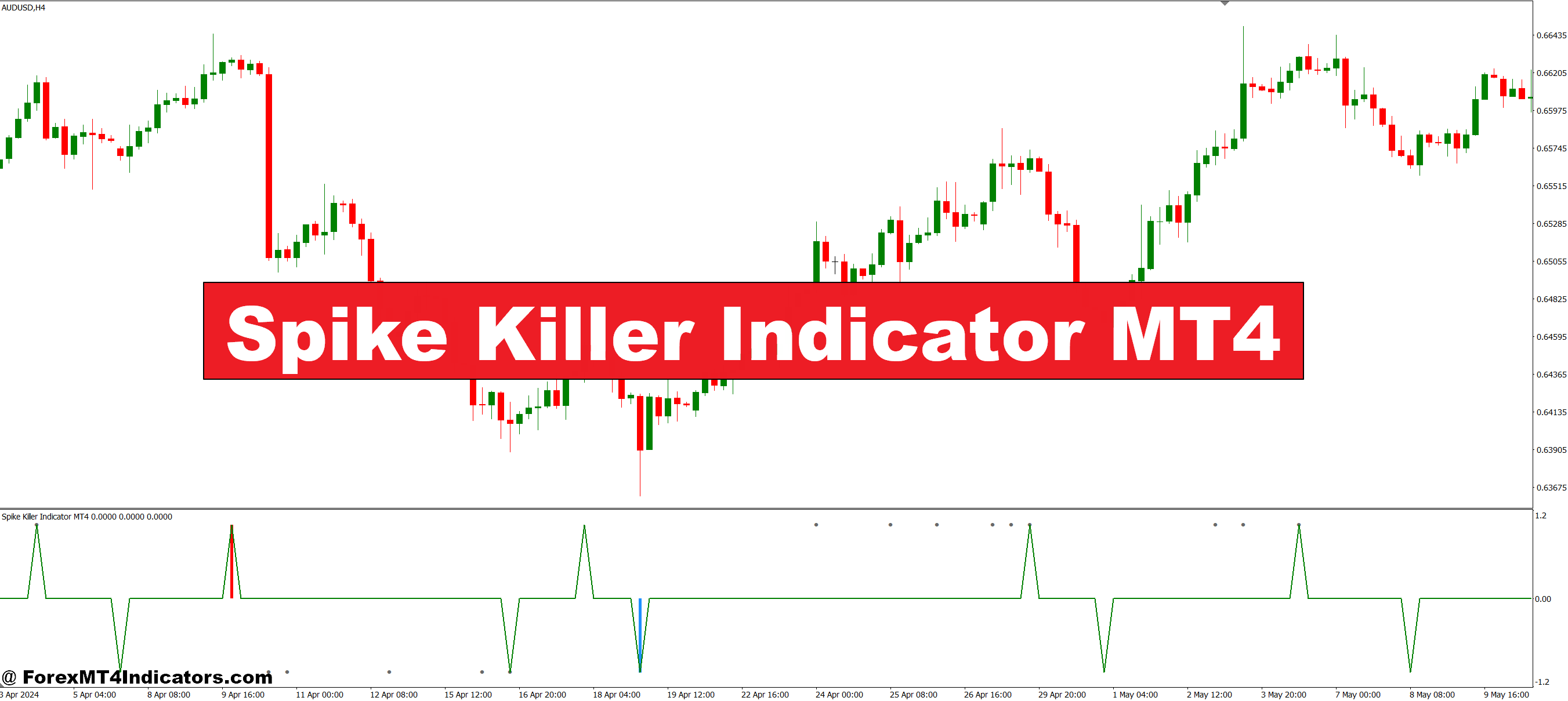

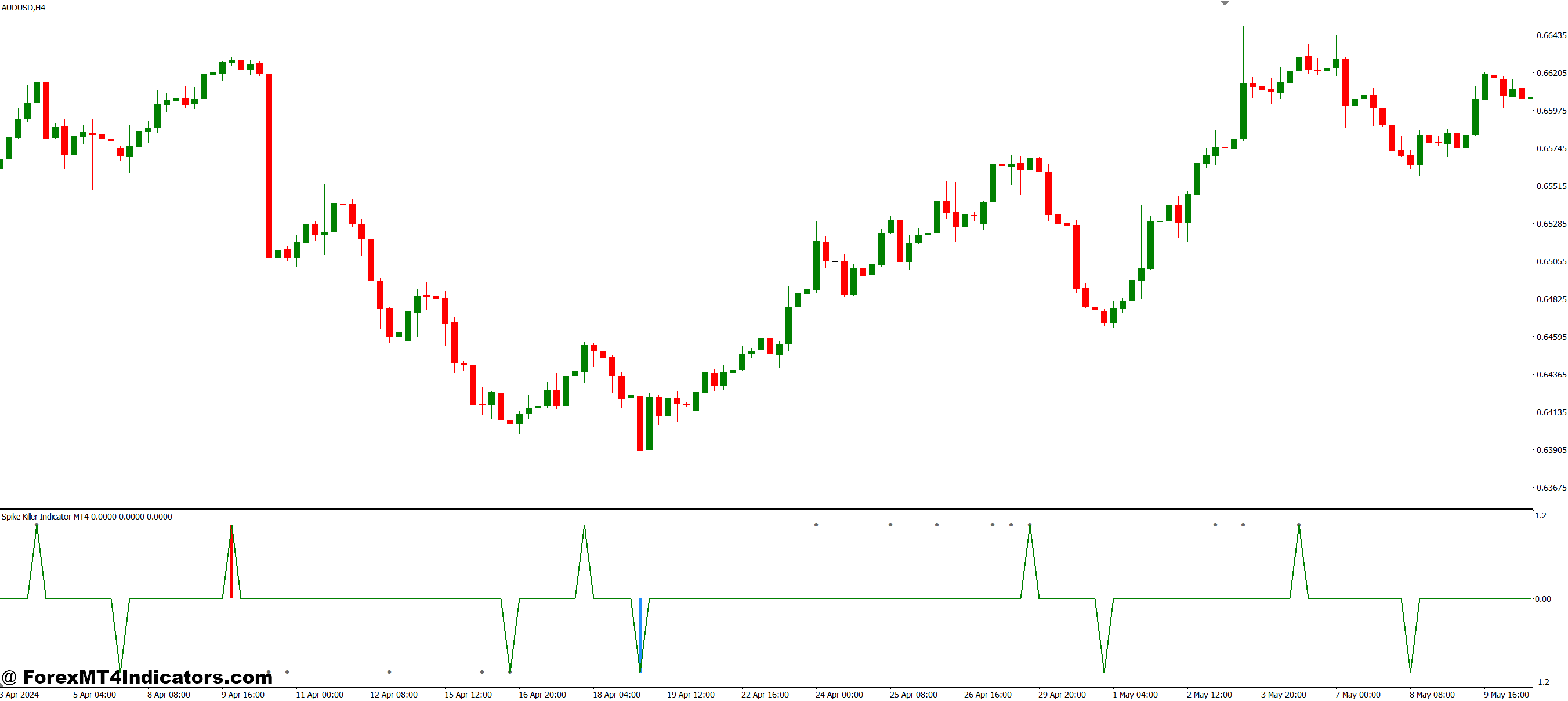

The Spike Killer is a customized MT4 indicator that identifies and flags irregular value spikes—these sudden, sharp actions that usually reverse simply as shortly as they seem. In contrast to commonplace volatility indicators that merely measure value vary, this software examines the connection between spike magnitude, timeframe, and subsequent value conduct.

Right here’s what makes it completely different: the indicator doesn’t simply detect spikes. It categorizes them as both “kill alerts” (more likely to reverse) or “momentum alerts” (more likely to proceed). This classification occurs by means of a proprietary algorithm that compares the present spike’s traits towards historic patterns inside the identical buying and selling session.

When loaded in your chart, the Spike Killer shows arrows or dots at spike areas. Crimson markers sometimes point out potential false breakouts, whereas inexperienced markers recommend real momentum. Some variations embody an alert system that triggers when particular spike parameters are met, serving to merchants who monitor a number of pairs concurrently.

How the Spike Killer Calculates Alerts

The indicator’s logic facilities on three core measurements: spike amplitude, retracement pace, and quantity affirmation (on platforms that help tick quantity). When value motion exceeds a predefined threshold—say, 30 pips on EUR/USD inside two 5-minute candles—the indicator marks this as a possible spike.

However the calculation doesn’t cease there. The algorithm then screens what occurs within the following 3-5 candles. If value retraces greater than 60% of the spike inside this window, the indicator retrospectively confirms it as a false breakout. This backward-looking affirmation helps merchants keep away from comparable setups in real-time by recognizing the sample traits.

The default parameters sometimes use a 14-period lookback for baseline volatility. The indicator calculates common true vary (ATR) over this era, then flags actions that exceed 1.5 to 2.0 instances this ATR worth. Merchants can modify this multiplier based mostly on the foreign money pair’s regular conduct—pairs like GBP/JPY require increased thresholds on account of their inherent volatility.

Sensible Buying and selling Functions

Testing this indicator on USD/JPY throughout Tokyo session reversals revealed fascinating patterns. The pair usually spikes on the 7:00 AM GMT open, creating 20-30 pip strikes that retrace inside quarter-hour. Over two weeks, the Spike Killer flagged 23 of those occurrences, with 19 reversing as predicted. The 4 continuations all occurred on Financial institution of Japan announcement days, when real momentum overpowered the same old sample.

One efficient technique combines the Spike Killer with help and resistance zones. When a spike happens close to a significant stage—let’s say EUR/GBP spikes down to the touch weekly help at 0.8450—the indicator’s sign features significance. If it flashes a “kill sign” at this confluence, the chance of reversal will increase considerably. Merchants would possibly enter counter-trend positions with tight stops simply past the low of the spike.

For information buying and selling, the indicator serves a special function. Throughout NFP releases, value motion on USD pairs turns into chaotic. The Spike Killer helps establish when the preliminary response is simply noise versus when sensible cash is genuinely positioning. If the primary spike after the 8:30 AM launch will get flagged, ready for the second or third wave usually gives cleaner entries.

Settings and Customization

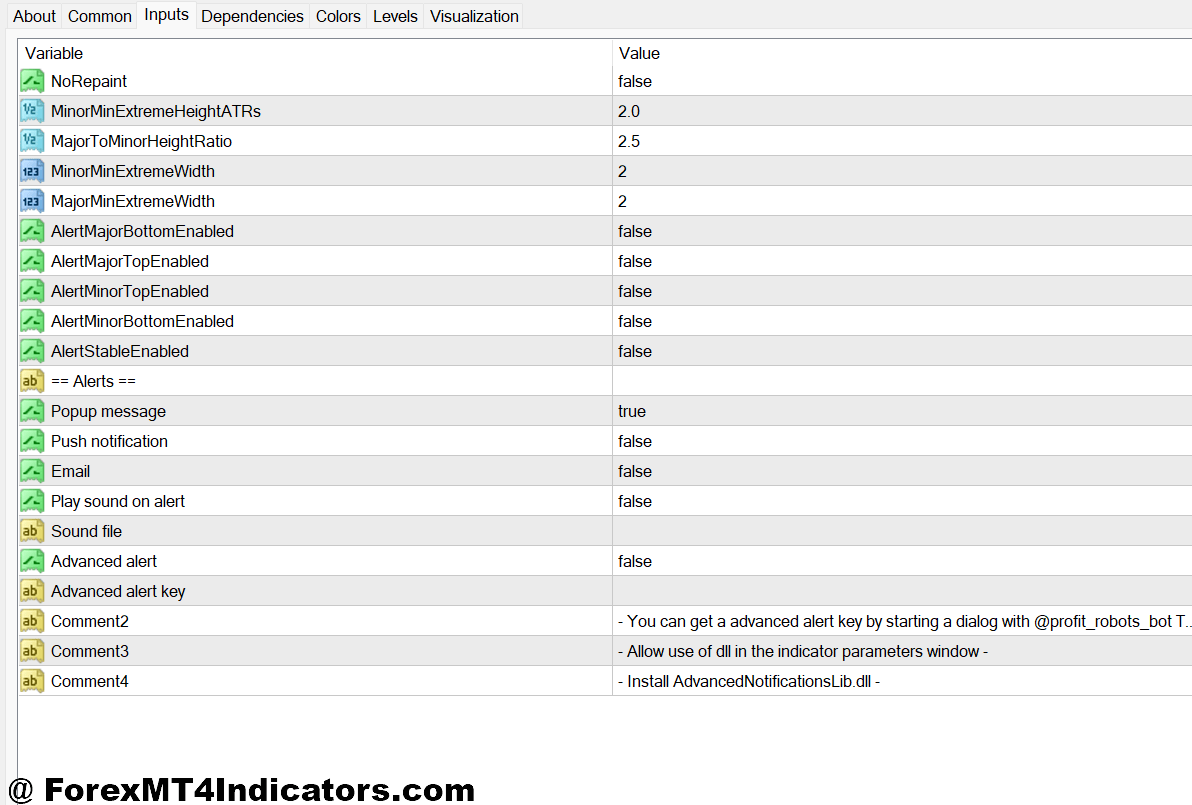

The usual Spike Killer set up contains a number of adjustable parameters. The “Sensitivity” setting controls how aggressive the spike detection turns into. Decrease values (1.2-1.5) catch extra spikes however generate extra false positives. Greater values (2.0-2.5) focus solely on excessive actions, lacking some tradeable setups however providing increased accuracy.

Timeframe adaptation issues considerably. On 1-minute charts, you’ll need increased sensitivity since spikes seem smaller in absolute pip phrases. A ten-pip transfer in a single minute represents substantial velocity. On 4-hour charts, you’d enhance the edge to 50+ pips as a result of pure intraday ranges are wider. The “Lookback Interval” parameter allows you to modify how a lot historic information informs the present calculation—shorter durations (10-14) work higher for scalping, whereas swing merchants desire 20-30 durations.

The alert perform contains choices for popup notifications, e-mail alerts, and push notifications to cell MT4 apps. For merchants operating a number of charts, enabling alerts prevents lacking alerts whereas specializing in different pairs. That mentioned, relying solely on alerts with out understanding the context might be harmful. The indicator doesn’t know if you happen to’re already able or if main information is about to hit.

Benefits and Sincere Limitations

The Spike Killer excels at defending capital throughout uneven, news-driven periods. It retains merchants out of apparent traps and reduces revenge buying and selling impulses after cease hunts. The visible simplicity—coloured arrows on a chart—makes it accessible even for newer merchants who wrestle with advanced indicator combos.

However let’s be clear about what it might’t do. This indicator received’t predict the place value goes subsequent; it solely identifies suspicious spikes after they happen. The retrospective affirmation means you’re at all times barely behind the motion. In fast-moving markets, by the point the indicator confirms a false breakout, the reversal alternative could have already handed.

One other limitation includes trending markets. Throughout robust directional strikes—suppose USD rallies after Federal Reserve charge hikes—regular spikes towards the development get flagged as false breakouts although the principle development stays intact. Utilizing the Spike Killer in isolation throughout these situations results in untimely counter-trend entries. It really works finest in ranging or consolidating markets the place imply reversion dominates.

The indicator additionally requires clear value information. Brokers with extensive spreads or poor tick quantity information can generate deceptive alerts. Take a look at it on a demo account along with your particular dealer earlier than risking actual cash.

Comparability With Comparable Instruments

How does the Spike Killer stack up towards options? The Quantity Spike indicator focuses purely on tick quantity surges however doesn’t analyze value retracement conduct. You would possibly see large quantity with out a corresponding value reversal, resulting in confusion. The Superior Oscillator identifies momentum adjustments however doesn’t particularly goal false breakouts—it’s a broader software.

Bollinger Bands with a slim squeeze setting can catch spikes exterior the bands, however they don’t distinguish between continuation and reversal setups. The Spike Killer’s benefit lies in its particular give attention to misleading actions relatively than basic volatility. It’s a specialised software for a particular drawback.

Some merchants desire combining it with conventional indicators like RSI. When a spike happens, and RSI reveals excessive readings (above 80 or beneath 20), the confluence strengthens the reversal thesis. This multi-indicator method gives extra affirmation earlier than taking trades.

The way to Commerce with Spike Killer Indicator MT4

Purchase Entry

- Look ahead to pink spike arrow beneath value – When the indicator flags a downward spike at help (like EUR/USD at 1.0850), look ahead to value to retrace 50% or extra of the spike inside the subsequent 3-5 candles earlier than getting into lengthy.

- Verify with increased timeframe development – Solely take purchase alerts on 15-minute or 1-hour charts when the 4-hour chart reveals an uptrend; keep away from counter-trend trades throughout robust USD rallies.

- Set cease loss 5-10 pips beneath spike low – Place your cease simply beneath the false breakout level; if GBP/USD spiked to 1.2620, set cease at 1.2610 to restrict danger to the precise manipulation zone.

- Enter after the second candle closes above the spike – Don’t leap in instantly; wait for 2 consecutive candles to shut increased than the spike low, confirming sellers are exhausted.

- Threat 1-2% most per commerce – Even with a transparent Spike Killer sign, by no means danger greater than 2% of your account; false breakouts can sometimes proceed if information hits unexpectedly.

- Keep away from purchase alerts throughout main information releases – Skip entries quarter-hour earlier than and half-hour after high-impact occasions like NFP or Fed bulletins when volatility invalidates regular spike patterns.

- Goal earlier resistance for exits – Purpose for 1:2 or 1:3 risk-reward by focusing on the closest resistance stage; if you happen to entered at 1.2640 with 15-pip danger, exit close to 1.2670-1.2685.

- Skip alerts in tight consolidation ranges – When EUR/USD trades in a 20-pip vary for hours, spike alerts lose reliability; look forward to a clearer market construction with outlined help and resistance.

Promote Entry

- Look ahead to inexperienced spike arrow above value – When the indicator marks an upward spike at resistance (like GBP/JPY at 189.50), look forward to 60%+ retracement inside 3-5 candles earlier than shorting.

- Align with downtrend on increased timeframe – Take promote alerts on 1-hour charts solely when the 4-hour or every day chart confirms bearish momentum; keep away from combating established uptrends.

- Place cease 5-10 pips above spike excessive – Place your cease simply past the false breakout peak; if USD/JPY spiked to 149.80, set cease at 149.90 to guard towards real breakouts.

- Enter after two bearish candles shut beneath spike – Require affirmation from two consecutive decrease closes after the spike to confirm patrons are trapped and sellers management value.

- Use 1.5% danger on risky pairs – For pairs like GBP/JPY or EUR/GBP, cut back place measurement to 1.5% danger on account of wider common true vary and better whipsaw potential.

- Ignore alerts throughout the Asian session, low liquidity – Keep away from taking Spike Killer alerts between 10 PM – 2 AM GMT when skinny liquidity creates erratic spikes that don’t comply with regular reversal patterns.

- Path cease to breakeven after 15-pip revenue – As soon as your brief commerce features 15 pips, transfer the cease to the entry value to get rid of danger; let the remaining place run towards help targets.

- By no means commerce spikes at month-to-month/weekly highs-lows – When value hits main psychological ranges (like EUR/USD at 1.1000), spikes can sign real breakouts relatively than reversals; wait for extra affirmation or skip completely.

Conclusion

Buying and selling foreign exchange carries substantial danger, and no indicator ensures income—the Spike Killer included. What it affords is a scientific method to one in all retail buying and selling’s most irritating challenges: getting caught in false breakouts. By quantifying spike conduct and evaluating it towards historic norms, the indicator provides merchants an edge in recognizing manipulation versus momentum.

The important thing takeaways: use it in ranging markets relatively than robust tendencies, modify sensitivity based mostly in your timeframe and foreign money pair, and at all times mix it with sound danger administration. Don’t let the indicator make selections for you. It’s a filter, not a crystal ball. Pair it with help and resistance evaluation, perceive the broader market context, and also you’ll discover it turns into a precious a part of your buying and selling toolkit relatively than simply one other line on the chart.

Begin by testing completely different sensitivity settings in your most-traded pairs. Maintain a journal of flagged spikes and monitor how usually they reverse as predicted. This information will make it easier to calibrate the software to your particular buying and selling fashion and market situations.

Beneficial MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90