Auto Buying and selling — Bollinger Band Technique

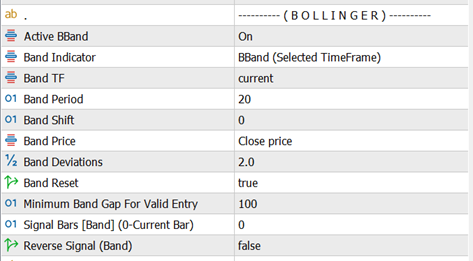

The Bollinger Band technique is without doubt one of the built-in auto buying and selling strategies utilized by AZ Commerce Restoration EA to open the preliminary commerce mechanically. This technique reacts to cost interplay with the Bollinger Bands and is designed for mean-reversion model entries.

Entry Logic

SELL Sign

When the worth touches or strikes past the Higher Bollinger Band, the EA generates a SELL sign.BUY Sign

When the worth touches or strikes beneath the Decrease Bollinger Band, the EA generates a BUY sign.

Reset Logic (Mid Line Habits)

The center band (shifting common) acts as a reset stage to manage how regularly trades are opened.

Instance (Default Habits):

Worth touches the Higher Band → EA opens a SELL

Worth continues close to the Higher Band → no new SELL trades

Worth comes again and touches the Center Band → technique is reset

Worth touches Higher Band once more → EA can open a brand new SELL

Open Commerce After Reset Choice

OpenTradeAfterReset = true (beneficial)

Trades are opened solely after value resets on the center band.OpenTradeAfterReset = false

The reset rule is ignored.

Each time value touches the Higher or Decrease Band, the EA can open a brand new commerce — even with out returning to the center band.

⚠️ Disabling reset can considerably enhance commerce frequency and danger.

Abstract

Higher Band → SELL

Decrease Band → BUY

Center Band → Reset management

Reset enabled = managed entries

Reset disabled = aggressive entries

This technique works greatest in ranging or mildly trending markets and might be mixed with different auto methods to create a customized hybrid buying and selling logic.

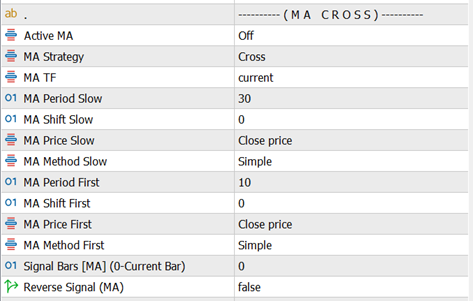

Auto Buying and selling — Transferring Common (MA) Technique

The Transferring Common (MA) technique opens trades based mostly on the connection between two shifting averages: a Quick MA and a Sluggish MA. AZ Commerce Restoration EA helps two MA-based entry modes, permitting you to decide on between sign precision or trend-following habits.

1. Cross Mode (MA Crossover)

This mode generates alerts solely for the time being of a crossover, making it extra selective.

Entry Logic:

Key Traits:

Trades open solely on the crossing level

Fewer alerts, cleaner entries

Finest for figuring out pattern modifications

2. Up & Down Mode (Pattern Place)

This mode is extra aggressive and focuses on pattern course, not the crossover occasion.

Entry Logic:

Key Traits:

Abstract

Cross Mode → Commerce solely on MA cross occasions (precision-based)

Up & Down Mode → Commerce based mostly on MA place (trend-following)

Quick MA reacts faster to cost

Sluggish MA defines general pattern course

This technique can be utilized alone or mixed with different auto methods to kind a extra strong buying and selling

Auto Buying and selling — RSI Technique

The RSI (Relative Power Index) technique makes use of overbought and oversold ranges to establish potential reversal factors available in the market. AZ Commerce Restoration EA opens trades when the RSI reaches predefined threshold ranges and makes use of a reset rule to keep away from repeated entries in the identical situation.

How the RSI Technique Works

Entry Logic

SELL Sign

When the RSI line reaches or touches the Promote Degree (default: 70), the market is taken into account overbought and a SELL sign is generated.BUY Sign

When the RSI line reaches or touches the Purchase Degree (default: 30), the market is taken into account oversold and a BUY sign is generated.

Each the Purchase Degree and Promote Degree might be personalized from the EA inputs to fit your buying and selling model or market situations.

Reset Logic (Necessary)

To stop a number of trades from opening repeatedly on the similar RSI excessive:

After a SELL commerce is opened, the EA will not open one other SELL till the RSI strikes again beneath the Promote Reset stage.

After a BUY commerce is opened, the EA will not open one other BUY till the RSI strikes again above the Purchase Reset stage.

This reset mechanism ensures:

Abstract

RSI detects overbought and oversold situations

Trades open solely when RSI touches outlined ranges

Reset strains should be crossed earlier than the subsequent commerce of the identical sort

Ranges are absolutely adjustable from inputs

The RSI technique works properly on ranging or corrective markets and might be mixed with different methods for stronger affirmation.

Auto Buying and selling — Heiken Ashi Technique

The Heiken Ashi technique makes use of candle colour and pattern consistency to establish clear market course and scale back noise. AZ Commerce Restoration EA helps two Heiken Ashi–based mostly entry strategies, each managed by candle colour guidelines and a affirmation filter.

Primary Rule

All Heiken Ashi methods depend on the Minimal Bar for Legitimate Sign setting.

This defines what number of consecutive candles (ranging from the present candle) should verify the sign earlier than a commerce is allowed.

Instance:

If Minimal Bar for Legitimate Sign = 2, then the present candle + earlier candle should each be the identical colour.

Heiken Sign Sorts

1) Cross Technique

This methodology seems to be for a colour change adopted by affirmation.

BUY Sign

SELL Sign

This strategy helps seize early pattern reversals.

2) Up and Down Technique

This methodology follows pattern continuation with out requiring a colour change.

BUY Sign

SELL Sign

This strategy is smoother and works greatest in trending markets.

Heiken Ashi Inputs Defined

Heiken TimeFrame

Selects the timeframe used to calculate the Heiken Ashi candles. This may be the present chart timeframe or the next/decrease one.Heiken Indicator Sort

Select between:Heiken Smoothed Technique / Interval

Parameters used solely when Heiken Ashi Smoothed is chosen. These management how a lot smoothing is utilized.Minimal Bar for Legitimate Sign

Variety of consecutive candles (ranging from the present candle) that should be the identical colour to substantiate a sign.Reverse Sign (Heiken)

When enabled, BUY and SELL alerts are swapped.

Helpful for counter-trend or experimental methods.

Abstract

Inexperienced candles sign BUY, crimson candles sign SELL

Two modes: Cross (reversal) and Up & Down (trend-following)

Minimal candle affirmation prevents false entries

Works with each commonplace and smoothed Heiken Ashi indicators

Indicators might be reversed if wanted

This technique is very efficient in clear trending markets and pairs properly with recovery-based commerce administration.

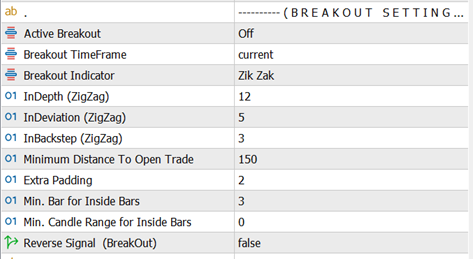

Breakout Technique

The Breakout technique is designed to enter trades when value breaks a key construction or stage. AZ Commerce Restoration EA helps a number of breakout strategies, permitting you to commerce volatility expansions utilizing completely different market behaviors. You’ll be able to choose one breakout methodology at a time from the inputs.

Breakout Technique Sorts

1) ZigZag Breakout

This methodology makes use of ZigZag swing factors as dynamic breakout ranges.

Necessary habits

If the present market value is already above or beneath the latest ZigZag stage, the EA will mechanically seek for the nearest legitimate higher or decrease ZigZag stage and await a breakout from that stage as a substitute of getting into instantly.

ZigZag Parameters

ZigZag Depth: Controls what number of candles are used to kind swing factors.

ZigZag Deviation: Defines how far value should transfer to kind a brand new swing.

ZigZag Backstep: Filters out minor swings to cut back noise.

These parameters straight have an effect on how delicate or clean the breakout ranges are.

2) Fractal Breakout

This methodology makes use of Fractal highs and lows as breakout reference factors.

Necessary habits

If value is already past the present fractal stage, the EA will mechanically find the nearest legitimate fractal stage and await a correct breakout earlier than opening a commerce.

This technique is helpful for clear structure-based breakouts.

3) Every day Breakout

This methodology trades breakouts of the earlier day’s vary.

Every day Breakout is easy, efficient, and generally utilized in intraday buying and selling methods.

4) Inside Bar Breakout

An Inside Bar types when a candle is totally contained throughout the excessive and low of the earlier candle. This means value compression and potential growth.

Sign Formation

BUY Commerce

SELL Commerce

Inside Bar Filters

Minimal Bar In (Inside Bars)

Defines what number of candles should be inside one candle to qualify as a sound sign.Minimal Candle Vary (Inside Bars)

Units the minimal Excessive–Low vary of the sign candle.

Worth 0 disables this filter.

This technique is efficient throughout consolidation phases earlier than sturdy strikes.

Further Breakout Controls

Minimal Distance To Open Commerce

Units the minimal distance (in factors) value should transfer past a breakout stage earlier than a commerce is allowed.

Helps keep away from false breakouts.Further Padding

Provides or subtracts factors from the unique breakout stage.Constructive worth → Entry positioned additional away from the breakout stage

Unfavourable worth → Entry positioned nearer to the breakout stage

0 → Commerce opens precisely on the breakout stage

Instance:

If breakout stage = 1.2000 and Further Padding = 10 factors

→ Purchase commerce opens at 1.2010Reverse Sign (Breakout)

When enabled, all breakout alerts are inverted:

Abstract

A number of breakout kinds supported: ZigZag, Fractal, Every day, Inside Bar

EA mechanically adjusts to nearest legitimate breakout ranges

Distance and padding filters assist scale back false entries

Indicators might be reversed if required

Works seamlessly with the restoration engine for danger management

The Breakout technique is greatest suited to unstable market situations the place value growth is anticipated after consolidation or construction breaks.

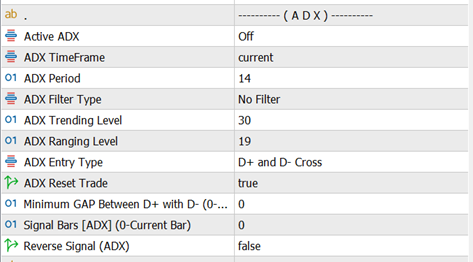

Auto Buying and selling — ADX Technique

The ADX technique makes use of the Common Directional Index to determine when the market is tradable and how trades must be opened.

It really works in two levels:

ADX Filter Sort – decides market situation (pattern or vary)

ADX Entry Sort – decides purchase or promote course

Each settings work collectively to kind the ultimate buying and selling logic.

1) ADX Filter Sort (Market Situation)

This setting defines when the EA is allowed to commerce.

Commerce On Trending Degree

The EA checks the ADX fundamental line

When ADX is above the ADX Trending Degree, the market is taken into account trending

Trades are allowed solely throughout sturdy pattern situations

Use this mode if you need to commerce momentum and directional strikes.

Commerce On Ranging Degree

The EA checks the ADX fundamental line

When ADX is beneath the ADX Ranging Degree, the market is taken into account ranging

Trades are allowed solely throughout sideways or low-volatility situations

Use this mode if you need to commerce consolidations or mean-reversion setups.

2) ADX Entry Sort (Commerce Path)

After the market situation is confirmed by the ADX Filter Sort, the EA makes use of the ADX Entry Sort to determine whether or not to open a BUY or SELL commerce.

D+ and D− Up & Down

This methodology focuses on directional dominance relatively than crossings.

D+ and D− Cross

This methodology is extra reactive and works properly at potential pattern modifications.

No Entry Sign

The EA does not use D+ or D− for course

Trades are opened solely based mostly on the ADX Filter Sort

Path is dealt with by different lively methods or settings

Use this selection when ADX is meant purely as a market situation filter.

How the ADX Technique Works Collectively

EA first checks ADX Filter Sort

→ Is the market trending or ranging as outlined by your settings?If the situation is legitimate, EA applies ADX Entry Sort

→ Determines BUY or SELL logic (except “No Entry Sign” is chosen)If all situations match, the preliminary commerce is opened

Abstract

ADX Filter Sort controls when the EA can commerce

ADX Entry Sort controls how trades are entered

Can be utilized alone or mixed with different auto methods

Works greatest as a market situation filter to keep away from poor commerce environments

The ADX technique is very efficient when mixed with different entry programs to keep away from buying and selling in unfavorable market situations.

Auto Buying and selling — Ichimoku Technique

The Ichimoku technique makes use of the complete Ichimoku Kinko Hyo system to establish pattern course, momentum, assist/resistance, and market bias.

AZ Commerce Restoration EA gives a number of impartial Ichimoku-based methods, every with its personal entry and (non-obligatory) exit logic. These methods don’t intrude with each other.

You’ll be able to choose:

Obtainable Ichimoku Entry Methods

1) Tenkan–Kijun Cross

Entry Logic

This technique focuses on short-term momentum modifications.

2) Tenkan–Kijun Cross (Superior)

Entry Logic

This model provides pattern affirmation utilizing the cloud.

3) Kumo Cloud Breakout

Entry Logic

Used to catch sturdy breakout strikes.

4) Kumo Cloud Breakout (Superior)

Entry Logic

Provides momentum and future pattern affirmation.

5) Kijun–Worth Cross

Entry Logic

Works properly in established traits.

6) Chikou Span Breakout

Entry Logic

Makes use of historic value affirmation.

7) Kumo Future Twist

Entry Logic

This technique anticipates future pattern shifts.

Supporting Inputs

Ichimoku TimeFrame – Timeframe used to calculate the indicator

Tenkan-sen – Tenkan interval worth

Kijun-sen – Kijun interval worth

Senkou Span B – Senkou Span B interval

Sign Bars (Ichimoku) – Which candle is used because the sign

0 = present candle

1 = earlier candle

Reverse Sign (Ichimoku)

Abstract

A number of Ichimoku methods can be found for entry and exit

Superior modes add cloud and future pattern affirmation

Entry and exit methods might be combined independently

Appropriate for pattern buying and selling, breakouts, and momentum setups

The Ichimoku module is designed to be versatile, permitting merchants to adapt the system to completely different market situations whereas maintaining the restoration engine absolutely lively.