There’s an ample quantity of buying and selling alternatives every month available in the market, however we don’t at all times have the time or want to sit down round watching our charts ready for the market to hit our pre-determined entry stage. Additionally, I ought to point out that sitting round ready for the market to set off an entry is an pointless waste of time and may tempt us into getting into a commerce prematurely or to enter a commerce that we in any other case may not. Fortuitously, with the data of methods to use ‘on-stop’ entry orders, we will get rid of the necessity to sit in entrance of our computer systems ready for the market to set off a commerce entry.

There’s an ample quantity of buying and selling alternatives every month available in the market, however we don’t at all times have the time or want to sit down round watching our charts ready for the market to hit our pre-determined entry stage. Additionally, I ought to point out that sitting round ready for the market to set off an entry is an pointless waste of time and may tempt us into getting into a commerce prematurely or to enter a commerce that we in any other case may not. Fortuitously, with the data of methods to use ‘on-stop’ entry orders, we will get rid of the necessity to sit in entrance of our computer systems ready for the market to set off a commerce entry.

I get a whole lot of emails from merchants asking me about totally different commerce entry order sorts and methods to use their Meta Dealer 4 (MT4) buying and selling platform. Thus, in at the moment’s lesson I believed I might reply each of those questions by discussing methods to use ‘on-stop’ entries correctly and a few of the benefits they supply.

Benefits of ‘on-stop’ entries

Let’s talk about a few of the ways in which ‘on-stop’ entry orders can enhance your buying and selling and the most important benefits they supply:

• Momentum affirmation – While you enter the market on a cease entry, the market strikes into your order on momentum that’s in-line with the route you need to commerce. This has the added benefit that value is already shifting within the route that you’re buying and selling on the time of entry and infrequently leads to your commerce shifting into revenue rapidly. For those who had been to make use of the opposite two standard entry orders; a market or restrict entry, you don’t essentially have this benefit.

For instance, if you’re getting into on a ‘purchase cease’, it means you’re shopping for the market and to ensure that your purchase cease to get crammed the market must be shifting greater and transfer up into your purchase cease entry, and which means it has bullish momentum behind it. Conversely, in case you enter on a ‘promote cease’ entry, the market will must be shifting decrease, down into your promote order. It doesn’t “assure” that the commerce will proceed in your favor, however not less than on the time of entry the market is shifting in your favor.

• You don’t must be at your laptop – A lot of you might have learn my set and neglect buying and selling lesson, however what I don’t get into in that lesson is that the cease entry order lets you arrange your commerce and ‘neglect’ about it (cease entries enable you to ‘set and neglect’). Additionally, not like a restrict entry, with a cease entry order you might have the added peace of thoughts of figuring out that in case your commerce does get crammed after you set and neglect it, you’ll get full of ‘momentum affirmation’ as we mentioned above.

Many people (myself included), don’t have all day to sit down round ready for the market to maneuver to our desired entry stage. For those who use an on-stop entry, you do not want to sit down there watching and ready; as soon as you notice a value motion commerce setup you may merely enter your cease entry order, cease loss and goal, after which stroll away for some time.

• Get rid of commerce ‘obsession’ – In case you are buying and selling an inside bar setup for instance, you do not want to sit down there ready for the market to interrupt previous the mom bar excessive or low to enter. As a substitute, you may merely place a purchase cease or promote cease simply above the excessive or low of the within bar after which go do one thing else. Merchants who obsess over trades and are glued to their screens are inclined to lose cash, you have to have an interest and enthusiastic about buying and selling however not “in love” with it, I mentioned this in final week’s article wherein I talked in regards to the variations between novice {and professional} merchants.

• Reinforce self-discipline – For those who set an on-stop entry order after which stroll away and let the commerce play out, you’re buying and selling with self-discipline. There’s something to be stated for “letting the market come to you” versus simply leaping in with ‘at-market’ orders on a regular basis. A cease entry lets you set the precise stage you need to enter at; if the market breaks previous a sure stage you’ll get crammed, if it doesn’t, then you definately received’t. Many merchants get into trades too early, earlier than they actually begin shifting, and this causes every kind of psychological issues for them like second-guessing their entry, over-analyzing and shutting out trades prematurely; in case you enter with a cease order because the market strikes into your required entry stage, it will possibly provide help to keep away from these errors.

Additionally, by setting your order after which going and doing one thing else, letting the market ‘do the work’, you’re entering into the behavior of not ‘forcing’ trades and of buying and selling in a relaxed method, as an alternative of over-trading and (or) getting in prematurely. When you begin to see success buying and selling on this method it should start to bolster the self-discipline you needed to put forth to set your order up and stroll away.

Examples of efficient use of ‘on-stop’ commerce entry orders

Utilizing cease entries to enter the market in-line with recent market momentum is a superb technique to make the most of this entry kind. The concept right here is, after a surge of momentum reverse to a current pattern, a cease entry on a value motion sign will help “affirm” that the recent momentum will proceed not less than for some time after filling your entry order.

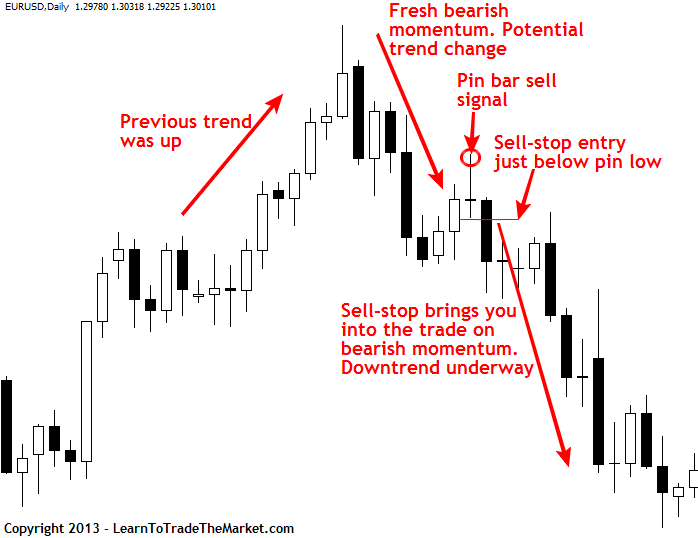

Within the chart picture beneath, we see a EURUSD pin bar promote sign that fashioned shortly after a down transfer available in the market that adopted a powerful up pattern. Probably the most logical entry order on this pin bar promote sign was a promote cease, as a result of this provides us some extra “affirmation” (not 100%) that extra bearish momentum is likely to be in retailer. On this case, the pin bar sign truly kicked off a really massive transfer decrease and fashioned very early within the new downtrend.

Utilizing on-stop entry orders will help get you into new tendencies early. By taking you into the market in-line with the near-term momentum, you get just a little additional “affirmation” that the transfer you’re getting into on is greater than only a short-term counter-trend retrace:

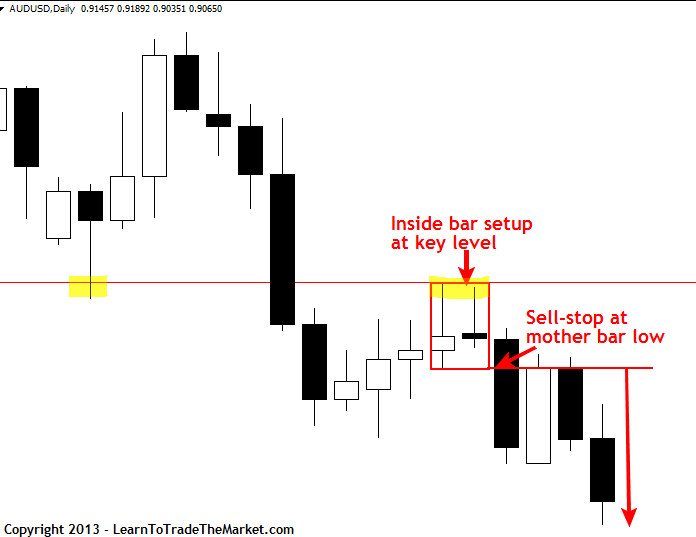

The on-stop entry is the solely entry kind to make use of for an inside bar buying and selling technique. An inside setup is a ‘breakout’ play by definition, so you have to enter in-line with momentum by ready for value to interrupt both above or beneath the mom bar excessive or low.

Within the chart picture beneath, we will see an inside bar setup within the AUDUSD that we mentioned in our June 27th commentary. Be aware that utilizing the sell-stop entry allowed us to have just a little additional “affirmation” that the downtrend would possibly proceed by bringing us into the commerce as bearish momentum pushed value down into our cease entry which might be positioned simply (sometimes 1 pip beneath) beneath the mom bar low of the within bar setup:

The current sell-off within the spot Gold market has been extensively mentioned on our website and in case you knew methods to use sell-stop entry orders correctly you didn’t must waste time ready for the large strikes to set off. You may have merely positioned a promote cease entry order beneath the lows of two current value motion promote indicators on the each day spot Gold chart after which actually walked away, and you’d nonetheless (on the time of this writing) be up a really massive revenue. This actually exhibits the ability of utilizing on-stop entry orders in trending markets.

Within the chart picture beneath, we will see two current value motion promote indicators within the Gold market that you could possibly have entered on sell-stop orders. The primary one was a fakey promote sign that fashioned again on Could 3rd, observe how the market consolidated and ‘chopped’ sideways for 4 days after the sign fashioned. For those who had positioned a promote cease slightly below the fakey’s mom bar low, you wouldn’t have gotten crammed till value lastly broke decrease, triggering the fakey promote entry on Could 10th. Had you entered “at market” or on a restrict retrace entry earlier than value broke the mom bar low, you’d have needed to endure 4 days of value chopping sideways, together with one huge up day towards your place. Many merchants battle with the feelings that get stirred up once they enter a commerce early like this and have to attend for it to return off, they usually find yourself closing trades out prematurely for no actual purpose in consequence, then the commerce comes off with out then on board; this could principally be prevented through the use of on-stop entry orders as we see beneath:

Be aware: On the three examples above, while they’re all sell-stop entries, buy-stop entries work simply as properly and all the things above applies for buy-stop entries too.

Easy methods to place an ‘on-stop’ entry order…

What good is figuring out the benefits of on-stop entry orders in case you don’t know HOW to position them?

Let’s do a fast walk-through of methods to place pending on-stop entry orders on the Meta Dealer 4 buying and selling platform:

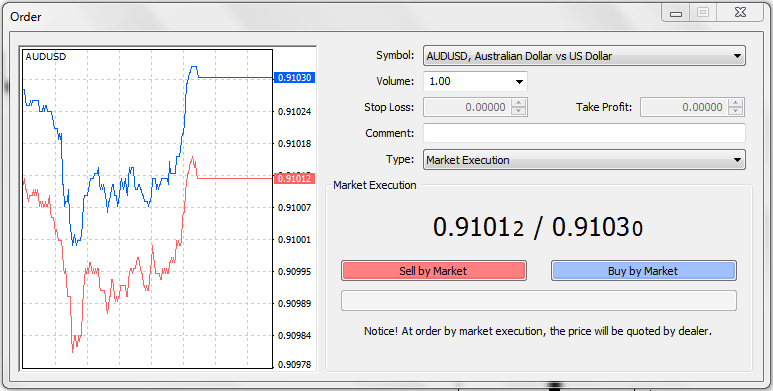

Step 1. There are three straightforward methods to open the order entry display in MT4. The primary one is to easily proper click on on the chart of the market you need to commerce after which slide your mouse over “buying and selling” after which “new order”, click on on it after which it’s best to see this field seem:

An excellent simpler technique to make the order window seem is to easily push the ‘F9’ button in your laptop when you might have the MT4 platform open, doing so may even open up the above order entry window.

The third technique to get the order entry window open is to go to “Instruments” on the prime of the platform after which choose “new order”. These are the three major methods to open up the order entry window in MT4.

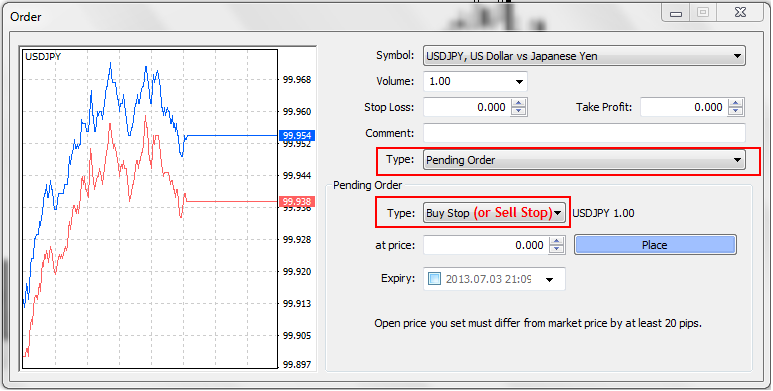

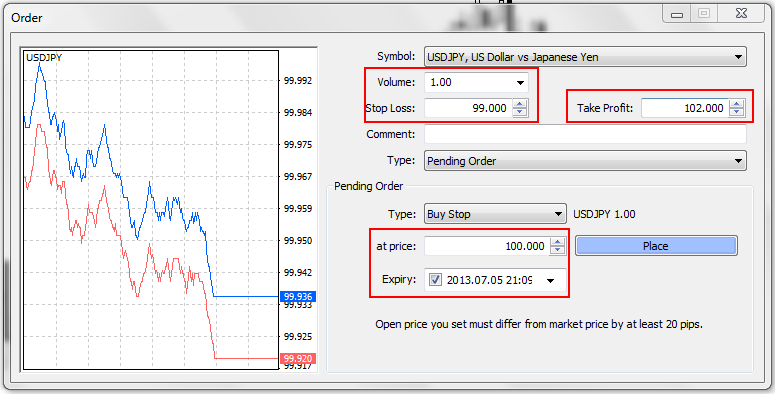

Step 2. The subsequent step is to pick “Pending Order” from the order “Sort” drop down menu. Then, you’ll choose Purchase Cease or Promote Cease, relying after all on which route you’re buying and selling (Purchase Cease for purchase entry, Promote Cease for promote entry).

Step 3. Subsequent, you have to choose the value you need to enter the market at and the expiry date of the entry order; the expiry date means if the market hasn’t crammed your order by that date, the order will routinely be cancelled. You additionally must resolve the amount you’ll commerce (lot measurement) and put in your cease loss stage and revenue goal, for extra on this, checkout this text on methods to place cease losses and targets.

After you place your cease entry order you may see it within the “Terminal” window on the backside of the MT4 platform. Remember to both set an “expiry” as defined above, or cancel your pending cease entry order if it doesn’t get crammed by the day you need. Forgetting a few pending order with no expiry could cause you to enter the market once you aren’t anticipating to or don’t need to, this clearly may end up in an unplanned loss.

In closing

Lastly, I belief that you just’ve realized a few of the benefits of utilizing ‘on-stop’ entry orders and a few new ideas in regards to the MT4 buying and selling platform in at the moment’s lesson. The entire ‘order-strategies’ mentioned above are attainable on our most well-liked foreign exchange dealer’s buying and selling platform. This highly effective but easy expertise is one thing that it’s best to make the most of and hopefully after studying at the moment’s lesson you might have a greater concept of how to do this.

If it’s not already clear, it can save you time, be taught to commerce with self-discipline and make the most of buying and selling in-line with the present market momentum all simply by figuring out methods to use ‘on-stop’ entry orders. For extra data on methods to commerce my value motion methods, together with utilizing ‘on-stop’ entry orders and different order sorts, checkout my buying and selling course and members group.

Associated Articles: