It’s pure to need to have a excessive share of successful trades, it makes us really feel good when a commerce seems to be a winner as a result of we generate profits and we have been proper in regards to the route of the market. Nevertheless, as we’ll focus on in as we speak’s lesson, being proper in regards to the consequence of any given commerce and having a excessive share of successful trades are two issues that aren’t essential to be a worthwhile dealer.

It’s pure to need to have a excessive share of successful trades, it makes us really feel good when a commerce seems to be a winner as a result of we generate profits and we have been proper in regards to the route of the market. Nevertheless, as we’ll focus on in as we speak’s lesson, being proper in regards to the consequence of any given commerce and having a excessive share of successful trades are two issues that aren’t essential to be a worthwhile dealer.

Being proper and improper are two issues that we’re all very aware of. In life, individuals appear to have an inherent have to be proper about nearly every thing. Even after we are improper about one thing and we all know it, we nonetheless are likely to rationalize our actions to ourselves to gloss over the truth that we weren’t proper. Certainly, we regularly are likely to get upset when somebody tells us we’re improper about one thing; individuals don’t wish to be improper as a result of they internalize that data to imply they’re inferior in a roundabout way. This is a vital level to contemplate as a dealer, as a result of as merchants one of many issues we’ve got to be taught to cope with regularly is shedding, A.Ok.A. being improper in regards to the route of the market.

Proof that being proper a few commerce is irrelevant

Being ‘proper’ in regards to the route of the market on any given commerce is just not actually related to your total success or failure as a dealer. As I’ll present you under, you may be improper extra usually than you’re proper in regards to the route of the market and nonetheless be a worthwhile dealer. Subsequently, it’s paramount to our foreign currency trading mindset and to our total buying and selling efficiency that we be taught to detach ourselves from the sensation of needing to be proper about each commerce.

For proof that you shouldn’t fear about being proper or improper on any given commerce, let’s focus on the subject of threat reward…

If you begin considering when it comes to threat reward and actually perceive the facility of threat reward, you’ll start to know that issues like successful share and being ‘proper’ about any singular commerce are merely irrelevant as to if or not you turn out to be a constantly worthwhile dealer.

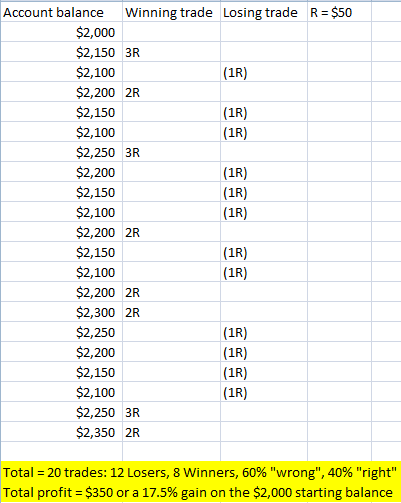

Should you study the chart of hypothetical commerce outcomes under, you possibly can simply see the facility of threat reward. That energy may be seen in the truth that when you maintain your threat (R) fixed, and also you receive a reward of 2R or extra on all of your successful trades, you possibly can lose considerably greater than you win and nonetheless come out comfortably forward. That’s to say, you may be “improper” about market route greater than you might be “proper” about it and nonetheless generate profits within the markets.

A 20 commerce hypothetical pattern of randomly distributed successful and shedding trades:

For many merchants, this concept of being improper and nonetheless earning money is just not one thing they consider very a lot. Most merchants assume they’ll be proper on each commerce they take proper after they enter it. It’s pure to assume that your evaluation was proper and that this commerce is “going to be a winner” simply as you enter it. So, we mainly set ourselves as much as anticipate to win and to be proper each time we enter the market. Nevertheless, this clearly clashes with the FACT that we’re not going to win on each commerce…thus we’ve got the recipe for an emotional response to a shedding commerce. In essence, when our expectations don’t mesh with the fact of a state of affairs, we are likely to turn out to be emotional, and that is very true in buying and selling.

So, to treatment this case, we merely have to simply accept the FACT that we aren’t going to be proper about each commerce we take…AND that ‘being proper’ is just not essential to make constant cash within the markets. Don’t take it personally when you lose on a commerce and do not forget that it’s simply one other execution of your edge. Over a sequence of say 20 trades like we noticed above, you might be GOING TO have losers, you shouldn’t turn out to be emotional about any shedding commerce when you’re following a plan and sustaining your pre-determined threat tolerance. Have a look at that chart above, it exhibits solely a 40% win fee however over 20 trades the account was nonetheless up 17.5%. Even when that hypothetical commerce set passed off over 3 or 4 months, a 17.5% achieve in your buying and selling account remains to be superb.

It can assist when you research the chart above and picture you may have a much bigger account than what you may have. Should you gained solely 40% of the time like within the instance above, however you hit 2R and 3R winners while conserving your losers all at 1R, you’d make some huge cash after these 20 trades on say a 50k or 100k account. That $350 hypothetical revenue could be $8,750 on a 50k account…that’s not a small chunk of change by anybody’s requirements. So, at all times do not forget that when you can constantly generate profits on a small account, even when you aren’t “proper” on a regular basis, you can too generate profits on a much bigger account; an amount of cash that could be life-changing.

So, don’t be discouraged if in case you have a small buying and selling account, don’t attempt to over-trade it or over-leverage it since you assume you possibly can “generate profits quicker that means”. As an alternative, perceive that when you keep a constant threat quantity that you just’re comfy with, and solely commerce high-probability value motion methods, over a sequence of trades you need to come out worthwhile, even when you lose nearly all of the time.

Verify your ego on the buying and selling room door

Dropping a commerce or being improper in regards to the market route doesn’t imply you’re inferior in any means. It simply signifies that the market didn’t transfer in your favor this time…there’s no purpose to take it personally. Dropping is a part of being a dealer and it’s one thing you possibly can’t keep away from. The extra you attempt to keep away from shedding trades the extra money you’ll lose as a result of you’ll start assigning an excessive amount of significance to anyone commerce.

Dropping a commerce or being improper in regards to the market route doesn’t imply you’re inferior in any means. It simply signifies that the market didn’t transfer in your favor this time…there’s no purpose to take it personally. Dropping is a part of being a dealer and it’s one thing you possibly can’t keep away from. The extra you attempt to keep away from shedding trades the extra money you’ll lose as a result of you’ll start assigning an excessive amount of significance to anyone commerce.

Many merchants turn out to be fixated on making an attempt to keep away from all shedding trades. They take losses means too personally. They overlook that shedding is a part of the enterprise of buying and selling and so they let each shedding commerce have an effect on them on a private stage.

As merchants, it’s essential to know that even when we see what we predict is a ‘good’ commerce setup and it turns right into a loser, we didn’t do something improper…we simply had a shedding commerce. It doesn’t imply we suck at buying and selling or we that we aren’t sensible sufficient to “determine it out”, it simply signifies that that specific occasion of your buying and selling edge was a loser. In a special article I speak about how there’s a random distribution of winners and losers for any specific buying and selling technique, and when you perceive and settle for that reality, it should considerably assist you commerce with much less emotion.

Should you’ve participated in any public boards about buying and selling you most likely have discovered that almost all merchants have a tendency to debate their successful trades way over their shedding trades. You will have even caught your self doing this. It’s pure to need to gloat about our successful trades to our associates and on on-line boards, even when total we’ve got misplaced cash within the markets…as a result of it makes us really feel good after we are proper a few commerce.

What it’s a must to do is perceive that whether or not or not you win on anyone commerce actually doesn’t matter within the grand scheme of issues. As we confirmed within the threat reward diagram above, being “proper” in regards to the route of the market is just not related to your success or failure available in the market. You may be “improper” greater than you’re “proper” available in the market and nonetheless generate profits when you make correct use of threat reward and you might be buying and selling a high-probability buying and selling technique like value motion in a disciplined method.

The purpose is that this; don’t let your ego get the very best of you available in the market. If that commerce that you just waited patiently for and that seemed “good” finally ends up not understanding, don’t instantly bounce again into the market simply since you really feel indignant otherwise you really feel “cheated” by the market. As an alternative, consider it as simply one other occasion of your buying and selling edge, and this commerce simply occurred to be one of many losers that you’ll inevitably have. Two key issues you must do to generate profits within the markets is to take away all emotions of “needing” to generate profits quick and of “needing” to be proper about each commerce. If you are able to do these two issues you’ll be mild years forward of most merchants who can’t see the forest for the timber.

Be taught to lose gracefully

Buying and selling is the final word take a look at of with the ability to ignore short-term temptations like buying and selling whenever you shouldn’t and risking greater than you need to, for the longer-term achieve of being a worthwhile dealer at month’s finish and 12 months’s finish. We have to always remind ourselves than anyone commerce doesn’t dictate our success within the markets, however what does is how constant our conduct is within the markets, day in and time out. Consistency and persistence are what makes merchants cash over the long-run; these traits are rewarded by the market while impulsiveness and unpreparedness are usually not.

The best way that we ignore these short-term emotional buying and selling temptations is to consider the larger image, which is that our buying and selling outcomes are measured over a big sequence of trades, not over a small handful of them. Because of this getting upset about being improper about anyone commerce is each irrelevant in addition to counter-productive to earning money within the markets. As merchants, we’ve got to be taught to ‘lose gracefully’ by merely transferring on after a shedding commerce. By “transferring on”, I imply finishing up your buying and selling plan as common, not reacting after a shedding commerce, simply take it in stride and at all times do not forget that you don’t need to be proper on each commerce to generate profits within the markets. Should you’re buying and selling with a high-probability buying and selling technique like the value motion methods I educate in my Foreign currency trading course, you can also make cash over the long-run by sticking to your buying and selling plan and understanding the facility of threat reward.

Good buying and selling, Nial Fuller