Immediately’s lesson goes to problem widespread beliefs that the majority novice merchants have about win percentages in buying and selling and what their relevance is, if something. You may need to ask for an additional shot of espresso in your espresso earlier than studying right this moment’s lesson…

Immediately’s lesson goes to problem widespread beliefs that the majority novice merchants have about win percentages in buying and selling and what their relevance is, if something. You may need to ask for an additional shot of espresso in your espresso earlier than studying right this moment’s lesson…

“Successful” and being “proper” are usually issues that individuals affiliate with being worthwhile and profitable. For instance, being proper loads at your 9 to five job will most likely get you a promotion in time, whereas being incorrect more often than not most likely is not going to. Thus, given these optimistic societal connections and beliefs about profitable and being proper, it’s no shock that the majority merchants affiliate “profitable” and being “proper” out there with being a worthwhile and profitable dealer. Conversely, most merchants affiliate “shedding” and being “incorrect” out there with shedding cash and being a “unhealthy” dealer. The irony in all of this, is that skilled merchants have lengthy since discovered that profitable, and extra particularly their general win proportion, has virtually nothing to do with how worthwhile or unprofitable they’re out there. If this all sounds complicated or opposite to what you might be used to listening to, don’t fear, I’ll make clear these factors within the charts and diagrams under. For now, I want you to contemplate the FACT that it will probably truly be dangerous to your buying and selling psychology and thus to your general buying and selling efficiency to focus an excessive amount of on win percentages and whether or not or not you have been “proper” about your final commerce(s). Buying and selling is without doubt one of the few professions the place you is usually a internet loser and nonetheless make some huge cash…thus, profitable and shedding percentages are virtually completely irrelevant within the buying and selling world.

How one can lose cash whereas profitable 90% of your trades

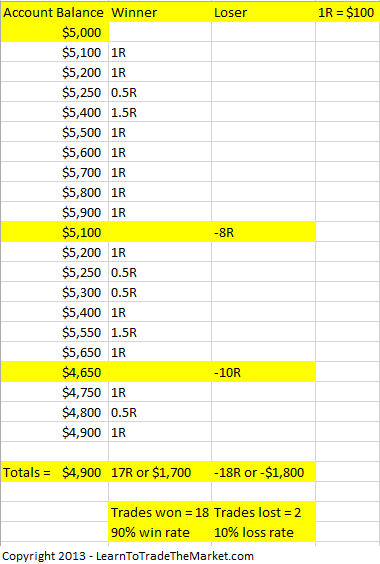

I get loads of emails from merchants asking about win charges and what the general profitable proportion is of my worth motion methods. My response to those questions is all the time the identical; it varies and it doesn’t actually matter in any case. I’ll admit, for those who’ve gotten such a response from me you might need been confused as to why I’d say that, as a result of certainly profitable proportion has a direct affect on how worthwhile we’re as merchants…or does it? I’d such as you to try the spreadsheet under. Upon analyzing it, you will notice {that a} dealer who takes comparatively small winners in comparison with his or her losers can truly nonetheless lose cash even with a win price of 90%. Sadly, for a lot of merchants, the outcomes under are all too acquainted; they offer again all their smaller winners by letting a pair losers get uncontrolled. Within the instance picture under, we are able to see that even with a 90% profitable proportion, a dealer can nonetheless lose cash in the event that they take losses which might be too giant relative to their winners:

The primary takeaway from the spreadsheet above is {that a} excessive profitable proportion mixed with even one or two draw-downs which might be a lot bigger than your winners, will kill your buying and selling account, to not point out your buying and selling mindset and general confidence.

