As worth motion merchants, we primarily examine charts and worth bars, and the value bars in every time-frame present us the ‘emotion’ of worth for that particular time period. Whether or not it’s a 1 hour, 4 hour or every day chart, every worth bar on the chart reveals the ‘emotion’ and sentiment for the time period it displays. For instance, on a 1 hour chart we can see the emotion and feeling of the market over the past hour by wanting on the final worth bar on that chart. That stated, a 1 hour chart or a 4 hour chart goes to indicate us much more information, emotion and perception into the market than a 5 minute chart will, would you agree? Would you additionally agree that the every day chart will present us much more emotion than a 1 hour chart or 4 hour chart?

As worth motion merchants, we primarily examine charts and worth bars, and the value bars in every time-frame present us the ‘emotion’ of worth for that particular time period. Whether or not it’s a 1 hour, 4 hour or every day chart, every worth bar on the chart reveals the ‘emotion’ and sentiment for the time period it displays. For instance, on a 1 hour chart we can see the emotion and feeling of the market over the past hour by wanting on the final worth bar on that chart. That stated, a 1 hour chart or a 4 hour chart goes to indicate us much more information, emotion and perception into the market than a 5 minute chart will, would you agree? Would you additionally agree that the every day chart will present us much more emotion than a 1 hour chart or 4 hour chart?

Right now, I’m not simply going to let you know what time-frame to commerce, however I’m going to elucidate to you why time frames affect the sign you’re buying and selling, cease placement on a commerce and the probabilities of profitable and shedding a commerce. The implications of those factors are profound, but they’re typically over-looked or ignored by day-traders and scalpers. I’m going to indicate you some proof of why you must take these things significantly and switch off your low time-frame charts as soon as and for all.

The connection between time and trustworthiness of a relationship

Consider the market like a private relationship between two folks; the longer you’ve recognized somebody, the extra you understand whether or not or not you’ll be able to belief them, proper? If somebody reveals you they’re a reliable individual over time then you’ll in all probability belief them, nonetheless, if an individual lies so much you may very well belief them much less as you get to know them…however the purpose is that till you’ve frolicked attending to know an individual, you actually can’t make any judgments about them, someway.

To provide you a extra particular instance; whenever you meet somebody for the primary time, can you actually get a great really feel for his or her character and character in simply 5 minutes of speaking to them? Or would it not take a full day of dialog to get a extra correct really feel for his or her character and general temper? The longer you’ve recognized somebody, the higher “really feel” you have got for who they are surely.

It’s actually very comparable in buying and selling; the extra you examine greater time-frame charts just like the 4 hour and every day, the higher ‘really feel’ you develop for the market since you are attending to know extra about it and you may see the “larger image” so much simpler than you’ll be able to on smaller time frames. The upper time frames carry extra weight as a result of they show extra information and present extra time than a smaller time-frame does. If you’re simply finding out 5 minute or 15 minute charts on a regular basis, you’re lacking out on the larger, extra important image of the market. You’ve in all probability witnessed this with a long-time good friend; you’ll be able to nearly determine how they may react in any state of affairs…whereas with a whole stranger whom you’ve recognized for less than 5 or 10 minutes, this might nearly be unimaginable; it’s clearly since you’ve had extra time to check and study your good friend.

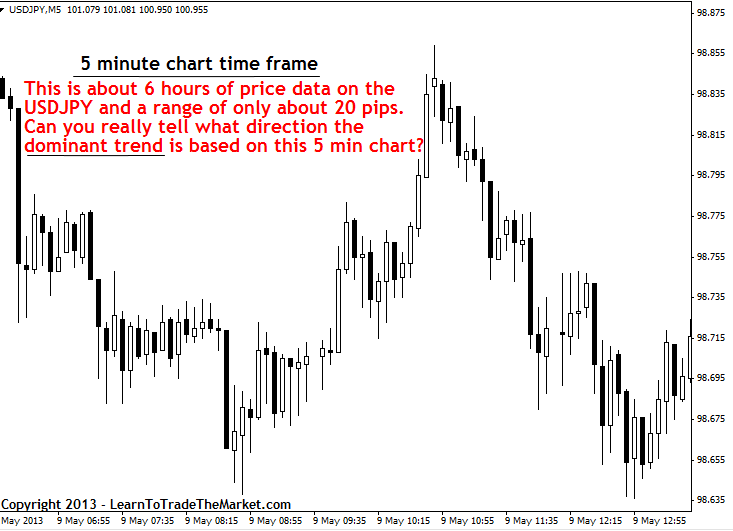

Let’s have a look at a chart instance of how a 5 minute chart actually doesn’t let you know a lot concerning the “larger image” of a market. Under, we see the 5 minute USDJPY chart, and from this information we actually can’t inform if the general development is up or down, because the market seems to only be ebbing and flowing in a short time and with out a lot underlying or constant sentiment:

