I am presently intently monitoring my skilled advisor’s efficiency on gold. One of many monitoring steps is evaluating trades on the sign account with the outcomes obtained within the technique tester.

I attempt to write Knowledgeable Advisors that solely act when a brand new bar opens. That is because of the lack of high-quality tick information and restricted machine sources for testing. So, the leads to the technique tester and on actual information ought to match. However sadly, this isn’t the case.

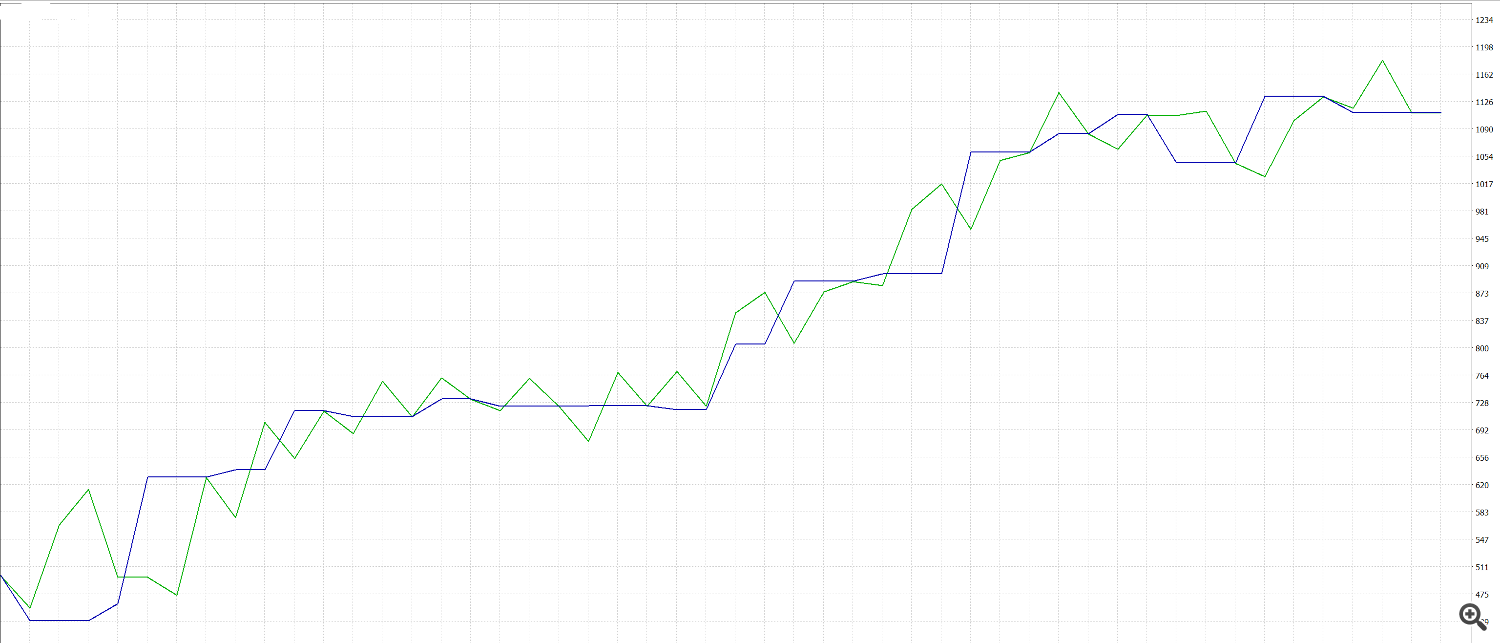

Take a look at outcomes for the primary 10 days of February

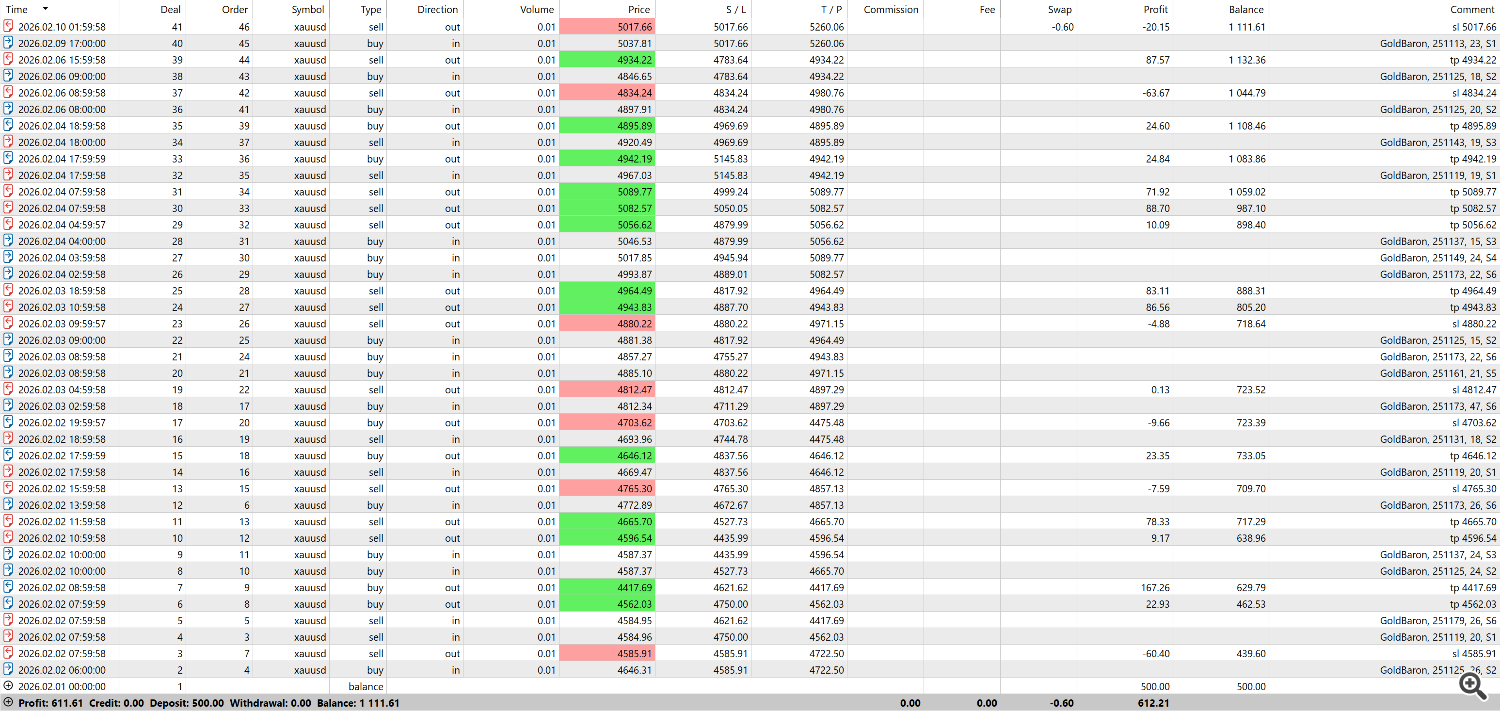

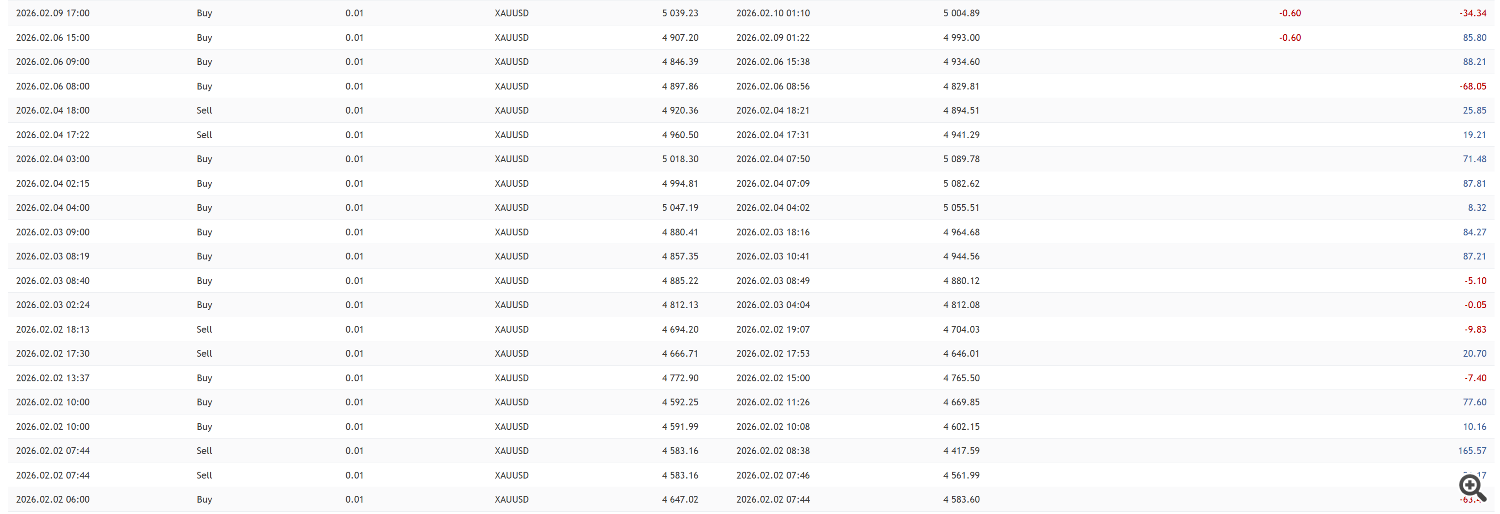

Over the identical 10 days, the skilled earned 70% on an actual account . It is a checklist of transactions.

Total, the outcomes are an identical. In each circumstances, the skilled advisor demonstrated large earnings with minimal drawdowns.

However there are variations! The true account has extra trades and, on common, decrease earnings. Let’s examine trades on the chart from the tester and the actual account.

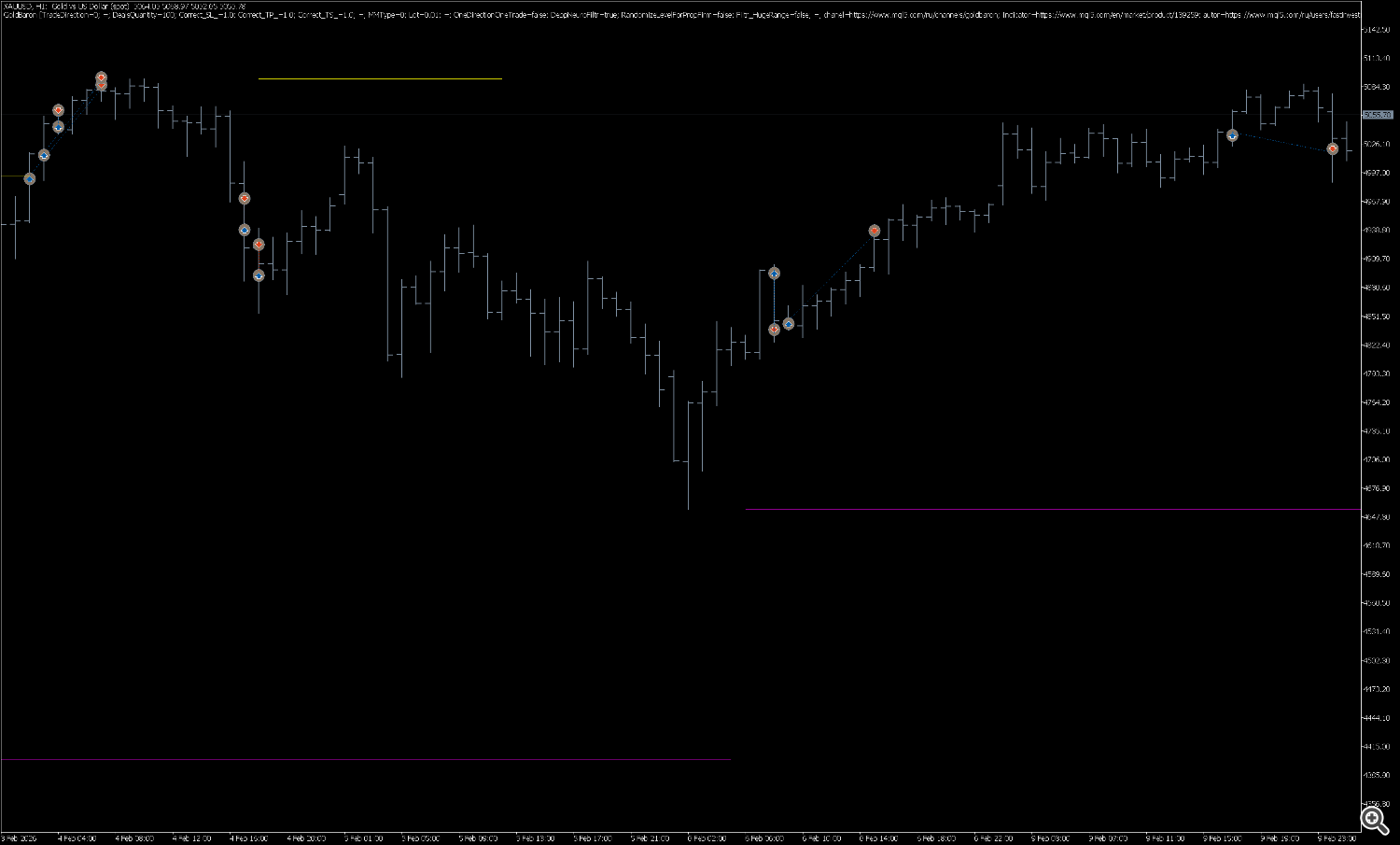

Tester

Actual rating

Causes for this conduct

1) The distinction within the variety of trades happens as a result of, within the “at opening costs” testing mode, the skilled advisor is late studying a few commerce closed by stop-loss or take-profit. Consequently, it does not open a brand new commerce utilizing the identical system. On an actual account, the commerce is closed inside the bar, and when a brand new bar opens, the skilled advisor can open a brand new place.

2) Revenue on an actual account is decrease as a consequence of slippage, opening delays and different requotes.

Outcomes and conclusions

Having performed a comparative evaluation of the advisor’s work within the “testing at opening costs” mode (Open Costs) and on an actual account, we are able to draw the next key conclusions.

1. The order closing section is the testing bottleneck

The principle purpose for the discrepancy within the variety of transactions is the totally different logic of occasion processing. closing a place .

Within the tester: The sign concerning the activation of Cease Loss or Take Revenue is shipped to the advisor Strictly on the opening of the subsequent bar . Due to this, the chance to open a brand new commerce on the similar ranges is missed—one time interval is “dropped” from buying and selling.

In actual life: The deal is closed inside the bar. The system instantly releases the margin and locks within the end result. By the point new bar The advisor is not burdened by the earlier place and has the appropriate to open a brand new transaction instantly after receiving a tick/bar.

Conclusion: The “Open Costs” testing mode underestimates the variety of accomplished trades by artificially creating “lifeless zones” after protecting orders are triggered.

2. The character of decrease returns on actual cash

The distinction in closing revenue is due solely to the market microstructure, which can’t be simulated in a tester with out tick information:

Slippage: Execution at a value worse than the asking value, particularly in periods of excessive volatility.

Execution delays: The value at which the system sees a sign to open and the value at which the order is definitely stuffed are totally different values.

Re-quotas: Lack of time and potential revenue when asking for a value once more.

Conclusion: The tester idealizes the entry, assuming the order will at all times be opened on the present market request value. An actual account pays a liquidity tax.

3. Elementary limitation of the methodology

Regardless of the mathematical discrepancy (variety of transactions + proportion of revenue), the system conduct sample is preserved :

Which means that the advisor’s code is appropriate and the decision-making logic works accurately. Deviations are quantitative , not qualitative character.