That is an version of The Atlantic Every day, a publication that guides you thru the most important tales of the day, helps you uncover new concepts, and recommends one of the best in tradition. Join it right here.

Making an attempt to parse market reactions to world occasions can really feel a bit like armchair psychology. These days, traders appear to be holding one thing again—amid a barrage of doubtless seismic choices from the White Home, markets have barely budged.

In moments of worldwide instability, merchants often begin promoting. President Obama’s threats to Syria throughout his second time period gave merchants “jitters.” Trump’s escalating commerce struggle with China throughout his first time period deflated the inventory market. And final spring, when Trump unveiled “Liberation Day”—a plan to impose punitive tariffs on dozens of overseas nations—the S&P 500 shed a document $5 trillion over two days. It stays the most important market shock of the president’s second time period thus far.

However the reactions to a few headlines from this previous month inform a distinct story. When U.S. forces captured Venezuelan President Nicolás Maduro on January 3, reviving an previous protocol for dominance within the Western Hemisphere, the markets held sturdy. When Federal Reserve Chair Jerome Powell revealed on January 11 that he was below prison investigation by the Justice Division, and that the central financial institution’s independence was probably below menace, markets responded with startling calm. And when Trump proposed a raft of European tariffs on January 17, as a part of an effort to grab Greenland from our Danish allies, the market response, though noticeable, was removed from catastrophic.

The truth that merchants haven’t reacted so dramatically to volatility in 2026 is partly the product of better-than-expected financial progress in 2025. Though shopper costs stay excessive and job progress is gradual, most specialists will let you know that the American economic system is in fairly fine condition: The S&P 500 grew 16.39 % final 12 months; unemployment, though increased than when Trump took workplace, remains to be comparatively low; and inflation isn’t anticipated to balloon over the approaching 12 months. (Prophecies of a recession turned out to have been flawed.)

Merchants are weighing Trump’s actions in opposition to that rosy backdrop, and have these days been acclimating to the president’s caprice. The “TACO” idea (quick for “Trump All the time Chickens Out”) emerged as a technique to describe his tendency to overpromise. However the markets’ resiliency over the previous month signifies a extra all-encompassing anhedonia.

Forward of the mission to extract Maduro from Caracas, Trump prompt that U.S. intervention in Venezuela was meant to unencumber the nation’s oil reserves, that are regarded as the most important on the earth. It appeared potential that American corporations would barrel up these trillions of gallons of oil, rising world provide and reducing costs—a boon for purchasers and a possible drawback for the vitality corporations already dealing with an oversupply drawback. However as a result of this all unfolded early on a Saturday morning, and oil-futures buying and selling doesn’t open till Sunday night, traders had a slight buffer.

Josh Lipsky, the chair of worldwide economics on the Atlantic Council, advised me that vitality merchants understood fairly shortly that there wouldn’t be “some inflow of oil approaching.” American oil corporations had been reluctant to pour cash into Venezuela given the nation’s crumbling infrastructure, its historical past of political instability, and the price of refining its low-quality reserves. A protracted battle over the nation’s management additionally appeared unlikely, which means that the results of Maduro’s seize would largely be felt regionally. After a second of preliminary uncertainty, the markets shortly recovered—a muted response to what may have been a a lot bigger, and far costlier, occasion.

The revelation that the Justice Division had subpoenaed the Federal Reserve chair posed a wholly totally different form of danger. In a video message saying the information, Powell accused Trump of persecuting him over his refusal to decrease rates of interest as shortly because the president would love. The Fed is famously unbiased from day by day politics, which is a part of its power, and the greenback’s power; Trump’s try to say management over it may have extreme financial penalties. There was an opportunity that, after Powell’s announcement, merchants would begin to value in that hazard.

However as with the Maduro operation, this occurred on a weekend, and markets had a buffer. That very same evening, Trump distanced himself from the DOJ’s investigation, and Senator Thom Tillis (a member of the Senate banking committee) got here out strongly in opposition to it. Krishna Guha, the vice chair of the investment-research agency Evercore ISI, advised me that had these developments not occurred, the market may have “responded very violently.” However by Monday afternoon, merchants had barely reacted.

One thing about Trump’s social-media proposal to place tariffs on European nations spooked markets greater than the investigation of Powell or the seize of Maduro. As soon as once more, the information arrived on a weekend. When buying and selling resumed, shares did noticeably decline, and the greenback weakened—however the 2.1 % dip within the S&P 500 was nothing near what occurred after the “Liberation Day” announcement. When the president reneged on his Greenland-tariff plan final week, markets steadied.

“I feel that we bought a bit style of how unhealthy issues would have been if the administration had continued alongside the escalation path,” Guha stated. In accordance with John Canavan, the lead market analyst at Oxford Economics, that preliminary dip was possible compounded by a spike in Japanese-long-term-bond yields. Buyers might have additionally discovered their lesson from the slight pullback that adopted final 12 months’s “Liberation Day” panic; a few of these proposed tariffs had been ultimately paused, decreased, or delayed. Though lots of the massive ones remained in place, it turned clear that Trump was basically utilizing the specter of financial devastation as a negotiation tactic.

The economists I spoke with careworn that though these three circumstances are distinct, on the entire, markets have turn out to be extra inured to the Trump administration’s actions. For now, the destiny of People’ 401(okay)s is just not tied to the president’s Fact Social account. However that might at all times change; simply this week, the president wrote that the US has deployed a “huge armada” to the Center East in an try and drive Iran to finish its nuclear weapons program. Monetary markets are within the enterprise of pricing threats—and Trump will certainly preserve them coming.

Associated:

Listed below are three new tales from The Atlantic:

Right this moment’s Information

- The Justice Division launched 3 million extra pages of recordsdata associated to Jeffrey Epstein, plus 1000’s of movies and images, its largest Epstein disclosure so far.

- President Trump stated he’ll nominate Kevin Warsh, a former Federal Reserve governor, to succeed Jerome Powell as Fed chair when Powell’s time period ends in mid-Might.

- The Justice Division has opened a civil-rights investigation into the deadly taking pictures of Alex Pretti in Minnesota, Deputy Lawyer Normal Todd Blanche stated.

Dispatches

Discover all of our newsletters right here.

Night Learn

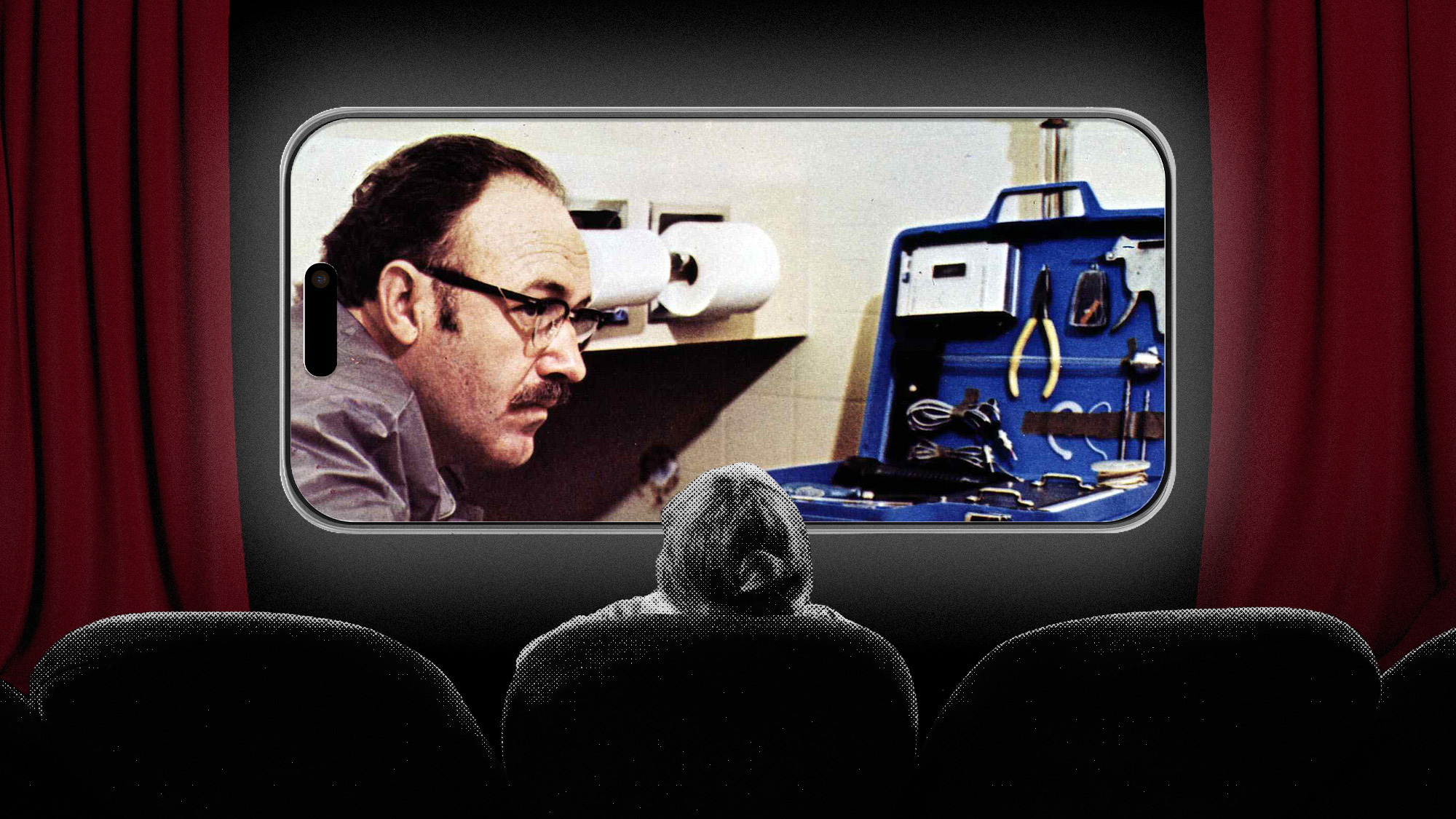

The Movie College students Who Can No Longer Sit By way of Movies

By Rose Horowitch

Everybody is aware of it’s onerous to get school college students to do the studying—keep in mind books? However the attention-span disaster is just not restricted to the written phrase. Professors are actually discovering that they’ll’t even get movie college students—movie college students—to sit down via motion pictures. “I used to assume, If homework is watching a film, that’s the finest homework ever,” Craig Erpelding, a movie professor on the College of Wisconsin at Madison, advised me. “However college students is not going to do it.”

Extra From The Atlantic

Tradition Break

Watch. The Melania Trump documentary is a shame, Sophie Gilbert argues. The exorbitant movie captures the rotten state of our leisure trade.

Curious? American males are loading up on testosterone—whether or not they want it or not, Yasmin Tayag writes.

Play our day by day crossword.

Rafaela Jinich contributed to this text.

Once you purchase a ebook utilizing a hyperlink on this publication, we obtain a fee. Thanks for supporting The Atlantic.