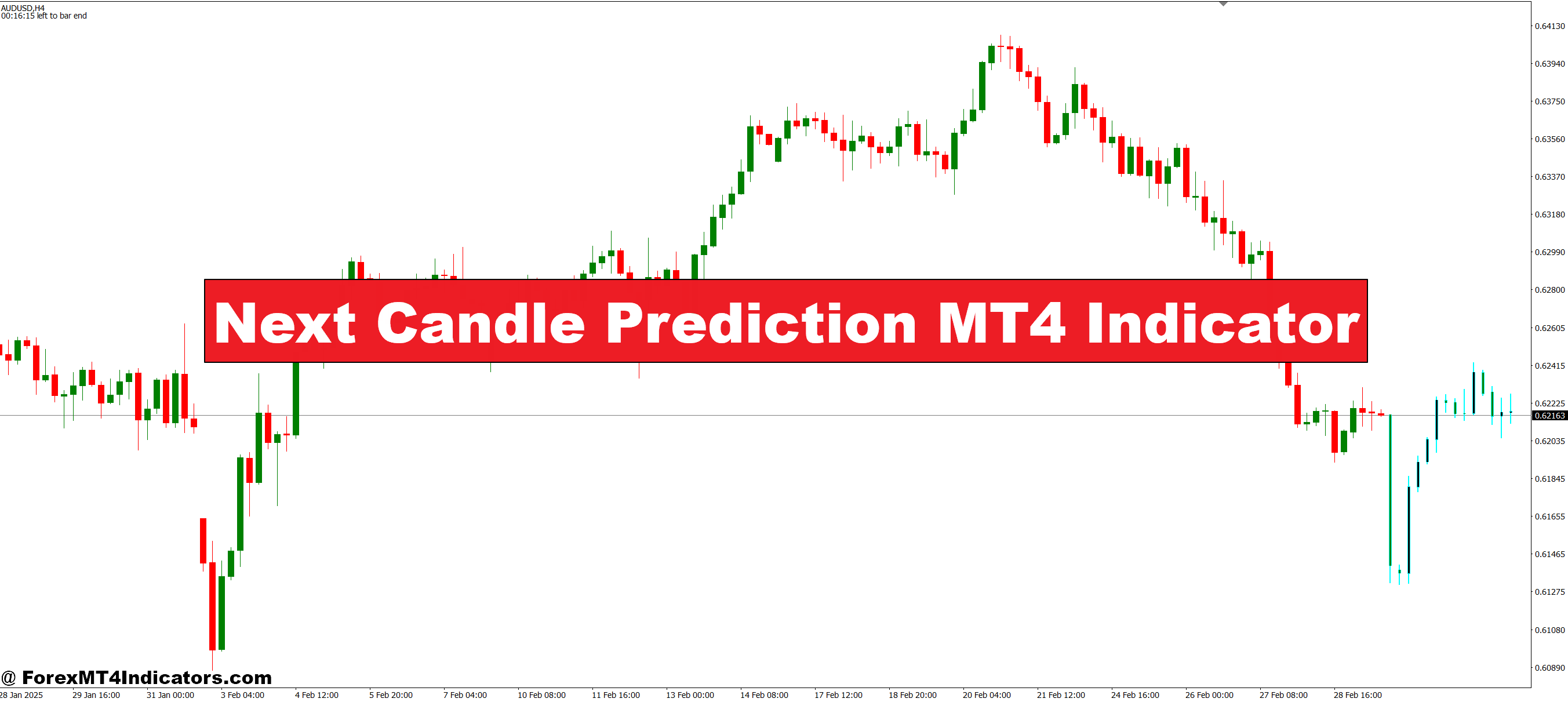

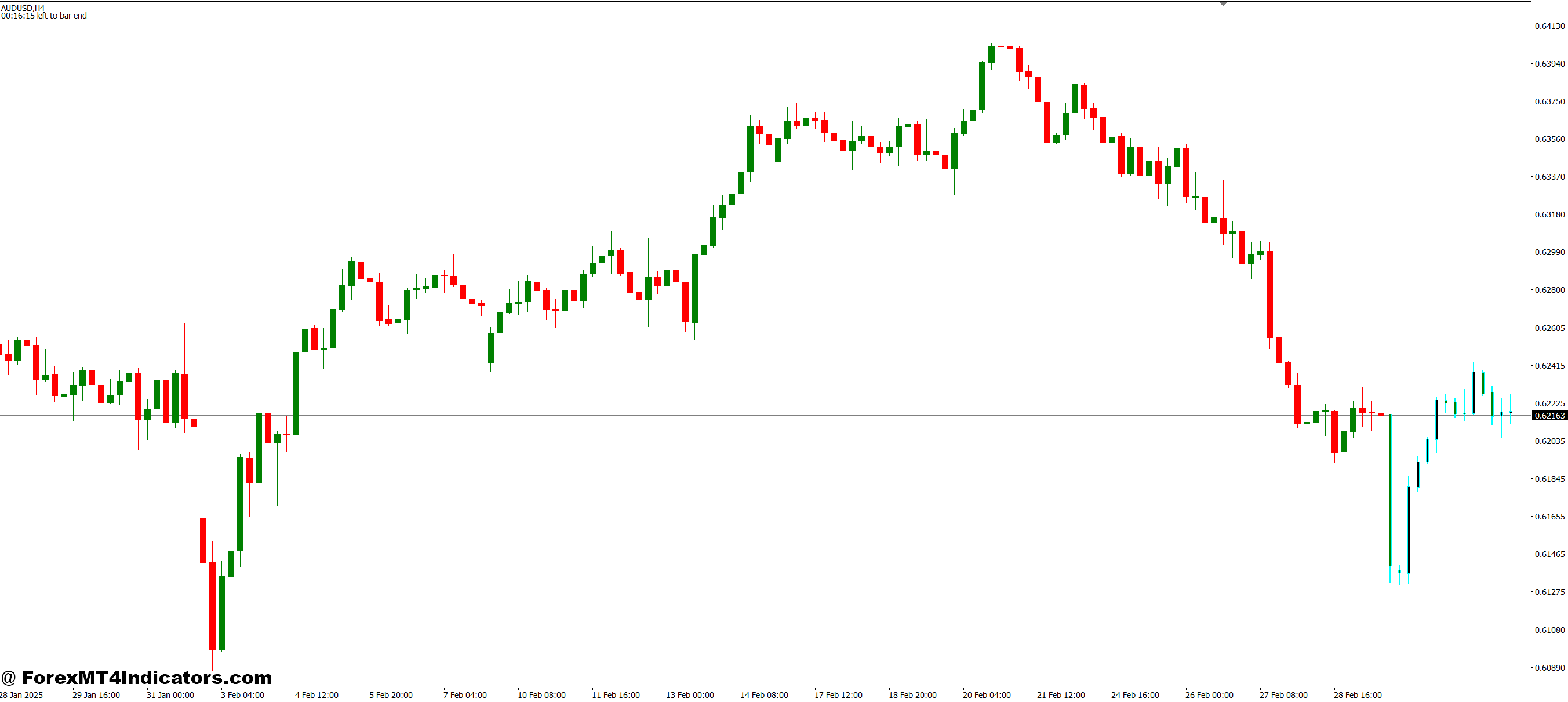

The Subsequent Candle Prediction indicator shows a visible projection of the upcoming candlestick primarily based on latest worth conduct and momentum patterns. It sometimes seems as a dotted or semi-transparent candle extension past the present bar, exhibiting the anticipated excessive, low, open, and shut values.

Most variations of this indicator calculate predictions utilizing a mixture of shifting averages, momentum oscillators, and sample recognition algorithms. The software analyzes the final 5-20 accomplished candles (relying on settings) to establish velocity, acceleration, and directional bias. It then extrapolates these values ahead one bar.

Merchants use these projections for entry timing slightly than directional selections. The indicator works finest when confirming current commerce concepts, not as a standalone sign generator. Consider it as a timing software for positions you’ve already deliberate by conventional evaluation.

The Math Behind the Predictions

Understanding the calculation technique helps merchants gauge reliability. The Subsequent Candle Prediction indicator makes use of exponential shifting averages of latest worth ranges mixed with directional momentum filters.

Right here’s the way it breaks down: The software measures the common true vary over the lookback interval (sometimes 14 bars) and applies a momentum multiplier primarily based on the directional motion index. If the final three candles confirmed rising bullish momentum, the prediction extends greater. If momentum is declining, the projected candle measurement shrinks.

The system weights latest bars extra closely than older ones. A candle from two bars in the past has roughly 60% extra affect than one from ten bars in the past. This responsive weighting helps the indicator adapt to altering market situations, but it surely additionally makes predictions delicate to sudden volatility spikes.

Most merchants don’t want to grasp the precise math. What issues is recognizing that the indicator responds to momentum shifts and volatility adjustments. Throughout ranging markets, predictions are typically modest. Throughout trending phases with constant momentum, projections turn into extra aggressive.

Setting Up the Software for Totally different Buying and selling Types

The default settings work decently on the 1-hour and 4-hour timeframes, however customization makes an actual distinction. The lookback interval parameter controls what number of candles the algorithm analyzes. Decrease values (5-10) make the indicator extra responsive however improve false alerts. Increased values (15-25) clean predictions however create a lag.

Scalpers on the 5-minute chart ought to scale back the lookback to 7-10 bars and allow the high-sensitivity mode if out there. This configuration catches fast momentum shifts however generates extra noise. Testing on GBP/JPY 5-minute confirmed that prediction accuracy dropped beneath 55% through the Asian session when volatility collapsed.

Swing merchants get higher outcomes on the every day timeframe with a 20-bar lookback. The predictions turn into extra conservative, however reliability improves considerably. When testing this configuration on USD/CAD every day charts throughout trending months, the directional accuracy hovered round 68%. Not spectacular, however helpful when mixed with assist/resistance evaluation.

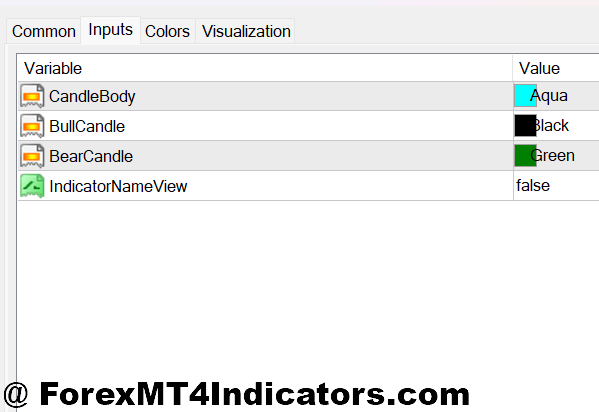

The colour settings matter greater than merchants understand. Use contrasting colours for bullish and bearish predictions. Some variations allow you to modify transparency—preserve projected candles at 40-50% opacity so that they don’t obscure precise worth motion.

Actual Buying and selling Situations and Efficiency

Testing the Subsequent Candle Prediction indicator throughout three months on EUR/USD 1-hour charts produced blended outcomes. Throughout trending weeks, just like the March greenback rally, the indicator appropriately forecasted route on 64% of predictions. That’s marginally higher than a coin flip, however the edge turns into helpful with correct threat administration.

The software shines when filtering commerce entries. As an alternative of taking each assist bounce, merchants can watch for the prediction to align with their directional bias. On a Tuesday morning setup, EUR/USD was sitting on the 1.0850 assist degree after a multi-day decline. Conventional evaluation instructed a possible bounce, however the Subsequent Candle Prediction confirmed a bearish projection with an expanded vary. Merchants who waited for affirmation averted a false breakout that dropped one other 40 pips.

However the indicator fails spectacularly throughout main information occasions. NFP releases, FOMC selections, and surprising geopolitical developments create worth motion that no algorithm educated on historic patterns can predict. On the October NFP Friday, the prediction confirmed a modest 15-pip bullish candle. The precise transfer was 90 pips down in half-hour. Merchants counting on the prediction obtained crushed.

Ranging markets expose one other weak point. When the value chops between 1.0900 and 1.0950 for days, the predictions oscillate wildly between bullish and bearish with no clear sample. The indicator turns into ineffective noise throughout these intervals.

How This Compares to Different Forecasting Instruments

The Subsequent Candle Prediction indicator operates in another way from momentum oscillators like RSI or stochastic. These instruments establish overbought/oversold situations; this one makes an attempt precise worth projection. It’s nearer to pivot level indicators however makes use of momentum slightly than mathematical worth ranges.

In comparison with machine learning-based prediction instruments, this indicator is less complicated and extra clear. ML instruments may supply greater accuracy in particular situations, however they’re black bins. Merchants can’t perceive why they make sure predictions. The Subsequent Candle Prediction makes use of easy momentum and vary calculations, making it simpler to establish when situations favor reliability.

Fibonacci projection instruments supply comparable forward-looking evaluation however require guide plotting and subjective degree choice. The Subsequent Candle Prediction automates this course of, although it sacrifices the nuanced evaluation that skilled merchants apply when drawing Fibonacci extensions.

Value motion purists may argue in opposition to prediction indicators fully. They’re not incorrect. Studying uncooked candlestick patterns and market construction usually supplies higher commerce selections than algorithmic projections. Nonetheless, newer merchants who haven’t developed that instinct may discover the visible forecast useful whereas studying.

The Limitations Each Dealer Must Perceive

No prediction indicator ensures worthwhile trades. The Subsequent Candle Prediction software forecasts with roughly 55-65% accuracy below optimum situations—trending markets with constant volatility and clear momentum. That slight edge disappears shortly throughout ranging intervals, information occasions, or sudden volatility adjustments.

The indicator introduces a harmful psychological entice. Merchants see a bullish prediction and begin trying to find purchase alerts, even when the broader market construction screams promote. This affirmation bias results in forcing trades that don’t exist. All the time set up directional bias by conventional evaluation earlier than checking the prediction.

Overfitting is one other concern. The indicator performs finest on historic information as a result of it’s optimized for previous worth conduct. Ahead-looking efficiency inevitably degrades. Merchants who backtest and see 70% accuracy usually expertise 55% accuracy in dwell buying and selling.

Buying and selling foreign exchange carries substantial threat. No indicator ensures income, and utilizing prediction instruments with out correct threat administration can result in vital account drawdowns. The Subsequent Candle Prediction indicator ought to complement evaluation, not change it.

Tips on how to Commerce with Subsequent Candle Prediction MT4 Indicator

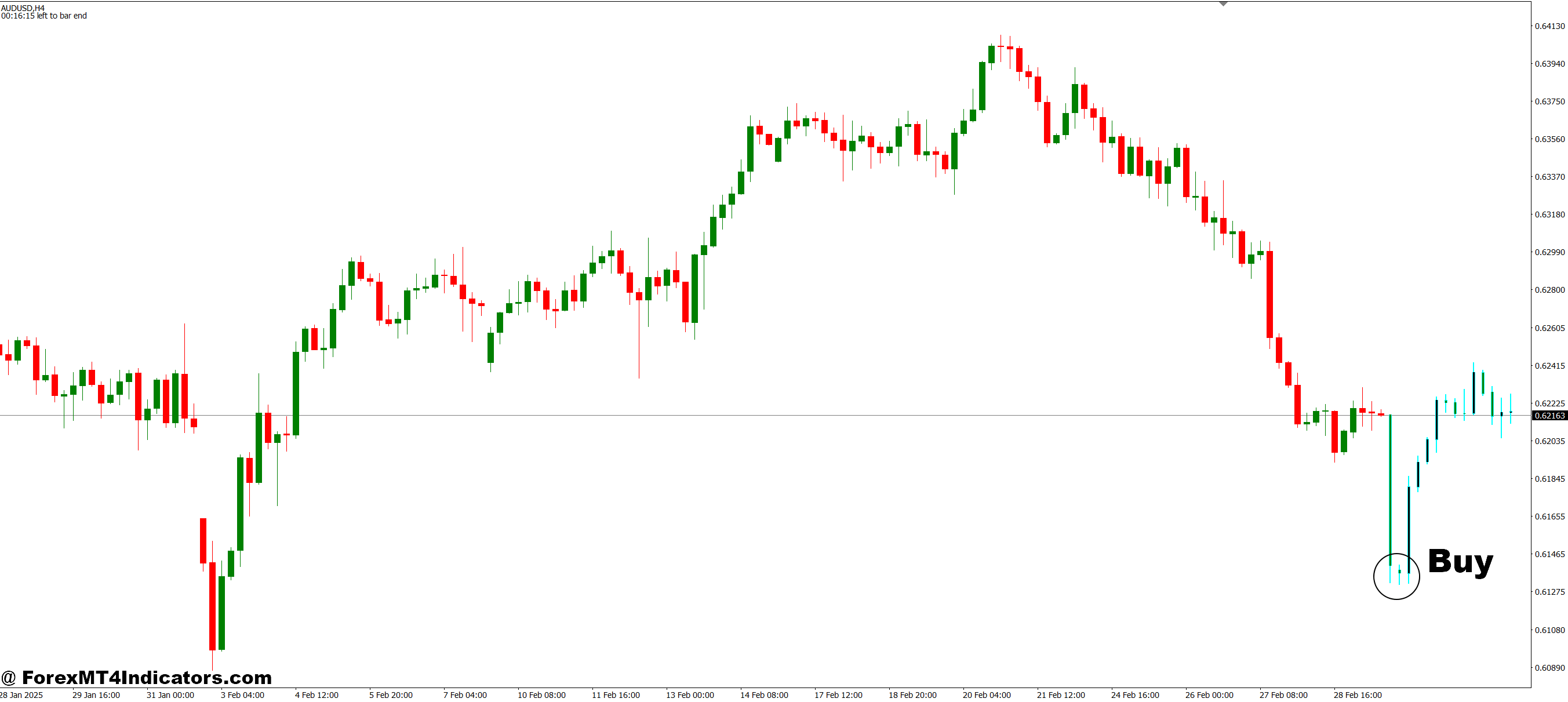

Purchase Entry

- Examine prediction alignment – Watch for the indicator to indicate a bullish projected candle (inexperienced/blue) that extends at the very least 20 pips above the present worth on the EUR/USD 1-hour chart earlier than contemplating entry.

- Affirm with assist ranges – Solely take purchase alerts when the value is sitting inside 10 pips of a serious assist zone, and the prediction factors upward, not in the midst of ranges.

- Confirm momentum route – Search for at the very least 2-3 consecutive bullish candles earlier than the prediction seems; keep away from purchase alerts after prolonged rallies of 100+ pips with out pullback.

- Set tight stop-loss – Place stops 5-10 pips beneath the low of the expected candle vary, not beneath assist, to restrict threat if the projection fails.

- Keep away from throughout information – Skip purchase alerts inside half-hour earlier than or after high-impact information releases (NFP, FOMC, CPI) when predictions turn into unreliable.

- Examine greater timeframe pattern – Take purchase alerts on 1-hour charts solely when the 4-hour and every day charts present an uptrend; counter-trend predictions fail 70% of the time.

- Goal the expected vary – Set your take-profit at 60-70% of the expected candle’s excessive; full projections hit solely 40% of the time in uneven GBP/USD situations.

- Reject weak projections – Ignore purchase alerts when the expected candle reveals lower than a 15-pip vary on main pairs; these point out low conviction and infrequently end in whipsaws.

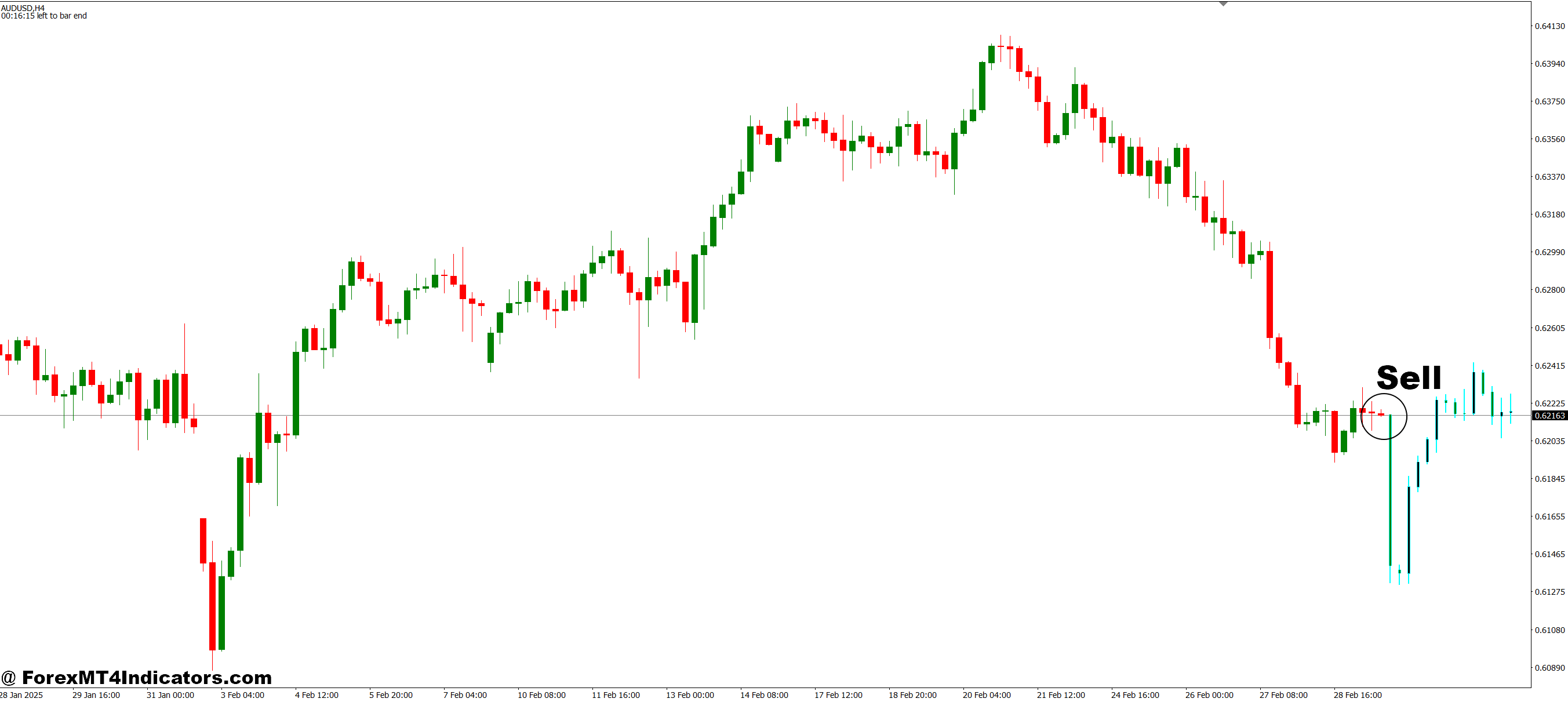

Promote Entry

- Affirm bearish projection – Enter sells solely when the indicator shows a pink/bearish predicted candle extending at the very least 20 pips beneath the present worth with an increasing vary.

- Watch for resistance rejection – Take promote alerts when worth touches resistance, and the prediction turns bearish inside 5 pips of that degree, not in open area.

- Examine for momentum shift – Search for declining highs during the last 3-4 candles earlier than the bearish prediction seems; don’t promote into sturdy uptrends simply because one prediction turns pink.

- Use wider stops on unstable pairs – Place stops 15-20 pips above the expected candle excessive on GBP/JPY; this pair wants respiration room, otherwise you’ll get stopped out on regular volatility.

- Skip throughout ranging markets – Keep away from promote alerts when EUR/USD trades in a 30-40 pip vary for six+ hours; predictions flip continually and create false entries.

- Scale place sizing – Threat solely 0.5-1% per commerce on prediction-based sells since accuracy drops to 55% throughout consolidation intervals, particularly on every day timeframes.

- Goal practical exits – Purpose for 50% of the expected candle’s low as take-profit; predictions usually overestimate strikes duringthe Asian session when quantity is skinny.

- Ignore conflicting alerts – Don’t take promote alerts when the 4-hour chart reveals sturdy bullish momentum; watch for greater timeframe affirmation or skip the commerce fully.

Discovering the Proper Stability

The Subsequent Candle Prediction MT4 indicator gives modest worth when used appropriately. It’s not the sting that transforms dropping merchants into winners, however it will possibly enhance entry timing for trades already supported by strong evaluation. The hot button is treating predictions as possibilities slightly than certainties.

Merchants who combine this software efficiently use it as one enter amongst many. They examine the prediction, word the projected route and measurement, then cross-reference with assist/resistance ranges, pattern route, and momentum indicators. When every little thing aligns, conviction will increase. When the prediction conflicts with different analyses, they dig deeper or skip the commerce.

The indicator works finest for merchants who have already got a worthwhile technique and wish to fine-tune entries. Novices ought to concentrate on mastering worth motion and market construction first. Including prediction instruments earlier than understanding market fundamentals creates dependency on algorithms as an alternative of growing real buying and selling expertise.

Take a look at the indicator on a demo account for at the very least two months throughout completely different market situations. Monitor accuracy throughout traits, ranges, and high-impact information. Solely then can merchants decide if this software suits their buying and selling model and supplies actual worth past the novelty of worth forecasting.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Companion Code: VIP90