Hi there MQL5 Group,

I want to share the technical structure and improvement journey of my newest mission: X-TRADER AI V4.1 (Codename: NEXUS).

Not like conventional Professional Advisors that depend on inflexible if/else logic or easy indicator crossovers (RSI/MACD), NEXUS is constructed upon a Deep Reinforcement Studying (DRL) framework, particularly using Proximal Coverage Optimization (PPO).

The target was to not construct a “bot” that indicators entries, however to construct an autonomous agent that understands market context, construction, and regime.

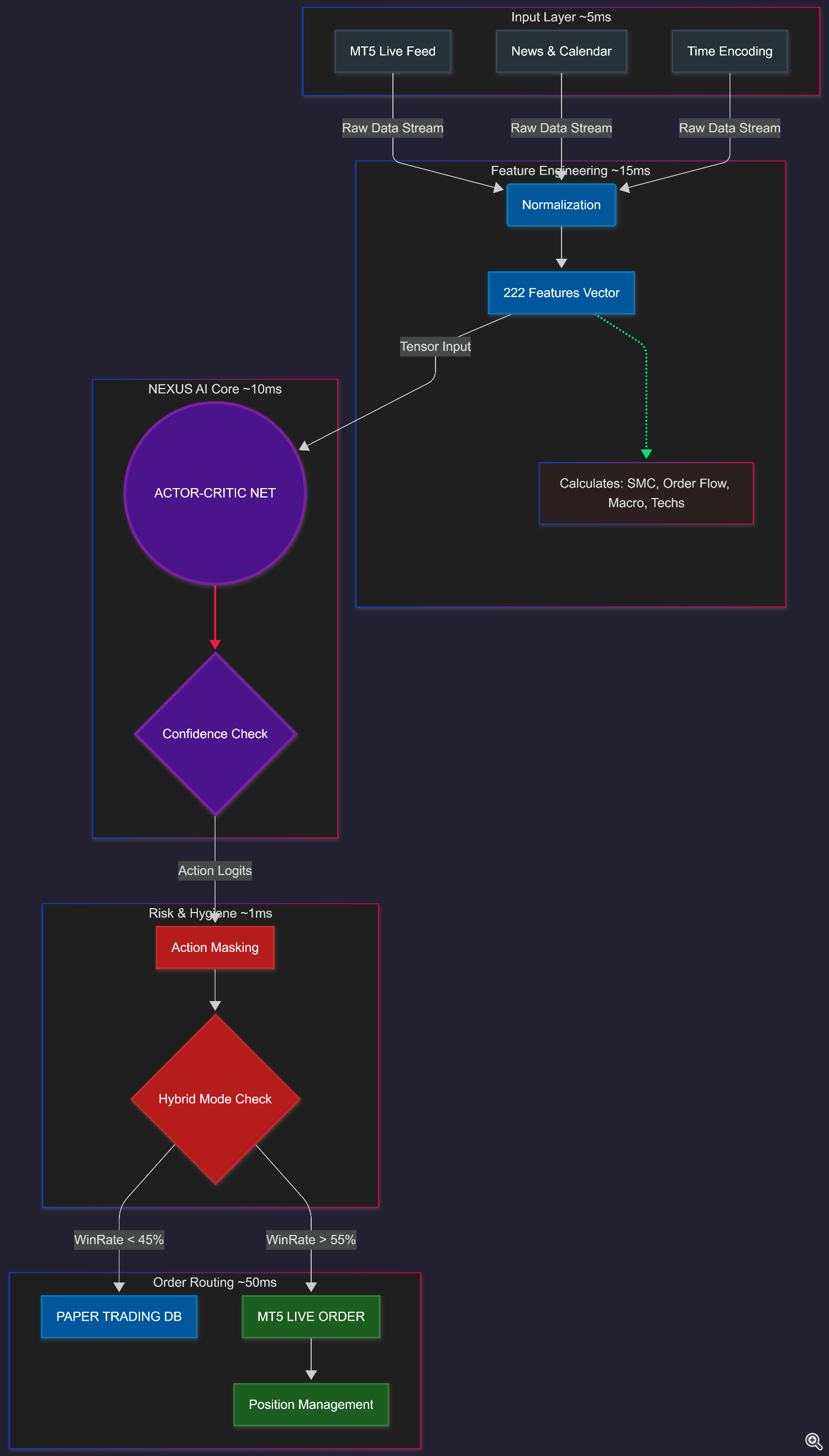

Here’s a breakdown of the system structure:

