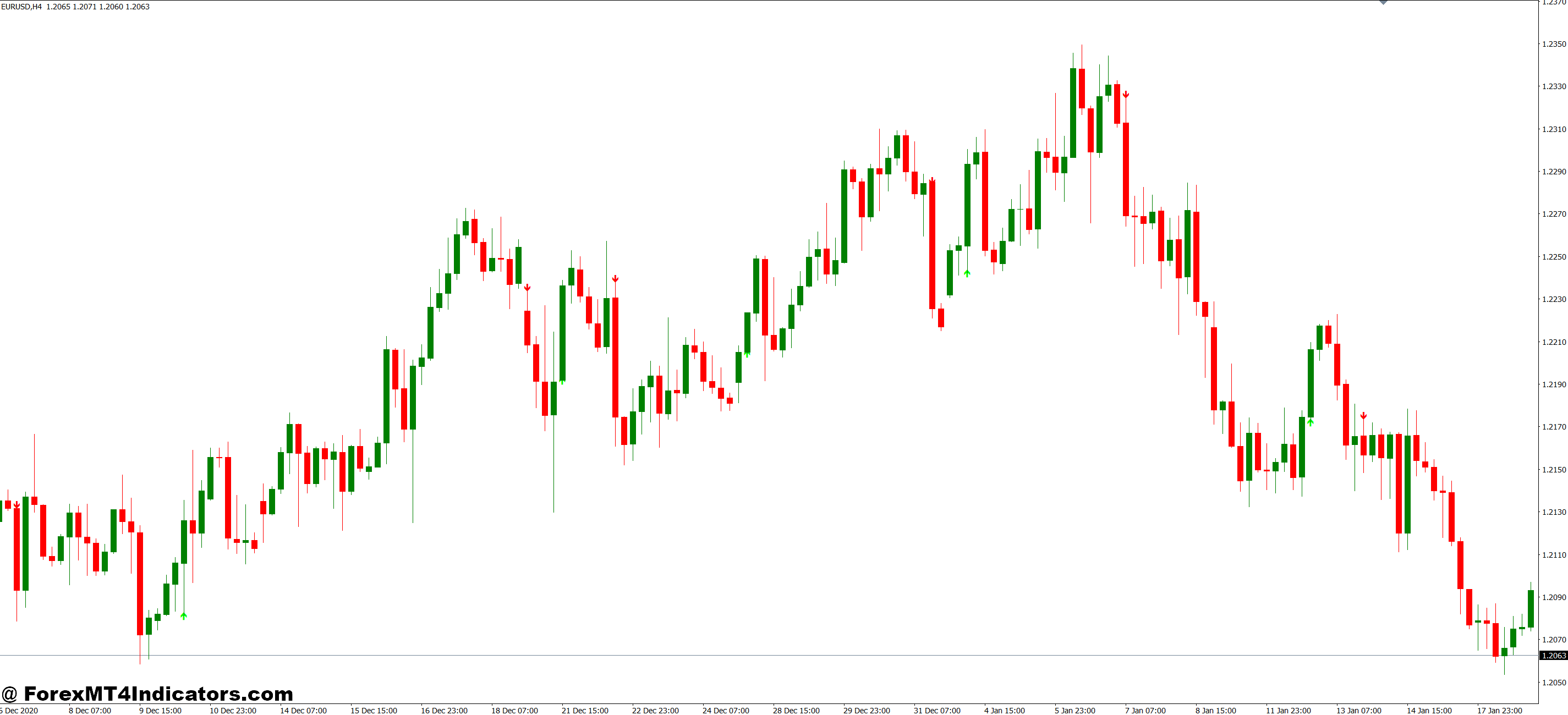

The Vary Filter MT4 indicator tackles this head-on by filtering out market noise and highlighting durations when value is genuinely trending. In contrast to commonplace transferring averages that lag behind or oscillators that give conflicting indicators, this software creates a dynamic channel that adapts to present volatility. When value strikes outdoors this channel with conviction, merchants get a clearer sign that momentum has shifted. Let’s break down how this indicator really works and whether or not it deserves a spot in your charts.

What Is the Vary Filter Indicator?

The Vary Filter is a volatility-based pattern detection software that creates an adaptive vary round value motion. Consider it as a wise transferring common that widens throughout unstable durations and tightens when the market calms down. The indicator plots two traces that type a channel, and the actual magic occurs when value breaks and sustains motion outdoors this channel.

In contrast to fixed-period transferring averages that deal with all market situations the identical, the Vary Filter adjusts its sensitivity primarily based on latest value motion. This implies it gained’t provide the identical sign in a sleepy Asian session that it might throughout a unstable London open. The calculation makes use of a mixture of value vary measurements and smoothing methods, although most merchants don’t want to know the mathematics to make use of it successfully.

What makes this completely different from Bollinger Bands or Keltner Channels? The Vary Filter responds quicker to real pattern modifications whereas being extra proof against random value spikes. It’s designed particularly to catch the transition from ranging to trending situations.

How the Vary Filter Works in Apply

The indicator calculates a median true vary over a specified interval, then applies smoothing to create higher and decrease boundaries. When value closes above the higher line, the indicator indicators bullish momentum. When it closes under the decrease line, bearish momentum takes over. The hot button is sustained breaks, not momentary spikes.

Right here’s an actual state of affairs: On the EUR/USD 1-hour chart throughout final month’s ECB announcement, value was chopping between 1.0850 and 1.0870 for 3 hours. The Vary Filter traces have been tight, hugging value motion, with the indicator displaying no clear directional bias. Normal MACD was crossing forwards and backwards, producing 4 false indicators in that interval.

Then the information hit. Worth spiked to 1.0895, breaking cleanly above the higher Vary Filter line. However right here’s the essential half—the indicator didn’t simply flash a fast sign and reverse. It held that bullish posture as value consolidated briefly at 1.0890, then continued to 1.0920 over the following two hours. Merchants who waited for the Vary Filter affirmation averted the three fake-outs earlier than the actual transfer.

The indicator works greatest whenever you perceive what it’s really telling you. It’s not predicting the longer term; it’s confirming when market character has shifted from balanced to directional.

Buying and selling Purposes and Actual Setups

Most merchants use the Vary Filter as a pattern affirmation software reasonably than a standalone entry system. Pair it with help and resistance ranges for higher outcomes. When value breaks a key stage AND the Vary Filter confirms pattern course, you’ve bought a higher-probability setup.

Take the USD/JPY on the every day chart final October. Worth had been grinding larger however saved pulling again to the 148.50 zone. Every time it bounced, momentum felt weak. The Vary Filter was displaying uneven situations—traces crossing steadily with no sustained directional sign. Good merchants stayed out.

Then on October 18th, value broke above 149.80 with a robust every day candle and the Vary Filter flipped decisively bullish. That sign held for 12 buying and selling days as USD/JPY climbed to 151.70. The indicator filtered out two minor pullbacks throughout that run which may have shaken out merchants utilizing tighter pattern instruments.

For exits, watch when value crosses again contained in the Vary Filter channel. That doesn’t all the time imply reverse your place, nevertheless it’s telling you the robust directional transfer is taking a breather. On shorter timeframes like 15-minute or 30-minute charts, you’ll get extra indicators but in addition extra noise. The indicator works, however it’s good to match your timeframe to your buying and selling type.

Settings and Customization

The default Vary Filter settings on most MT4 variations use a interval of 100 with a multiplier round 3.0. These work okay for every day charts however really feel sluggish on something under 4-hour. For day buying and selling, attempt dropping the interval to 50 and even 30, and experiment with multipliers between 2.0 and a couple of.5.

Forex pairs matter too. The GBP pairs (GBP/USD, GBP/JPY) are naturally extra unstable than one thing like EUR/CHF. What works for cable would possibly provide you with fixed indicators on a quieter pair. Begin with commonplace settings, then alter primarily based on what number of indicators you’re getting. Too many? Enhance the multiplier. Too few? Drop it down.

One trick skilled merchants use: run two Vary Filters with completely different settings. Set one quicker (interval 30, multiplier 2.0) and one slower (interval 100, multiplier 3.0). When each agree on course, you’ve bought stronger affirmation. After they battle, the market’s most likely in transition—think about staying flat.

Don’t neglect that settings that work throughout regular market situations would possibly fail throughout main information occasions or low-liquidity vacation durations. No indicator adapts to each state of affairs completely.

Benefits and Trustworthy Limitations

The Vary Filter’s greatest energy is reducing by way of sideways chop. It retains you out of messy ranges higher than most momentum oscillators. Throughout trending markets, it catches the meat of the transfer with out getting you in too early or out too late. The visible simplicity helps too—inexperienced or crimson, bullish or bearish, no sophisticated interpretations wanted.

However let’s be actual in regards to the downsides. In genuinely ranging markets with vast swings, the indicator can nonetheless generate false breakout indicators. You’ll see value punch by way of the channel, get excited, take the commerce, then watch it reverse again contained in the vary. Occurs on consolidating triangles and rectangles on a regular basis.

The indicator additionally lags throughout fast reversals. If a pattern instantly shifts, you would possibly give again earnings ready for the Vary Filter to substantiate the change. And like all technical software, it really works greatest when mixed with correct danger administration and market context. A bullish Vary Filter sign doesn’t imply a lot for those who’re shopping for into main resistance or ignoring basic developments.

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings, and the Vary Filter gained’t prevent from poor place sizing or revenge buying and selling. It’s a software, not a magic answer.

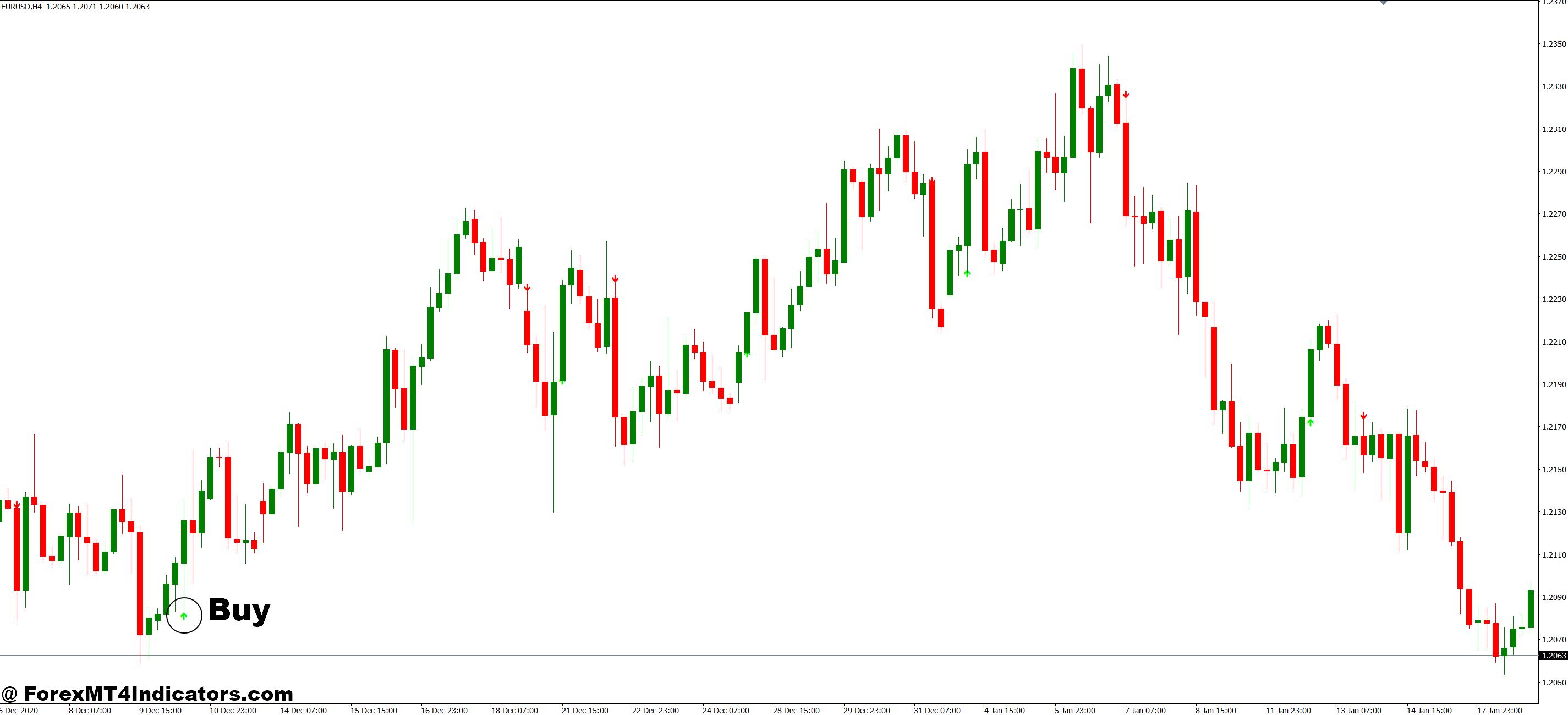

Commerce with Vary Filter MT4 Indicator

Purchase Entry

- Worth breaks above higher Vary Filter line – Watch for a full candle shut above the higher boundary on 1-hour or 4-hour charts; enter on the following candle open with a 20-30 pip cease loss under the filter line.

- Filter line modifications from crimson to inexperienced – This shade shift confirms bullish momentum; greatest taken when it happens close to help ranges on EUR/USD or GBP/USD every day charts.

- Retest of the Vary Filter after breakout – If value breaks above then pulls again to the touch the higher line with out crossing under it, enter lengthy with cease 15 pips under the retest candle.

- Align with larger timeframe pattern – Solely take purchase indicators when the every day Vary Filter can also be bullish; this doubles your win price on 1-hour chart entries.

- Quantity affirmation on breakout – Skip the commerce if value breaks the filter throughout low-volume Asian session hours (midnight-4am GMT); watch for London or New York affirmation.

- Keep away from shopping for close to main resistance – Don’t take Vary Filter purchase indicators inside 50 pips of spherical numbers (1.1000, 1.2000) or earlier swing highs; danger of rejection is simply too excessive.

- Threat not more than 1-2% per sign – Even with Vary Filter affirmation, restrict place dimension so a 30-pip cease equals most 2% of your account; information occasions can set off false breakouts.

- Watch for consolidation break – If value has been contained in the Vary Filter channel for 20+ candles on 4-hour charts, the primary breakout above usually provides the cleanest entry.

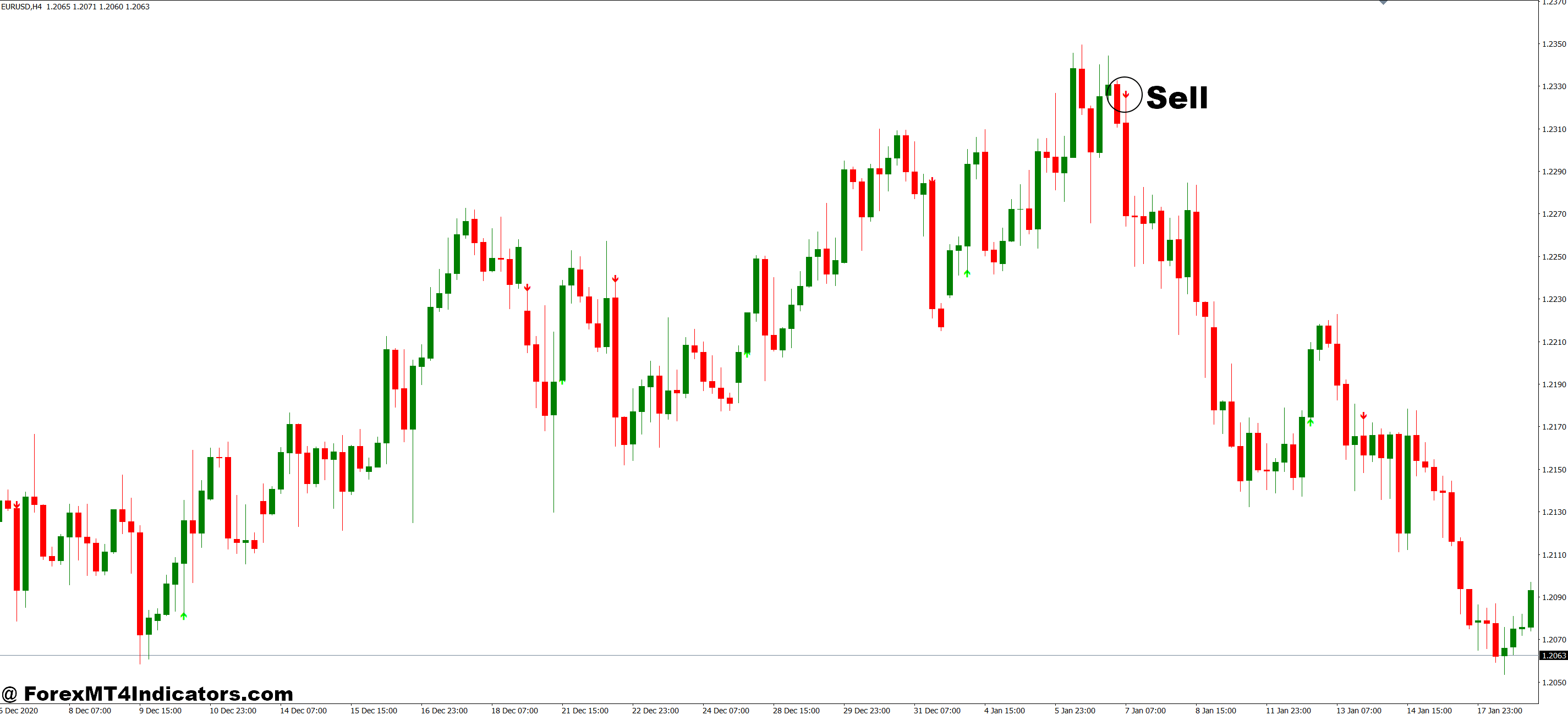

Promote Entry

- Worth breaks under decrease Vary Filter line – Enter quick when candle closes utterly under the decrease boundary; place cease 25-30 pips above the filter line for GBP/USD trades.

- Filter line shifts from inexperienced to crimson – Coloration change to bearish confirms downtrend initiation; most dependable on 4-hour and every day timeframes throughout European buying and selling hours.

- Failed rally again to the filter – When value breaks under then makes an attempt to reclaim the decrease line however will get rejected, enter quick on the rejection candle with tight 15-20 pip cease.

- A number of timeframe alignment – Solely promote when each 1-hour and 4-hour Vary Filters present crimson; single timeframe indicators produce too many false entries in uneven situations.

- Keep away from promoting into robust help zones – Skip Vary Filter promote indicators inside 30 pips of main psychological ranges or every day/weekly help; bounce chance is 60%+ in these areas.

- Information occasion filter – Don’t take promote indicators half-hour earlier than or after high-impact information releases (NFP, price choices, CPI); the Vary Filter can’t account for basic volatility spikes.

- Place dimension primarily based on ATR – If common true vary on EUR/USD is above 100 pips on the every day chart, cut back place dimension by 50%; wider ranges imply extra stop-out danger.

- Ignore indicators throughout tight consolidation – If the Vary Filter traces are lower than 20 pips aside on 1-hour charts, market is simply too compressed; watch for enlargement earlier than taking promote indicators.

Wrapping It Up

The Vary Filter MT4 indicator brings one thing worthwhile to the desk for merchants who battle with uneven markets and false breakout indicators. It creates an adaptive framework that identifies when value is genuinely trending versus simply making noise. The volatility-based method means it adjusts to present market situations reasonably than making use of the identical inflexible guidelines throughout all environments.

What makes it helpful is the mix of pattern detection and noise filtering in a single visible bundle. You’re not juggling a number of indicators making an attempt to substantiate one another. That stated, it’s not good—anticipate some false indicators in ranging situations and minor lag throughout sharp reversals. Use it as affirmation alongside your present technique, not as a substitute for sound buying and selling ideas.

The actual check? Paper commerce it for a month in your most popular pairs and timeframes. Modify the settings, see the way it performs throughout completely different market situations, and resolve if it really improves your edge. Some merchants swear by it; others discover completely different instruments work higher for his or her type. The one technique to know is to place within the display time your self.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90