Everybody is aware of the story of the Tortoise and the Hare, however what you may not know is that it may be a really efficient metaphor to explain the variations between profitable and dropping merchants. Just like the Hare, you in all probability skilled plenty of pleasure and success proper out of the gate, as you started buying and selling your first reside account. Nonetheless, since you in all probability didn’t tempo your self by being constant in your strategy, you noticed your early success evaporate as time went on, simply because the Hare did. The Tortoise was a lot slower than the Hare, however as a result of he was constant and unemotional, he ultimately gained the race as you in all probability know. Thus, your purpose as a dealer, is to commerce extra just like the Tortoise and fewer just like the Hare, as a result of that’s how the buying and selling sport is gained…

Everybody is aware of the story of the Tortoise and the Hare, however what you may not know is that it may be a really efficient metaphor to explain the variations between profitable and dropping merchants. Just like the Hare, you in all probability skilled plenty of pleasure and success proper out of the gate, as you started buying and selling your first reside account. Nonetheless, since you in all probability didn’t tempo your self by being constant in your strategy, you noticed your early success evaporate as time went on, simply because the Hare did. The Tortoise was a lot slower than the Hare, however as a result of he was constant and unemotional, he ultimately gained the race as you in all probability know. Thus, your purpose as a dealer, is to commerce extra just like the Tortoise and fewer just like the Hare, as a result of that’s how the buying and selling sport is gained…

Are you a “Tortoise” or a “Hare” out there?

Within the fable of The Tortoise and the Hare, the Hare begins the race by ridiculing the slow-moving Tortoise after which leaving him behind within the mud as he sprints off from the beginning line. The Tortoise, unemotional however positive of himself, begins the race in a sluggish however constant method, pacing himself from the beginning. The Hare will get distracted by different animals alongside the way in which, stopping to indicate off his pace as he tries to impress some woman rabbits (within the Disney video model) and as everyone knows, stopping for a nap alongside the way in which as properly. Sadly for the Hare, this inconsistency and emotion will get the higher of him and in the end is the rationale why he loses to the a lot slower Tortoise, regardless that he began with an enormous bodily benefit. The Tortoise could have had an obstacle bodily, however as a result of his mindset was extra constant and in-sync with what it took to win the race, he out-lasted the haphazard and emotional Hare, and in the end made it throughout the end line first.

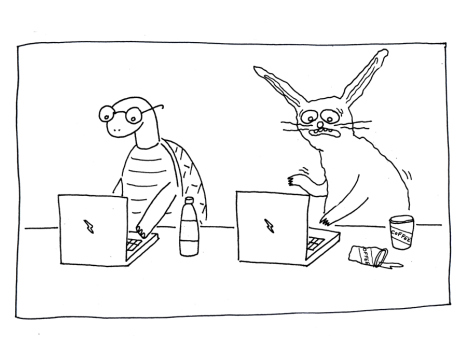

This fable of the Tortoise and the Hare actually does an excellent job of describing the first variations between merchants who constantly lose cash out there and people who constantly generate profits. Merchants who commerce with plenty of inconsistency, haphazardness and emotion, are those who wrestle and endure by way of the ache of repeatedly blowing out their buying and selling accounts, these merchants are buying and selling as if they’re the “Hare”. Merchants who take a slower and extra constant strategy, just like the Tortoise, are likely to do a lot better within the long-run and don’t expertise the extreme emotional and monetary ups and downs because the “Hare” merchants.

Anybody who has adopted my weblog for some time is aware of that I’m an enormous proponent of the low frequency buying and selling mannequin. As I talk about in my article on low frequency vs. excessive frequency buying and selling, it’s a fairly properly studied indisputable fact that day-traders and different high-frequency merchants make far much less cash over the course of their buying and selling careers than decrease frequency merchants who take a slower and extra constant strategy, just like the “Tortoise”. In reality, for most individuals, taking a low-frequency strategy to buying and selling and buying and selling just like the Tortoise, is absolutely the one likelihood they’ve at making vital cash out there over the long-run.

Buying and selling is a marathon, not a dash

Be aware, within the part above I ended with speaking in regards to the “long-run”, this can be a key level on this entire lesson. It’s not tough to get fortunate and hit just a few good winners early in your buying and selling profession, simply because the Hare received off to an excellent begin towards the Tortoise. Nonetheless, what differentiates profitable and dropping merchants is just not the power to get fortunate or dissipate all their buying and selling capital within the first month of reside buying and selling, however the potential to stay disciplined and affected person even within the face of fixed temptation to over-trade and over-leverage their account, in different phrases, you’ll want to tempo your self as you commerce.

Be aware, within the part above I ended with speaking in regards to the “long-run”, this can be a key level on this entire lesson. It’s not tough to get fortunate and hit just a few good winners early in your buying and selling profession, simply because the Hare received off to an excellent begin towards the Tortoise. Nonetheless, what differentiates profitable and dropping merchants is just not the power to get fortunate or dissipate all their buying and selling capital within the first month of reside buying and selling, however the potential to stay disciplined and affected person even within the face of fixed temptation to over-trade and over-leverage their account, in different phrases, you’ll want to tempo your self as you commerce.

The Tortoise paced himself within the race towards the Rabbit, and this in the end allowed him to beat the Rabbit, who didn’t put together correctly and who clearly under-estimated the significance of mindset over potential. The Hare blew all his power within the early-going (buying and selling cash) and received over-confident (quite common amongst struggling merchants), a lot in order that he actually fell asleep midway by way of the race, which in the end led to him dropping to the a lot slower Tortoise.

Many merchants are likely to focus an excessive amount of on the short-term, treating their buying and selling as whether it is some all-out dash to the end line. After they stumble on a few winners, they have an inclination to then over-estimate the function that their buying and selling potential performed and underestimate the significance of remaining constant and never doubling up their threat on the following commerce. As I mentioned in my article on getting again your buying and selling mojo, merchants are likely to do essentially the most harm to themselves proper after a giant profitable commerce or a number of profitable trades. Just like the Rabbit, they turn into frantic and over-excited, as an alternative of remaining calm and picked up just like the Tortoise. This sometimes ends in them over-estimating their buying and selling potential, which causes them to begin cranking up their threat per commerce and over-trading, also referred to as burning up your buying and selling capital.

Simply because the Tortoise did, it’s a must to protect your power to win the buying and selling race. In different phrases, you’ll want to protect your buying and selling capital for high-probability value motion setups, reasonably than blowing it on random gambles out there. Moreover, I need you to consider buying and selling as a marathon, not a dash, as a result of you’ll want to tempo your self if you wish to make it by way of to the land of profitable buying and selling and win the “marathon”. “Sprinting” has no place within the skilled dealer’s buying and selling strategy; sluggish and regular really does win the marathon of buying and selling.

The Tortoise reaped the massive reward

Regardless of the chances seemingly stacked towards the Tortoise in the beginning of the race, he in the end takes residence the trophy. That is precisely the identical as two merchants beginning out with completely different dimension buying and selling accounts, one giant, one small and the dealer with small account would possibly discover after 3 years of buying and selling he has much more cash in his account than the dealer who began with the big account. This occurs on a regular basis out there, and it’s as a result of it doesn’t matter how a lot cash you could have, what matter is your potential to commerce and your potential to handle your emotion and your cash. Consistency all the time wins ultimately.

As I mentioned beforehand, you’ll want to protect your buying and selling capital for the apparent commerce setups, and never blow all of it quickly after you star buying and selling reside. The Hare expended an excessive amount of power within the early going, whereas the Tortoise stayed constant. You have to save your cash just like the Tortoise with the intention to keep within the sport lengthy sufficient to hit sufficient massive winners so that you just finish the yr worthwhile. Many merchants achieve this a lot harm to their buying and selling accounts early within the yr that they don’t have any likelihood of ending the yr in revenue. You have to attempt to have much less trades however extra certainty within the trades you do take, take into consideration ultimately changing into a “baller dealer” with decrease general threat and better rewards. That is the way you generate profits over the long-run, it’s not carried out by buying and selling always till your cash is gone. In the event you do that you’ll certainly get handed up by dealer who had smaller accounts however who had a greater buying and selling mindset and who understood the significance of buying and selling with consistency.

Reptiles rule

Crocodiles and Tortoises can each train us lots about buying and selling. As I mentioned in my article on Buying and selling like a Crocodile, we should be affected person and stealthy as merchants, like a Croc, ready for the straightforward “prey” after which appearing on it with confidence. The theme is obvious right here; sluggish and regular wins the race. In the event you do a little bit of analysis on each Crocodiles and Tortoises, you will notice that each have been round for the reason that time Dinosaurs walked the Earth; lots of of hundreds of thousands of years in the past. This clearly tells us that their sluggish but constant lifestyle is one which pays off with nice rewards within the long-run.

Crocodiles and Tortoises can each train us lots about buying and selling. As I mentioned in my article on Buying and selling like a Crocodile, we should be affected person and stealthy as merchants, like a Croc, ready for the straightforward “prey” after which appearing on it with confidence. The theme is obvious right here; sluggish and regular wins the race. In the event you do a little bit of analysis on each Crocodiles and Tortoises, you will notice that each have been round for the reason that time Dinosaurs walked the Earth; lots of of hundreds of thousands of years in the past. This clearly tells us that their sluggish but constant lifestyle is one which pays off with nice rewards within the long-run.

If you wish to learn to commerce just like the Tortoise and fewer just like the Hare, with the intention to have long-term, lasting success out there, checkout my Foreign exchange value motion buying and selling course for extra data.