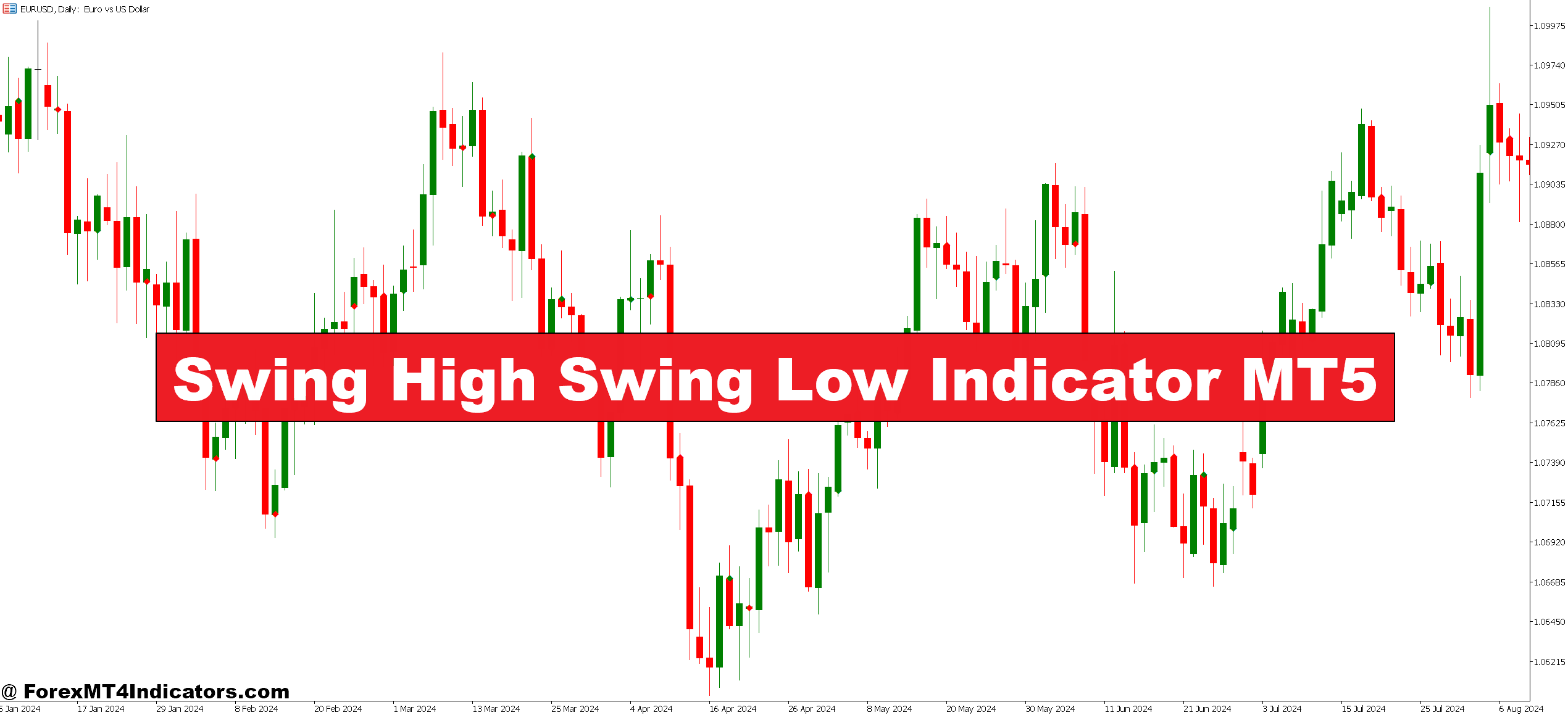

The Swing Excessive Swing Low Indicator works by scanning a selected variety of bars to the left and proper of a possible pivot level. When value kinds a excessive that’s greater than a set variety of bars on either side, it marks a swing excessive. The identical logic applies in reverse for swing lows—the indicator flags a low that’s decrease than surrounding bars on either side.

Right here’s the place it will get sensible. Most variations use a default setting of 5 bars on all sides, that means the indicator wants 5 bars to the left and 5 to the suitable to verify a swing level. This 10-bar window (5+5) creates a buffer that eliminates minor fluctuations whereas capturing vital pivots. You may regulate this parameter primarily based in your buying and selling model—day merchants may use 3-3 for quicker indicators, whereas swing merchants may desire 7-7 and even 10-10 for extra substantial strikes.

