Just lately, the S&P 500 ($SPX) has been racking up an excellent variety of wins.

Just lately, the S&P 500 ($SPX) has been racking up an excellent variety of wins.

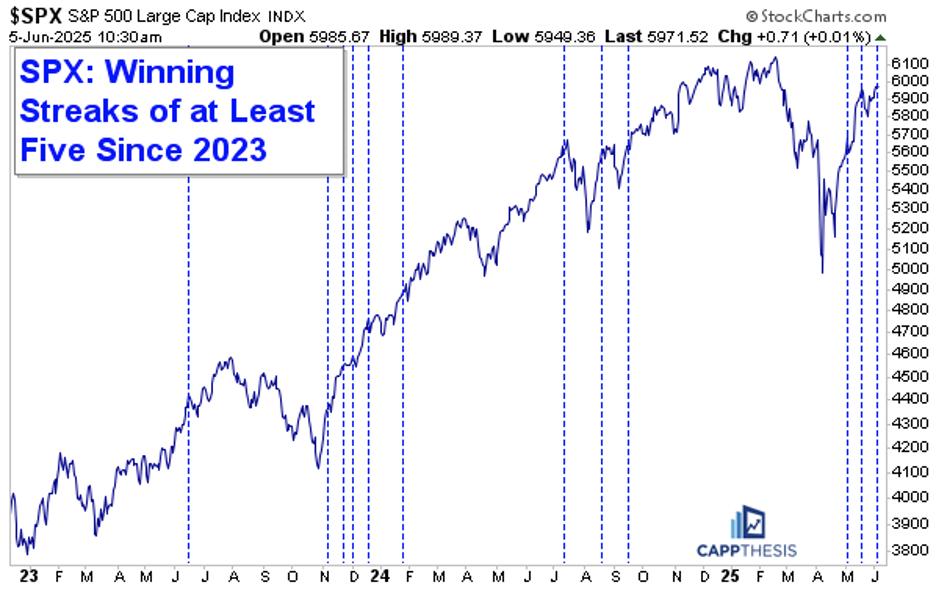

Since late April, the index has logged its third profitable streak of a minimum of 5: a nine-day streak from April 22–Might 2 and a six-day streak from Might 12–Might 19. That makes for a cluster of lengthy profitable streaks, which is one thing that additionally confirmed up in late 2023 and mid-2024.

To place it merely, these bunches of shopping for normally present up in uptrends. Observe how there have been no five-day profitable streaks in the course of the three corrections pictured on the chart under (in August–October 2023, July–August 2024, and February–April 2025). A lot of the clusters occurred because the S&P 500 was in the midst of a constant upswing; the solely time we noticed a protracted profitable streak happen proper earlier than a giant downturn was in late July 2024. That got here after a powerful three-month run from the April lows, with the S&P 500 gaining 14% in three months.

CHART 1. WINNING STREAKS IN THE S&P 500. Since late April, the S&P 500 has logged a nine-day streak from April 22 to Might 2 and a six-day streak from Might 12 to Might 19.

Presently, the SPX is up 23% in slightly below two months. It would not be stunning to see a break within the motion sooner or later.

The important thing distinction between now and July is that again in July, the S&P 500 was making new highs for 2 straight months. That is not the case now, because the index continues to be under the February 2025 highs. So it is not apples to apples, however, in some unspecified time in the future, the market must cope with greater than a minor pullback as soon as once more.

Sentiment Test

After the shut on Wednesday, I ran an X ballot asking if the 0.01% transfer was bullish or bearish. The consequence: 61% stated bullish.

This tells us that most individuals noticed Wednesday’s pause as an indication that the bears are unable to push the market greater, which could possibly be true. However it additionally suggests complacency. The onus nonetheless is squarely on the bears to do one thing with this, with the one true signal of weak point within the final six weeks approaching Might 21, when the S&P 500 plummeted 1.6%. That ended up being an aberration… for now.

UBER Inventory: One to Watch

Typically, a selected inventory can present clues concerning the broader market’s subsequent step. Proper now, we expect that the inventory is UBER.

Technically talking, UBER is at a vital spot, and it is also an essential inventory on condition that it was one of many first development names to interrupt out to new all-time highs. The inventory stays in a long-term uptrend, which, after all, is bullish, nevertheless it has quietly pulled again 13% from its Might 20 excessive of $93 and was simply down 9 out of 10 buying and selling periods (see the weekly chart of UBER inventory). We will see that the inventory has absolutely retraced the value motion from the sample breakout close to $82.

CHART 2. WEEKLY CHART OF UBER STOCK. The inventory is in a long-term uptrend, though it has retraced. This is the place issues get actually fascinating. UBER has now shaped a possible bearish head-and-shoulders sample, seen on the day by day chart. If the inventory breaks under $82, it’s going to goal the 71-zone.

CHART 3. DAILY CHART OF UBER STOCK. Will UBER’s inventory value maintain help or break under it? This chart is one to observe.

So, listed below are three outcomes to observe for. UBER’s inventory value may:

- Maintain help (bullish).

- Break under $82, however then reverse greater, which might be a bear lure (bullish).

- Break under $82 and proceed decrease and hit the draw back goal (bearish).

If #3 happens, the chances are UBER will not be declining by itself; it will possible drag the broader market down with it. This reveals the importance of UBER inventory, which actually makes it one to regulate.

Frank Cappelleri is the founder and president of CappThesis, an unbiased analysis agency that helps energetic traders by means of time-tested chart and statistical evaluation. Previous to beginning CappThesis, Frank spent 25 years on Wall Road as an fairness gross sales dealer, technical analyst, analysis gross sales specialist and desk strategist. Frank maintain the CFA and CMT designations and is a CNBC contributor.

Be taught Extra