Buying and selling efficiently is dependent upon recognizing market buildings and patterns that point out whether or not an present pattern will proceed. Pattern continuation patterns are necessary for merchants trying to capitalize on ongoing market momentum. This information will cowl the best pattern continuation patterns, shedding mild on how merchants can use them to determine profitable buying and selling alternatives.

2. What Are Pattern Continuation Patterns?

Pattern continuation patterns are chart formations that sign a short lived pause in a prevailing pattern, suggesting that the pattern will seemingly resume after the sample completes. These patterns matter as a result of they assist merchants spot alternatives to hitch a pattern after a quick consolidation section, bettering entry timing and minimizing the danger of shopping for or promoting on the improper time.

Within the following we’re going to cowl crucial and hottest continuation patterns. The important thing for locating the most effective continuation sample is the general pattern context during which the patterns happen. While you spot an ascending triangle, for instance, you need it to kind after a earlier bullish trending section. Most merchants neglect this necessary side after which run into issues with their sample buying and selling as a result of they commerce patterns within the improper context. Thus, ensuring you analyze the general pattern context throughout which patterns kind is crucial side of discovering the most effective continuation patterns.

3. High Pattern Continuation Patterns Defined

a. Flags and Pennants

Description: Flags and pennants are short-term continuation patterns that kind after a pointy worth motion, often called the flagpole. Flags are marked by parallel assist and resistance pattern strains, whereas pennants function converging trendlines, resembling a small symmetrical triangle.

Visible Traits:

Pennants: A smaller, converging form resembling a wedge, or a symmetrical triangle.

Entry and Exit Factors:

Entry: Merchants sometimes enter a commerce when the value breaks out of the flag or pennant within the path of the prior pattern.

Exit: A typical technique is to set the revenue goal equal to the size of the flagpole.

b. Ascending and Descending Triangles

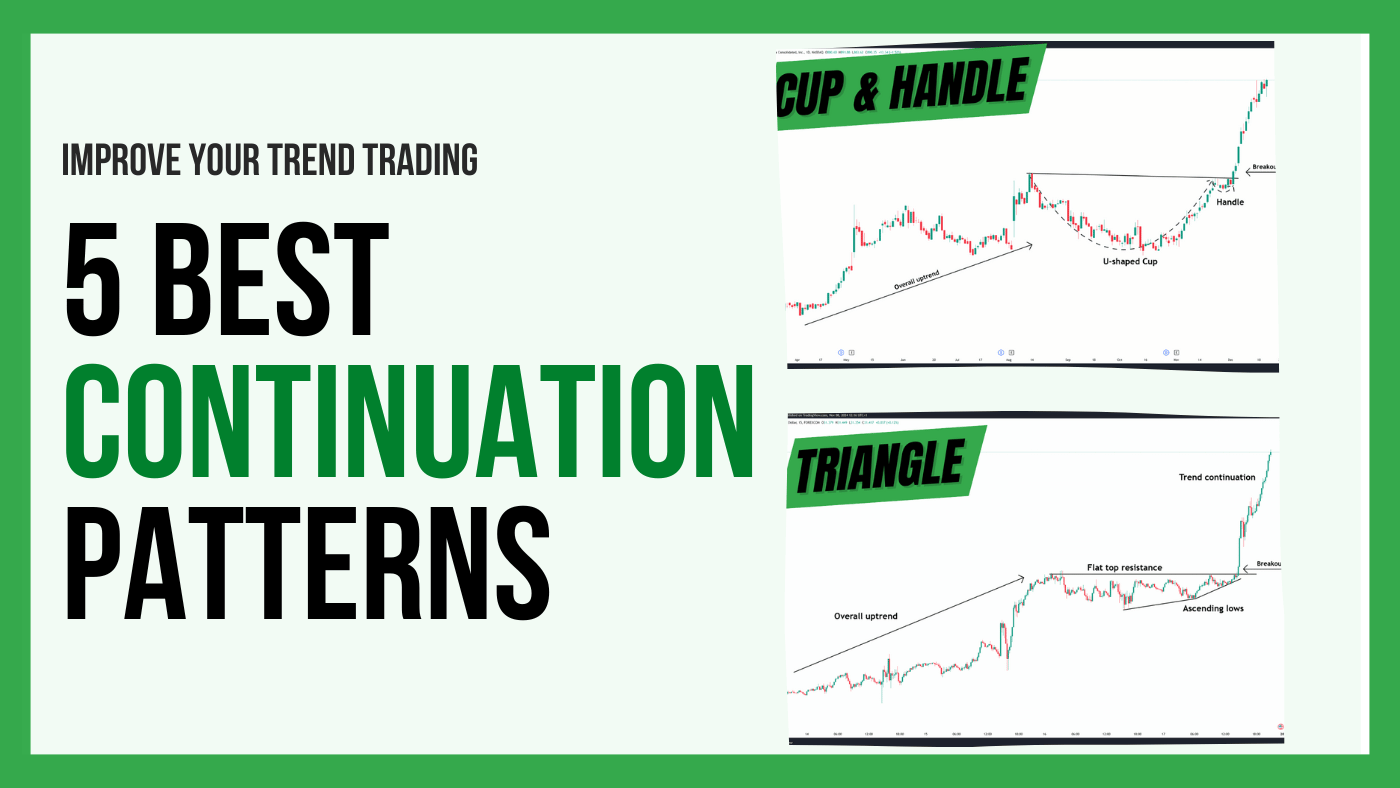

Clarification: Ascending triangles kind throughout uptrends and are characterised by a horizontal resistance line and an upward-sloping assist line. Descending triangles seem in downtrends with a horizontal assist line and a downward-sloping resistance line.