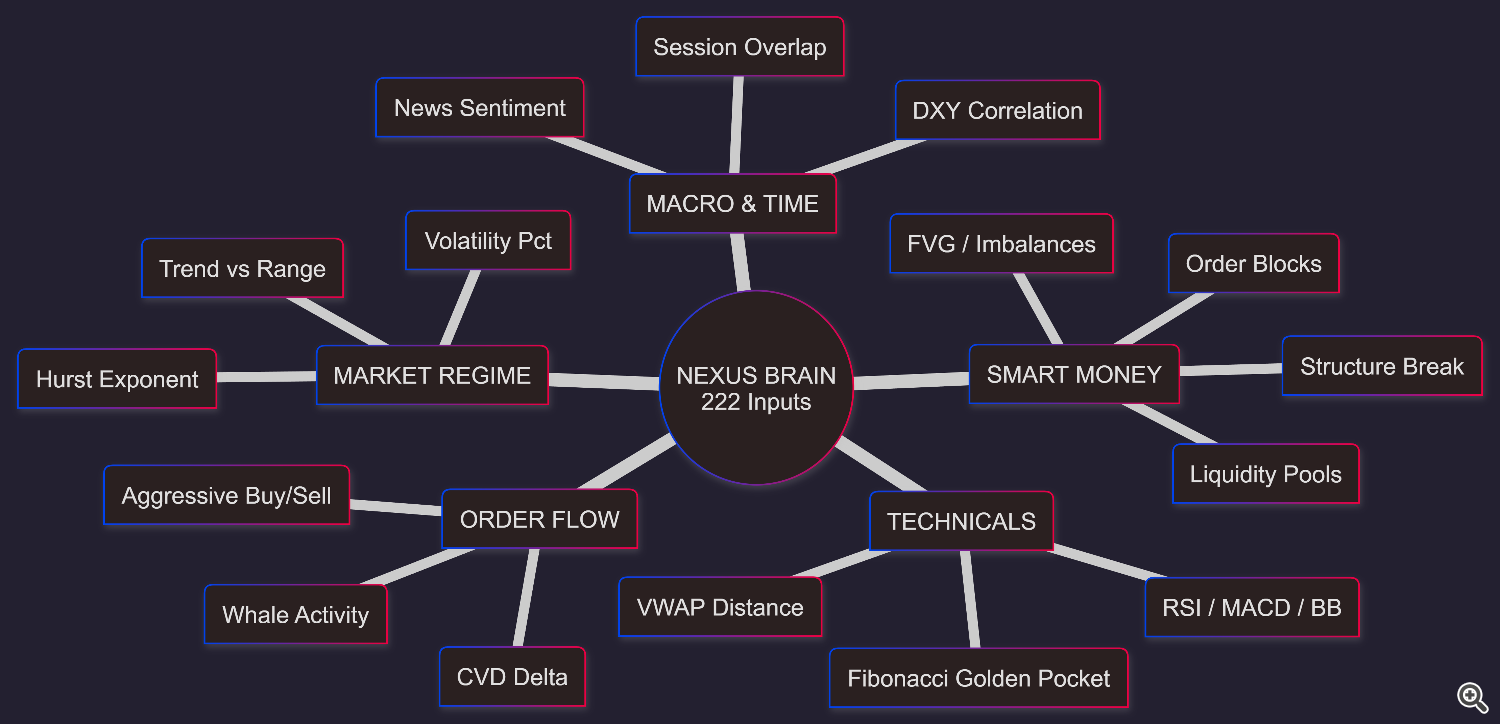

1. Characteristic Engineering (The Imaginative and prescient)

The enter layer of the neural community is huge. The agent doesn’t merely take a look at Open/Shut costs. It processes a normalized vector of 222 distinct options concurrently throughout 5 timeframes (M1, M5, M15, H1, H4).

The function set is engineered to seize institutional footprints:

Good Cash Ideas (SMC): The system algorithmically detects Order Blocks, Truthful Worth Gaps (FVG), and inner/swing construction breaks (BOS/CHoCH).

Superior Order Movement: It calculates Cumulative Quantity Delta (CVD), aggressive Purchase/Promote imbalances, and enormous commerce depth z-scores in real-time.

Market Regime Detection: Utilizing Hurst Exponents, the agent identifies whether or not the market is in a Random Stroll, Imply-Reverting, or Trending state, adjusting its bias accordingly.

Macro & Temporal: Inputs embrace DXY correlation, Session Overlaps (London/NY), and information proximity vectors.

2. Mannequin Structure (The Mind)

The core is an Actor-Critic Community with roughly 3.5 Million trainable parameters.

The Spine: A deep residual community processes the 222 inputs to extract latent options.

The Actor (Coverage): Outputs likelihood distributions for actions (Discrete) and steady values for dynamic SL/TP sizing.

The Critic (Worth): Estimates the anticipated return of the present state to stabilize coaching.

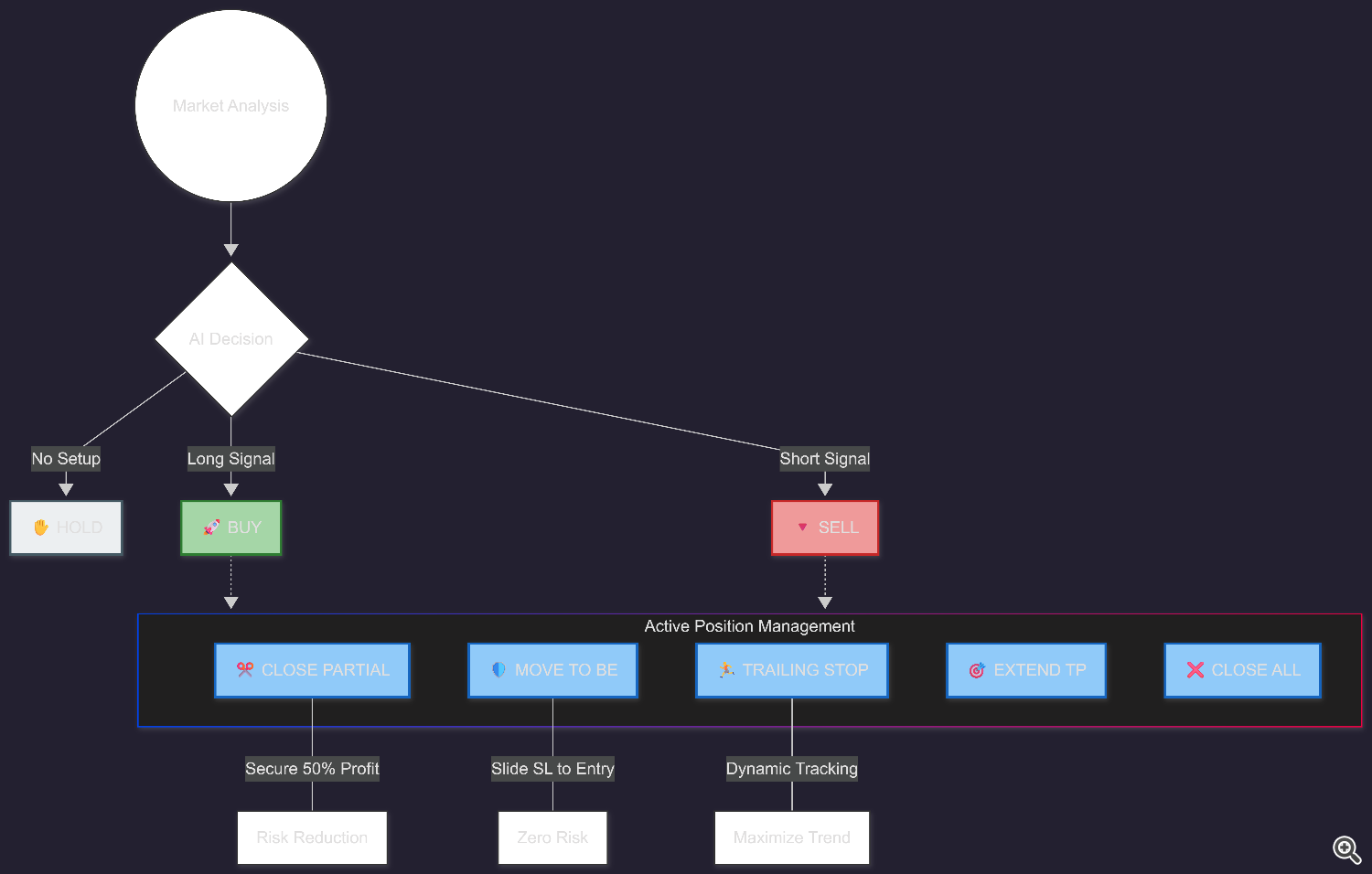

3. Discrete Motion Area (Execution)

Commonplace EAs are binary (Purchase or Promote). NEXUS operates in a steady setting with 8 Discrete Actions, permitting it to handle positions like a human dealer:

HOLD (Do nothing / Watch for setup)

BUY (Open Lengthy)

SELL (Open Quick)

CLOSE_ALL (Exit place)

CLOSE_PARTIAL (Safe 50% revenue)

MOVE_SL_BREAKEVEN (Threat-free commerce)

ACTIVATE_TRAILING (Volatility-based trailing)

EXTEND_TP (Let income run if pattern is powerful)

Notice: We use Motion Masking to make sure the agent can’t select invalid actions (e.g., making an attempt to Purchase whereas already able).

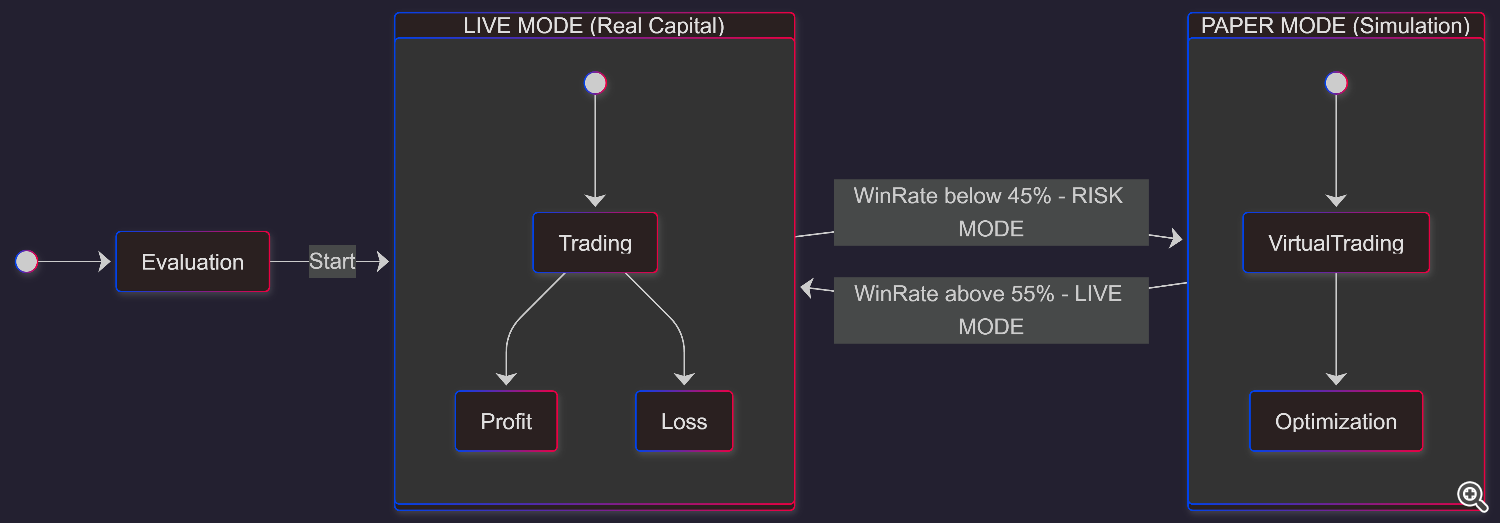

4. Hybrid Safety Engine (Threat Administration)

That is essentially the most important element for dwell deployment. To unravel the “mannequin drift” concern the place AI efficiency degrades in unseen market situations, I carried out a Hybrid Execution Mode:

Reside Mode: Energetic when the rolling 20-trade Win Price is > 55%.

Paper Mode (Kill Swap): If the Win Price drops beneath 45%, the system robotically disconnects from the dwell order move. It continues to commerce in an inner simulation (Paper Mode) till statistical confidence is restored.

This acts as an automatic circuit breaker, stopping account blow-ups throughout extremely erratic market occasions.

5. Multi-Agent Deployment

The system is presently deployed as 5 separate brokers, every fine-tuned for particular asset lessons:

I’m completely satisfied to debate the technical implementation, the challenges of coaching PPO fashions on monetary information, or the particular function engineering strategies used for Order Movement and SMC detection.

Let’s talk about: How do you deal with function normalization for multi-timeframe inputs in your ML initiatives?

📋 X-TRADER AI – Official Hyperlinks

🌐 Official Web site: https://fxairobot.com

✈️ Telegram Channel: https://t.me/xtraderai

📺 YouTube Channel: https://www.youtube.com/@xtraderai

📈 Vantage Markets Copy Commerce: (Join your account and begin auto-copying) 🔗 Be a part of Hyperlink: https://www.vantagemarkets.com/open-live-account/?sub1=spid_ODc5MTYz&affid=192756&platform=copytrading&autoCertification=false 👉 Technique Identify: X TRADER AI

📡 MQL5 Reside Sign Service: https://www.mql5.com/en/indicators/2352533 (⚠️ Notice: Outcomes could differ on totally different brokers as a result of unfold/latency.)

![[Dev Log] X-TRADER AI V4.1 NEXUS: A 3.5M Parameter Deep Reinforcement Studying Agent (PPO) – Buying and selling Methods – 7 January 2026 [Dev Log] X-TRADER AI V4.1 NEXUS: A 3.5M Parameter Deep Reinforcement Studying Agent (PPO) – Buying and selling Methods – 7 January 2026](https://c.mql5.com/6/990/splash-766701.png)