nationwide forex. Nonetheless, this time the state of affairs unfolded fairly in a different way.

● U.S. macroeconomic information launched on Thursday, September 28, indicated robust GDP progress in Q2 at 2.1%. The variety of preliminary unemployment claims was 204K, barely greater than the earlier determine of 202K, however lower than the anticipated 215K. In the meantime, the full variety of residents receiving such advantages amounted to 1.67 million, falling wanting the 1.675 million forecast.

This information means that the U.S. financial system and labour market stay comparatively steady, which ought to immediate the U.S. Federal Reserve to extend rates of interest by 25 foundation factors (bps). It is value noting that Neil Kashkari, President of the Federal Reserve Financial institution of Minneapolis, just lately confirmed his full assist for such a transfer, as combating excessive inflation stays the central financial institution’s main goal. Jamie Dimon, CEO of JPMorgan, went even additional, stating that he doesn’t rule out the potential for charge hikes from the present 5.50% to as excessive as 7.00%.

Nonetheless, these figures and forecasts did not make an impression on market contributors. Particularly because the rhetoric from Fed officers proved to be fairly contradictory. For example, Thomas Barkin, President of the Federal Reserve Financial institution of Richmond, doesn’t imagine that U.S. GDP will proceed to develop in This fall. He additionally identified that there is a variety of opinions relating to future charges and that it is unclear if extra adjustments in financial coverage are required. Austin Goolsbee, President of the Federal Reserve Financial institution of Chicago, famous that overconfidence within the trade-off between inflation and unemployment carries the chance of coverage errors.

Such statements have tempered bullish sentiment on the greenback. Amid this murky and contradictory backdrop, yields on U.S. Treasury bonds, which had been supporting the greenback, fell from multi-year highs. Uncertainty surrounding the U.S. federal finances and the specter of a authorities shutdown additionally weighed on the greenback. Moreover, September 28 and 29 marked the final buying and selling days of Q3, and after 11 weeks of positive factors, greenback bulls started closing lengthy positions on the DXY index, locking in income.

● As for the Eurozone, inflation has clearly began to wane. Preliminary information signifies that the annual Client Value Index (CPI) progress in Germany has slowed from 6.4% to 4.3%, reaching its lowest level because the onset of Russia’s army invasion of Ukraine. The general Eurozone CPI additionally fell—regardless of a earlier charge of 5.3% and a forecast of 4.8%, it declined to 4.5%.

This discount in CPI led to a rescheduling of the European Central Financial institution’s (ECB) anticipated dovish coverage shift from Q3 2024 to Q2 2024. Furthermore, the chance of a brand new rate of interest hike has considerably diminished. In idea, this could have weakened the euro. Nonetheless, issues over the destiny of the greenback proved to be extra impactful, and after bouncing off 1.0487, EUR/USD moved upward, reaching a excessive of 1.0609.

● In response to analysts at Germany’s Commerzbank, some merchants have been merely very dissatisfied with ranges beneath 1.0500, so neither macro information nor statements from Fed officers might exert any vital affect on this. Nonetheless, the rebound doesn’t point out both a development reversal or the entire finish of the greenback rally. Commerzbank analysts imagine that because the market has clearly wager on a tender touchdown for the U.S. financial system, the greenback is prone to react notably harshly to information that doesn’t verify this viewpoint.

Analysts at MUFG Financial institution additionally imagine that the 1.0500 zone has lastly change into a robust stage that served as a catalyst for the reversal. Nonetheless, within the opinion of the financial institution’s economists, the correction is primarily technical in nature and will quickly fizzle out.

● On Friday, September 29, merchants awaited the discharge of the Private Consumption Expenditures Index (PCE) within the U.S., which is a key indicator. 12 months-on-year, it registered at 3.9%, exactly matching forecasts (the earlier determine was 4.3%). The market reacted with a minor enhance in volatility, after which EUR/USD closed the buying and selling week, month, and quarter at 1.0573. Strategists at Wells Fargo, a part of the “massive 4” U.S. banks, imagine that Europe’s low metrics in comparison with the U.S. ought to exert additional downward stress on the euro. In addition they imagine that the European Central Financial institution (ECB) has already concluded its present cycle of financial tightening, because of which the pair could drop to the 1.0200 stage by early 2024.