Breakout Affirmation:

c. Cup and Deal with Sample

Formation: The cup and deal with sample is a bullish continuation setup the place the value varieties a “U”-shaped cup adopted by a small downward deal with. This sample alerts that the market has consolidated and is able to resume its upward motion.

The deal with a part of the sample is crucial sign as a result of it exhibits that the stress it constructing beneath the resistance when the value doesn’t pull again decrease. Subsequently, the low of the deal with needs to be a lot larger then the low of the cup.

Period:

Entry Technique:

Entry: Place a purchase order above the deal with’s resistance.

Cease-Loss: Positioned under the deal with’s low to reduce danger.

Take-Revenue: Usually set at a degree equal to the cup’s depth.

d. Rectangles (Consolidation Patterns)

Overview: Rectangles are shaped when the value consolidates sideways between parallel assist and resistance ranges, signifying a pause within the pattern.

Commerce Triggers:

Entry is confirmed when the value breaks above or under the rectangle sample within the path of the pattern.

Threat Administration Suggestions:

All the time anticipate affirmation earlier than coming into a commerce. False breakouts are widespread in rectangle patterns, so use quantity as a further affirmation software.

e. Inverted Head and Shoulders

Description: This sample, normally related to reversals, can generally point out a continuation throughout an uptrend. It varieties when the value makes three swing lows, with the center one being the bottom (the pinnacle) and the opposite two (the shoulders) being larger however almost equal.

Continuation Context:

In an uptrend, the inverted head and shoulders sample can act as a consolidation earlier than the pattern resumes.

Sample Formation:

The neckline, shaped by connecting the peaks of the 2 shoulders, serves because the breakout degree. A profitable breakout above this line alerts the continuation.

Entry Technique:

Enter when the value breaks above the neckline, confirming the sample.

Cease-Loss: Place a stop-loss slightly below the correct shoulder for cover.

f. Inside Day:

Formation: When, throughout an uptrend, a small inside day by day candle varieties, a possible next-day-breakout, could be a robust continuation sign. The sample of momentum-inside-momentum candlestick can usually be noticed throughout a trending market.

Candle dimension:

The nearer the value closes to the excessive of the earlier momentum candle, the higher the general sign. If the value is ready to push in opposition to the earlier momentum candle in a robust method, it alerts an excessive amount of pattern opposition.

Entry Technique:

After the day by day inside candle has absolutely closed, merchants go to a decrease timeframe to search for short-term entry patterns. Dealer can select any of the beforehand mentioned continuation patterns and anticipate them to point out up on the decrease timeframe after the within candle has closed.

4. How you can Determine a Legitimate Continuation Sample

Assist and resistance ranges are important for outlining the sample’s construction as a result of they sometimes kind the boundaries of pattern continuation patterns.

Figuring out trendlines additionally helps affirm the sample’s boundaries and potential breakout factors when coping with patterns that don’t observe horizontal boundaries.

In an uptrend, observing larger lows approaching a resistance degree can point out that stress is constructing. This remark is essential for patterns like triangles and cup and handles.

5. Buying and selling Methods Utilizing Pattern Continuation Patterns

Time Frames:

Patterns like flags and triangles may be noticed in varied time frames, from 1-hour to day by day charts.

Use the next time-frame (HTF) to ascertain pattern path and a decrease time-frame (LTF) to search out entry alternatives utilizing continuation patterns.

Entry and Exit Methods:

Sometimes, merchants wait for an entire candle shut above the sample boundary earlier than executing a commerce. Pending order buying and selling methods are extra liable to false alerts however some merchants could select to put entry orders barely above breakout ranges.

Set stop-loss orders under current swing lows (in uptrends) or highs (in downtrends) for efficient danger administration. The shut the cease loss to the breakout degree, the extra susceptible the cease loss to short-term volatility.

Outline revenue targets based mostly on the measured transfer precept, similar to the peak of the sample. Alternatively, utilizing a hard and fast reward:danger ratio based mostly on the cease loss distance is one other nice strategy to work out targets.

6. Conclusion

Pattern continuation patterns are invaluable instruments for merchants aiming to trip present traits with extra confidence and precision. Patterns like flags, pennants, triangles, cups and handles, and rectangles provide clear alerts when accurately recognized and traded within the right larger timeframe context.

The large good thing about sample buying and selling lies of their excessive degree of objectivity. Patterns needs to be apparent once they kind in your charts, eradicating plenty of uncertainty and subjectivity that different buying and selling approaches carry.

Incorporating these patterns into your buying and selling technique and working towards them in a demo atmosphere or by backtesting historic knowledge can enhance your technical evaluation abilities. Take time to watch, apply, and journal your findings for constant development in your buying and selling journey.