Some of the essential facets of foreign currency trading that many merchants appear to be unaware of is that they need to not count on any specific commerce to be a winner or a loser. That’s proper, it might sound a bit unusual, nevertheless it’s a reality. You see, even when you’ve got a buying and selling technique that you realize has a selected win fee, you continue to have no idea when any given occasion of your edge will lead to a profitable commerce or a dropping commerce. Give it some thought, when you’ve got a 60% win fee over the past 12 months, do you ever know which commerce goes to fall into the 60% winner column and which can fall into the 40% loser column? No. You don’t know, and you may by no means know, are you aware why? It’s as a result of in buying and selling, there’s a random distribution of profitable and dropping trades, it doesn’t matter what your buying and selling edge is.

Some of the essential facets of foreign currency trading that many merchants appear to be unaware of is that they need to not count on any specific commerce to be a winner or a loser. That’s proper, it might sound a bit unusual, nevertheless it’s a reality. You see, even when you’ve got a buying and selling technique that you realize has a selected win fee, you continue to have no idea when any given occasion of your edge will lead to a profitable commerce or a dropping commerce. Give it some thought, when you’ve got a 60% win fee over the past 12 months, do you ever know which commerce goes to fall into the 60% winner column and which can fall into the 40% loser column? No. You don’t know, and you may by no means know, are you aware why? It’s as a result of in buying and selling, there’s a random distribution of profitable and dropping trades, it doesn’t matter what your buying and selling edge is.

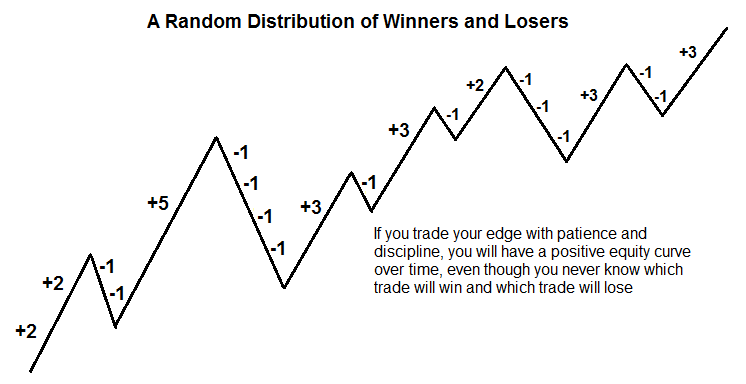

Now, this may look like one thing you already know, however the reality is that MOST merchants don’t commerce as in the event that they perceive or are even conscious of the truth that their profitable and dropping trades are randomly distributed. If you’re nonetheless a bit unclear as to what I imply by “randomly distributed”, it merely implies that you by no means know while you’ll hit a profitable commerce and while you’ll hit a dropping commerce, EVEN IF you might be following your high-probability buying and selling technique to the T. Thus, the outcomes of your trades will likely be randomly distributed, however if you happen to ARE following your buying and selling technique to the T, over time, you ought to be worthwhile. The important thing right here is ‘over time’, and it’s this half that the majority merchants overlook about or have bother with; they merely don’t have the self-discipline and(or) the endurance to stay with their buying and selling edge and cash administration technique over a big sufficient collection of trades to see it grow to be worthwhile.

Right here’s an instance of what a random distribution of profitable and dropping trades may appear like. Observe that as a result of the fairness curve is growing over time it means the buying and selling technique getting used is an efficient and worthwhile technique over a time period. The implications of this are profound:

The implications of randomly distributed buying and selling outcomes

Maybe the most important factor that that you must perceive concerning the FACT that your foreign currency trading outcomes are randomly distributed is that if you happen to REALLY perceive this reality and settle for it, you’ll by no means need to danger extra money than you might be snug with dropping on anybody commerce. It’s because merchants who perceive that they NEVER know when a dropping or profitable commerce will pop up of their distribution of trades, would by no means behave as if they did.

Merchants who danger greater than they know they’re snug with dropping on a commerce are behaving as in the event that they KNOW they may win on THIS commerce. It’s maybe this angle and perception that will get merchants into extra bother than another. For those who commerce in-line with the truth that your buying and selling outcomes are randomly distributed you then would all the time be consciously conscious of how a lot you might be risking and you’ll all the time weigh the potential danger reward of the commerce earlier than coming into, moderately than solely enthusiastic about the reward.

How your expectations are killing your buying and selling account

You in all probability don’t enter very many trades and count on to lose on them; the truth is, you in all probability count on to win on each commerce you enter. It’s human nature to need to win on each commerce you are taking; in any case, we’ve got an innate must be proper and to really feel like we’re in management. Because of this most individuals are extra afraid of flying than they’re of driving, despite the fact that statistics present that flying is considerably safer; folks prefer to really feel like they’re in management.

The issue with buying and selling is that that you must launch all your expectations about any given commerce, and for many merchants that is practically unimaginable. If you lose on a commerce there are two issues that occur; 1) You lose cash, and a pair of) You’re incorrect concerning the path of the market.

We have now to be taught that each dropping cash and being incorrect concerning the path of the market on a commerce are each simply ‘a part of the sport’. It is advisable to keep in mind that Foreign currency trading is a enterprise, however the prices are a bit totally different than most different companies. Your prices are very direct and in your face; dropping cash and having the market let you know that you simply had been incorrect in your commerce. You need to be taught to disregard this stuff and never allow them to make you emotional.

Expectations kill most merchants. You need to be taught to launch ALL of your expectations about any given commerce; as an alternative it is best to have long-term expectations. For instance, it’s good to count on to be worthwhile on the finish of the 12 months IF you comply with your plan and commerce with self-discipline and endurance. Nonetheless, it’s not good to count on to win on the subsequent commerce you are taking. The explanation why it’s not good is as a result of it merely doesn’t matter if you happen to win on the subsequent commerce, what issues is if you’re being disciplined and solely buying and selling when your edge is current and all the time controlling your danger. For those who do these issues persistently, you’ll be able to count on to earn a living over a collection of trades. However, most merchants grow to be emotional and up over-trading and blowing out their accounts as a result of they count on each commerce to be a winner. If you count on to win on each commerce you might be like a freight prepare of emotion heading in the direction of a brick wall of actuality; which means when our expectations should not in-line with actuality, we get emotional, and after we get emotional within the markets we lose cash!

Actual-world examples of randomly distributed buying and selling outcomes

Okay, we’ve got had sufficient concept; now let’s get into the appliance of it. I need to go over a number of charts of real-world current examples of value motion commerce setups. I ought to first point out that these examples are simply to current the purpose of random distribution and to show the purpose that we by no means know after we’ll hit a winner or loser. I’m not saying all these trades would have been taken in actuality.

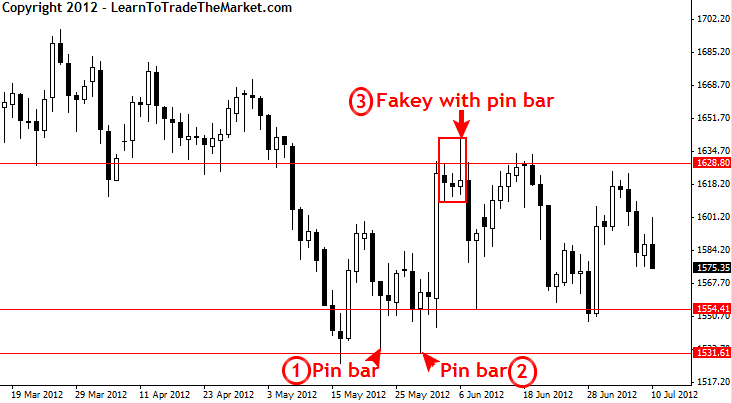

XAUUSD

The chart beneath is the XAUDUSD each day chart, or the spot Gold market. We will see examples of three totally different value motion commerce setups that occurred just lately in that market. Let’s go over them in keeping with their quantity:

1: This setup was a big pin bar that fashioned off a key help stage. Though it was counter pattern the setup was nonetheless legitimate and apparent, so it is a good illustration of a legitimate occasion of our value motion buying and selling edge. This specific pin bar would in all probability have resulted in a dropping commerce for many merchants as we are able to see it briefly broke greater after which reversed to simply beneath the pin bar low earlier than forming one other pin bar off that very same help. Thus, despite the fact that the setup was legitimate and apparent it resulted in a dropping commerce; the purpose being that that you must launch your expectations of profitable on each commerce!

2: One other pin bar, this day without work the identical help mentioned within the earlier setup; $1530.00 space. This setup was additionally a big pin bar off a key help, thus it was one other legitimate occasion of our buying and selling edge. After briefly retracing to concerning the 50% stage of the pin bar the market then launched greater and offered us with a profitable commerce. Once more, no motive to count on it to be a winner, it was only a profitable occasion of our buying and selling edge; value motion.

3: Subsequent, we are able to see a well-defined fakey setup that fashioned with a pin bar because the false-break. This was a well-defined setup that fashioned off a key resistance stage, so definitely it was a legitimate occasion of our value motion buying and selling edge. We will see value shortly fell decrease and offered us with a pleasant revenue, particularly if you happen to would have entered close to the 50% stage of the pin bar on a 50% retrace entry, one of many pin bar entry methods I focus on in my value motion buying and selling course. All of those setups had been legitimate examples of my value motion buying and selling edge, two of them occurred to be winners and one occurred to be a loser, however there was NO WAY we might have recognized for positive WHICH ONE would lose and which one would win earlier than they got here off.

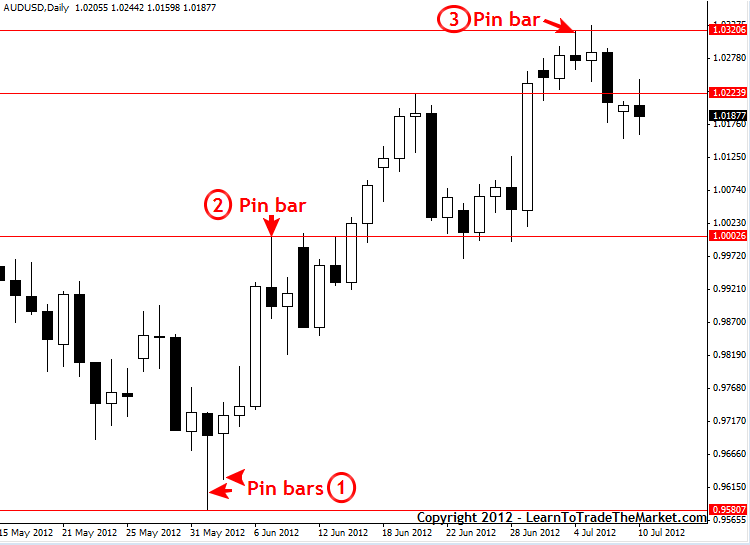

AUDUSD

The chart beneath is the AUDUSD each day chart. We will see examples of three totally different value motion commerce setups that occurred just lately in that market. Let’s go over them in keeping with their quantity:

1: This primary setup was a pin bar setup, really two good pin bars fashioned consecutively, so even if you happen to handed on the primary one you’ll have taken the second since they each fashioned exhibiting rejection of a key long-term help. We will see fairly a big winner might have resulted from these pin bars, relying in your cease placement you would have gotten a danger reward of 1:3 or 1:4 or perhaps extra. Once more, many individuals could have ‘anticipated’ these pin bars to lose since they had been counter to the current downtrend. However the reality is that they had been legitimate counter-trend setups, so we must always simply arrange our commerce after which let the market do the work. Don’t count on to win or lose on anybody commerce, simply comply with your buying and selling edge and buying and selling plan religiously and know that if you happen to do this you’ll succeed over a big collection of trades.

2: This was a well-defined bearish pin bar reversal setup which might have in all probability resulted in a dropping commerce for many merchants who took it. Though this commerce misplaced we must always not have grow to be emotional or upset, as a result of we KNOW that our winners and losers are randomly distributed, thus we’ve got no expectations for anybody commerce.

3: This was a smaller pin bar nevertheless it was exhibiting rejection of a stable resistance stage and after the large run greater that had simply occurred it could have been a value motion promote sign many merchants would have taken. We will see the market ended up shifting decrease however then reversing greater to check the resistance once more and this may have stopped most merchants out for a 1R loss. So, on this chart we had one massive winner that will have netted us 3 or 4R after which two dropping trades of 1R every, and as you’ll be able to see we might nonetheless be forward despite the fact that we had no expectation as to which commerce would lose and which might win.

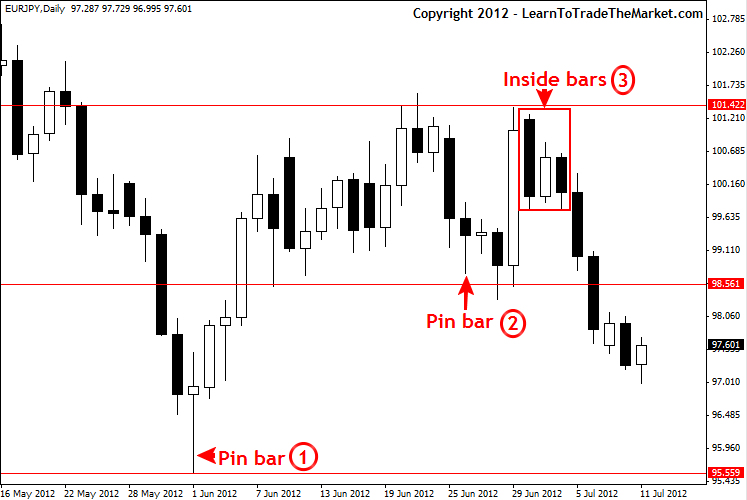

EURJPY

The chart beneath is the EURJPY each day chart. We will see examples of three totally different value motion commerce setups that occurred just lately in that market. Let’s go over them in keeping with their quantity:

1: This setup was a long-tailed pin bar that was exhibiting rejection of a long-term help stage close to 97.00 – 96.00. Observe that value moved considerably greater off this pin bar offering us with a really good danger reward potential.

2: This pin bar setup would have been a dropping commerce if you happen to entered it at market after the shut or on a restrict entry close to the 50% retrace of the pin. It was legitimate pin bar because it fashioned near key help close to 98.70 – 98.50 and had apparent pin bar definition. Nonetheless, no motive to count on it to be a winner or loser since we all know our buying and selling outcomes are randomly distributed; simply comply with your plan and when a legitimate commerce setup types you enter it after which let the market do the ‘pondering’.

3: Subsequent, we are able to see an inside bar setup that fashioned slightly below the resistance close to 101.40 on this market when it was vary sure just lately. Observe that this setup got here off aggressively to the draw back and if you happen to positioned your cease close to the 50% of the mom bar you’ll have made a really good danger reward return, and of this scripting this market remains to be shifting decrease off that setup.

Cease anticipating to win on each commerce, and also you simply may grow to be a profitable dealer

The explanation why so many individuals have bother making constant cash within the markets can basically be boiled right down to the truth that they merely count on an excessive amount of. Most merchants attempt actually arduous to regulate all facets of their buying and selling, whether or not they notice it or not. In actuality, the market can’t be managed; all you are able to do is management your self. However, it’s tougher to regulate our personal actions and ideas than it’s to over-trade or danger an excessive amount of on a commerce since you’ve satisfied your self that that ‘this’ commerce will likely be a winner. Folks persuade themselves they’re proper about their trades; it feels good to assume we’re proper, certainly many merchants really grow to be hooked on the sensation of coming into a brand new commerce, despite the fact that they’ve lengthy histories of dropping out there.

You’ve got to be taught to have a look at your self as the basis of your buying and selling issues. It’s not your dealer’s fault, it’s not the market’s fault, it’s your fault you might be dropping cash, and also you’re in all probability dropping cash since you count on to win on each commerce and so that you largely ignore the chance concerned with buying and selling. Folks are likely to focus method an excessive amount of on the potential reward of a commerce and never sufficient on the chance. Nonetheless, as we’ve got already mentioned, the potential to win or lose on ANY ONE commerce is basically equal. It’s because your winners and losers are randomly distributed, you must bear in mind this. You’ll be able to assign an general profitable proportion to your commerce technique over an extended collection of trades, however you’ll be able to’t assign a profitable proportion to anybody particular occasion of your buying and selling technique, it is a tough idea to understand at first, nevertheless it’s essential. I can assist you be taught an efficient buying and selling edge in my Foreign exchange value motion buying and selling course, nevertheless it’s as much as you to grasp the factors mentioned in immediately’s lesson. It is advisable to perceive them in addition to commerce in-line with them by not turning into emotionally hooked up to anybody commerce and by understanding you can be a worthwhile dealer if you happen to stick with your buying and selling edge and commerce it with self-discipline over a collection of trades.

I would like you all to re-read this text and actually take into consideration its implications by yourself buying and selling, then go away me a remark beneath.