What number of instances have you ever simply wished to kick your self since you exited a commerce for a loss earlier than it hit your cease loss, solely to see it take off in your favor with out you on board? Or, what number of instances have you ever felt the intense frustration that comes with giving again your current buying and selling income to a commerce that you just knew was ‘silly’ earlier than you entered it?

What number of instances have you ever simply wished to kick your self since you exited a commerce for a loss earlier than it hit your cease loss, solely to see it take off in your favor with out you on board? Or, what number of instances have you ever felt the intense frustration that comes with giving again your current buying and selling income to a commerce that you just knew was ‘silly’ earlier than you entered it?

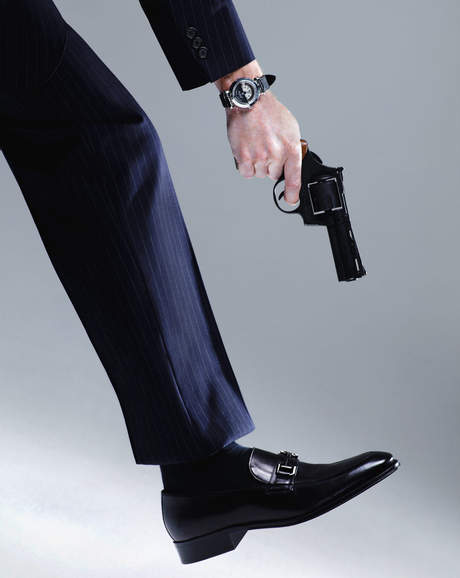

Buying and selling could be thee most irritating career on the planet, if you happen to let it. The much less ‘unforced errors’ you make in buying and selling, the higher you do, identical to tennis. The worst technique to lose cash out there is by doing one thing that you realize you shouldn’t do, however do in any case. We’re all responsible of them generally, the bottom line is to restrict these unforced errors as a lot as potential so that you’re doing all the things you’ll be able to to place the percentages of buying and selling success in your favor, as a substitute of capturing your self within the proverbial foot.

‘Unforced Errors’ Can Destroy Your Buying and selling Account

Should you’ve ever performed a sport of tennis towards a aggressive pal, you understand how maddeningly irritating unforced errors could be. Basically, an unforced error signifies that you ‘gave away’ the sport to your opponent due to ‘silly’ errors that you just made, which had been simply preventable.

Now, except you’re Rafael Nadal or Novak Djokovic, you most likely don’t have some huge cash on the road if you happen to’re into leisure tennis, but you continue to know the frustration of unforced errors. In buying and selling, ‘unforced errors’ mainly means making silly trades / over-trading / over-leveraging your account. Besides, when your actual, hard-earned cash is on the road, and turns into the direct ‘sufferer’ of those unforced buying and selling errors, it might actually make you’re feeling such as you need to soar out of your personal pores and skin. I’m positive you realize what I’m speaking about!

Unforced errors in tennis, while nonetheless preventable, may really be a little bit more durable to manage than unforced buying and selling errors, as a result of in tennis you are attempting to manage your whole physique, and hitting the ball just a bit too exhausting can ship it flying out of bounds (unforced error), for instance. In buying and selling, unforced errors are completely preventable as a result of they’re merely the results of a scarcity of self-discipline and logic. You’ll be able to change the way in which you consider buying and selling by making a acutely aware effort to take action and you’ll work on controlling your self out there higher, in order to completely get rid of unforced errors out of your buying and selling. However you’ll have to work at it.

Buying and selling is tough sufficient as it’s, you don’t must do ‘silly issues’ out there that you realize you shouldn’t do, you should have sufficient dropping trades with out doing this stuff. So, don’t make it any more durable on your self than it must be!

Right here’s an inventory of concrete / logical methods to assist get rid of ‘unforced buying and selling errors’ and put the percentages of buying and selling success again in your favor…

The way to Get rid of ‘Unforced Buying and selling Errors’

It’s going to take a acutely aware effort to have the main focus and self-discipline required, however if you wish to develop into worthwhile out there, it’s a must to get rid of the unforced buying and selling errors that plague most merchants. Listed here are some issues to give attention to that can allow you to cut back and finally get rid of unforced buying and selling errors…

- Cease closing trades out manually except there’s a REALLY apparent cause to take action. Closing trades out manually earlier than they hit your pre-determined cease loss is nearly all the time a nasty thought. Let the commerce play out, if you happen to don’t, you’re voluntarily eliminating the possibility of revenue and concurrently implying that you realize ‘for positive’ what the market will do subsequent. That is each conceitedness and ignorance! You might have a buying and selling edge (your buying and selling technique, e.g. worth motion), so if you happen to enter on a legitimate worth motion commerce setup, then you must let that commerce play out to have an opportunity to work in your favor. In any other case, you’re slicing down its general profitability / potential to make you cash.