The calculation itself is simple, which is a part of its reliability. The indicator doesn’t use complicated formulation or lagging shifting averages. It’s pure value motion evaluation, figuring out factors the place momentum really shifted. If you see a swing excessive marker seem above a candlestick, you recognize that value failed to interrupt greater for a minimum of the desired variety of bars on either side.

Actual-World Buying and selling Purposes

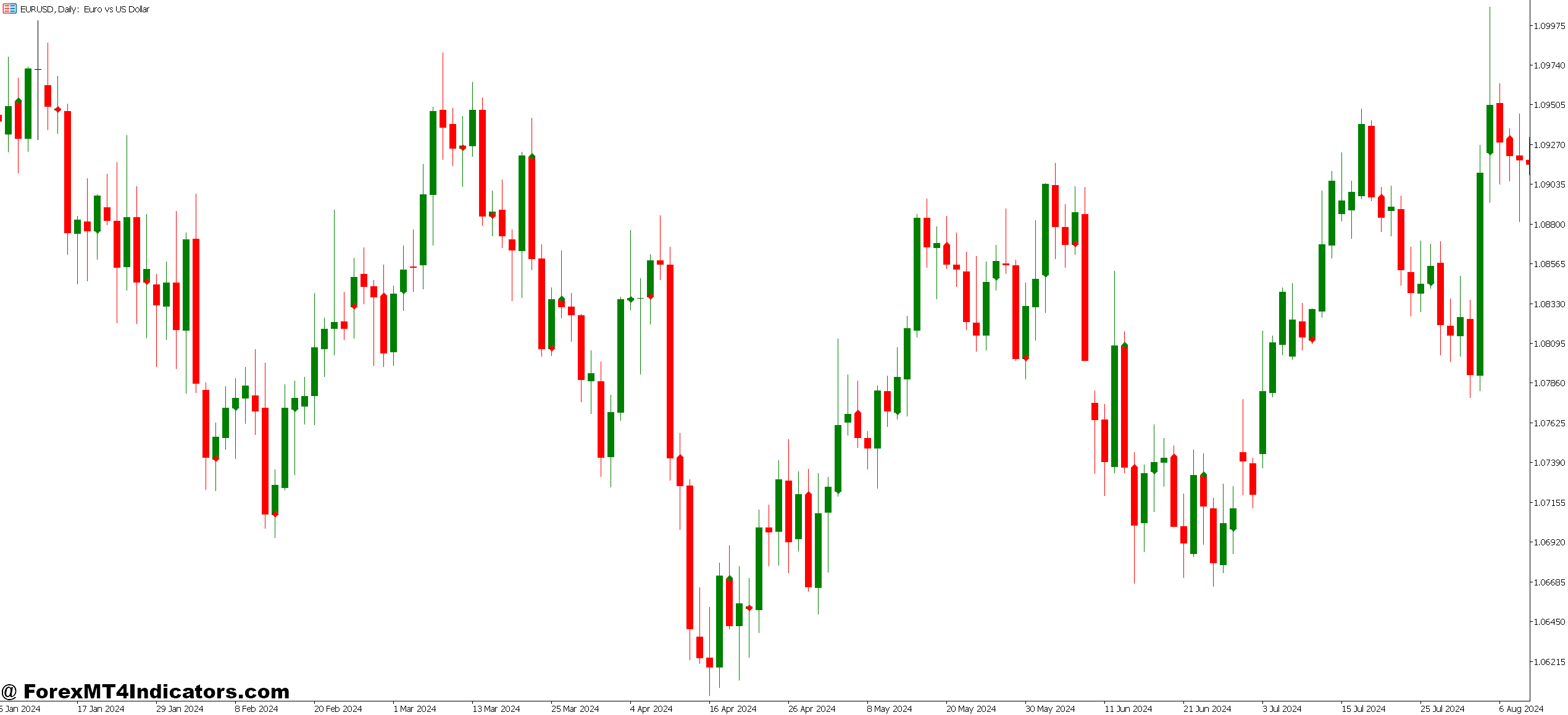

I examined this on GBP/USD through the London session final month, and the outcomes confirmed why swing factors matter a lot. The pair was ranging between 1.2650 and 1.2720, making uneven strikes that may’ve triggered false breakouts on typical indicators. However the Swing Excessive Swing Low Indicator marked solely 4 vital pivots throughout that three-hour window—two highs close to 1.2720 and two lows close to 1.2655.

These 4 factors advised the entire story. The vary was clear, and when value lastly broke above the second swing excessive with robust momentum, it was an apparent lengthy entry. The swing low from earlier within the session offered a logical cease loss placement, and the risk-to-reward setup was clear.

Right here’s one other state of affairs. On USD/JPY’s 4-hour chart, the indicator marked a sequence of decrease swing highs throughout a downtrend. Every new swing excessive appeared decrease than the earlier one, confirming bearish market construction. Merchants who shorted close to these swing highs, with stops simply above them, caught a number of worthwhile strikes. That’s the facility of buying and selling with construction as a substitute of towards it.

The indicator additionally shines for figuring out development exhaustion. If you see swing highs forming nearer along with reducing momentum, or swing lows that fail to make new lows, it indicators potential reversals. I seen this on EUR/GBP final week—three consecutive swing lows that hardly broke beneath one another, adopted by a pointy rally. The compression was seen as a result of the indicator marked every pivot clearly.

Customizing Parameters for Completely different Markets

The lookback interval is your essential adjustment level, and it dramatically adjustments the indicator’s habits. Setting it to three bars on all sides offers you extra swing factors, which works nicely on 5-minute or 15-minute charts the place you want faster suggestions. However count on extra noise—you’ll get pivot marks which may not maintain significance.

Bump it as much as 10 or 15 bars on all sides, and also you’re filtering for main structural factors. This setting fits each day or weekly charts the place you need to determine long-term help and resistance zones. I take advantage of this configuration when analyzing main foreign money pairs like EUR/USD or USD/JPY for place trades. The swing factors seem much less steadily, however after they do, they carry extra weight.

Some variations of the indicator embody offset choices that decide the place the marker seems relative to the swing level. A zero offset locations the marker immediately on the pivot bar, whereas a adverse offset can present you the swing level earlier than all affirmation bars have fashioned. That’s dangerous, although—you may see a “swing excessive” marker that will get invalidated if value makes a better excessive within the subsequent few bars.

Colour and dimension changes may appear beauty, however they matter for chart readability. In case you’re working a number of indicators, utilizing distinct colours for swing highs (usually crimson or orange) and swing lows (inexperienced or blue) prevents visible muddle.

Benefits and Trustworthy Limitations

The indicator’s largest power is objectivity. It removes the guesswork from figuring out pivots. You’re not drawing help and resistance traces primarily based on intestine feeling—the indicator reveals you the place momentum really reversed primarily based on value construction. This consistency helps newer merchants develop a watch for market construction with out years of chart time.

It’s additionally common. The identical swing level that seems in your EUR/USD chart has that means for one more dealer on the opposite facet of the world. Evaluate this to one thing like RSI or MACD, the place settings and interpretations range wildly. Swing factors are swing factors—there’s no ambiguity about what they signify.

However right here’s the catch: the indicator is at all times delayed. By design, it wants affirmation bars earlier than marking a pivot, which implies you’ll by no means catch the precise swing excessive or low in real-time. That’s not a flaw—it’s a function that forestalls false indicators—nevertheless it does imply your entries won’t ever be on the absolute peak or trough.

The indicator additionally struggles in ranging, uneven markets the place value whipsaws with out clear path. You’ll get swing factors marked everywhere, however none of them outline tradeable construction as a result of there isn’t a construction. Throughout main information occasions like NFP or FOMC bulletins, the indicator can mild up your chart with pivots that haven’t any predictive worth.

And right here’s one thing merchants usually miss: swing factors alone don’t inform you path. They present you the place value reversed, however not the place it’s going subsequent. You want extra affirmation—trendlines, help/resistance, shifting averages, or candlestick patterns—to make buying and selling selections.

How It Compares to Zigzag and Fractals

The Zigzag indicator appears comparable because it additionally identifies swing factors, however the method differs considerably. Zigzag repaints—it redraws its traces as new value knowledge is available in, which makes it ineffective for real-time buying and selling selections. The Swing Excessive Swing Low Indicator doesn’t repaint as soon as a pivot is confirmed. What you see is what you get.

Fractals, popularized by Invoice Williams, mark five-bar patterns the place the center bar has the very best excessive or lowest low. The Swing Excessive Swing Low Indicator is extra versatile because you management the lookback interval. A fractal is actually a Swing Excessive Swing Low indicator locked at 2-2 bars, which is perhaps too delicate for some methods.

Help and resistance indicators draw horizontal traces at value ranges, however they don’t adapt to altering market construction. Swing factors transfer with the market, exhibiting you the present terrain relatively than historic ranges. That mentioned, when swing highs or lows cluster across the similar value stage, they affirm robust help or resistance zones.

Easy methods to Commerce with Swing Excessive Swing Low Indicator MT5

Purchase Entry

- Look forward to value to interrupt above the newest swing excessive – Enter lengthy when value closes a minimum of 5-10 pips above the marked swing excessive on EUR/USD 1-hour chart, confirming the breakout with elevated quantity or a powerful bullish candle.

- Establish greater swing lows forming – Search for a minimum of two consecutive swing lows the place each is greater than the earlier, indicating bullish market construction on GBP/USD 4-hour timeframe earlier than taking purchase entries.

- Place cease loss 10-15 pips beneath the final swing low – Use the newest confirmed swing low as your cease placement, giving sufficient room for regular value fluctuation whereas defending capital if construction breaks.

- Enter on pullbacks to earlier swing highs – After value breaks greater, watch for a retest of the outdated swing excessive (now help) on the each day chart, then purchase when value bounces with a 1:2 minimal risk-reward ratio.

- Affirm with development alignment – Solely take purchase indicators when a minimum of three swing highs are progressively greater on the 4-hour chart, avoiding counter-trend trades which have decrease likelihood of success.

- Keep away from shopping for throughout Asian session chop – Skip purchase indicators between 00:00-06:00 GMT on pairs like EUR/USD when liquidity is skinny and swing factors usually get violated with out significant follow-through.

- Scale in at a number of swing lows – Enter 50% place at first swing low break, add remaining 50% if value makes a better swing low, decreasing common entry threat on USD/JPY each day charts.

- Exit if new swing excessive fails to kind inside 20-30 bars – Shut your purchase place if momentum stalls and value doesn’t create a brand new swing excessive after breaking the earlier one, indicating potential development exhaustion.

Promote Entry

- Enter brief when value breaks beneath confirmed swing low – Promote when value closes 5-10 pips beneath the marked swing low on GBP/USD 1-hour chart with a powerful bearish candle, confirming draw back momentum.

- Establish decrease swing highs creating – Look ahead to a minimum of two consecutive swing highs the place every is decrease than the final on EUR/USD 4-hour timeframe, confirming bearish construction earlier than coming into shorts.

- Set cease loss 10-15 pips above the latest swing excessive – Place your cease simply above the final confirmed swing excessive, defending your place if bearish construction breaks and bulls regain management.

- Promote on rallies to damaged swing lows – After value breaks down, watch for a pullback to check the outdated swing low (now resistance) on the each day chart, then brief when value rejects with bearish affirmation.

- Affirm downtrend with descending swing highs – Solely take promote indicators while you see three or extra progressively decrease swing highs on the 4-hour chart, avoiding low-probability counter-trend shorts.

- Skip promote indicators throughout Friday afternoon – Keep away from coming into brief positions after 12:00 GMT Friday on main pairs as weekend gaps and low quantity usually invalidate technical swing level indicators.

- Scale positions at resistance clusters – Enter 50% brief at first swing excessive break, add remaining place if value kinds a decrease swing excessive, enhancing your common entry on USD/CHF weekly charts.

- Exit if value consolidates with out new swing low – Shut brief positions if value fails to make a brand new swing low inside 20-30 bars after breaking earlier help, signaling potential bottoming sample formation.

Key Takeaways for Sensible Use

The Swing Excessive Swing Low Indicator MT5 offers merchants an goal solution to determine the place momentum shifted, which is prime to studying value motion. It really works finest while you regulate the lookback interval to match your timeframe—tighter settings for intraday charts, wider settings for longer-term evaluation. The indicator’s worth comes from exhibiting market construction clearly, serving to you place stops logically and determine development continuation or reversal patterns.

That mentioned, it’s a device, not a system. Swing factors want context from help and resistance, development path, or different technical elements earlier than they develop into actionable commerce indicators. The delayed affirmation by design means you gained’t catch actual tops and bottoms, however you’ll keep away from many false indicators that plague real-time pivot detection strategies.

Buying and selling foreign exchange carries substantial threat, and no indicator ensures income. The Swing Excessive Swing Low Indicator can enhance your market construction evaluation, however success nonetheless relies on correct threat administration, buying and selling psychology, and the way you combine these indicators right into a broader technique. Take a look at it on demo accounts with totally different settings earlier than risking actual capital, and keep in mind that even the clearest swing factors can fail throughout sudden market circumstances.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90