The market has been considerably tough to commerce in current months; most of the main foreign money pairs have been quite erratic and “uneven”, and till not too long ago, very quiet. There’s ONLY ONE SINGLE THING that stored the worthwhile dealer from shedding cash throughout market circumstances like these: PATIENCE. Probably the most IMPORTANT factor that I’ve realized over my 10+ years buying and selling the markets, is that persistence actually does pay, and what’s extra, a scarcity of persistence will make YOU pay.

The market has been considerably tough to commerce in current months; most of the main foreign money pairs have been quite erratic and “uneven”, and till not too long ago, very quiet. There’s ONLY ONE SINGLE THING that stored the worthwhile dealer from shedding cash throughout market circumstances like these: PATIENCE. Probably the most IMPORTANT factor that I’ve realized over my 10+ years buying and selling the markets, is that persistence actually does pay, and what’s extra, a scarcity of persistence will make YOU pay.

The “Snowball impact” is an excellent metaphor to elucidate the significance of persistence to a dealer and likewise the how a scarcity of persistence can rapidly destroy buying and selling accounts…

Wikipedia defines the phenomenon referred to as the “Snowball impact” as “…a figurative time period for a course of that begins from an preliminary state of small significance and builds upon itself, changing into bigger (graver, extra severe), and likewise maybe doubtlessly harmful or disastrous (a vicious circle, a “spiral of decline”), although it is likely to be useful as a substitute (a virtuous circle).”

Right here’s what I might let you know if we had been buying and selling aspect by aspect:

Think about me ‘banging in your buying and selling desk’ making an attempt to get this level by way of to you: THE SINGLE BIGGEST REASON YOU’RE EITHER GOING TO MAKE IT OR BREAK IT AS A TRADER IS BEING ABLE TO WAIT, WAIT, WAIT…after which wait some extra….and THEN you POUNCE and go arduous while you see a setup that’s so apparent you actually don’t have to consider whether or not or to not take it.

In uneven buying and selling circumstances, when the market is behaving erratically or just ‘backing and filling’ on itself, the first factor that separates profitable merchants from struggling merchants, is the flexibility to muster and keep excessive persistence, following a buying and selling plan with obsessive self-discipline and executing trades with out hesitation.

Poker, chess and different technique video games are received when the opponent ‘walks’ into your lure. The good thoughts video games like poker, chess and buying and selling, are all received by way of technique, self-discipline and execution with out hesitation. The technique half is the place persistence is available in, having an efficient buying and selling technique means nothing if you happen to shouldn’t have the persistence to attend on your technique to offer you high-probability entry indicators.

Having this persistence as you commerce, will work to “snowball” your buying and selling success by reinforcing the truth that buying and selling with low frequency shouldn’t be solely simpler, far much less aggravating and time consuming than high-frequency buying and selling, however can also be the “key” to buying and selling success for many merchants. Conversely, merchants who’ve little or no persistence find yourself making a “snowball” of more and more worse buying and selling, as a result of they develop more and more determined and emotional the extra they over-trade and lose cash out there. Thus, your job is to make the snowball impact be just right for you quite than towards you, and the best way you do that’s by merely sitting in your palms till a “rattling” apparent commerce setup comes alongside…

A case research of persistence in “motion”

As of late, I’m so relaxed with regard to how usually I commerce, that I’ll solely commerce one or two instances a month. A part of it’s because I’ve been very busy not too long ago with redesigning my web site as you could have observed and with planning a seminar in Singapore for my members. Nonetheless, a humorous factor hit me as I used to be so busy not too long ago, I observed that while I used to be nonetheless staying in-touch with the markets every day, I used to be not analyzing the charts as usually as I often do and I additionally was not likely seeing any apparent commerce setups.

As of late, I’m so relaxed with regard to how usually I commerce, that I’ll solely commerce one or two instances a month. A part of it’s because I’ve been very busy not too long ago with redesigning my web site as you could have observed and with planning a seminar in Singapore for my members. Nonetheless, a humorous factor hit me as I used to be so busy not too long ago, I observed that while I used to be nonetheless staying in-touch with the markets every day, I used to be not analyzing the charts as usually as I often do and I additionally was not likely seeing any apparent commerce setups.

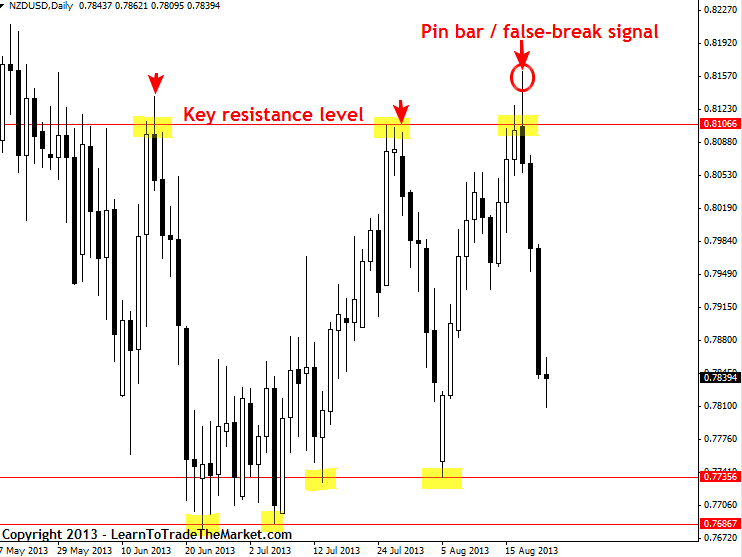

Then, on Monday of this week, a really very apparent pin bar reversal / false-break sign fashioned on the Kiwi/Greenback each day chart at a key degree of resistance up close to 0.8105 which we had been discussing and watching within the members’ group over the earlier weeks.

I had not traded for a few week earlier than this sign fashioned, I had merely been busy doing different issues whereas casually scanning the markets for setups every day; nothing intense or over-analytical. Then, after I noticed this setup within the NZDUSD which we talked about in our August 19th commentary, I knew that it was a sound commerce and one thing I needed to threat some cash on, so I acted rapidly to setup my entry order, cease loss and revenue goal after which went to mattress. The commerce really hit my goal as I used to be boarding a aircraft to Singapore the subsequent day.

Now, just a bit “inside data” right here, personally, I method buying and selling from the mindset of making an attempt to do every thing to not be in a commerce. dealer will attempt to discover issues flawed with a commerce setup earlier than getting into it…if in case you have a tough market with a variety of chop, staying flat on the sidelines is a no brainer for the profitable dealer. Conversely, these are often the very same instances when the beginner / struggling dealer can not preserve his or palms of their pockets and continues to attempt to “drive” trades out of the market, ultimately giving again any current earnings they could have made. I mentioned a “case research” of this widespread buying and selling error in my article on the best way to discover your buying and selling ‘mojo’. Simply keep in mind; in a quiet market, persistence is the one factor that may prevent, that’s an important factor to remove from at this time’s lesson.

I wasn’t nervous about this NZDUSD commerce after I put it on, as I mentioned earlier, my revenue goal really get hit whereas I used to be on an airplane to Singapore. I don’t fear about all of the little intra-day actions towards my positions, I simply let the trades come to me after which execute my orders, if the commerce ends in a loss, then I can dwell with that as a result of at the very least I do know I waited for setup that qualifies below my buying and selling plan and I didn’t over-trade. The one time you need to really feel remorse a few loss is if you happen to traded while you knew you shouldn’t have otherwise you risked greater than you had been snug with shedding.

Right here’s the NZDUSD each day chart displaying the pin bar / false-break promote sign that lots of my members and I traded this week. I’ll typically wait two or three weeks for an apparent value motion sign like this to type:

A number of issues are price noting about this commerce:

1) This was not a hindsight name. My members and I had been discussing the important thing resistance close to 0.8105 within the members’ each day commentary and within the discussion board for about one or two weeks earlier than the sign fashioned there. That is referred to as anticipating commerce indicators and is a key a part of my buying and selling method and relates again to that entire “technique in thoughts video games” idea I mentioned earlier on this lesson.

2) I couldn’t fault this sign. If I can not discover something flawed with a selected sign than I’ll commerce it. Usually, I do certainly discover issues flawed with indicators, and that method has saved me numerous quantities of cash through the years while different merchants who’re less-picky had been shedding cash on the identical indicators almost definitely.

3) I had not traded for some time earlier than this NZDUSD sign fashioned, I used to be ready within the “darkness” like a sniper ready for his goal, after which when it fashioned, I had been anticipating its arrival and so I acted with complete confidence within the setup, win or lose.

4) As I used to be doing through the two weeks main as much as this sign; on a regular basis, casually scan your watch record of markets that you just choose to commerce, however don’t sit there all day observing them. Checking in on the finish of the buying and selling day gives you a transparent image of what occurred that day, and the closing value on the each day chart is essential as it’ll make it easier to see false-break kind indicators just like the NZDUSD pin bar false-break within the chart above.

If you end up posting on boards asking different folks if you happen to ought to take a selected setup or not, you most likely shouldn’t take it. I don’t threat my cash out there until there’s a setup so rattling apparent that I’ll really feel silly for not taking it, however after I do go in, as I mentioned earlier than, I’ll go in with a place measurement that’s huge, however that I’m snug with shedding as a result of I consider within the setups I commerce.

How the life-style of a professional dealer helps their buying and selling success

Correct buying and selling habits (buying and selling with persistence) breeds buying and selling success which breeds a “dealer life-style” which in and of itself works to additional help buying and selling success…it truly is a “snowball impact”. Let me clarify this extra clearly…

Correct buying and selling habits (buying and selling with persistence) breeds buying and selling success which breeds a “dealer life-style” which in and of itself works to additional help buying and selling success…it truly is a “snowball impact”. Let me clarify this extra clearly…

The profitable dealer would possibly select to go play a spherical of 18 holes after placing a commerce on, or perhaps go fishing together with his buddies, and so forth. In the meantime, the struggling or failing dealer is sitting in entrance of his pc display screen biting his finger nails at each little pip that strikes towards his place. Which of those two merchants do you suppose is buying and selling in concord with the market and buying and selling with a stress-free buying and selling mindset? Clearly, it’s the dealer out having fun with his life and letting the market do the ‘arduous work’.

He’s doing this as a result of he has lengthy since found out that what the beginner merchants are doing; sitting in entrance of their charts, over-analyzing every thing and over-trading, is each a waste of time and quite a bit much less more likely to make him cash within the long-run.

The distinction between an “obsessed” dealer who must be out there on a regular basis and the profitable dealer, is just that the profitable dealer has realized to ENJOY THE DISCIPLINE AND MODERATION and has realized that THAT is what’s making him (or her) worthwhile. In the meantime, the unsuccessful dealer remains to be hooked on the “hope” of buying and selling and can’t appear to consider that doing “much less” will finally end in him making more cash ultimately. Thus, the struggling dealer will commerce away as if they’ve some kind of dependancy to the market. A really comparable analogy may be drawn between alcoholics and people who drink socially and moderately; the alcoholic permits alcohol to destroy their life while the accountable drinker has self-control and will get to take pleasure in a number of drinks right here and there and go about their lives efficiently. In different phrases, simply as you should management your self when ingesting alcohol, you should management your self when buying and selling the market, by having persistence and never changing into hooked on being in a commerce.

Good merchants who get to benefit from the “dealer life-style” additionally profit from it, as a result of dwelling their life fills within the time and retains them busy and makes them much less more likely to intervene with their trades or over-trade. Clearly, I can not converse for “each” profitable dealer on this planet, however this lesson has given you some very clear perception into what has labored for me through the years and I hope you employ it to your benefit. If you wish to study extra about my affected person value motion buying and selling method, checkout my buying and selling course for extra info.