What’s Market Construction?

Market Construction helps you determine whether or not the market pattern is bullish, bearish, or sideways by analyzing swing highs and swing lows.

Merely put:

Worth retains making larger highs + larger lows → the market is in an Uptrend.

Worth retains making decrease highs + decrease lows → the market is in a Downtrend.

Not clear / inconsistent → the market is Ranging.

As well as, the module detects two necessary occasions:

BOS (Break of Construction): Worth breaks the construction within the present course → the pattern continues.

CHoCH (Change of Character): Worth breaks the construction in opposition to the present course → the pattern could reverse.

The way to allow Market Construction

Market Construction is constructed into these indicators: Mirage, PinBar, InvertedHammer (and the Template). Once you connect the indicator to the chart, Market Construction runs mechanically — no additional set up is required.

To regulate parameters: right-click the indicator → Properties (or press F7) → discover the parameter teams whose names begin with “Fractal”, “ATR”, “Present Swing”…

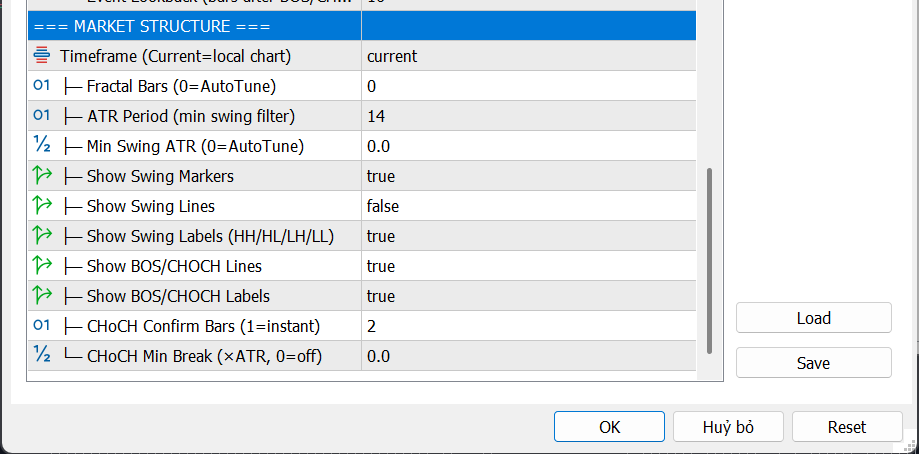

Enter parameters defined

1. Timeframe — Evaluation timeframe

| Information | Particulars |

|---|---|

| Identify in indicator | Timeframe (Present=native chart) |

| Default | PERIOD_CURRENT (makes use of the presently opened timeframe) |

| Values | M1, M5, M15, M30, H1, H4, D1, W1… or Present |

Which means: Choose the timeframe used to find out construction. If set to Present, the indicator analyzes the precise chart timeframe you’re viewing.

When altering it:

Select a larger timeframe (e.g., H4 on an M15 chart) → extra “massive image”, much less noise, however indicators are extra delayed.

Maintain Present → reacts quicker to cost adjustments, however will be noisy on small timeframes.

Tip: For those who commerce on M15, attempt setting Timeframe = H1 to view higher-timeframe construction and make sure the primary pattern.

2. Fractal Bars — Fractal width (candles on each side of a swing)

| Information | Particulars |

|---|---|

| Identify in indicator | Fractal Bars (0=AutoTune) |

| Default | 0 (computerized) |

| Vary | 0 to 10 |

| Unit | Variety of candles (bars) |

Which means: To substantiate a swing excessive, the indicator checks whether or not that candle’s excessive is larger than N neighboring candles on each side. That N is Fractal Bars.

When altering it:

0 (AutoTune) → the indicator mechanically selects an optimum worth (sometimes 2 to 4) for many circumstances.

Enhance (3, 4, 5…) → detects solely bigger, clearer swings → fewer indicators however larger high quality.

Lower (1, 2) → detects smaller swings → extra indicators however extra noise.

Tip: Maintain 0 (AutoTune) typically. Solely enhance to three–5 for those who commerce swing/place and wish to filter smaller swings.

3. ATR Interval — ATR lookback used for swing filtering

| Information | Particulars |

|---|---|

| Identify in indicator | ATR Interval (min swing filter) |

| Default | 14 |

| Vary | 2 to 100 |

| Unit | Variety of candles (bars) |

Which means: ATR (Common True Vary) measures the typical worth vary. This parameter defines what number of latest candles are used to compute ATR, which is then used to filter out swings which are too small (insignificant).

When altering it:

Enhance (20, 50…) → smoother ATR, displays longer-term vary → steady filtering however slower adaptation.

Lower (5, 7…) → extra delicate ATR → adapts quicker however can fluctuate extra.

Tip: 14 (default) matches most pairs and timeframes. You sometimes don’t want to alter it until you commerce very small timeframes (M1/M5 → contemplate 7–10).

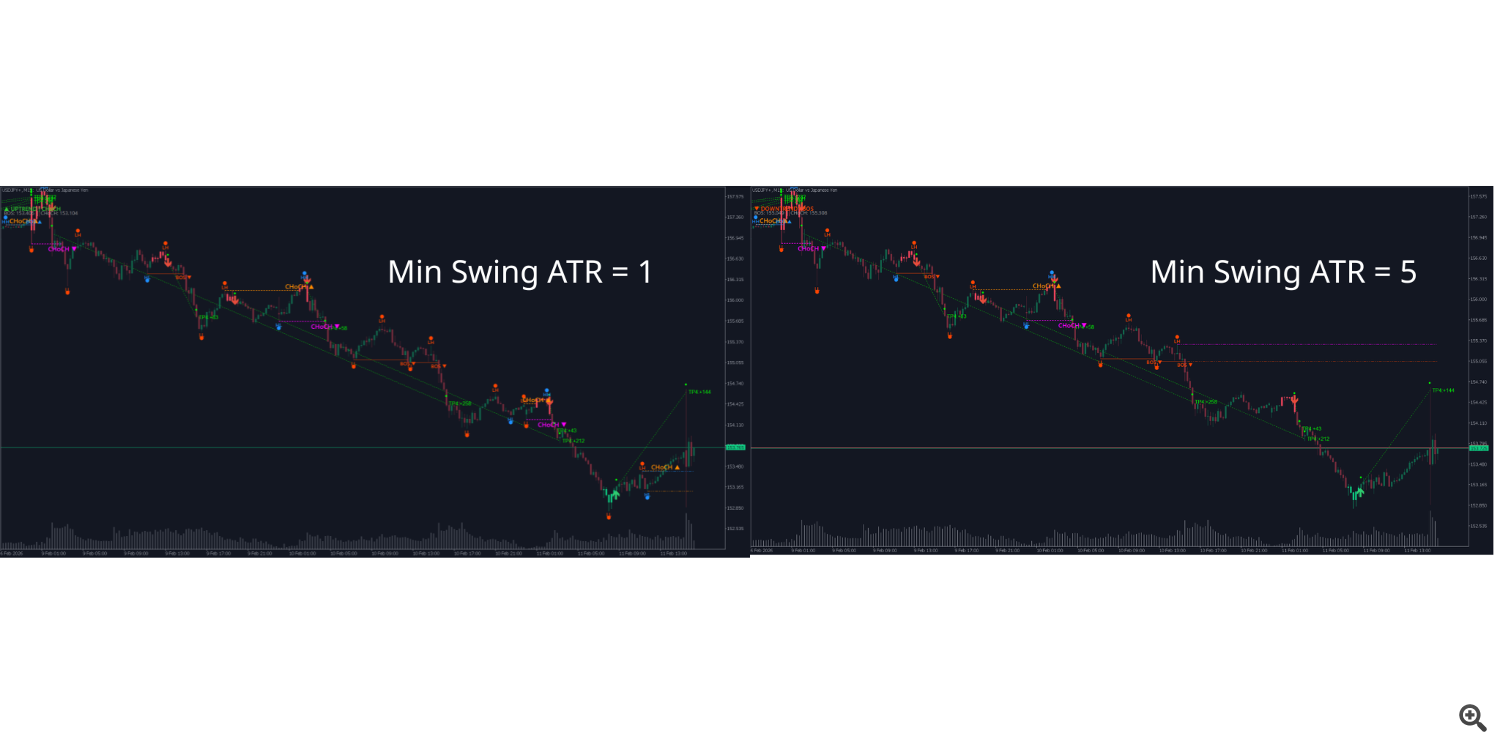

4. Min Swing ATR — Minimal swing measurement (ATR multiplier)

| Information | Particulars |

|---|---|

| Identify in indicator | Min Swing ATR (0=AutoTune) |

| Default | 0.0 (computerized) |

| Vary | 0.0 to five.0 |

| Unit | ATR multiplier (×ATR) |

Which means: The minimal distance between adjoining swing excessive and swing low have to be not less than Min Swing ATR × ATR to be thought of a legitimate swing. If set to 0 , the indicator mechanically calculates an appropriate threshold.

When altering it:

0.0 (AutoTune) → the indicator analyzes knowledge and selects an optimum threshold (really useful).

Enhance (0.8, 1.0, 1.5…) → retains solely massive swings → fewer swings however extra significant.

Lower (0.3, 0.5…) → retains small swings too → extra swings, extra delicate to short-term motion.

Instance: ATR = 50 pips, Min Swing ATR = 1.0 → swing amplitude have to be ≥ 50 pips to be proven.

Tip: Maintain 0.0 (AutoTune). In case your chart reveals too many small swings, attempt rising to 0.5–1.0.

5. Show parameter group (Present/Conceal)

| Parameter identify | Default | Which means |

|---|---|---|

| Present Swing Markers | true | Present/conceal round markers at swing highs/lows |

| Present Swing Strains | true | Present/conceal connecting traces between highs and between lows |

| Present Swing Labels (HH/HL/LH/LL) | true | Present/conceal textual content labels classifying swings |

| Present BOS/CHOCH Strains | true | Present/conceal horizontal traces at BOS/CHoCH places |

| Present BOS/CHOCH Labels | true | Present/conceal “BOS” / “CHoCH” textual content labels |

Tip: In case your chart already has many indicators, you may disable Present Swing Strains and Present Swing Markers to cut back muddle, and maintain solely Present BOS/CHOCH Strains + Labels — that’s a very powerful info.

6. CHoCH Affirm Bars — Variety of candles to substantiate reversal

| Information | Particulars |

|---|---|

| Identify in indicator | CHoCH Affirm Bars (1=immediate) |

| Default | 2 |

| Vary | 1 to five |

| Unit | Variety of candles (bars) |

Which means: When worth breaks construction in opposition to the pattern (a reversal signal), the indicator requires a sure variety of consecutive candle closes past the break stage to substantiate it as an actual CHoCH.

When altering it:

1 (immediate) → CHoCH is confirmed as quickly as 1 candle closes past → quick however extra false indicators.

2 (default) → wants 2 closes → balanced velocity and reliability.

3–5 → wants extra affirmation → very dependable however extra delayed.

Actual instance: In an uptrend, worth breaks beneath the most recent low. If CHoCH Affirm = 2, the indicator waits for another candle shut beneath that low, then prints “CHoCH ▼” (potential bearish reversal).

Tip: 2 works for many circumstances. For those who scalp on M1–M5, you could use 1 . For those who swing commerce on H4–D1, use 2–3 .

7. CHoCH Min Break — Minimal break distance for CHoCH

| Information | Particulars |

|---|---|

| Identify in indicator | CHoCH Min Break (×ATR, 0=off) |

| Default | 0.0 (off) |

| Vary | 0.0 to 2.0 |

| Unit | ATR multiplier (×ATR) |

Which means: Apart from requiring a detailed past the extent, worth should additionally break by a minimal distance (ATR multiplier) to rely as CHoCH. This filters “tiny breaks” that shortly reverse (faux breaks).

When altering it:

0.0 (off) → no minimal distance required → extra delicate.

Enhance (0.1, 0.3, 0.5…) → requires a stronger break → fewer faux CHoCH, however slower.

Instance: ATR = 50 pips, CHoCH Min Break = 0.3 → worth should break not less than 15 pips (0.3 × 50) past the outdated swing stage to rely as CHoCH.

Tip: Maintain 0.0 for those who already use CHoCH Affirm Bars = 2 or larger (stacking filters could make indicators too delayed). Allow it solely if you need an additional filter in very noisy markets.

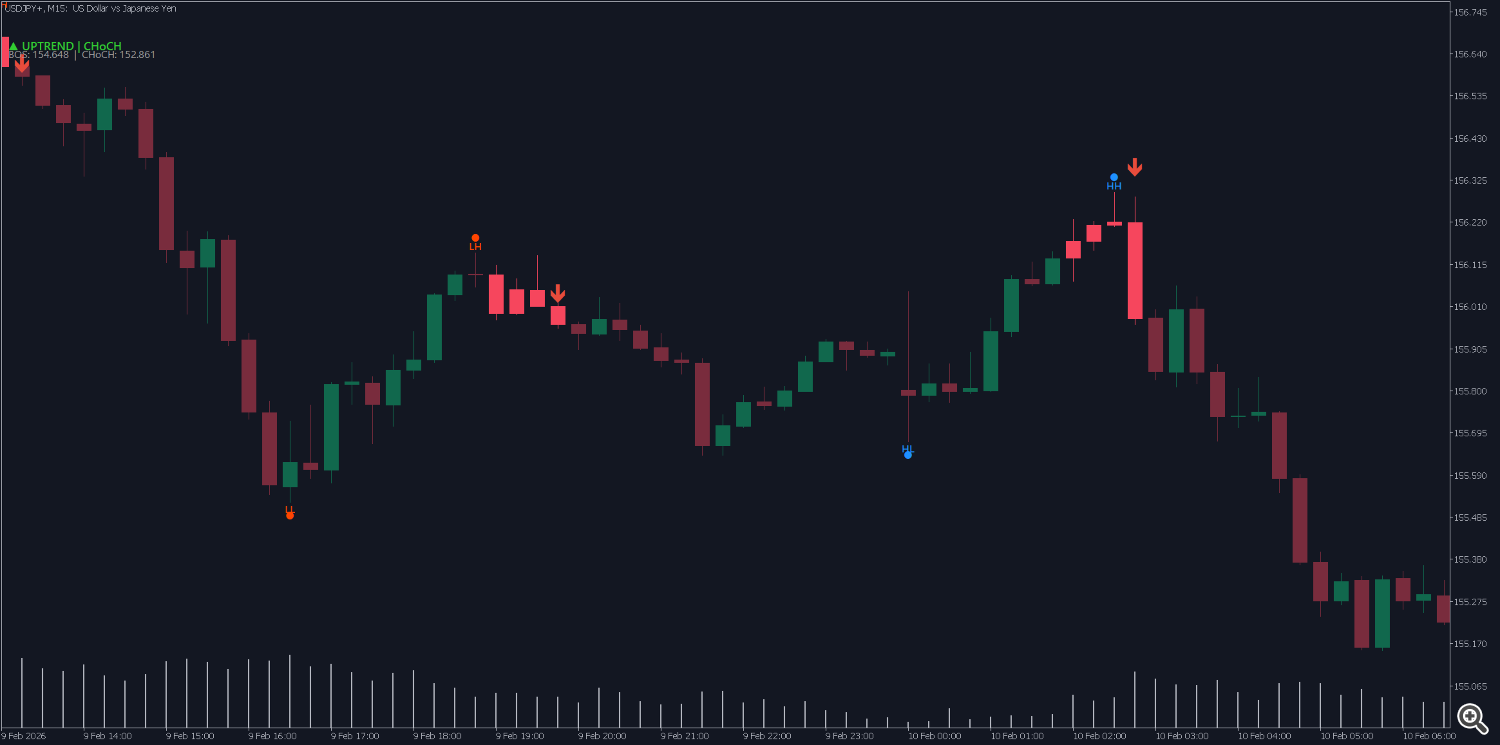

Studying indicators on the chart

Swing markers (dots)

Dot above a candle = Swing Excessive

Dot beneath a candle = Swing Low

Blue = swing in bullish course

Orange/Crimson = swing in bearish course

Grey = the most recent swing (not sufficient knowledge but for comparability)

HH / HL / LH / LL labels (swing labels)

| Label | Which means | Pattern sign |

|---|---|---|

| HH (Increased Excessive) | A excessive larger than the earlier excessive | Uptrend |

| HL (Increased Low) | A low larger than the earlier low | Uptrend |

| LH (Decrease Excessive) | A excessive decrease than the earlier excessive | Downtrend |

| LL (Decrease Low) | A low decrease than the earlier low | Downtrend |

Swing traces

Dotted traces join highs to highs, and lows to lows

Blue = bullish course (HH or HL)

Orange/Crimson = bearish course (LH or LL)

BOS / CHoCH labels

| Label | Coloration | Which means |

|---|---|---|

| BOS ▲ | Blue | Bullish break of construction → uptrend continues |

| BOS ▼ | Orange/Crimson | Bearish break of construction → downtrend continues |

| CHoCH ▲ | Darkish orange | Potential reversal from downtrend to uptrend |

| CHoCH ▼ | Pink/Purple | Potential reversal from uptrend to downtrend |

BOS / CHoCH occasion traces (horizontal traces)

Horizontal line extends from the damaged swing level to the breakout candle

BOS: strong line, thinner

CHoCH: dashed line, thicker (as a result of it’s extra necessary)

Essential ranges

Sprint-dot line extends to the present candle

BOS stage: if worth breaks this stage → pattern continuation

CHoCH stage: if worth breaks this stage → potential reversal

Standing panel (top-left nook)

Line 1: ▲ UPTREND , ▼ DOWNTREND , or ◆ RANGING + final occasion (BOS/CHoCH)

Line 2: the particular BOS and CHoCH worth ranges

Buying and selling situations (examples)

Situation 1: Affirm a Purchase entry in an uptrend

Chart reveals ▲ UPTREND | BOS → uptrend is confirmed

Newest labels are HH (larger excessive) + HL (larger low)

Worth pulls again to the most recent HL zone → potential Purchase space

Mix with a sample sign on the HL zone → enter Purchase

Place cease loss beneath the newly fashioned HL low

Situation 2: Reversal warning — keep away from getting into

Market is in ▲ UPTREND , and a CHoCH ▼ label seems (pink/purple)

This warns the uptrend could also be ending

You must not open new Purchase trades at this second

Watch for additional affirmation: if a BOS ▼ seems afterward → downtrend is confirmed → search for Promote alternatives

Situation 3: Sideways market

Standing reveals ◆ RANGING

Swing labels alternate inconsistently: HH then LL, and so on.

Finest strategy: keep away from buying and selling, or commerce throughout the vary solely (purchase low, promote excessive) with small targets

Sensible ideas

Noise filtering

Keep away from buying and selling in opposition to construction: If Market Construction reveals UPTREND + BOS ▲ → prioritize Purchase, cut back Promote trades.

Watch for BOS affirmation after CHoCH: CHoCH is barely an “early signal” of reversal; watch for BOS within the new course earlier than buying and selling the reversal course.

Keep away from main information periods: unusually sturdy volatility can create faux CHoCH. Throughout NFP, FOMC, and so on., keep away from counting on construction for choices.

Use the next timeframe to substantiate: If H1 is UPTREND however H4 is DOWNTREND → prioritize H4 (larger timeframe is often extra dependable).

Threat administration

CHoCH isn’t a right away reversal commerce: It’s an early warning; don’t rush to Promote once you see CHoCH ▼ with out additional affirmation.

BOS on a small timeframe will be noise on the next timeframe: A BOS ▲ on M5 could also be solely a small fluctuation inside an H1 downtrend.

Alerts are delayed by design: As a result of it wants candle-close affirmation (Affirm Bars), indicators all the time seem after the occasion. That is intentional to cut back false indicators — not a bug.

All the time mix with patterns: Market Construction tells you the course, patterns (Fakey, PinBar, Inverted Hammer) let you know the entry level. Utilizing each is simpler than utilizing both alone.

Optimize by buying and selling model

| Type | Fractal Bars | CHoCH Affirm | CHoCH Min Break | Notes |

|---|---|---|---|---|

| Scalp (M1–M5) | 0 or 2 | 1 | 0.0 | Want quick response, settle for extra noise |

| Intraday (M15–H1) | 0 (AutoTune) | 2 | 0.0 | Balanced velocity and accuracy — really useful for many |

| Swing (H4–D1) | 3–5 | 2–3 | 0.1–0.3 | Robust filtering, retains solely massive swings and clear CHoCH |

Fast abstract

| If you wish to… | Do that |

|---|---|

| See the present pattern | Have a look at the top-left: ▲ UPTREND / ▼ DOWNTREND / ◆ RANGING |

| Know the pattern could reverse | Discover a CHoCH label (darkish orange or pink/purple) on the chart |

| Affirm pattern continuation | Discover a BOS label (blue or orange/pink) |

| Discover a Purchase entry zone | Watch for worth to drag again to the HL zone in an uptrend |

| Discover a Promote entry zone | Watch for worth to drag again to the LH zone in a downtrend |

| Cut back noise on small charts | Enhance Fractal Bars or set the next Timeframe |

| Cut back faux CHoCH | Enhance CHoCH Affirm Bars to 2–3 |