Resilient funding portfolios take extra than simply tossing collectively a couple of shares from totally different sectors. True defensiveness comes from intentionally specializing in components which have traditionally held up properly throughout market crashes and financial downturns.

In my case, which means prioritizing low-volatility shares and ultra-short-term bonds. In case your purpose is to guard capital whereas nonetheless incomes modest development and revenue, I’ve received a three-exchange-traded fund (ETF) portfolio in thoughts that matches a $50,000 allocation completely.

The inventory facet

We’re placing 80% of the portfolio into shares. That may sound excessive for a defensive setup, however for those who’re nonetheless years or a long time from retirement, equities stay your finest wager for long-term development. The important thing is choosing the right form of shares—ones which are constructed to final when markets get tough.

To try this, we’re beginning with two low-volatility ETFs: BMO Low Volatility US Fairness ETF (TSX:ZLU) at 50%, and BMO Low Volatility Canadian Fairness ETF (TSX:ZLB) at 30%.

Each ETFs use a rules-based technique to display for shares with low beta, which is a measure of how a lot a inventory strikes relative to the broader market. A beta of 1 means a inventory tends to maneuver in sync with the market. A beta under one means it tends to maneuver much less, which is right for preserving capital throughout pullbacks.

Now, ZLU and ZLB don’t simply search for secure worth motion. Additionally they skew towards defensive sectors like utilities, healthcare, and shopper staples. These are industries that promote issues individuals want, it doesn’t matter what the economic system’s doing, making their revenues and inventory costs much less delicate to financial cycles.

Additionally they throw off respectable revenue. ZLU at the moment yields 1.98% and ZLB yields 2.13%, providing regular money circulation alongside stability.

The bond facet

The remaining 20% of the portfolio goes into bonds, however not simply any bonds. We noticed in 2022 what occurs when rates of interest rise sharply: long-term bonds can get hammered. And if a recession hits, lower-rated company bonds can drop simply as exhausting as shares. That’s why I’m choosing BMO Extremely Brief-Time period Bond ETF (TSX:ZST).

This ETF focuses on debt with both a maturity or reset date inside the subsequent 12 months, which helps defend it from rate of interest swings. It primarily holds investment-grade company bonds, however can even embrace authorities debt, floating-rate notes, high-yield bonds, and even most well-liked shares.

The important thing level: 100% of the portfolio is funding grade, with over half (54%) rated A. Which means these are high-quality issuers with low credit score danger, precisely what you need for the protected facet of your portfolio.

ZST can also be low-cost, with a 0.17% expense ratio, and it pays month-to-month distributions. The present yield is 2.94%, which is definitely greater than the Financial institution of Canada’s coverage rate of interest of two.75%, a pleasant bonus for buyers on the lookout for regular revenue with out reaching for danger.

Placing it collectively

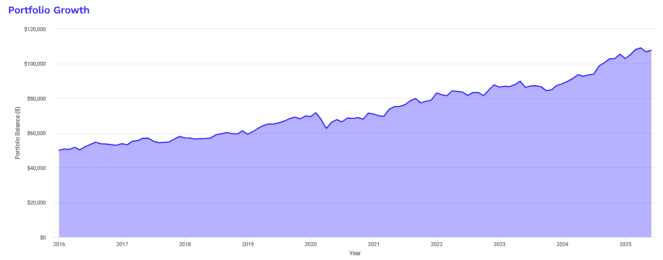

For those who had invested $50,000 into this straightforward three-ETF portfolio again in 2016, by mid-2025, you’d be sitting on about $107,600 earlier than taxes. That’s greater than doubling your cash in below a decade, with an 8.48% annualized return.

Importantly, this wasn’t finished by swinging for the fences. The portfolio stored issues secure. The worst 12 months (2022) was solely a 2.12% loss, and even throughout the COVID-19 crash, it was down simply 12.66% from its peak. For comparability, many stock-only portfolios misplaced 30% or extra throughout that point.

The Sharpe ratio of 0.84 and Sortino ratio of 1.38 imply that, relative to how a lot danger was taken, the returns have been stable. These ratios inform you that you just’re getting an excellent bang on your buck by way of risk-adjusted efficiency.

In plain English: this portfolio grew steadily, didn’t panic in a crash, and delivered outcomes that might make most buyers fairly completely satisfied, particularly for those who worth peace of thoughts.