KEY

TAKEAWAYS

- Retail buyers are benefiting from the inventory market pullback.

- Instruments just like the Market Abstract web page will help buyers keep away from shopping for into short-lived rallies and keep aligned with broader market traits.

- Study to establish weakening momentum, assist ranges, and relative energy efficiency.

Retail merchants and buyers usually do not get the credit score they deserve. However in April, they confirmed they have critical market smarts.

Whereas headlines screamed a few tanking inventory market — keep in mind, post-Liberation Day— retail buyers waited patiently. And when the time felt proper, they jumped in, including $40 billion to the inventory market through the month. Simply this previous Monday, retail buyers poured one other $5.4 billion in by day’s finish. That was greater than a 3rd of the day’s buying and selling quantity!

If this retains up, Could might beat April by way of whole inflows.

Classes From the Previous

Lots of you most likely keep in mind the dot-com growth and the painful bust that adopted. Numerous retail merchants jumped in pondering they had been shopping for the dip. Sadly, the market had different plans. Many retail merchants received worn out as a result of they ended up shopping for on the peak fairly than the dip.

That is the danger “purchase the dip” consumers face. Typically it really works. Typically it would not. So, how do you shield your portfolio worth, particularly now that you just’re managing a few of your investments?

Begin With a Easy Each day Routine

Taking management of your funds doesn’t suggest it is advisable stare at a display screen all day. However checking in available on the market frequently can go a great distance. Even a fast peek on the Market Abstract web page on the finish of every day (or as soon as per week) will help you keep on monitor.

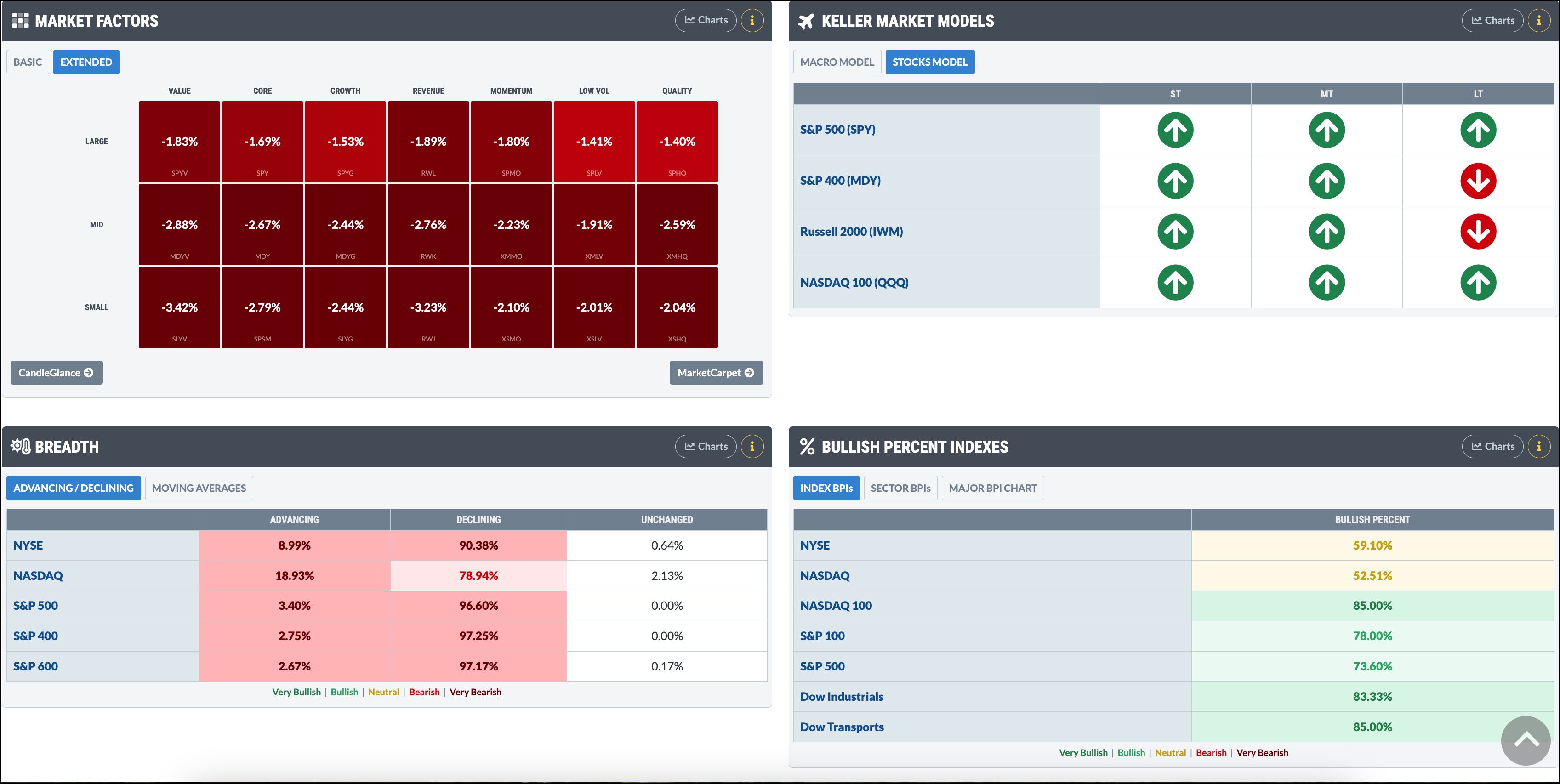

You will get a snapshot of how the key indexes are performing, what their every day or weekly streaks are, and if they’re above particular transferring averages. Here is just a little snippet of the web page. There’s much more to find on the web page.

An Instance: Maintaining Tabs on NVIDIA (NVDA)

As an instance to procure shares of NVIDIA Corp. (NVDA) after it dipped in early April. Regardless of how effectively the inventory carried out in 2024, you may’t simply “set it and neglect it.”

You’ll want to monitor how the S&P 500 ($SPX), Nasdaq ($COMPQ), and Nasdaq 100 ($NDX) are performing since NVDA is a closely weighted inventory in these indexes.

Here is what you are able to do:

- Examine the pattern. Are the indexes trending larger? Are they above key transferring averages?

- Click on on the index identify. Begin with the every day chart and search for any purple flags like a break beneath the 200-day easy transferring common (SMA).

- Watch the up or down streaks. If a profitable streak turns right into a dropping one, it is value noting.

Digging Deeper With Internals and Sector Insights

The Market Abstract web page additionally offers you entry to market internals that may make it easier to decide the well being of the indexes. These embody the Advancing/Declining Points, Bullish % Index (BPI), and New Highs/New Lows, amongst many others.

Since your focus is semiconductor shares, you’ll intently watch the associated indexes. For BPI, you’d go one step additional and monitor the Know-how Sector BPI ($BPINFO).

The US Industries panel shows the efficiency of the Semiconductors.

What’s Up With Semis? Let’s Take a look at XSD

At this level, it is value analyzing the chart of the SPDR S&P Semiconductor ETF (XSD), the ETF included within the Market Abstract web page. The six-month every day chart beneath exhibits that XSD is now buying and selling beneath its 200-day SMA, which is a cause for concern.

FIGURE 1. DAILY CHART OF XSD. The ETF fell beneath its 200-day SMA on Wednesday and is underperforming SPY. Chart supply: StockCharts.com. For instructional functions.

Be aware that XSD is holding on to the assist of the Could 12 low, which is when the worth gapped up. Gaps usually get crammed, so a fall beneath the place XSD closed on Wednesday might take the ETF right down to the $210 stage.

As well as, the ETF’s efficiency relative to the S&P 500 ETF (SPY) during the last six months is at -3.96%. This means that semiconductors are attempting laborious to re-establish their pre-2025 management place. If XSD continues to underperform SPY, it might be extra cause to be involved.

Examine In on NVDA Once more

Seeing this chart ought to immediate you to tug up the chart of NVDA. Is the inventory following the identical sample because the ETF?

Trying on the six-month every day chart of NVDA, it is nonetheless above its 200-day SMA, not like XSD. Nevertheless, NVDA’s inventory worth is flirting with the assist of its Could 14 low. A breach of the low might take NVDA’s inventory worth to its 200-day SMA or decrease. This would not be good for the general fairness market as a result of NVDA is such a heavyweight within the U.S. large-cap indexes.

FIGURE 2. DAILY CHART OF NVDA STOCK. Wednesday’s worth motion suggests the opportunity of a pullback. If worth falls beneath the Could 14 low, the subsequent cease could possibly be the 200-day SMA. Chart supply: StockCharts.com. For instructional functions.

Earlier than getting into your place, it is best to have recognized your revenue goal and exit level primarily based in your danger tolerance stage. Keep in mind, when managing your investments, self-discipline is vital.

Maintain It Easy

The Market Abstract web page is a instrument that may make it easier to keep forward of the inventory market with out overwhelming you.

Right here is a method to make use of the Market Abstract web page:

- You do not have to be glued to the display screen. Simply make checking in part of your routine.

- Know what issues. Give attention to the important thing indexes, which path they’re trending, and the sectors you are invested in.

- Interact with the market. The extra you perceive the worth motion of the market, the extra empowered you grow to be.

There are lots of extra methods to make use of the Market Abstract web page, and we’ll be sharing extra in upcoming articles.

Backside Line

Whether or not you are hands-on together with your investments, semi-retired, or retired, staying knowledgeable will help you are feeling assured and in management.

So go on, take a look at the Market Abstract web page, discover the charts, and stick with your buying and selling plan.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra