The Spike Killer operates as a volatility filter that identifies irregular value actions in real-time. In contrast to normal indicators that clean value information or observe tendencies, this software focuses on detecting outliers—these sharp strikes that seem abruptly and infrequently disappear simply as quick.

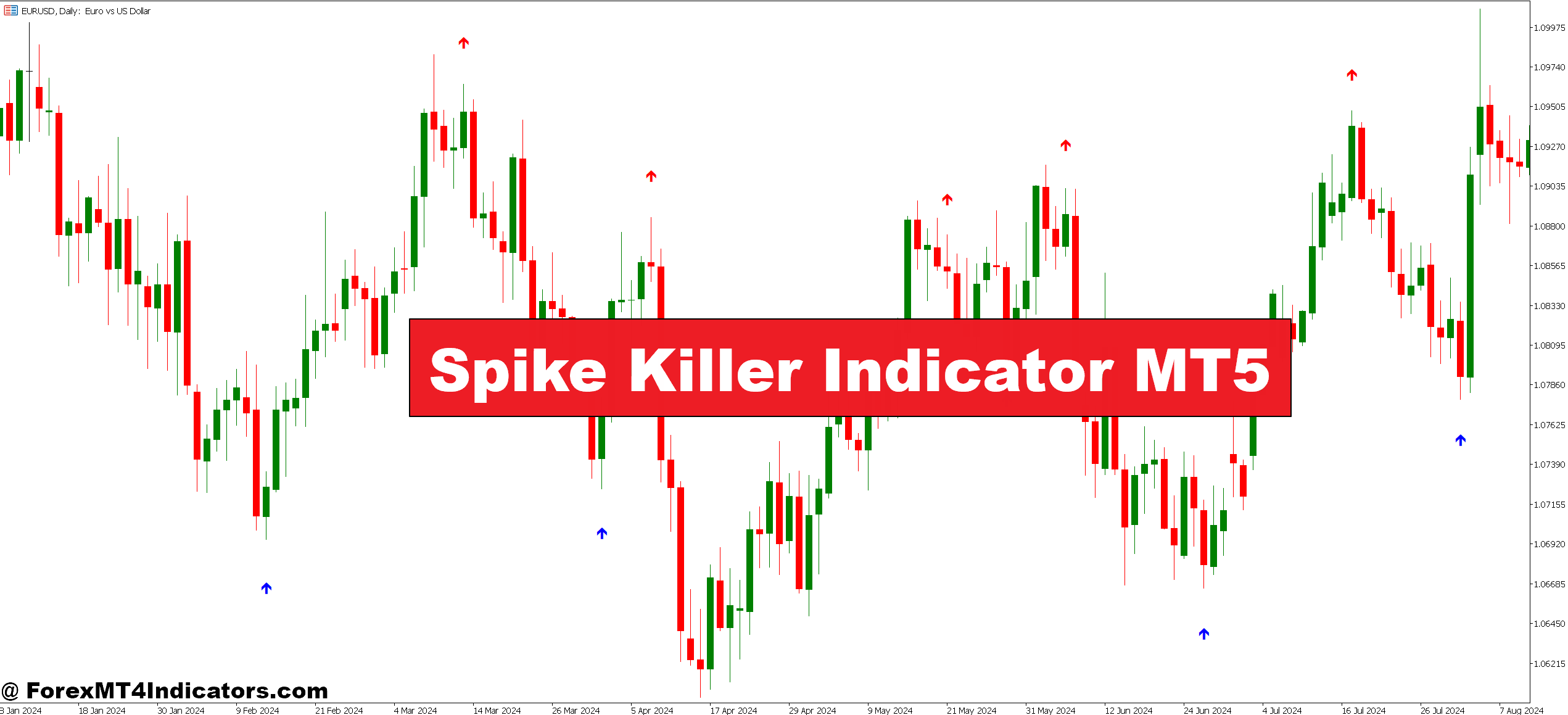

At its core, the indicator calculates the usual deviation of value motion over a specified lookback interval. When the worth strikes past a threshold (usually 2-3 normal deviations), the indicator marks it as a possible false transfer. Merchants see this as a visible alert—often a coloured dot or line—that means warning quite than rapid motion.

The logic is simple: real tendencies construct regularly with a number of confirming candles, whereas spikes seem as single-candle or two-candle anomalies that don’t align with the broader value construction. By flagging these moments, the indicator helps merchants distinguish between significant breakouts and non permanent liquidity grabs.

How Merchants Apply It in Stay Markets

The sensible utility modifications relying on buying and selling type. Scalpers on 1-minute or 5-minute charts use Spike Killer to keep away from getting caught in spreads widening throughout information releases. When NFP information hits at 8:30 AM EST, for example, GBP/USD may spike 40 pips in seconds earlier than retracing 35 of them. The indicator would flag that preliminary transfer, suggesting merchants anticipate affirmation quite than chasing.

Swing merchants profit in another way. On 4-hour or day by day timeframes, the indicator helps filter false breakouts from consolidation ranges. Take into account a state of affairs the place AUD/USD has been buying and selling between 0.6400 and 0.6450 for 2 weeks. A sudden spike to 0.6475 may appear like a breakout, but when Spike Killer flags it, the likelihood will increase that the worth will return to the vary. That’s worthwhile info for place administration.

The settings matter considerably. The default lookback interval (usually 20-30 bars) works properly for many timeframes, however scalpers may scale back it to 10-15 bars for quicker responsiveness. The usual deviation multiplier—often set at 2.0—determines sensitivity. Greater values (2.5-3.0) scale back false alarms however may miss some official spikes. Decrease values (1.5-1.8) catch extra anomalies however generate extra indicators general.

Benefits Over Customary Volatility Filters

What separates Spike Killer from instruments like Bollinger Bands or Common True Vary? Specificity. Bollinger Bands present when value reaches statistical extremes, however they don’t distinguish between wholesome momentum and whipsaw strikes. ATR measures volatility however doesn’t point out course or high quality of motion.

Spike Killer particularly targets sudden deviations—the type that occur throughout low-liquidity intervals or when algos push costs to set off cease clusters. Merchants who’ve examined this through the Asian session know precisely what this implies. USD/JPY may commerce in a decent 15-pip vary for 3 hours, then abruptly spike 25 pips at 2:00 AM EST earlier than returning to the vary. Customary indicators wouldn’t flag this in another way from another transfer, however Spike Killer would.

The indicator additionally works properly as a affirmation software alongside trend-following techniques. Let’s say a transferring common crossover suggests going lengthy on EUR/GBP at 0.8520. However Spike Killer reveals current value motion has been uneven with a number of flagged spikes. That context may lead a dealer to cut back place measurement or anticipate a cleaner construction—sensible danger administration that improves edge over time.

Limitations and Lifelike Expectations

That stated, no indicator solves each drawback. Spike Killer struggles in genuinely trending markets the place momentum builds by robust consecutive strikes. Throughout a greenback rally, for instance, a number of foreign exchange pairs may present “spike-like” conduct that really represents institutional positioning. The indicator would flag these strikes, doubtlessly maintaining merchants sidelined throughout worthwhile tendencies.

One other consideration: the indicator reacts to what already occurred. When value spikes and will get flagged, the transfer has already occurred. Merchants nonetheless want exit methods for open positions or guidelines for re-entry timing. The software supplies info, not buying and selling selections.

False positives happen, too, particularly in high-volatility environments. Throughout a Financial institution of England charge resolution or ECB press convention, sustained volatility can set off a number of spike alerts even when directional strikes have legitimacy. Merchants want further context—help/resistance ranges, quantity evaluation, or correlation with different pairs—to interpret indicators accurately.

Buying and selling foreign exchange carries substantial danger of loss and isn’t appropriate for all buyers. No indicator, together with Spike Killer, ensures worthwhile outcomes or eliminates danger solely. Merchants ought to use correct place sizing and danger administration regardless ofthe technical instruments employed.

How It Compares to Comparable Instruments

The market gives a number of spike detection and volatility filtering indicators. Quantity Spike Detector focuses on transaction quantity quite than value deviation—helpful for futures however much less relevant to identify foreign exchange the place quantity information isn’t centralized. The Elder Impulse System combines value and momentum however doesn’t particularly goal anomalous strikes.

ADX (Common Directional Index) tells merchants whether or not a market tendencies strongly however says nothing about spike high quality. A market may present weak ADX readings however expertise sharp spikes—precisely the place Spike Killer provides worth. Conversely, robust ADX readings with clear value motion would render Spike Killer much less related since a number of false strikes would happen.

Some merchants mix Spike Killer with normal deviation channels or Keltner Channels for complete filtering. When value breaks a Keltner Channel AND triggers Spike Killer, the likelihood of imply reversion will increase. When value breaks cleanly with out a spike alert, the transfer may need legs. This layered method supplies extra context than any single indicator alone.

The way to Commerce with Spike Killer Indicator MT5

Purchase Entry

- Anticipate spike rejection – Enter lengthy solely after the indicator flags a downward spike on EUR/USD and value closes again above the earlier 5-candle low on the 1-hour chart.

- Verify with help – Take purchase indicators when a flagged spike touches a key help stage (like 1.0800 on EUR/USD), and value bounces 15-20 pips inside 2 candles.

- Keep away from rapid entries – Don’t purchase through the spike itself; wait 3-5 bars after the alert to make sure value stabilizes and the fake-out is full.

- Use smaller place sizes – Threat just one% per commerce throughout high-volatility classes (London open, NFP days), even when spike rejection appears clear.

- Verify larger timeframes – Solely take 15-minute spike indicators if the 4-hour chart reveals bullish construction; ignore counter-trend spike performs.

- Set tight stops – Place stop-loss 5-10 pips beneath the spike low since real reversals shouldn’t retest that stage on GBP/USD or comparable risky pairs.

- Skip uneven ranges – Don’t commerce spike rejections when ADX is beneath 20 or when the pair has flagged 4+ spikes within the final 2 hours; market’s too erratic.

- Mix with transferring averages – Enter buys solely when value returns above the 50-period EMA after a draw back spike on the day by day chart for swing trades.

Promote Entry

- Enter on upward spike rejection – Go quick after the indicator flags an upside spike on GBP/USD and value closes beneath the earlier 5-candle excessive throughout the subsequent 3 bars.

- Goal resistance rejection – Promote when a flagged spike hits overhead resistance (like 1.2700 on GBP/USD) and reverses 20+ pips shortly.

- Anticipate affirmation candles – By no means promote instantly on the spike alert; require 2 bearish candles or a 15-pip retracement first to verify a false breakout.

- Scale back measurement in tendencies – Lower place measurement by 50% when promoting spike rejections towards a powerful uptrend; these setups fail extra usually.

- Confirm with decrease timeframes – If buying and selling 4-hour spike indicators, verify that the 1-hour chart additionally reveals rejection with decrease highs forming.

- Use wider stops initially – Set stop-loss 15-20 pips above the spike excessive on risky pairs like GBP/JPY; tighten to breakeven after 20-pip achieve.

- Ignore news-driven spikes – Don’t commerce spike rejections through the half-hour after main information releases (NFP, CPI, charge selections); volatility is unpredictable.

- Keep away from Friday afternoon indicators – Skip spike-based promote indicators after 12 PM EST on Fridays; weekend positioning creates unreliable value motion which will hole Monday.

Ultimate Ideas for Sensible Implementation

The Spike Killer Indicator MT5 serves one major goal: serving to merchants keep away from chasing low-probability strikes that look thrilling within the second however usually reverse. It received’t rework a shedding technique right into a winner, however it will probably forestall the irritating trades that erode each capital and confidence.

Three key takeaways stand out. First, the indicator works greatest as a filter quite than a standalone system—use it to get rid of dangerous setups, to not generate entries. Second, settings require optimization for particular person buying and selling kinds and timeframes; default parameters aren’t common. Third, understanding why a spike occurred (information, liquidity, cease runs) issues as a lot as figuring out a spike occurred.

For merchants uninterested in getting stopped out by pretend breakouts or whipsawed throughout range-bound classes, this indicator deserves testing on a demo account. The objective isn’t perfection—it’s decreasing the pricey errors that compound over time. In buying and selling, typically figuring out when not to behave creates extra worth than figuring out when to behave.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90