1. Introduction

StoplossHunt Filter is an clever software that helps you determine buying and selling alerts with larger win chance by checking whether or not worth “swept stoploss” earlier than forming a sample.

What’s StoplossHunt Filter?

That is an automatic filter that checks:

- For BUY alerts (bullish): Did worth contact beneath the earlier backside? (sweeping consumers’ stoploss)

- For SELL alerts (bearish): Did worth contact above the earlier prime? (sweeping sellers’ stoploss)

If worth didn’t sweep stoploss → sign is rejected (weak, excessive threat) If worth already swept stoploss → sign is accepted (sturdy, excessive chance)

Why must you use it?

When this filter is enabled, you’ll:

- Solely commerce alerts the place “Good Cash” has already acted (swept the group’s SL)

- Keep away from mid-air alerts (no clear momentum)

- Enhance win fee since you enter AFTER the market has purged weak liquidity

- Higher perceive market construction — know which ranges have been swept

-

2. Why do you want StoplossHunt Filter?

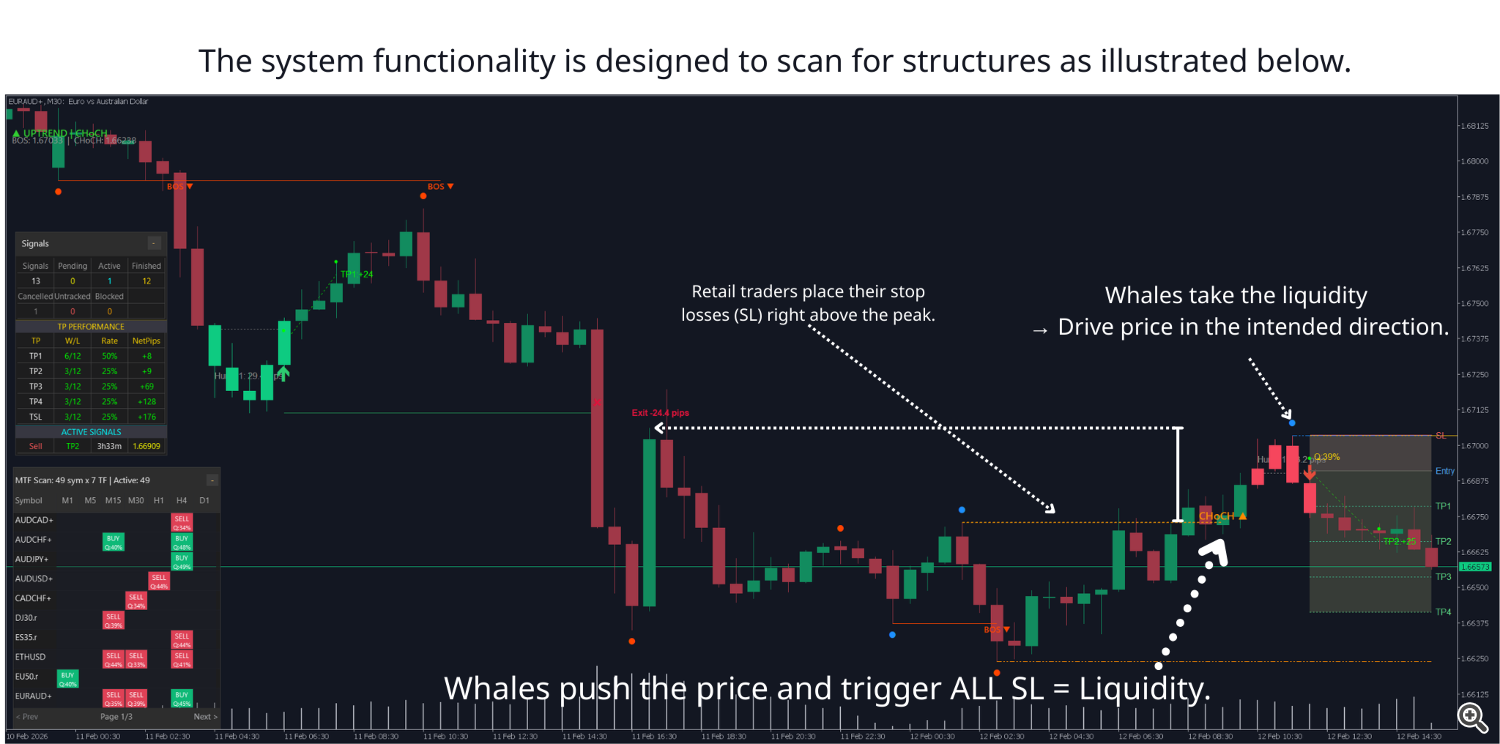

How “sharks” (Good Cash) function

Step 1: Market creates tops/bottoms → many merchants promote/purchase Step 2: SL orders cluster slightly below/above these tops/bottoms Step 3: Sharks push worth previous the highest/backside barely → set off all SL (large liquidity) Step 4: Sharks take up all that liquidity at an excellent worth → then push worth in the true route

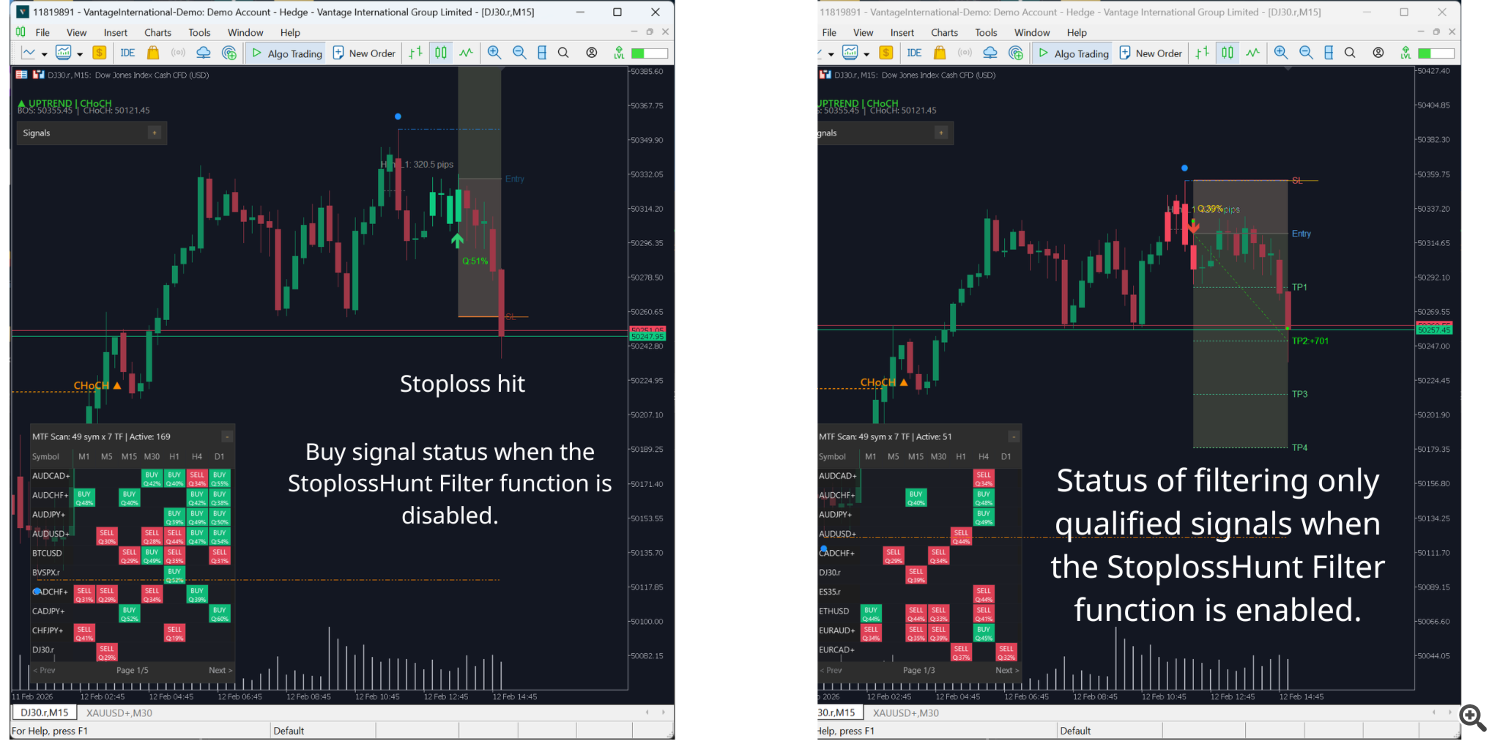

With out vs With the Filter

WITHOUT StoplossHunt Filter: You enter at “random” patterns mid-air, do not know if sharks have acted but, simple to fall into traps.

WITH StoplossHunt Filter: You ONLY enter AFTER sharks have completed sweeping, you progress IN THE SAME DIRECTION as the massive cash move. Fewer alerts however a lot larger high quality.

3. Step-by-step Parameter Setup Information

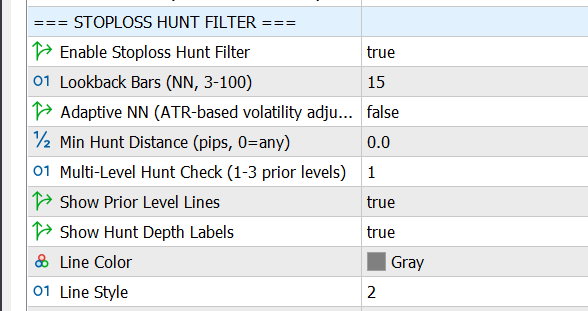

If you load the indicator onto a chart, you may see 9 settings associated to StoplossHunt Filter.

3.1. Allow Stoploss Hunt Filter (On/Off)

| Parameter title | InpSH_Enable |

|---|---|

| Information kind | true/false |

| Default worth | false (OFF) |

- false : All alerts are accepted (no filtering)

- true : ONLY settle for alerts with stoploss sweep

Allow when: Buying and selling Gold, main Foreign exchange pairs, Good Cash / ICT fashion, need high quality over amount. Disable when: Testing new technique, buying and selling erratic small cash, already utilizing many different filters.

3.2. Lookback Bars (Variety of candles to look again)

| Parameter title | InpSH_LookbackBars |

|---|---|

| Information kind | Integer (3-100) |

| Default worth | 15 candles |

| Advice | Small TF → 10-20, Massive TF → 30-50 |

The filter scans backwards this many candles to search out earlier tops/bottoms.

- Rising (e.g. 15 → 50): Finds extra/older tops/bottoms, simpler to move filter, however could discover ranges not vital

- Lowering (e.g. 15 → 5): Solely latest tops/bottoms, stricter, however could miss vital ranges

Advisable Lookback by Timeframe:

| Timeframe | Lookback Bars | Notes |

|---|---|---|

| M5 | 8-15 | Scalping, close by bottoms/tops solely |

| M15 | 15-25 | Intraday, balanced |

| H1 | 20-35 | Swing, look additional |

| H4 | 30-50 | Place, extensive scan |

Normal rule: Excessive volatility merchandise (indices, crypto) → improve 30-50% from the desk above.

3.3. Adaptive NN (Automated adjustment based mostly on volatility)

| Parameter title | InpSH_AdaptiveNN |

|---|---|

| Information kind | true/false |

| Default worth | false |

When ENABLED, the filter robotically adjusts Lookback Bars based mostly on market volatility (ATR):

- Robust volatility (excessive ATR) → Robotically INCREASE lookback

- Weak volatility (low ATR) → Robotically DECREASE lookback

Instance: You set Lookback = 20, Adaptive = true. US session (sturdy vol) → system adjusts to ~30. Asian session (weak vol) → system adjusts to ~14.

Allow when: Buying and selling throughout periods, buying and selling Gold, need auto-adjustment. Disable when: Solely commerce one fastened session, backtesting (want fastened parameters).

3.4. Min Hunt Distance (Minimal sweep distance)

| Parameter title | InpSH_MinHuntPips |

|---|---|

| Information kind | Decimal (pips) |

| Default worth | 0.0 (settle for any) |

Value should sweep at the very least this many pips previous the earlier prime/backside to depend as a “hunt”. This filters out market noise (unfold, slippage touches of 0.1-0.2 pips).

Advisable MinHuntPips:

| Product kind | MinHuntPips | Notes |

|---|---|---|

| Low volatility (Foreign exchange majors) | 0.5 – 2.0 | Small unfold, gradual strikes |

| Medium volatility (Gold, Foreign exchange cross) | 2.0 – 5.0 | Filter noise extra clearly |

| Excessive volatility (Indices, Crypto) | 5.0 – 50.0 | Is determined by common ATR |

Tip: Begin with MinHuntPips = 0 → observe → step by step improve till noise is filtered however actual hunts are saved. Massive dealer unfold → improve MinHuntPips.

3.5. Multi-Stage Hunt Test

| Parameter title | InpSH_MultiLevel |

|---|---|

| Information kind | 1, 2, or 3 |

| Default worth | 1 (solely verify 1 stage) |

| Advice | 2 (balanced), 3 (sideways market) |

The filter checks this many ranges of earlier tops/bottoms:

- Stage 1: ONLY checks the closest prime/backside → strictest

- Stage 2: Checks 2 ranges → balanced (really helpful)

- Stage 3: Checks 3 ranges → best to move, extra alternatives

When to make use of: Stage 1 for sturdy trending market. Stage 2 for many circumstances. Stage 3 for sideways market with many alternating tops/bottoms.

3.6. Present Prior Stage Strains

| Parameter title | InpSH_ShowLines |

|---|---|

| Information kind | true/false |

| Default worth | true (SHOW) |

Shows horizontal traces on chart marking swept tops/bottoms. Allow throughout studying part, disable for cleaner chart in reside buying and selling.

3.7. Present Hunt Depth Labels

| Parameter title | InpSH_ShowLabels |

|---|---|

| Information kind | true/false |

| Default worth | true (SHOW) |

Shows textual content label on chart, e.g.: “Hunt L1: 3.5 pips” displaying which stage was swept and the way deep.

Studying hunt depth:

- Shallow (1-3 pips): Mild hunt, may be testing stage

- Deep (5-10 pips): STRONG hunt, many SL triggered → excellent sign

- Extraordinarily deep (>15 pips): Could also be construction change, want warning

Advice: Maintain ENABLED — helps assess sign high quality shortly.

3.8. Line Shade

| Parameter title | InpSH_LineColor |

|---|---|

| Default worth | clrGray (grey) |

| Parameter title | InpSH_LineColor |

|---|---|

| Default worth | clrGray (grey) |

Shade of horizontal traces. Strategies: clrGray (impartial), clrDimGray (darkish background), clrSilver (softer). Keep away from pink/inexperienced (confuses with candle colours).

3.9. Line Fashion

| Parameter title | InpSH_LineStyle | |

|---|---|---|

| Default worth | STYLE_DOT (dotted) | |

| Worth | Identify | Look |

| 0 | STYLE_SOLID | __________ (stable) |

| 1 | STYLE_DASH | – – – – – – (dashed) |

| 2 | STYLE_DOT | . . . . . . . (dotted) |

| 3 | STYLE_DASHDOT | -.-.-.-.-(dash-dot) |

| 4 | STYLE_DASHDOTDOT | -..-..-..-(dash-dot-dot) |

Advice: STYLE_DOT — simple to differentiate from different chart traces.

4. Learn Alerts on Chart

4.1. BULLISH (BUY) Sign with Hunt

If you see: (1) Grey dotted horizontal line beneath candle sample, (2) Label “Hunt L1: X pips”, (3) Reversal candle (e.g.: Fakey, Pin Bar) kinds AFTER touching the road.

Studying: Line = earlier backside. Value touched previous this line = swept consumers’ SL. Value reversed up = sharks completed feeding. → CONSIDER BUY (if different filters additionally PASS).

4.2. BEARISH (SELL) Sign with Hunt

Identical logic reversed: horizontal line above candle = earlier prime. Value touched previous it = swept sellers’ SL. Value dropped = sharks pushing down. → CONSIDER SELL.

4.3. No Line = No Hunt = FILTERED OUT

Lovely candle sample however no horizontal line and no “Hunt” label → sign FILTERED OUT → SKIP (low chance “random” sample).

4.4. Studying Hunt Depth

| Hunt Depth | That means | Motion |

|---|---|---|

| 0.5 – 2 pips | Mild hunt | Cautious, watch for affirmation |

| 3 – 7 pips | Average hunt | Can enter commerce |

| 8 – 15 pips | STRONG hunt | Excessive precedence |

5. 7 Sensible Ideas

Tip 1: Do not Enter IMMEDIATELY When Seeing Hunt

WRONG: See “Hunt” → enter instantly. RIGHT: See “Hunt” → watch for candle CLOSE → verify different filters → enter.

Value usually sweeps and sweeps once more. Ready for shut = confirming actual reversal.

Tip 2: Deeper Hunt = Stronger Sign

Hunt < 3 pips → Weak, want extra affirmation. Hunt 5-10 pips → Good sign. Hunt > 10 pips → Extraordinarily sturdy, excessive precedence. Be aware: Excessive volatility merchandise have larger thresholds. Hunt too deep vs regular volatility → could also be actual breakout.

Tip 3: Commerce Throughout Peak Hours

Strongest hunts: US session (20:00-02:00 VN / 13:00-19:00 UTC), European session (14:00-20:00 VN / 07:00-13:00 UTC), London open (14:00-15:00 VN). Weak hunts: Asian session (early morning VN) — low quantity, uncommon/unclear. If buying and selling M15/M5 → ONLY commerce European-US session.

Tip 4: Mix with Danger Administration

Cease Loss: Place SL previous the hunt level (beneath/above lowest/highest sweep by 1-3 pips). Take Revenue: Deep hunt (>10 pips) → bigger TP (R:R 1:3 to 1:5). Shallow hunt (<5 pips) → smaller, safer TP.

Tip 5: Learn Market Construction

Hunt at vital assist/resistance (H4, D1) → extraordinarily sturdy sign (confluence). Hunt in center of vary → weaker sign.

Tip 6: Multi-Stage Hunt = Tremendous Sign

Label “Hunt L2: 15 pips” or “Hunt L3: 20 pips” = worth swept deep, reaching stage 2 or 3. Stage 2-3 + hunt > 10 pips = nice alternative. Stage 1 + hunt < 5 pips = weak sign.

Tip 7: Do not Commerce Towards Main Pattern

Regardless of how sturdy the hunt, NEVER commerce towards H4/D1 development. StoplossHunt Filter + Course Filter (similar development) = Excellent combo.

6. Actual-World Situations

State of affairs 1: Bullish Hunt — US Session

Setup: M15, US session (~21:00-23:00 VN), H1 uptrend. What occurred: Value created a backside 12 candles in the past → worth touched previous it by 2 pips → bullish Pin Bar fashioned → Label: “Hunt L1: 2.0 pips”. Evaluation: Hunt exists however shallow (2 pips). Nonetheless: H1 uptrend + US session + Pin Bar = good confluence. Resolution: ENTER BUY at 50% lot (shallow hunt → cautious). Outcome: TP1 (1:2) hit after ~35min, TP2 (1:4) hit after ~1.5h. Lesson: Shallow hunt + sturdy confluence = nonetheless worthwhile.

State of affairs 2: Bearish Hunt — London Open

Setup: M15, London open (~14:00 VN), H4 downtrend. What occurred: Value touched previous previous prime by 3 pips → bearish engulfing → Label: “Hunt L1: 3.0 pips”. Resolution: ENTER SELL full lot (3 pip hunt + downtrend + London open + sturdy sample). Outcome: TP1 (1:2) hit after ~20min. Lesson: Hunt at London Open + development alignment = golden method.

State of affairs 3: When to SKIP

Setup: M15, 08:00 (weak Asian session), H1 sideways. What occurred: Value touched previous vary backside solely 0.5 pips → Fakey sample → Label: “Hunt L1: 0.5 pips”. Resolution: SKIP (hunt too shallow + Asian session + no development). Outcome: Value reversed towards → skip was right. Lesson: Not each hunt needs to be traded. Will need to have context (time, development, depth).

7. Combining with Different Options

StoplossHunt Filter is extraordinarily highly effective when mixed with different filters.

7.1. Hunt + Course Filter (Pattern Alignment)

Course Filter solely permits alerts in H1/H4 development route. When each PASS → sign with development + with hunt = extraordinarily excessive win chance.

| Filter | Setting |

|---|---|

| Course Filter | ON, Timeframe = H1, Pattern Interval = 50 |

| StoplossHunt Filter | ON, Lookback = 20, MultiLevel = 2 |

7.2. Hunt + High quality Filter (Excessive-High quality Solely)

High quality Filter solely accepts patterns with High quality Rating > 0.7. When each PASS → lovely sample + hunt = golden sign.

7.3. Hunt + Excessive Zone Filter (Overbought/Oversold)

Excessive Zone Filter accepts alerts when RSI is in excessive zone. When each PASS → excessive + hunt = sturdy reversal.

| Filter | Setting |

|---|---|

| Excessive Zone Filter | RSI < 30 or > 70 |

| StoplossHunt Filter | ON, MinHuntPips = 5.0 |

7.4. 3-Filter Stack (Hunt + High quality + Course)

Strongest combo for medium/long-term merchants:

| Filter | Setting | Position |

|---|---|---|

| Course Filter | H4 development | Main development alignment |

| High quality Filter | Min = 0.7 | Lovely sample |

| StoplossHunt Filter | MinHunt = 5, MultiLevel = 2 | Robust hunt |

Outcome: 1-3 alerts/week, win fee 75-85%, R:R 1:3 to 1:5. Finest for busy merchants who need high quality over amount.

7.5. Technique by Timeframe

M5 (Scalping): Course=M15 development, Hunt MinHunt=1.0 Lookback=10, High quality Min=0.6. Goal: 5-15 pips/commerce.

M15 (Intraday): Course=H1 development, Hunt MinHunt=3.0 Lookback=20 MultiLevel=2, High quality Min=0.7. Goal: 20-50 pips/commerce.

H1 (Swing): Course=H4 development, Hunt MinHunt=5.0 Lookback=30 MultiLevel=2, High quality Min=0.75, Excessive Zone RSI<35 or >65. Goal: 80-150 pips/commerce.

H4 (Place): Course=D1 development, Hunt MinHunt=10.0 Lookback=50 MultiLevel=3, High quality Min=0.8. Goal: 200-500 pips/commerce.

8. FAQ

Q1: Enabled filter however no alerts?

Attempt: (1) Enhance Lookback to 25-30, (2) Set MinHuntPips = 0.0, (3) Enhance MultiLevel to three, (4) Disable different filters quickly. If nonetheless nothing → verify indicator is operating accurately.

Q2: What hunt depth is “ok”?

Hunt depth > 2x your MinHuntPips = good. > 4x = excellent. Greater volatility merchandise have larger thresholds.

Q3: Commerce EVERY sign with hunt?

NO. Hunt is important however not enough. Nonetheless want: development alignment, high quality sample, good buying and selling hours, affordable context.

This fall: Is Adaptive NN helpful?

Sure if buying and selling throughout periods or Gold. Not wanted if just one session or backtesting. Rule: ENABLE for reside, DISABLE for backtesting.

Q5: Why do alerts with hunt nonetheless lose?

Potential: “faux hunt” (lure), information/occasions, hunt too shallow (<2 pips), no affirmation. Options: Solely commerce deep sufficient hunts, keep away from main information, watch for candle shut + 1 affirmation candle.

Q6: MultiLevel = 1, 2, or 3?

Stage 1 = strictest. Stage 2 = really helpful for many. Stage 3 = sideways market. Begin with 2, regulate based mostly on sign depend.

Q7: Works for crypto?

Sure with changes: improve MinHuntPips (based mostly on ATR), improve Lookback, Adaptive = true (required). Be aware: crypto has “wash buying and selling” → mix with High quality + Quantity filter.

Q8: know settings are good?

Backtest 1 month (20+ buying and selling days). Goal: Win fee >60%, 1-5 alerts/day (M15/H1), avg R:R >1:2. Too low win fee → settings too unfastened. Too few alerts → too strict. Too many → too unfastened.

Q9: Present Strains and Labels?

Studying (1-3 months): ENABLE each. Proficient: disable Strains, maintain Labels. Reside buying and selling: Labels ON for fast selections.

Q10: Appropriate with SMC (Good Cash Ideas)?

Completely! StoplossHunt Filter automates Liquidity Sweep / Cease Hunt. Mix with Order Block, FVG, BOS for a robust automated SMC system.

SMC + Hunt workflow: (1) Establish Order Block on H1/H4 → (2) Look forward to worth to return → (3) Hunt + reversal sample at OB → ENTER.

9. Conclusion

StoplossHunt Filter helps you filter out 70-80% of junk alerts, solely commerce when Good Cash has acted, and improve win fee by 15-25%.

Keep in mind: Hunt is important however not enough. Mix with different filters, preserve strict threat administration, and do not FOMO.

Subsequent steps:

- Load indicator onto chart

- Set in accordance with suggestion desk (part 8)

- Observe 1 week (no trades, simply watch)

- Demo backtest 2 weeks

- Reside commerce with small tons

Wishing you profitable buying and selling!

Creator: Ich Khiem Nguyen Model: 1.0 Final up to date: 2026-02-11