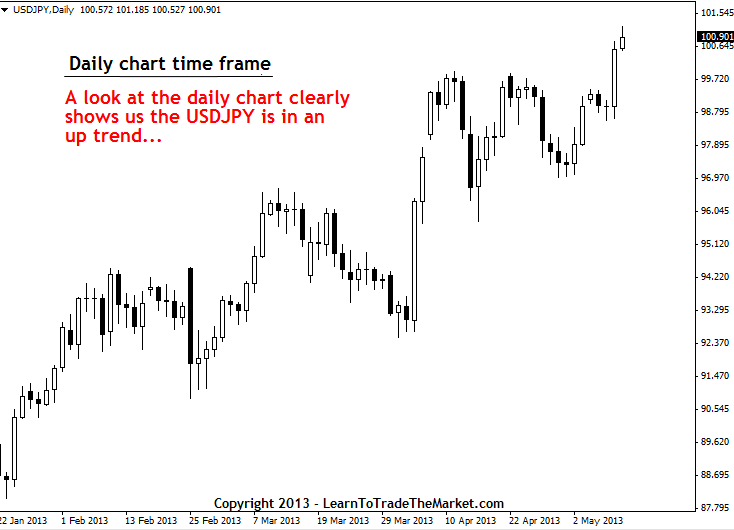

Subsequent, let’s evaluate that 5 minute chart above to a every day chart time-frame of the identical market; USDJPY. From the chart beneath, even a 6 12 months previous can inform that general worth is transferring up; there’s an uptrend underway. Because of the easy truth that you’re attending to know extra concerning the market from extra information, you’re studying some very essential issues about it (that the development is up!) that you just can’t inform from simply wanting on the 5 minute chart.

One other instance; if you’re touring and also you keep in a city you’ve by no means been in earlier than for one week, and it rained the entire week, would you inform everybody it “rains so much in that city”? Or would you agree that you actually need to remain in that city for longer and observe its longer-term climate patterns to make such a judgment? Most of us would agree that you just want multiple week’s information to guage a city’s general climate sample…in different phrases, per week within a 12 months is principally simply noise. You may’t make an assumption a couple of city’s climate sample except you look over an extended time period. Equally, it’s practically unimaginable to learn a market’s underlying sentiment with out analyzing greater time-frame charts. Longer time durations = extra information = extra proof / proof.

Why decrease time frames are “noise”

Merely evaluating a 5 minute chart to a 1 hour chart will present you what number of extra failed alerts there are on decrease time frames. The underlying motive as to why decrease time frames (I contemplate something beneath a 1 hour chart to be a “low time-frame”) have extra failed alerts than their greater time-frame counter components, is as a result of there will probably be much more meaningless worth motion on a 5 minute chart than on a 1 hour. For instance, if you happen to have been to only have a look at one worth bar on a 1 hour chart, you wouldn’t see all of the 5 minute incremental actions that made up that 1 hour interval….you’ll as an alternative see the collective image of all these 5 minute actions.

You merely aren’t going to get a really robust directional motion out of a 5 minute or 15 minute chart sign, as an alternative, you’ll get numerous little meaningless actions. You’ll get a a lot stronger directional motion out of a 1 hour sign and much more out of a 4 hour sign and but extra out of a every day chart sign. You may anticipate extra motion from a sign the upper up in time-frame you go.

