Extremely Charts: Full Person Information

Introduction

Extremely Charts is a robust Skilled Advisor that transforms your MetaTrader 5 platform by enabling a number of various chart varieties past the usual candlestick, bar, and line charts. This device offers merchants entry to Second Charts, Tick Charts, Renko, Vary, Line Break, and Heiken Ashi charts—all inside the acquainted MT5 surroundings.

This information will stroll you thru every chart kind, clarify the settings, focus on efficiency issues, and present you methods to use the management panel successfully.

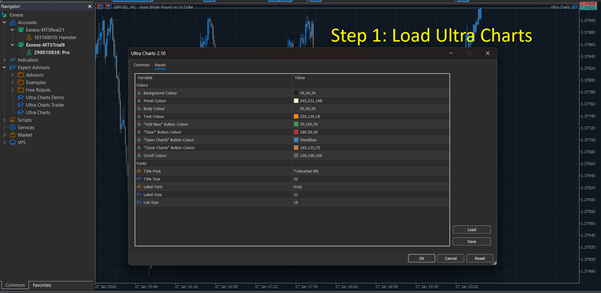

Getting Began with MT5 Extremely Charts

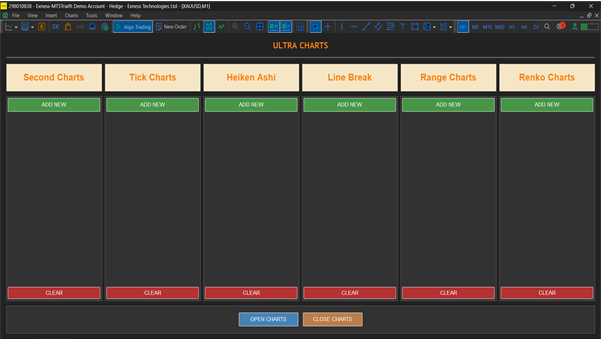

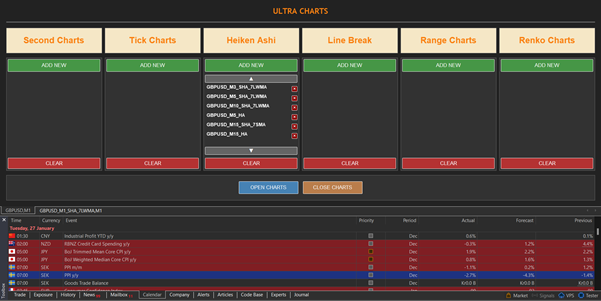

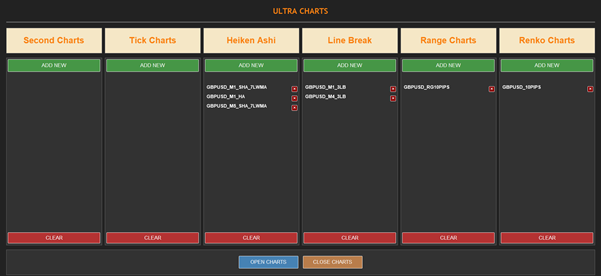

The Management Panel Overview

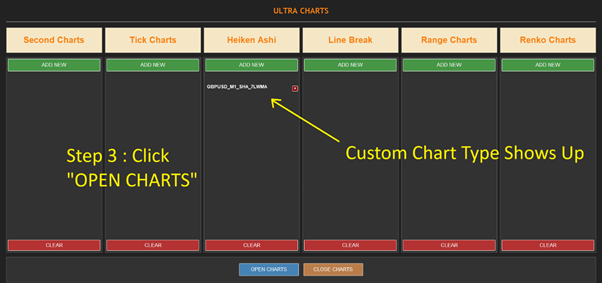

As soon as activated, MT5 Extremely Charts shows a user-friendly management panel with six essential buttons:

- Add New: Creates a brand new customized chart primarily based in your chosen parameters

- Clear: Closes & removes all presently displayed customized charts for the chart kind

- Scroll Up: Navigates upward by way of your checklist of charts

- Scroll Down: Navigates downward by way of your checklist of charts

- Open Charts: Opens chosen charts in new home windows

- Shut Charts: Closes & eliminated all presently opened charts

Chart Sorts and Settings

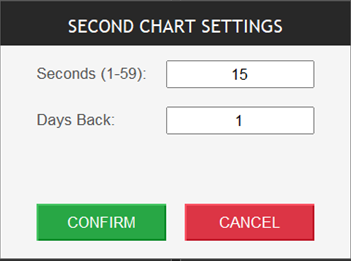

1. Second Charts

What Are Second Charts?

Second Charts create new candles primarily based on time intervals measured in seconds relatively than minutes or hours. This offers ultra-short-term value motion visibility.

Key Settings:

- Interval: Variety of seconds per candle, with an higher restrict of seconds

- Days Again: What number of days again price of knowledge we wish to use to create customized bars

Efficiency with Smaller Ranges:

When utilizing very small second intervals (5-15 seconds), anticipate:

- Excessive CPU utilization throughout energetic market hours

- Giant information storage necessities

- Glorious granularity for scalping methods

- Extra noise in value motion

- Sooner sign era

Greatest Use Circumstances:

- Scalping methods

- Order movement evaluation

- Entry timing refinement

- Excessive-frequency buying and selling setups

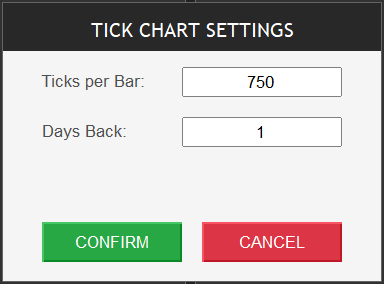

2. Tick Charts

What Are Tick Charts?

Tick Charts create a brand new candle after a specified variety of value modifications (ticks) happen, no matter time. This volume-based strategy filters out low-activity intervals.

Key Settings:

- Ticks Per Bar: Variety of ticks earlier than a brand new candle kinds (e.g., 50, 100, 500)

- Days Again: What number of days again price of knowledge we wish to use to create customized bars

Efficiency with Smaller Ranges:

Utilizing decrease tick counts (10-50 ticks per bar) ends in:

- Extraordinarily quick candle formation throughout unstable intervals

- Slower candle formation throughout quiet markets

- Higher filtering of time-based noise

- Increased processing calls for

- Extra attentive to precise buying and selling exercise

Greatest Use Circumstances:

- Quantity-based buying and selling methods

- Market volatility evaluation

- Filtering consolidation intervals

- Order ebook evaluation

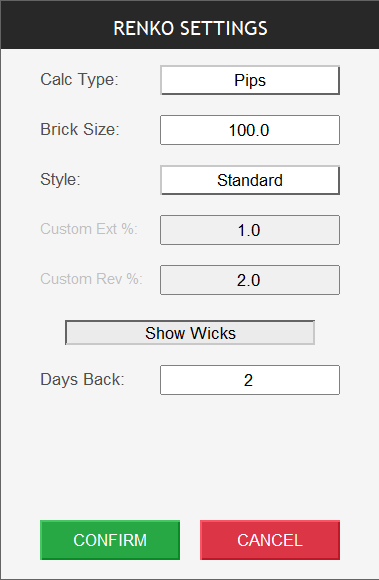

3. Renko Charts

What Are Renko Charts?

Renko charts show value actions utilizing bricks of mounted sizes, filtering out minor value fluctuations and time completely. A brand new brick solely kinds when value strikes a predetermined quantity.

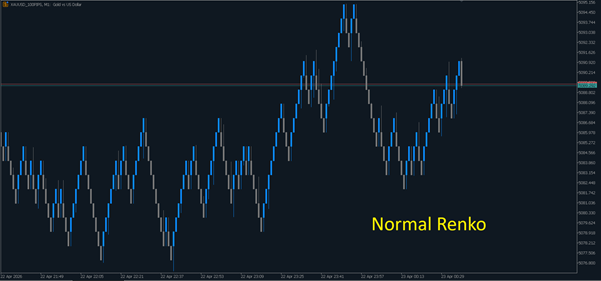

Regular Renko

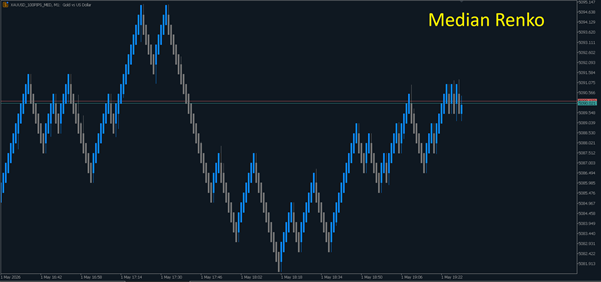

Median Renko

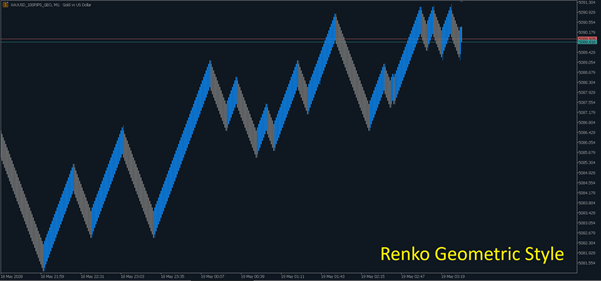

Geometric Renko

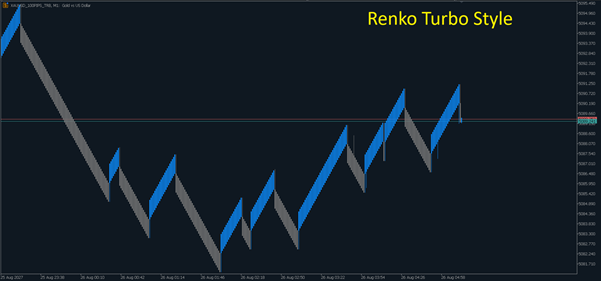

Turbo Renko

Key Settings:

- Brick Dimension: The pip/level worth for every brick (e.g., 5, 10, 20 pips)

- Calc Kind: To make use of pips/factors within the calculation

- Chart Kind: Regular, Median, Geometric or Turbo

- Present Wicks: To indicate wicks on Renko Bars or not

- Days Again: What number of days again price of knowledge we wish to use to create customized bars

- Customized Extension and Reversal : Worth motion in proportion for customized Renko bars

Efficiency with Smaller Ranges:

When utilizing smaller brick sizes (2-5 pips):

- Extra bricks kind, displaying finer value element

- Elevated sensitivity to minor value actions

- Increased useful resource consumption

- Higher for decrease timeframe evaluation

- Extra false indicators in ranging markets

Greatest Use Circumstances:

- Development identification

- Help/resistance ranges

- Breakout methods

- Noise discount in evaluation

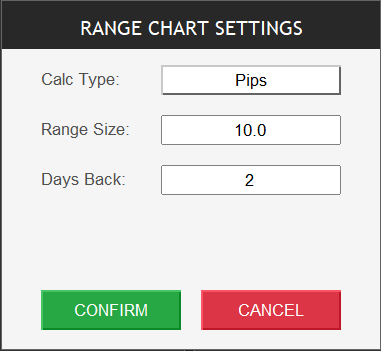

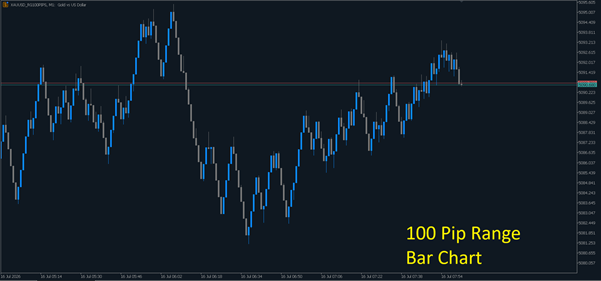

4. Vary Charts

What Are Vary Charts?

Vary Charts create a brand new bar when the worth strikes a specified vary from the opening value of the present bar. Every bar represents the identical value vary motion.

Key Settings:

- Vary Dimension: The worth vary in pips/factors (e.g., 10, 20, 50)

- Calc Kind: To make use of pips/factors within the calculation

- Days Again: What number of days again price of knowledge we wish to use to create customized bars

Efficiency with Smaller Ranges:

With smaller vary values (5-15 pips):

- Extra frequent bar creation

- Higher visibility of micro value actions

- Elevated computational load

- Helpful for exact entry/exit factors

- Can generate extreme bars in unstable situations

Greatest Use Circumstances:

- Constant value motion monitoring

- Volatility normalization

- Sample recognition

- Vary-bound market buying and selling

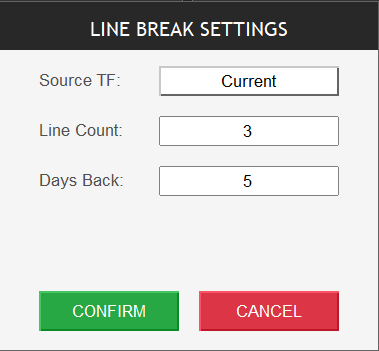

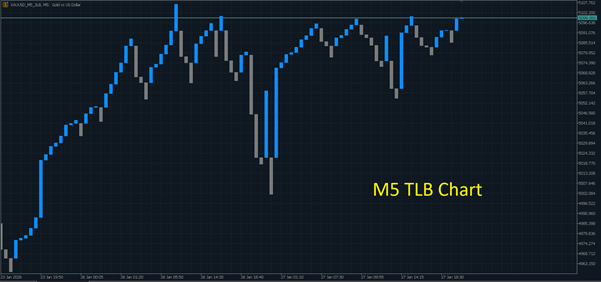

5. Line Break Charts

What Are Line Break Charts?

Line Break charts show a sequence of vertical strains primarily based on value actions. A brand new line in the identical path kinds when value exceeds the earlier excessive/low. A reversal requires breaking a number of earlier strains.

Key Settings:

- Variety of Strains: What number of strains should break for reversal (usually 3)

- Supply TF : Supply Timeframe

- Days Again: What number of days again price of knowledge we wish to use to create customized bars

Efficiency with Smaller Ranges:

When configured for increased sensitivity:

- Extra frequent line formations

- Earlier development change indicators

- Higher short-term development capturing

- Elevated false reversal indicators

- Extra processing necessities

Greatest Use Circumstances:

- Development continuation/reversal identification

- Breakout affirmation

- Filter for range-bound markets

- Japanese candlestick alternate options

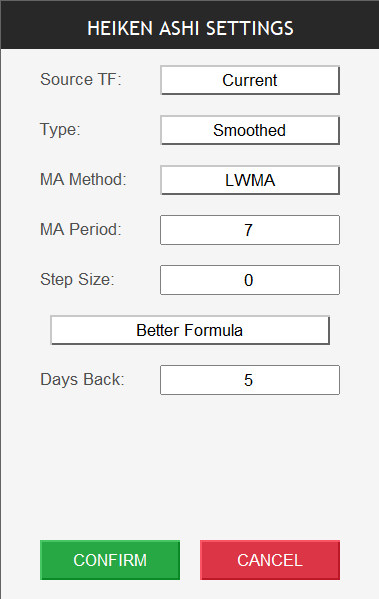

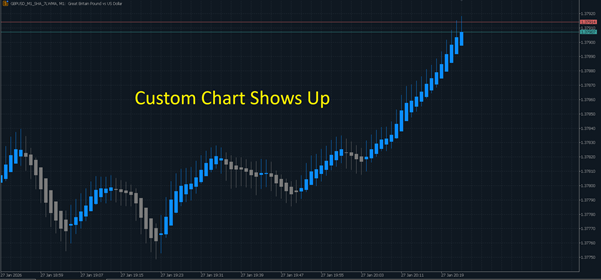

6. Heiken Ashi Charts

What Are Heiken Ashi Charts?

Heiken Ashi charts use modified candlestick calculations that common value information, creating smoother candles that higher spotlight developments and scale back market noise.

Key Settings:

- Timeframe: Base timeframe for calculations (M1, M5, H1, and many others.)

- Smoothing Interval: Further transferring common smoothing (non-obligatory)

- Kind: Normal or Smoothed Heiken Ashi

- MA Interval : The interval to make use of for Smoothed Heiken Ashi

- Step Dimension : The step dimension for step Heiken Ashi

- Higher Components : Toggle to make use of higher formulation Heiken Ashi or not

- Days Again: What number of days again price of knowledge we wish to use to create customized bars

Efficiency with Smaller Ranges:

On decrease timeframes (M1, M5):

- Smoother value motion even on small timeframes

- Delayed indicators attributable to averaging

- Lowered whipsaw trades

- Reasonable useful resource utilization

- Higher development visibility

Greatest Use Circumstances:

- Development identification and following

- Decreasing market noise

- Swing buying and selling entries

- Cease loss placement steering

Utilizing the Management Panel Successfully

Including New Charts

- Click on the Add New button

- Choose your required chart kind from the dropdown menu

- Configure the precise settings for that chart kind

- Set your most well-liked image and timeframe

- Click on “Create” to generate the chart

Managing A number of Charts

Scrolling By way of Charts:

- Use Scroll Up and Scroll Down to navigate by way of your checklist when you might have a number of charts created

Opening Charts in Separate Home windows:

- Choose the chart(s) you wish to view

- Click on Open Charts to launch them in particular person MT5 home windows

- This permits multi-monitor setups and simultaneous viewing

Clearing Charts:

- Click on Clear to take away all customized charts and begin recent

- This frees up system assets

Canceling Operations:

- Use Cancel if a chart is taking too lengthy to generate

- Useful when processing massive historic datasets

- Stops the present operation instantly

Efficiency Optimization Suggestions

Basic Pointers

- Begin with average settings earlier than going extraordinarily granular

- Monitor CPU and RAM utilization when working a number of customized charts

- Restrict historic information loading for very small vary charts

- Shut unused charts to free assets

- Use on higher-spec computer systems for finest efficiency with small ranges

Beneficial Settings by Buying and selling Type

Scalping:

- Second Charts: 15-30 seconds

- Tick Charts: 50-100 ticks

- Renko: 2-5 pip bricks

Day Buying and selling:

- Second Charts: 1-2 minutes

- Vary Charts: 10-20 pip vary

- Heiken Ashi: M5-M15 timeframe

Swing Buying and selling:

- Renko: 10-20 pip bricks

- Line Break: 3-line break on H1-H4

- Heiken Ashi: H1-D1 timeframe

Troubleshooting Frequent Points

Charts Not Loading

- Confirm ample historic information is obtainable

Gradual Efficiency

- Scale back the variety of energetic charts

- Load the Skilled on a special dealer image from watchlist

- Enhance the vary/interval settings

- Restrict historic bars loaded

- Shut different resource-intensive purposes

Lacking Knowledge

- Affirm your dealer offers tick information for the image

- Examine your information heart connection

- Refresh the chart or restart MT5

Conclusion

MT5 Extremely Charts unlocks highly effective various charting capabilities that may improve your technical evaluation and buying and selling methods. By understanding every chart kind’s traits and efficiency implications, you possibly can choose the precise instruments on your buying and selling type.

Begin with average settings, experiment with completely different chart varieties, and progressively optimize primarily based in your particular wants and system capabilities. The intuitive management panel makes managing a number of chart varieties easy and environment friendly.

Attempt the Demo Model

We have included a free demo model of MT5 Extremely Charts with this text so that you can take a look at the performance and discover every chart kind. Please word that the demo model has the next limitations:

- Single Day Knowledge Solely: The demo works with historic information from one buying and selling day solely

- No Reside Market Updates: Actual-time value feeds and reside market updates are disabled

- Characteristic Full: All chart varieties and management panel features are absolutely operational for testing functions

This demo means that you can familiarize your self with the interface, experiment with completely different settings, and perceive how every chart kind behaves earlier than upgrading to the total model. The complete model offers limitless historic information entry and real-time market updates for complete buying and selling evaluation.

Obtain the demo model beneath

Glad buying and selling!