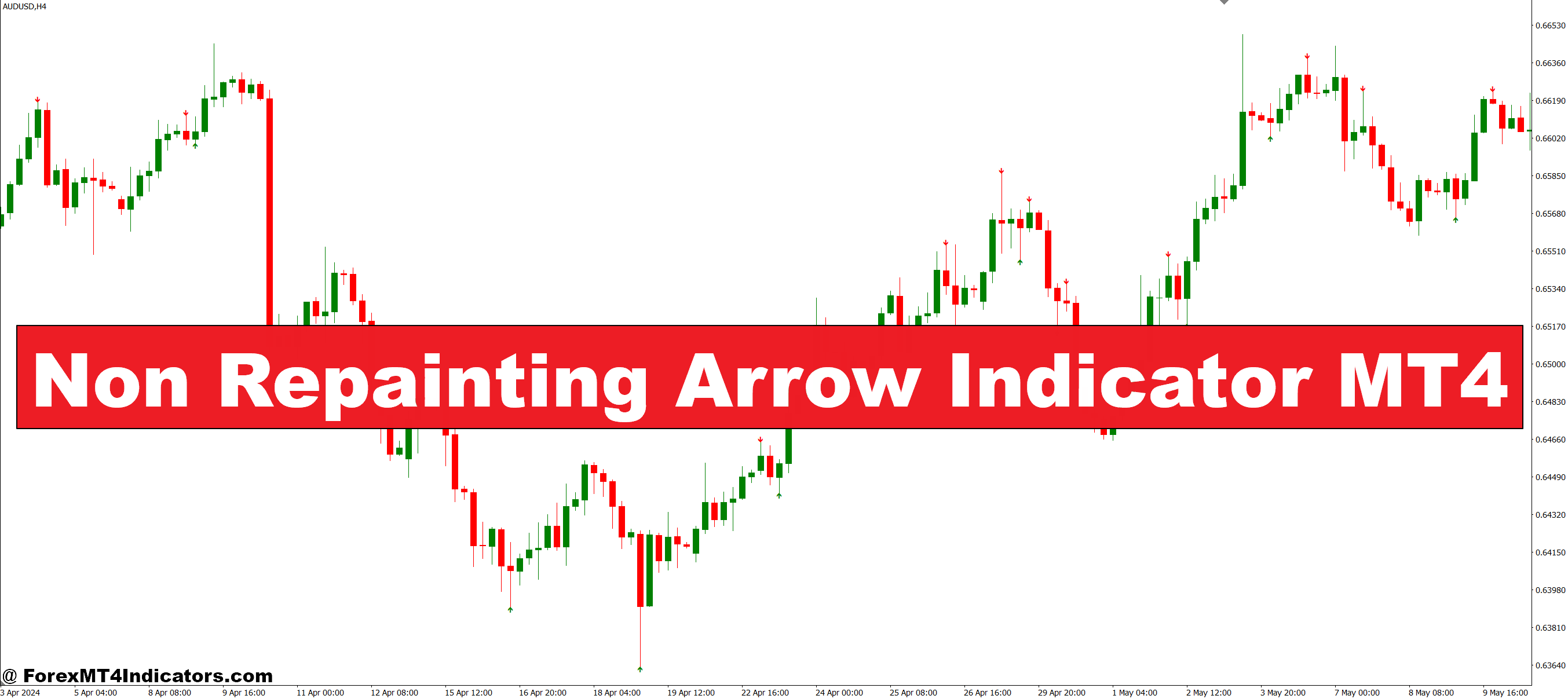

A non repainting indicator commits to its indicators. As soon as an arrow prints on a closed candle, it stays there—interval. The code doesn’t look again and redraw based mostly on future value motion.

Most repainting indicators use look-ahead features or recalculate values on present bars. They may present a purchase arrow at 1.0850 on EUR/USD, however when the subsequent candle closes at 1.0840, that arrow shifts or disappears completely. Merchants who acted on the unique sign discover themselves in shedding positions based mostly on knowledge that now not exists within the indicator’s reminiscence.

Non repainting variations keep away from this lure by way of strict coding self-discipline. They calculate indicators on closed candles solely, utilizing confirmed knowledge. When a selected situation triggers—say, a shifting common crossover mixed with momentum affirmation—the arrow seems and turns into everlasting historical past. This creates accountability. You possibly can backtest the precise indicators you’d obtain in stay buying and selling.

How These Indicators Calculate Entry Alerts

The mechanics fluctuate, however high quality non repainting arrow indicators usually mix a number of filters. A fundamental model may observe:

- Value construction: Greater highs and better lows for uptrends

- Momentum affirmation: RSI crossing above 50 or MACD histogram turning constructive

- Volatility examine: ATR readings to keep away from indicators throughout flat, uneven durations

When all situations align on a closed candle, the indicator prints an arrow. That’s the entry sign. The important thing element is a closed candle. If the worth remains to be forming the present bar, the indicator waits. No untimely indicators, no repainting.

Take the GBP/JPY on a 15-minute chart in the course of the London session. Value breaks above a consolidation zone at 187.20. The indicator checks: development filter confirms upward bias, RSI reads 58, and ATR reveals ample motion. A blue arrow seems after the 15-minute candle closes at 187.35. Merchants getting into on the subsequent candle’s open (187.36) have a documented sign they will belief.

Sensible Software Throughout Totally different Buying and selling Kinds

Scalpers use these indicators on 1-minute and 5-minute charts, although the sign frequency might be intense. Through the New York-London overlap, a dealer may see 8-12 arrows on USD/CAD inside an hour. Not all will likely be winners, however a minimum of they’re actual indicators, not phantom alternatives that regarded good solely in replay mode.

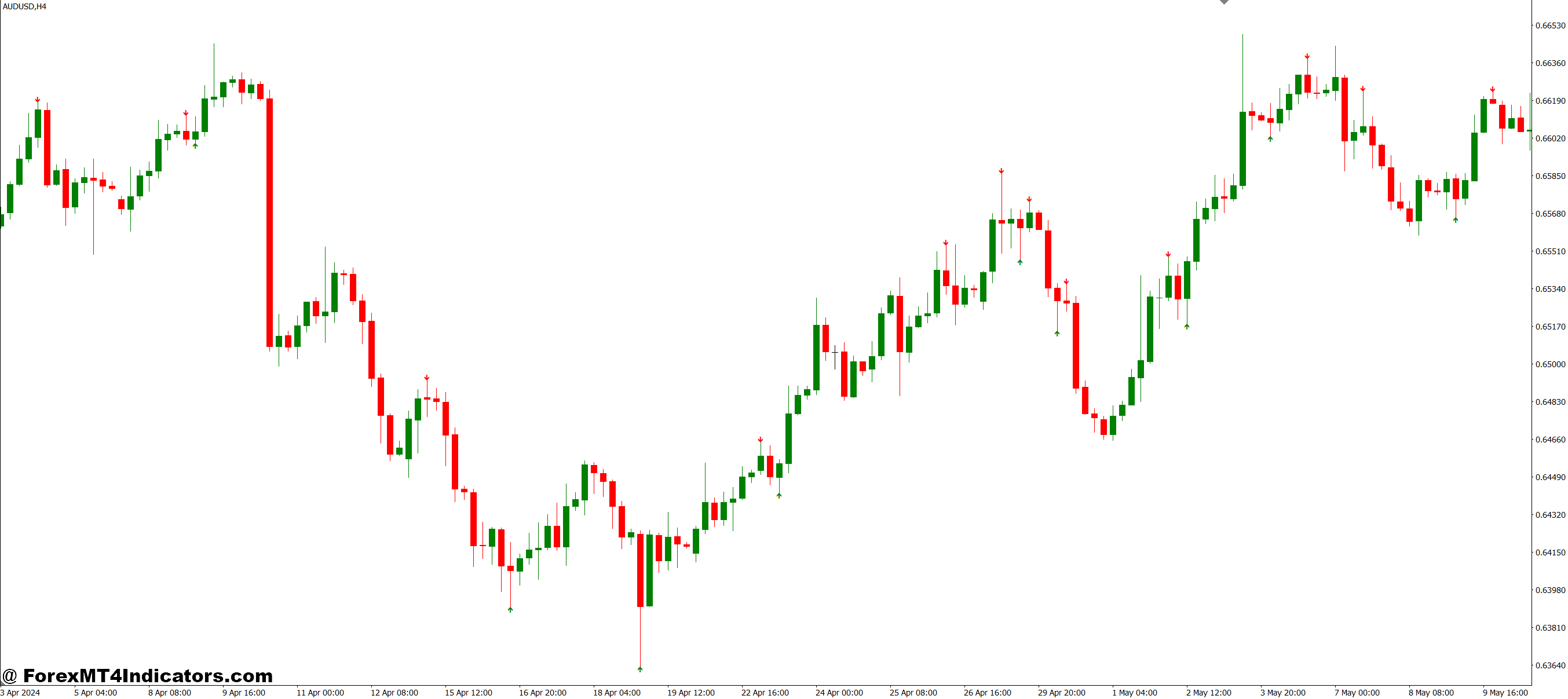

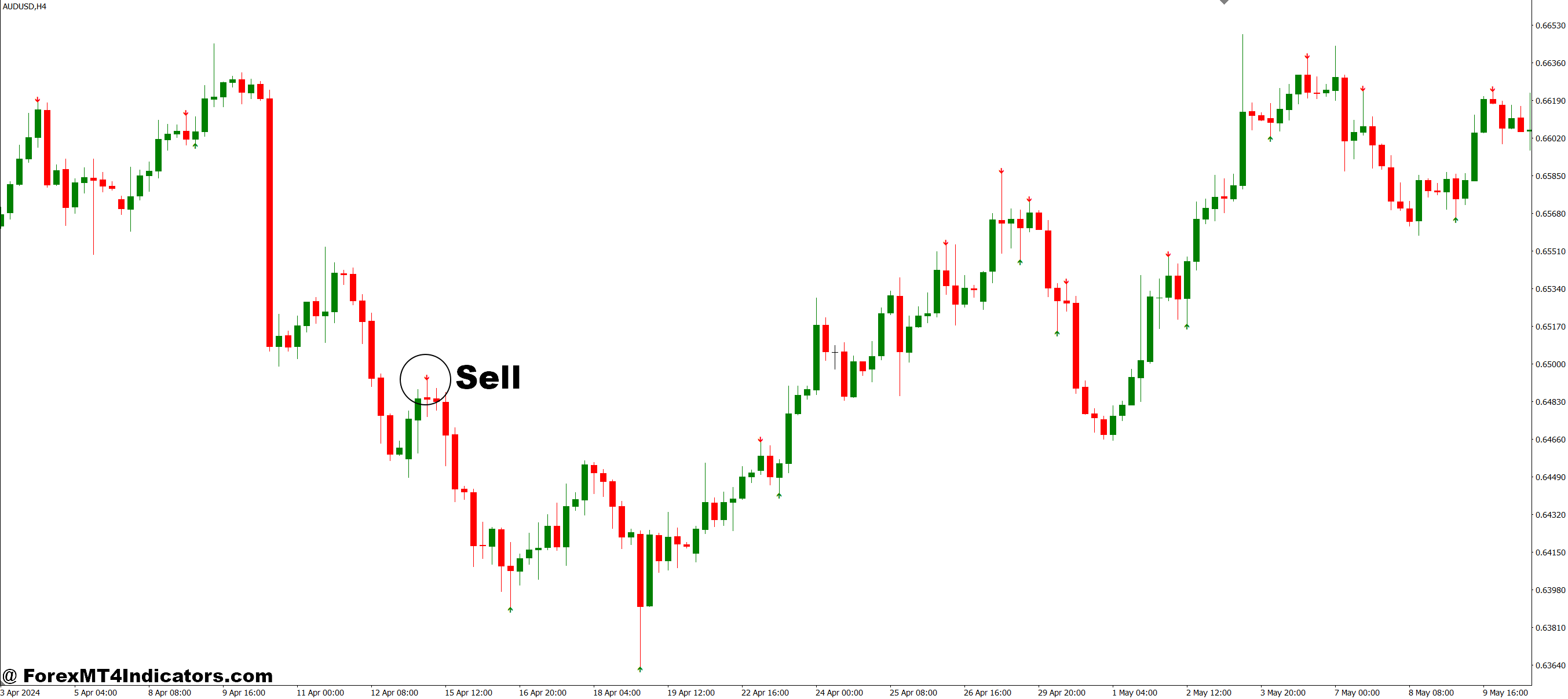

Swing merchants choose the 4-hour or each day timeframes. The arrows seem much less incessantly—possibly 2-3 instances per week on a single pair—however they carry extra weight. A promote arrow on the AUD/USD each day chart at 0.6420, confirmed by a broader downtrend construction, presents the next likelihood setup than dozens of 1-minute indicators.