Shifting from the medium-term outlook to the near-term, as of the night of September 29, skilled opinions are evenly break up into three classes: one-third foresee additional greenback strengthening and a decline in EUR/USD; one other third anticipate an upward correction; and the final third take a impartial stance. As for technical evaluation, each amongst development indicators and oscillators on the D1 chart, the bulk, 90%, nonetheless favor the U.S. greenback and are colored crimson. Solely 10% facet with the euro. The pair’s nearest assist ranges are round 1.0560, adopted by 1.0490-1.0525, 1.0375, 1.0255, 1.0130, and 1.0000. Bulls will encounter resistance within the space of 1.0620-1.0630, then 1.0670-1.0700, adopted by 1.0745-1.0770, 1.0800, 1.0865, 1.0895-1.0925, 1.0985, and 1.1045.

● Knowledge releases pertaining to the U.S. labour market are anticipated all through the week spanning from October 3 to October 6. The week will culminate on Friday, October 6, when key indicators, together with the unemployment charge and the Non-Farm Payroll (NFP) figures, are set to be disclosed. Earlier within the week, particularly on Monday, October 2, insights into the U.S. manufacturing sector’s enterprise exercise (PMI) will probably be unveiled. Federal Reserve Chair Jerome Powell can also be scheduled to talk on today. On Wednesday, October 4, info relating to the enterprise exercise within the U.S. companies sector in addition to Eurozone retail gross sales will probably be made public.

GBP/USD: No Drivers for Pound Development

● In response to the most recent information printed by the UK’s Nationwide Statistics Workplace, the nation’s Gross Home Product (GDP) elevated by 0.6% year-over-year in Q2, exceeding expectations of 0.4% and up from 0.5% within the earlier quarter. Whereas this constructive development is actually encouraging, the UK’s 0.6% progress charge is 3.5 occasions decrease than the comparable determine in the USA, which stands at 2.1%. Subsequently, any commentary on which financial system is stronger is pointless.

● Strategists from ING, the biggest banking group within the Netherlands, imagine that GBP/USD rose within the second half of the previous week solely on account of a correction within the U.S. greenback. In response to them, there aren’t any tangible catalysts associated to the UK that may justify a sustained enhance within the British forex at this stage.

Analysts at UOB Group anticipate that GBP/USD might fluctuate inside a reasonably broad vary of 1.2100-1.2380 over the subsequent 1-3 weeks. Nonetheless, Wells Fargo strategists anticipate the pair to proceed its decline, reaching the 1.1600 zone in early 2024, the place it final traded in November 2022. The chance of such a transfer is corroborated by alerts from the Financial institution of England suggesting that the rate of interest on the pound could have peaked.

● GBP/USD closed the previous week on the 1.2202 mark. Analyst opinions on the pair’s near-term future are break up, providing no clear route: 40% are bullish on the pair, one other 40% are bearish, and the remaining 20% have adopted a impartial stance. Amongst development indicators and oscillators on the day by day chart (D1), 90% are painted in crimson, whereas 10% are in inexperienced. Ought to the pair transfer downward, it would encounter assist ranges and zones at 1.2120-1.2145, 1.2085, 1.1960, and 1.1800. Conversely, if the pair rises, it would face resistance at 1.2270, 1.2330, 1.2440-1.2450, 1.2510, 1.2550-1.2575, 1.2600-1.2615, 1.2690-1.2710, 1.2760, and 1.2800-1.2815.

● No vital occasions associated to the UK’s financial system are anticipated for the upcoming week.

USD/JPY: Awaiting the Breach of 150.00

● “Applicable measures will probably be taken towards extreme forex actions, not ruling out any choices,” “We’re intently monitoring forex change charges.” Do these phrases sound acquainted? Certainly, they need to: these are phrases from one more verbal intervention performed by Japan’s Finance Minister Shunichi Suzuki on Friday, September 29. He added that “the federal government has no particular goal stage for the Japanese yen that might function a set off for forex intervention.”

● One can agree with the final assertion, particularly contemplating that USD/JPY reached the 149.70 stage final week, a peak it final achieved in October 2022. Furthermore, amid large-scale world bond selloffs, the Financial institution of Japan (BoJ) took measures to curb the rising yields of 10-year JGBs and introduced an unscheduled operation to buy these bonds on September 29. In such a state of affairs, if not for the worldwide greenback correction, it is extremely probably that this operation might have propelled USD/JPY to interrupt by means of the 150.00 mark.

As we have already famous above, in line with many specialists, the greenback’s sell-off is most probably associated to profit-taking within the ultimate days of the week, month, and quarter. Subsequently, this development could quickly dissipate, making the breach of the 150.00 stage inevitable.

● May 150.00 be the “magic quantity” that triggers Japan’s monetary authorities to begin forex interventions? On the very least, market contributors view this stage as a possible catalyst for such intervention. That is all of the extra believable given the present financial indicators. Industrial manufacturing remained unchanged in August in comparison with July, and core inflation in Japan’s capital slowed for the third consecutive month in September. Underneath these circumstances, economists at Mizuho Securities imagine that though forex interventions could have restricted impression, “the federal government would lose nothing politically by demonstrating to the Japanese public that it’s taking the sharp rise in import costs severely, brought on by the weakening yen.”.

● The week concluded with USD/JPY buying and selling on the 149.32 mark. A majority of surveyed specialists (60%) anticipate a southern correction for the USD/JPY pair, probably even a pointy yen strengthening on account of forex intervention. In the meantime, 20% predict the pair will confidently proceed its northward trajectory, and one other 20% have a impartial outlook. On the D1 timeframe, all development indicators and oscillators are painted in inexperienced; nevertheless, 10% of the latter are signalling overbought circumstances. The closest assist ranges are located at 149.15, adopted by 148.45, 147.95-148.05, 146.85-147.25, 145.90-146.10, 145.30, 144.45, 143.75-144.05, 142.20, 140.60-140.75, 138.95-139.05, and 137.25-137.50. The closest resistance stands at 149.70-150.00, adopted by 150.40, 151.90 (October 2022 excessive), and 153.15.

● Other than the discharge of the Tankan Giant Producers Index for Q3 on October 2, no different vital financial information in regards to the state of the Japanese financial system is scheduled for the upcoming week.

CRYPTOCURRENCIES: Hopes on Halving and Halloween

● Within the first half of the week, BTC/USD trended downward, succumbing to the strengthening U.S. greenback. Nonetheless, it managed to carry throughout the $26,000 zone, after which the dynamics shifted: The Greenback Index (DXY) started to weaken, giving the bulls a possibility to push the pair again to the assist/resistance space round $27,000.

● It is clear that the stringent financial coverage of the Federal Reserve will proceed to exert stress on bitcoin, in addition to the broader cryptocurrency market. Whereas the U.S. regulator opted to not increase the refinancing charge on the finish of September, it didn’t rule out such a transfer sooner or later. Including to the market’s uncertainty is the SEC’s pending selections on spot bitcoin ETF functions.

Mark Yusko, CEO of Morgan Creek Capital, believes {that a} beneficial choice by the SEC on these functions might set off an influx of $300 billion in investments. In such a state of affairs, each the market capitalization and the coin’s worth would considerably enhance.

Nonetheless, the important thing phrase right here is “if.” Anthony Scaramucci, the founding father of SkyBridge Capital, acknowledged on the Messari Mainnet Convention in New York the existence of “headwinds” for bitcoin within the type of excessive rates of interest set by the Federal Reserve and the hostility of SEC Chairman Gary Gensler. Nonetheless, this investor and former White Home official is assured that bitcoin presents higher prospects than gold. If the bitcoin ETF functions are ultimately permitted, it will result in widespread adoption of digital belongings. Scaramucci believes that the worst is already behind us within the present bear market. “In case you have bitcoin, I would not promote it. You’ve got weathered the winter. […] The following 10-20 years will probably be extremely bullish,” he acknowledged. In response to the financier, the youthful era will mainstream the primary cryptocurrency, simply as they did with the web.

● Amid uncertainties surrounding the actions of the Federal Reserve and the SEC, the first hope for the expansion of the crypto market lies within the forthcoming halving occasion scheduled for April 2024. This occasion is sort of sure to happen. Nonetheless, even right here, opinions range. Various specialists predict a decline in bitcoin’s worth earlier than the halving.

An analyst generally known as Rekt Capital in contrast the present market state of affairs to the BTC worth dynamics in 2020 and speculated that the coin’s worth might fall inside a descending triangle, probably reaching as little as $19,082.

Properly-known dealer Bluntz, who precisely predicted the extent of bitcoin’s fall throughout the 2018 bear development, additionally foresees a seamless downward trajectory. He doubts that the asset has hit its backside as a result of the descending triangle sample forming on the chart seems incomplete. Consequently, Bluntz anticipates that bitcoin might depreciate to round $23,800, thereby finishing the third corrective wave.

Benjamin Cowen, one other famend analyst, can also be bearish in his outlook. He believes that the BTC worth might plummet to the $23,000 stage. Cowen bases his prediction on historic patterns, which counsel that the worth of the flagship cryptocurrency often experiences a major stoop earlier than a halving occasion. In response to Cowen, previous cycles point out that BTC and different cryptocurrencies don’t exhibit robust efficiency within the interval main as much as this significant occasion.

● Within the occasion of a downturn in digital asset costs, the upcoming halving might spell monetary wreck for a lot of miners, a few of whom have already succumbed to the aggressive pressures of 2021-2022. Presently, miners are working on skinny margins. At current, block rewards represent 96% of their revenue, whereas transaction charges make up simply 4%. The halving will lower the block mining rewards in half, and if this happens and not using a corresponding enhance within the coin’s worth, it might result in monetary disaster for a lot of operators.

Some corporations have began to attach their mining farms on to nuclear energy vegetation, bypassing distribution networks, whereas others want to renewable vitality sources. Nonetheless, not everybody has such choices. In response to Glassnode, the industry-average price to mine one bitcoin at present stands at $24,000, though this varies considerably from nation to nation. CoinGecko information exhibits the bottom price of mining in international locations like Lebanon ($266), Iran ($532), and Syria ($1,330). In distinction, on account of greater electrical energy prices, the U.S. sees prices soar to $46,280. If bitcoin’s worth or community charges don’t considerably enhance by the point of the halving, a wave of bankruptcies is probably going.

Is that this a foul or good improvement? Such bankruptcies would result in a discount within the mining of recent cash, making a provide deficit, and in the end driving up their worth. As it’s, the crypto change reserves have already decreased to 2 million BTC, nearing a six-year low. Market contributors are opting to carry their reserves in chilly storage, anticipating a future surge in costs.

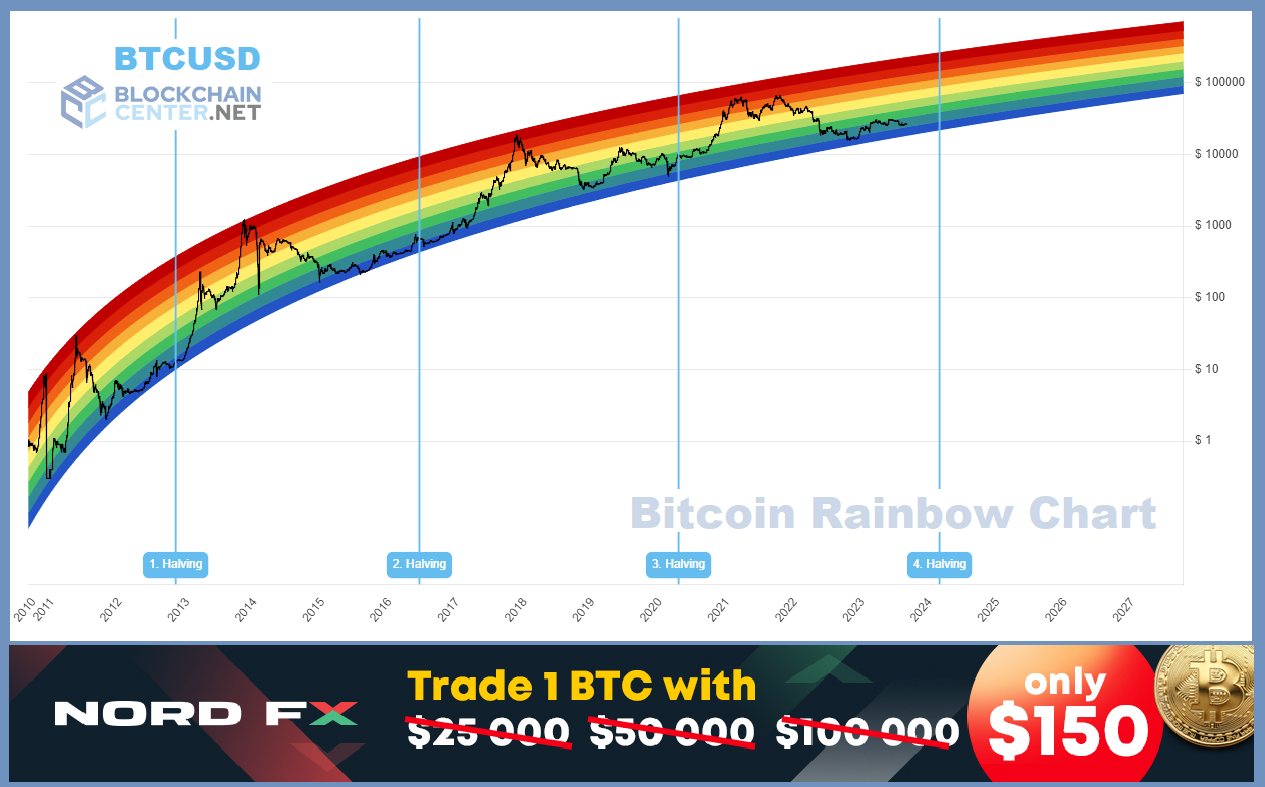

Analysis agency Fundstrat has speculated that towards the backdrop of the halving, BTC costs might surge by greater than 500% from present ranges, reaching the $180,000 mark. Monetary company Customary Chartered initiatives that the worth of the flagship cryptocurrency might rise to $50,000 this 12 months and to $120,000 by the top of 2024. The Bitcoin Rainbow Chart by the Blockchain Heart additionally recommends shopping for; BTC/USD quotes on their chart are at present within the decrease zone, suggesting a rebound is due.

● In response to Michael Saylor, the CEO of MicroStrategy, the inherent provide limitation of bitcoin capped at 21 million cash makes it the perfect asset for preserving and rising capital. The billionaire in contrast the depreciation charge of fiat currencies with the dynamics of inflation. He argued that people might see their financial savings erode if held in conventional currencies, citing that over the previous 100 years, funds held in U.S. {dollars} would have misplaced about 99% of their worth.

● As of the time of scripting this evaluation, on the night of Friday, September 29, BTC/USD has neither fallen to $19,000 nor risen to $180,000. It’s at present buying and selling at $26,850. The general market capitalization of the cryptocurrency market stands at $1.075 trillion, up from $1.053 trillion per week in the past. The Crypto Concern & Greed Index has elevated by 5 factors, transferring from 43 to 48, transitioning from the ‘Concern’ zone to the ‘Impartial’ zone.

● In conclusion, a forecast for the upcoming month. Consultants have as soon as once more turned to synthetic intelligence, this time to foretell the worth of the flagship cryptocurrency by Halloween (October 31). AI from CoinCodex posits that by the required date, bitcoin will enhance in worth and attain a mark of $29,703.

Curiously, there may be even a time period within the crypto market generally known as “Uptober.” The thought is that each October, bitcoin sees vital worth positive factors. Wanting on the 2021 figures, bitcoin was buying and selling close to $61,300 on October 31, marking a rise of over 344% in comparison with 2020. This phenomenon remained related even prior to now 12 months, 2022, following the high-profile crash of the FTX change. On October 1, 2022, the asset was buying and selling at $19,300, however by October 31, the coin had reached a mark of $21,000. Let’s have a look at what awaits us this time.

NordFX Analytical Group

Discover: These supplies should not funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx