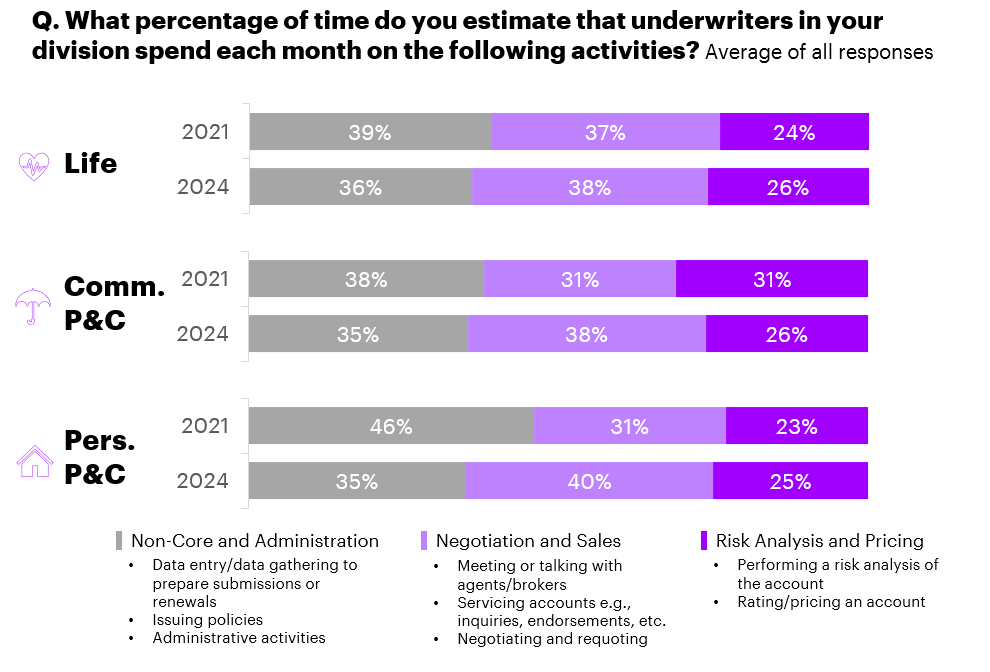

Now we have periodically performed surveys on underwriting for greater than 15 years to grasp the state of the operate and the way know-how is—or isn’t—serving to it to evolve. In our most up-to-date report Underwriting rewritten, we requested what proportion of time underwriters are spending on non-core duties. This time, we noticed some incremental enchancment 12 months–over–12 months in contrast to our 2021 survey however nonetheless extra than a 3rd of an underwriter’s time is spend on non-core actions akin to knowledge assortment or administrative actions.

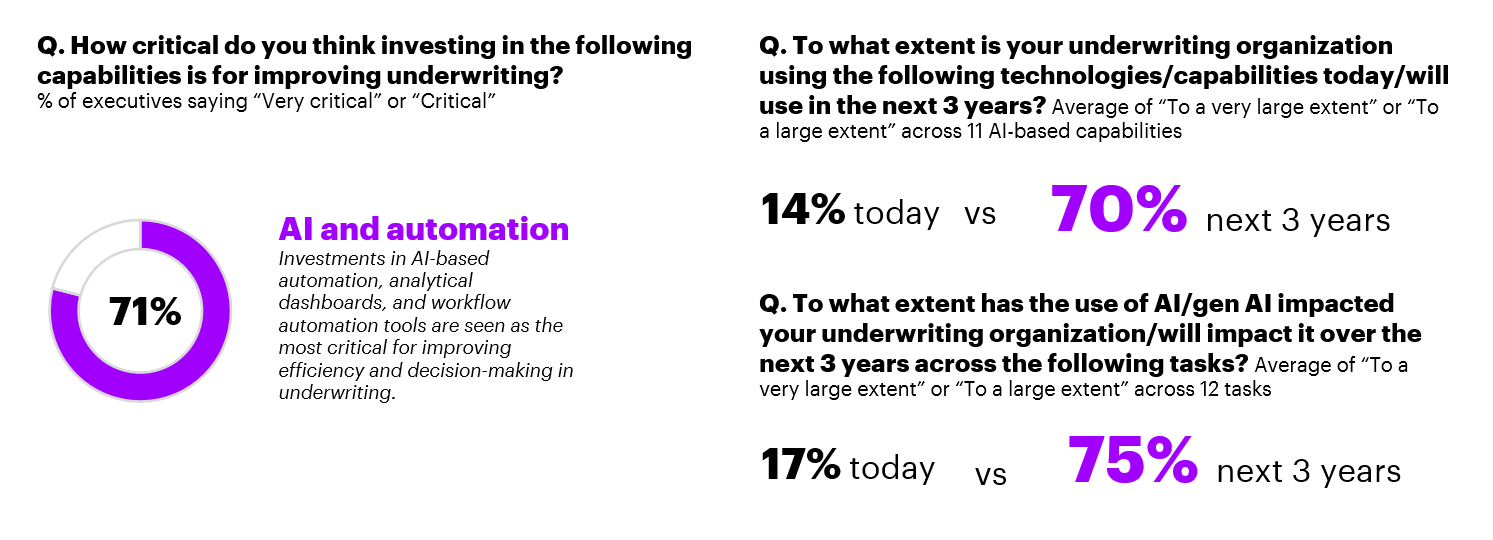

However greater than that, our 2024 survey total expresses the hope for the long run that new automation and AI applied sciences might assist change the function of underwriting and really cut back the time spent on non-core duties.

I’ve been round lengthy sufficient to recollect different waves of latest concepts and applied sciences akin to information administration, the web of issues, and analytics. And whereas every has discovered a spot throughout the total insurance coverage enterprise and know-how ecosystem, one might argue that none really modified the underwriting operate fully. However in on a regular basis that we’ve got accomplished our business surveys over my 30-year profession, I personally have by no means seen numbers like this:

Embracing automation and AI

In accordance with the information above, the share of time underwriters spend on non-core duties is ready to lower way more than simply incrementally with AI and automation going ahead. Throughout Life, Group, Private, and Business Insurance coverage, insurance coverage executives are satisfied that AI and automation instruments will change underwriting considerably and can change it comparatively shortly.

Over the past 3 years carriers have been experimenting with these applied sciences—doing e.g., pilots in knowledge assortment, knowledge synthesis, and recommendation for underwriting. And whereas not all of those pilots might need been profitable, the general conclusion appears to be now that this time there’s a justification for optimism in tackling the non-core share of actuarial duties. In reality, if you happen to aren’t pursuing some type of AI Underwriting pushed technique already, then you might be in all probability already behind in keeping with our survey.

Listed here are some key knowledge factors from our current Underwriting Government Survey:

- 81% of underwriting executives surveyed imagine AI and gen AI will create new roles “to a big extent” or “to a really massive extent”.

- 65% of executives imagine their workforce would require upskilling as AI turns into integral to creating new roles and augmenting current ones.

- 42% of executives suppose they might want to entry exterior expertise swimming pools to completely leverage the potential of the know-how

Empowering the AI-led underwriter

Mixed with fashionable automation instruments and superior knowledge ingestion capabilities, AI is probably essentially the most transformative pressure in fashionable underwriting, balancing each effectivity and complexity inside managed areas. It might probably allow pure language processing to work together with prospects and brokers to deal with points and to grasp requests in order that they are often routed to the right answer automations. Superior choice components and sample recognition additionally permit for processing of a wider array of self-service requests with out direct intervention. Plus, AI has the power to orchestrate automations to offer full self-service options.

Let’s be clear: the underwriting function isn’t going away, however it will likely be reworked as every provider charts one of the simplest ways to mix human plus machine decision-making to enhance each the velocity and effectivity of underwriting outcomes.

Your subsequent steps as gen AI augments your workforce

To achieve success in any AI journey, carriers should be pondering by way of three issues from my perspective:

- An AI-led technique that lays out a plan for profiting from these new instruments inside your current atmosphere. It must be grounded in a robust digital core. As AI know-how evolves to grow to be extra agentic, underwriters might even improve their productiveness additional by breaking down their workflow and delegating duties to those AI brokers.

- A expertise technique that reimagines work and is redesigning workflows to organize administration groups and underwriting organizations to reap the benefits of the brand new capabilities these options present. A skills-based strategy shall be key and in tandem, insurers might want to align AI integration with course of reinvention, guaranteeing accountable AI ideas are adhered to all through.

- A tradition that is ready to discover and experiment whereas defending core choice making. Insurers in all probability must take a bottom-up reasonably than a top-down strategy to AI adoption, capitalizing on worker willingness and eagerness to experiment with AI.

If you wish to study extra about Accenture’s Insurance coverage Underwriting Government Survey, discover at Underwriting rewritten or be happy to achieve out to me straight.