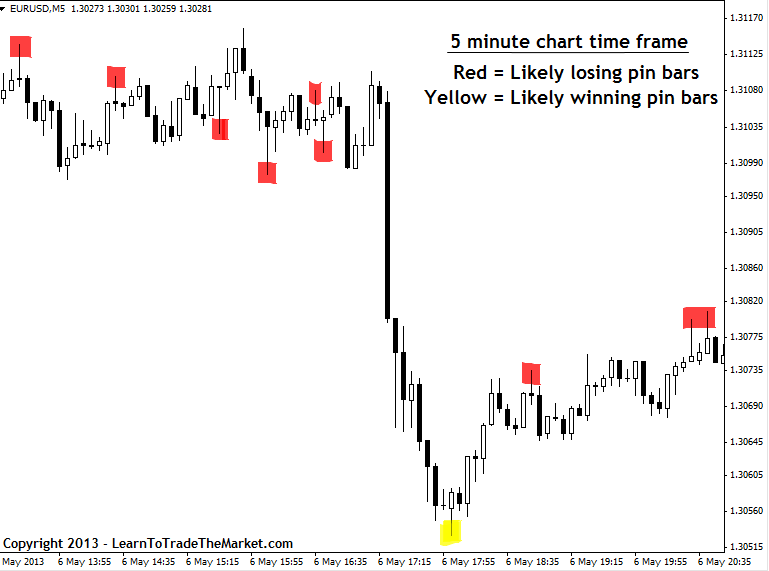

Within the chart beneath, we’re some latest worth motion on the 5 minute EURUSD chart. You may see that there have been much more pin bar alerts that in all probability would have been shedding trades than there have been profitable trades. This demonstrates clearly the truth that while there are extra alerts on decrease time frames…extra alerts doesn’t equal more cash, in truth it normally means extra shedding trades and misplaced cash.

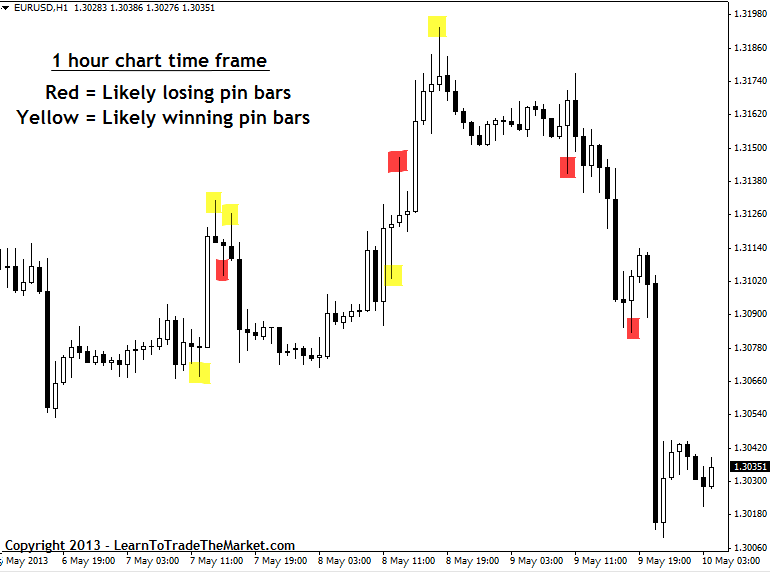

Subsequent, let’s have a look at the value motion that occurred on the 1 hour EURUSD chart across the identical time because the 5 minute picture above. The very first thing it’s best to instantly discover is that there have been so much much less shedding trades and much more profitable trades. It’s as a result of there have been much less false-signals on the 1 hour chart because the 1 hour chart filters out numerous that “noise” on the 5 minute chart.

Market noise and every day ranges

Markets transfer in statistical common ranges every day; that means there’s a sure common vary that the market might be going to maneuver inside on any given day. These common ranges will change over time as markets develop into kind of risky, however you must remember how they have an effect on your trades. The factor about these common ranges that many day merchants and scalpers are seemingly unaware of, is that if you happen to’re buying and selling a small time-frame and also you place a cease loss on that small time-frame, the possibilities that you’ll get stopped out just because your cease is inside the common statistical vary of the upper time-frame, are fairly excessive.

For those who’re buying and selling a better time-frame, your cease loss is prone to be exterior of the typical every day vary of the market so you’re unlikely to get stopped out from the random intra-day market noise that happens every day. Now, that’s to not say I would like you guys to put wider stops, I’m telling you to remember that cease loss placement is an enormous think about your success or failure as a dealer and you must remember how time frames have an effect on cease loss placement. It’s fairly apparent that in case your cease loss is near the present market worth, as it’s on lower-time body trades, it’s extra prone to get hit than if you happen to’re buying and selling the upper time frames.

Small time frames demand numerous consideration.

Would you prefer to verify the market each 5 minutes or each 4 hours? The upper the timeframe, the much less you must verify the markets. If you’re like most individuals, you in all probability have a full-time job or full-time faculty, or perhaps even each; most individuals merely don’t have the time to sit down at their computer systems all day attempting to commerce a 5 minute chart. It’s additionally much more traumatic, so it actually simply is not sensible to try to ‘drive’ cash out of the market by scalping or day-trading.

Would you prefer to verify the market each 5 minutes or each 4 hours? The upper the timeframe, the much less you must verify the markets. If you’re like most individuals, you in all probability have a full-time job or full-time faculty, or perhaps even each; most individuals merely don’t have the time to sit down at their computer systems all day attempting to commerce a 5 minute chart. It’s additionally much more traumatic, so it actually simply is not sensible to try to ‘drive’ cash out of the market by scalping or day-trading.

I’m an enormous proponent of ‘letting the trades come to me’. Which means, I verify the markets two or 3 times a day and search for apparent alerts, totally on the every day and 4 hour charts, and if nothing meets my standards for a commerce setup, I don’t commerce…I am going do one thing else as an alternative. I don’t sit there ruminating over the market all day wishing and hoping for a commerce like many starting and struggling merchants do. I actually don’t care if I’m out there or not on any given day, and that is the angle and buying and selling mindset that you just want if you wish to commerce fully devoid of emotional attachment to the market. My level is solely this; specializing in greater time frames is a lot better for busy professionals in addition to for individuals who don’t need to have the stress of being glued to their charts all day. It additionally permits you to make use of my crocodile buying and selling methodology which is a cornerstone of my general buying and selling concept and technique.

Small time frames elicit over-trading

“Over-trading”, also called buying and selling when no apparent sign is current, or taking “silly” trades, or “playing”, is one thing I’ve mentioned fairly a bit in different articles, so I gained’t get into it an excessive amount of right this moment. Nonetheless, I’ll say that buying and selling low time frames just like the 5 minute and 15 minute charts, and many others. is among the greatest causes why merchants commerce too ceaselessly. The longer you park your ‘backside’ in your pc chair watching the 5 minute chart tick up and down, the higher the possibility you’ll rationalize a motive to be out there.

For those who sit there looking at a 5 minute chart all day, the percentages of you truly not coming into a commerce are extraordinarily low. As people, we battle with self-control and self-discipline, particularly after we put ourselves immediately within the realm of temptation, like when buying and selling low time frames. Nonetheless, one space that we’re fortunate in as people, is that we are able to plan forward and keep away from temptation altogether if we put our minds to it. Simply as not shopping for junk meals on the grocery store is the best solution to keep away from consuming it…not immersing your self in low time-frame charts is one of the simplest ways to keep away from the temptation to continuously be out there.

Be taught, change, develop…

I clearly can’t communicate for everybody within the buying and selling world, however the merchants who contact me frequently about struggling out there and blowing out their accounts, are sometimes those who commerce the decrease time frames…that has to say one thing proper? From these experiences that I’ve had with different merchants through the years, it’s fairly secure to say that ‘social proof’ suggests {that a} primary explanation for failure out there is buying and selling low time-frame charts. Nonetheless, don’t take my phrase for it, final 12 months we had over 15,000 emails hit our inbox, and I can comfortably say that almost all of the struggling merchants I’ve helped have been attempting to commerce small time frames.

I clearly can’t communicate for everybody within the buying and selling world, however the merchants who contact me frequently about struggling out there and blowing out their accounts, are sometimes those who commerce the decrease time frames…that has to say one thing proper? From these experiences that I’ve had with different merchants through the years, it’s fairly secure to say that ‘social proof’ suggests {that a} primary explanation for failure out there is buying and selling low time-frame charts. Nonetheless, don’t take my phrase for it, final 12 months we had over 15,000 emails hit our inbox, and I can comfortably say that almost all of the struggling merchants I’ve helped have been attempting to commerce small time frames.

Thus, YOU ought to do one thing completely different…don’t be just like the plenty of failing merchants who’re continuously looking for trades on the low time-frame charts. Have endurance, commerce solely the upper time frames (1hr, 4hr, every day time frames are my favorites) and see in case your buying and selling doesn’t simply slowly however steadily enhance.

If you wish to be taught extra about greater time-frame buying and selling and the way it can enhance your buying and selling outcomes by filtering out meaningless market ‘noise’ and permitting you to see the ‘larger image’ of the market, checkout my Worth motion buying and selling course.