- Stick along with your preliminary commerce thought and intestine name. Don’t waffle and shut out completely good trades quickly after getting into them simply because the market strikes towards you a little bit bit. Stick along with your intestine feeling and belief your self and your buying and selling technique! Should you can not do that constantly over time, you stand no probability of making a living out there as a result of you’ll not have a buying and selling edge, you should have nothing however a bunch of randomness and pointless actions out there, i.e. playing.

- Cease jacking up your threat! Risking an excessive amount of per commerce might be the quickest technique to develop into your personal worst buying and selling enemy and is a really harmful ‘unforced buying and selling error’ to make. Buying and selling an excessive amount of (when your edge isn’t current) and risking an excessive amount of per commerce are the 2 greatest errors merchants make and are the 2 most preventable buying and selling errors. Should you can merely get rid of these two unforced buying and selling errors, you’ll most likely begin seeing income construct up in your buying and selling account, over time.

- Cease specializing in rewards and income. What try to be specializing in is studying to commerce correctly and turning into all-around dealer, as a result of that’s the way you become profitable. Most merchants get forward of themselves and start focusing manner an excessive amount of on income and reward and day-dream about quitting their jobs or telling their boss to ‘shove it’, and so on. That is actually not constructive or conducive to turning into a profitable dealer as a result of it merely diverts your focus from what actually issues. Focus your consideration on managing threat, preserving your buying and selling capital, and turning into a grasp of your buying and selling technique, and also you’ll discover that the income start to handle themselves.

- Cease taking a look at decrease time-frame charts. Except that is your first day studying my weblog, you realize I preach the ability and effectiveness of larger time-frame buying and selling. There’s simply no want to investigate any time-frame underneath the 1 hour chart. These low time frames are additionally low-probability and don’t offer you a major perspective / view available on the market, and they’re simply too ‘noisy’ and unpredictable. Keep in mind…don’t make buying and selling more durable than it already is! Buying and selling very brief time frames, like these underneath the 1 hour chart, is doing precisely that!

- Cease over-analyzing pointless variables. Merchants usually spend manner an excessive amount of time analyzing the charts and taking a look at pointless variables. Attempting to commerce the information is probably the only greatest waste of time and over-analysis mistake made by merchants. Individuals have totally different views on information buying and selling and a few don’t agree with me on my views, however the truth that the value motion displays all variables that have an effect on a market, is solely a truth and is indeniable.

- Make a acutely aware effort to remind your self of what your buying and selling technique is, follow it and monitor it. This implies having a buying and selling plan and really following it, in addition to having a buying and selling journal to document your trades. A buying and selling plan can merely be a guidelines of what you’re in search of out there and possibly even buying and selling affirmations / reminders to remain disciplined and to not deviate out of your threat administration plan or your buying and selling technique. The entire issues that you realize it’s best to do in buying and selling, ought to be included in your buying and selling plan and they’re going to act as a reminder of what you must do to succeed. Finally, this stuff will develop into behavior, however to construct that behavior, you must comply with the buying and selling plan.

Conclusion

The first cause most individuals fail at buying and selling is because of ‘unforced buying and selling errors’. Should you merely get out of your personal manner, and let your buying and selling technique and the market ‘do the work’, you’ll stand a far better probability of making a living within the foreign exchange market.

Sadly, as people, we appear to be ‘hard-wired’ to make the ‘unforced buying and selling errors’ mentioned in right this moment’s lesson, and the one sure-fire technique to overcome them is to make a acutely aware effort to take action. The ideas mentioned above are a wonderful start line. In fact, to ‘get out of your personal manner’ and let your buying and selling technique do the ‘work’, you first should know precisely what your buying and selling technique is and have it ‘mastered’. You’ll be able to be taught my easy worth motion buying and selling technique by taking my buying and selling course and becoming a member of my members’ space, this can be first step in formulating a plan of motion to place the percentages of buying and selling success in your favor, as a substitute of constant to be your personal worst buying and selling enemy.