Six main CEOs obtained eight-digit compensation

A latest evaluate performed by the Client Federation of America (CFA) has make clear the substantial compensation obtained by CEOs within the nation’s high 10 private traces insurance coverage corporations.

At a time when rising insurance coverage charges are inflicting monetary pressure for policyholders throughout america, the CEOs of main insurance coverage corporations have been incomes substantial salaries, bonuses, and extra funds.

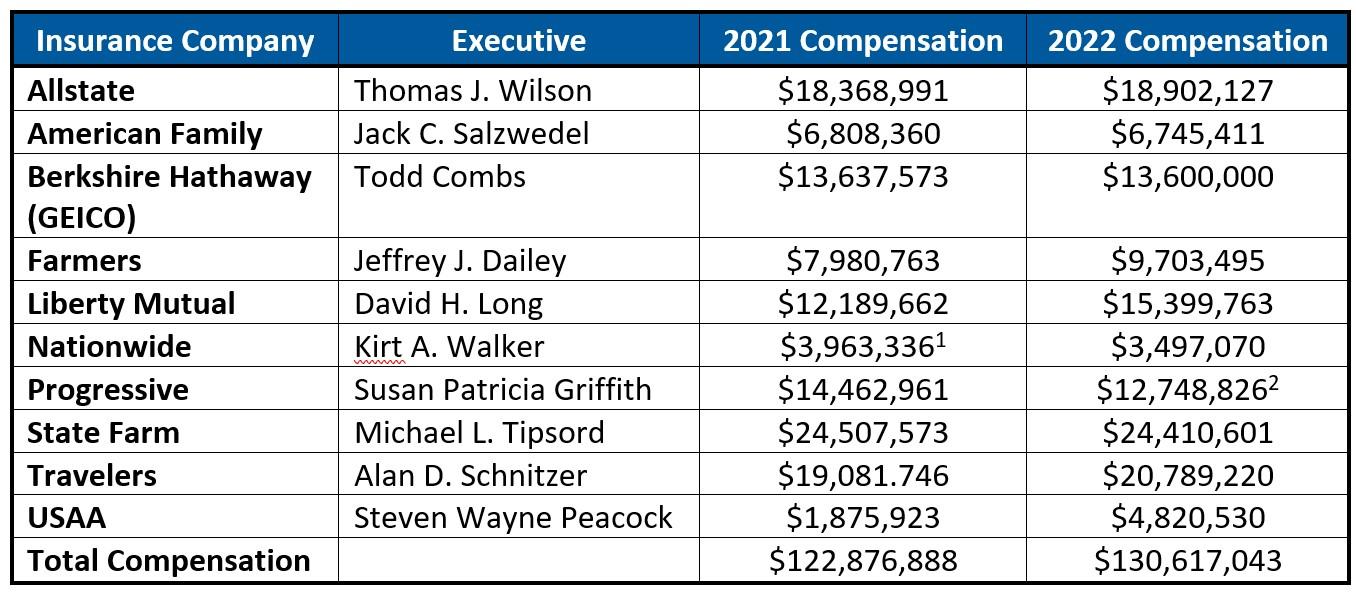

According to a information launch, the Client Value Index for August highlights a 19% enhance in auto insurance coverage prices in comparison with 2022. In the meantime, the CEOs of six main insurance coverage corporations obtained compensation exceeding $12 million every in 2022. In whole, these high 10 insurance coverage executives have been paid over $130 million in the identical yr, with mixed earnings over the span of two years amounting to $253,493,931.

The compensation figures for insurance coverage executives in 2021 and 2022 have been obtained from Nebraska’s Division of Insurance coverage, which mandates insurance coverage corporations to reveal info relating to salaries, bonuses, and different compensation for his or her high officers. Nevertheless, CFA additionally famous that these reported figures could underestimate the precise earnings of executives, as they could exclude compensation from affiliated corporations.

CFA additionally noticed that these extreme compensation for insurance coverage executives coincided with the burden confronted by clients and workers on account of stringent costs imposed by these corporations. The federation cited these examples:

- Farmers’ govt Jeff Dailey obtained an almost $2 million elevate in 2022, whereas the corporate elevated householders insurance coverage premiums by over $575 million throughout 42 states, restricted availability in California, halted renewals for nearly a 3rd of its householders insurance coverage insurance policies in Florida, and laid off 11% of its workforce

- Liberty Mutual paid its CEO, David Lengthy, over $15 million in 2022 and just lately raised householders insurance coverage charges by $729.8 million

- State Farm compensated its CEO, Michael Tipsord, with over $24 million whereas elevating auto insurance coverage charges 4 instances in a yr in its residence state of Illinois, growing auto charges by 17% in Louisiana, and elevating householders insurance coverage charges by 28.1% in California, alongside halting new functions for householders insurance coverage in California

“CEOs reside excessive on the hog whereas growing insurance coverage premiums for individuals dwelling paycheck to paycheck,” stated Michael DeLong, analysis and advocacy affiliate at CFA. “Insurers are telling regulators that unusual shoppers need to pay far more for auto and residential insurance coverage as a result of the businesses are battling inflation and local weather change, however they’re quietly handing CEOs gigantic bonuses. Drivers are required to purchase auto insurance coverage and householders have to purchase protection to fulfill their mortgage necessities, so there must be extra scrutiny of the speed hikes corporations are demanding and the massive CEO paydays which are funded with buyer premiums,.”

What are your ideas on this story? Please be happy to share your feedback beneath.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing listing, it’s free!