How one can make some huge cash profitable simply 30% of your trades

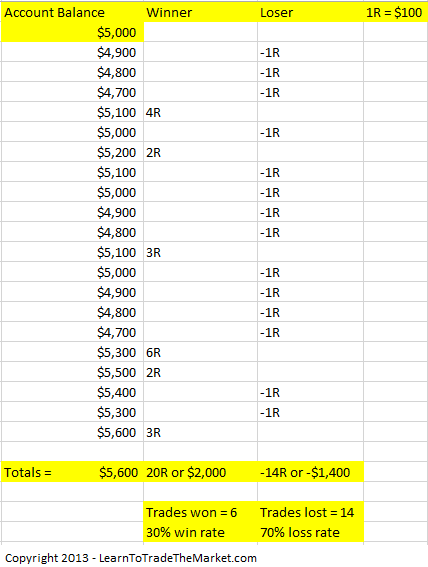

Now that you simply’ve seen how one can truly lose cash by profitable most of your trades, let’s have a look at how one can earn a living by shedding most of your trades, to additional hammer-home the purpose that profitable percentages are irrelevant. The very first thing you must discover within the spreadsheet instance under is that the shedding trades have been all fixed at -1R (R = your per-trade greenback danger quantity) and the profitable trades have been all bigger than 1R. The subsequent factor you’ll discover is that there have been much more shedding trades than profitable trades. Lastly, you’ll discover that although 70% of the trades have been losers and solely 30% have been winners, the account nonetheless made a stable 12% revenue over the sequence ($600 revenue is 12% of $5,000 beginning stability). Within the instance picture under, we are able to see that even with a 30% profitable proportion, a dealer can nonetheless make an excellent sum of money over a sequence of trades if they’re managing their danger and reward correctly:

The primary takeaway from the spreadsheet above is {that a} low profitable proportion can nonetheless make you a big sum of money in case you are managing your losers constantly and handle to make 2 occasions your danger or extra in your winners. Moreover, a low strike price (win proportion) can work simply positive and is extra real looking within the long-run than making an attempt to win a really excessive proportion of your trades. From the 2 instance spreadsheets above, it’s apparent that profitable proportion will not be very related, if in any respect. The primary instance confirmed how one can lose cash even on a 90% win price and the second instance confirmed how one can earn a living even on a 30% win price. Hopefully, by finding out these examples you’ll start to let go of your ego and understand that being “proper” on nearly all of your trades doesn’t actually matter, what issues is protecting your losers contained and getting probably the most out of your winners. You’ll be able to considerably improve your odds of getting probably the most out of your winners by buying and selling like a sniper by way of mastering your buying and selling technique…this will provide you with the power to select higher-probability commerce setups.

Actual-world examples of why profitable proportion is irrelevant

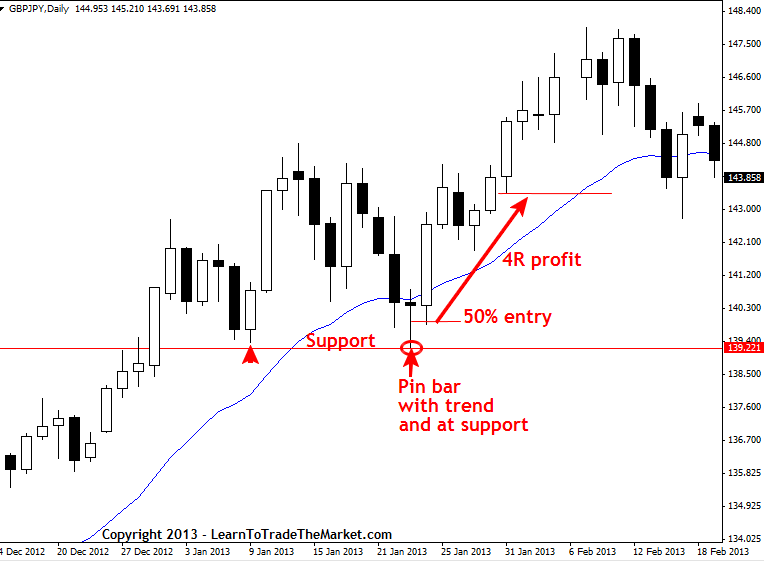

With a view to see how this idea of profitable percentages being irrelevant performs out in real-world buying and selling eventualities, let’s have a look at some examples of trades that occurred over the previous couple of months: Within the instance under, a pin bar sign shaped displaying rejection of assist throughout the current GBPJPY uptrend. The market subsequently shot larger offering merchants with a straightforward 4 to 1 or extra winner in the event that they entered on a retrace on the pin bar 50% stage:

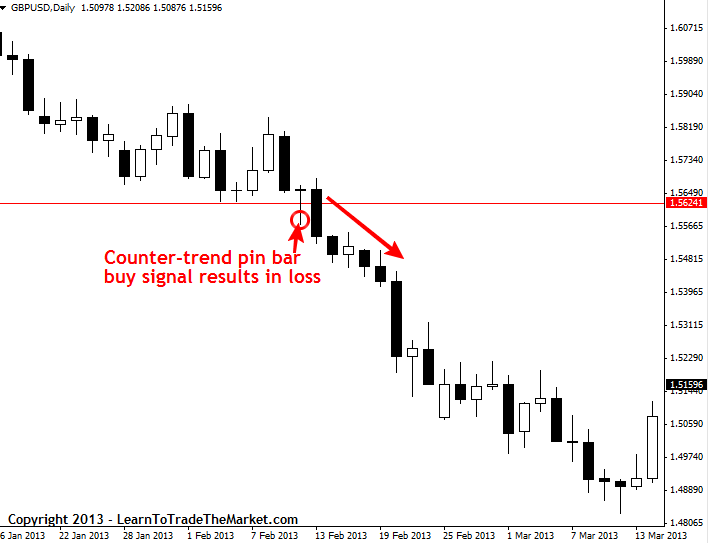

Within the instance under, we see a counter-trend pin bar setup on the GBPUSD that might have resulted in a 1R loss. It’s vital to maintain all losses contained under a sure greenback quantity. So, for those who’re 1R quantity is $100 per commerce, you be sure to NEVER take a loss larger than $100 per commerce. We noticed within the instance spreadsheets above how simply a pair massive shedding trades can break your buying and selling account…

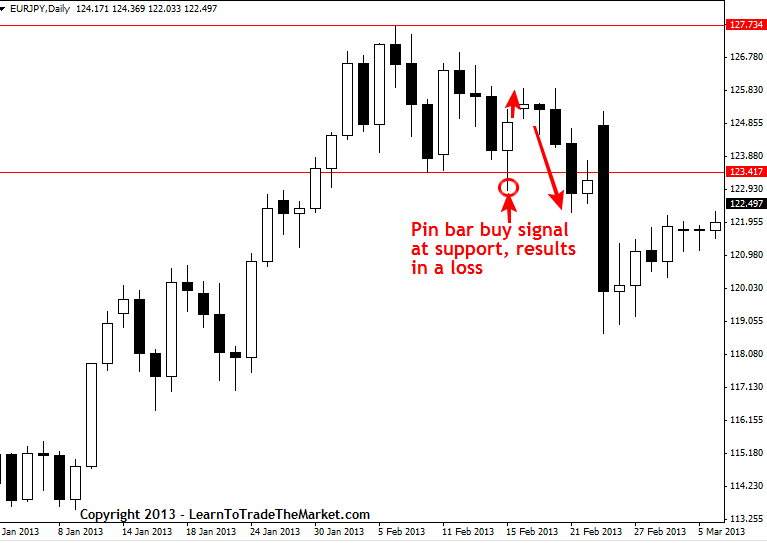

Within the instance under, we see a pin bar purchase sign that shaped lately within the EURJPY. This pin bar setup was in-line with the underlying uptrend and displaying rejection of an vital near-term assist stage, however the setup nonetheless failed. It simply goes to point out that any setup can fail, and because of this we have to be taught to just accept losses as a part of being a dealer and be taught to handle and include them correctly:

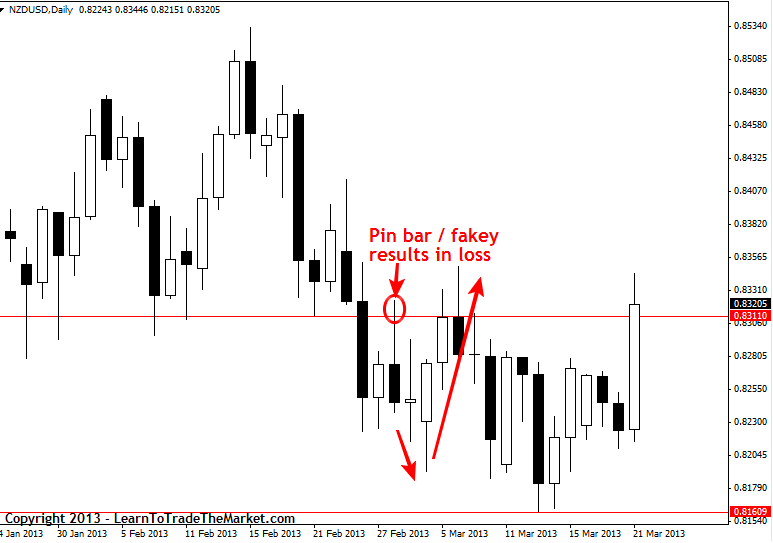

Within the instance under, we see a fakey pin bar combo commerce setup that resulted in a 1R loss.

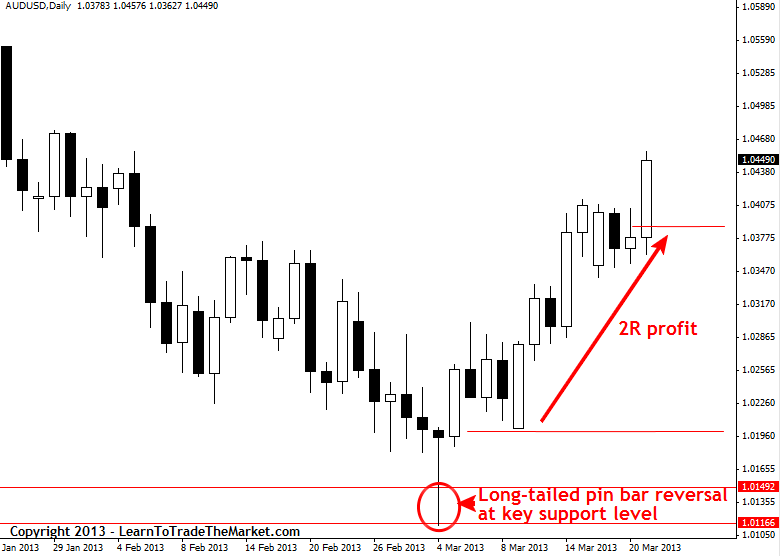

Within the instance under, we see the current long-tailed pin bar reversal setup from key assist that shaped on the each day AUDUSD chart. For these of you who missed it, we’ve been discussing this setup in our current AUDUSD commentaries and the market has now offered not less than a 2 to 1 winner from that setup. Should you positioned your cease close to the pin bar 50% stage, a 3 to 1 or 4 to 1 winner was doable by now. A majority of these apparent worth motion setups from key ranges are what you could look ahead to…

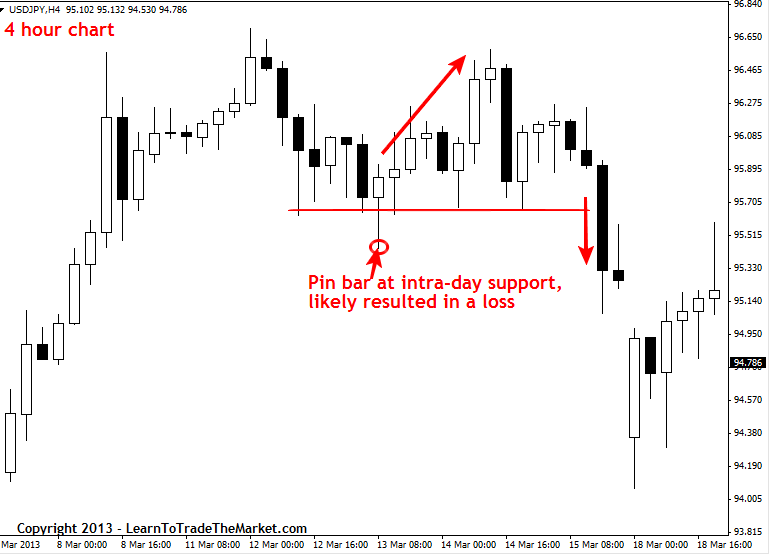

Within the instance under, we see a 4 hour USDJPY pin bar commerce that will have resulted in a 1R loss. Most merchants most likely would have exited round breakeven earlier than the commerce hit their cease loss on this one, however only for the sake of instance we are going to rely it as a loss.

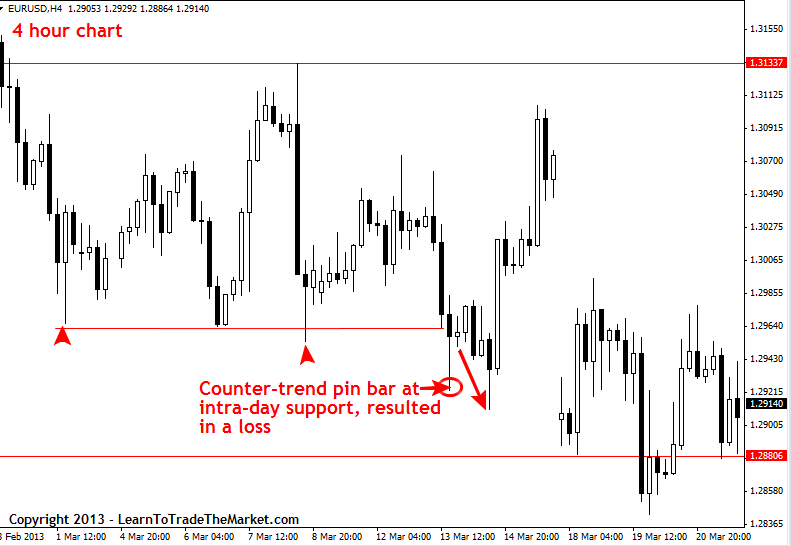

Within the instance under, we see a current 4 hour EURUSD pin bar purchase sign that resulted in one other 1R loss.

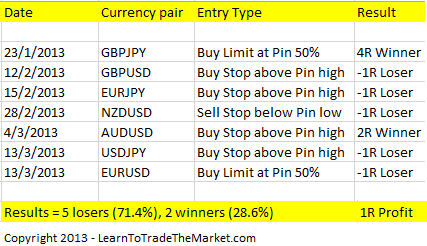

Buying and selling outcomes:

From the outcomes above, we are able to see that although we solely had a 28.6% profitable proportion, we nonetheless made a revenue. While 1R will not be an enormous revenue..it’s solely from a sequence of seven trades, and over a bigger sequence of trades the revenue would clearly be extra. Additionally, these have been conservative hypothetical examples, in actuality, a few of the above trades might have been lower than a 1R loser, just like the 4 hour USDJPY setup, and the 4R winner within the GBPJPY may have simply been a 5 or 6R winner. Thus, a talented worth motion dealer who is aware of what they’re doing will make even larger returns if they’re actually sticking to their edge and never over-trading. The important thing level to remove is that shedding on nearly all of your trades doesn’t essentially imply you’ll lose cash general.

The mechanics behind profiting whereas shedding nearly all of your trades

You noticed above that it’s doable to earn a living whereas shedding nearly all of your trades, and you must now perceive why profitable percentages are irrelevant in buying and selling. Nonetheless, it’s vital to debate slightly bit about HOW that is all doable. What are the “mechanics” of earning money within the markets even whereas shedding a excessive proportion of your trades?

• Threat reward – Threat reward is crucial cash administration idea to know. I’ve written fairly a bit about the facility of danger reward, however for these of you who’re unfamiliar with it, you must know that understanding it’s paramount to correct danger and cash administration within the markets. Figuring out learn how to decide the most effective cease loss placement on a commerce and learn how to logically exit a commerce, slightly than emotionally, is important to find out the potential danger reward on a commerce. Earlier than getting into any commerce, you could take into account what the potential danger reward of it’s, and whether or not or not it’s logically doable given the encircling market construction and circumstances.

• Retaining danger fixed – One of many greatest errors merchants make early-on of their careers is to fluctuate their greenback danger quantity on every commerce relying on the earlier commerce’s end result. The rationale this can be a mistake, is as a result of the following commerce’s end result is totally impartial of the earlier commerce’s, that’s in case you are sticking to your buying and selling plan and buying and selling off logic and never emotion. Many merchants crank up their danger after every winner or decrease it loads after every loser, this isn’t the suitable factor to do. As an alternative, strive protecting your greenback danger per commerce fixed till you’ve constructed up your account considerably. For extra on protecting danger fixed, learn this text on foreign exchange cash administration.

• Place sizing – Place sizing is the way you truly maintain your greenback danger fixed per commerce. I get emails virtually on daily basis from merchants who say they’re fearful about buying and selling larger time frames as a result of they assume wider cease loss distances imply they’re risking extra money per commerce, however that is simply not the case. By place sizing, you possibly can alter the variety of tons you might be buying and selling (your place measurement) up or down so that you simply keep roughly the identical greenback danger per commerce it doesn’t matter what the cease loss distance is.

Lastly, the final piece of the “pie” that may mean you can earn a living even whereas shedding nearly all of your trades, is to really be a grasp of your buying and selling technique. After I have a look at a chart, I’m on the lookout for very particular worth motion setups shaped at confluent ranges out there. There isn’t any “guessing” or doubt in my buying and selling anymore…as a result of I’ve mastered worth motion buying and selling. This permits me to really commerce like a “crocodile” by ready patiently for my setups to look out there. Once you commerce on this method, mixed with correct cash administration, your profitable proportion actually doesn’t matter. The keys listed below are being methodical and choosy in the way you enter the market; don’t enter except your buying and selling technique is truly telling you to. Once you mix this mastery of buying and selling technique with the cash administration rules mentioned in right this moment’s article, it actually will solely be a matter of time earlier than you earn a living within the markets. Checkout my buying and selling course and members’ neighborhood for extra data on learn how to revenue within the markets by combining a mastery of worth motion buying and selling with correct cash administration.