The indicator works greatest when merchants layer it with their current system. Utilizing it alone invitations hassle. Mix arrow indicators with assist and resistance ranges, development evaluation, or session timing. For example, a purchase arrow that seems proper at a key assist zone carries extra conviction than one printed in the midst of nowhere.

Settings and Customization Choices

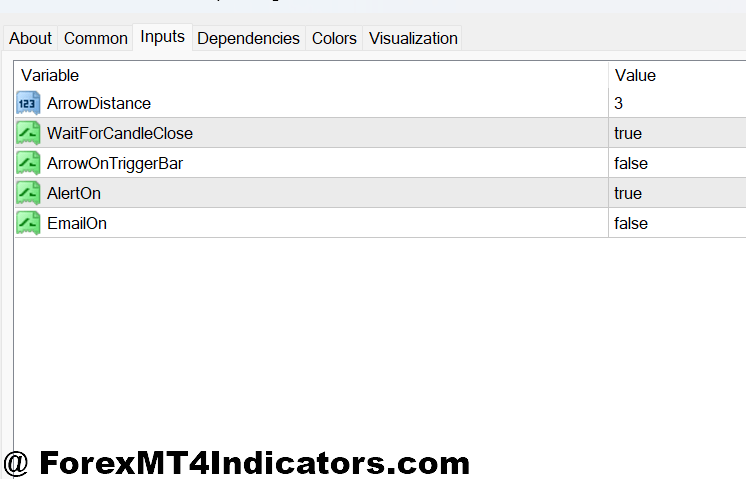

Most MT4 variations let merchants regulate sensitivity. The primary parameters embrace:

- Interval settings: Greater values (20-30) filter out noise however cut back sign frequency. Decrease values (5-10) generate extra arrows however enhance false indicators. Testing on the EUR/USD 1-hour chart, a 14-period setting produced about 15 indicators per week, whereas a 7-period setting jumped to 40+ indicators with noticeably decrease accuracy.

- Alert varieties: Audio notifications, e mail alerts, or push notifications to cell. Merchants managing a number of charts respect cell alerts—no must stare at screens ready for the subsequent arrow.

- Shade schemes: Customizable arrow colours assist distinguish purchase from promote indicators shortly. Some merchants choose inexperienced/purple, others use blue/orange to keep away from emotional shade associations.

The hazard is over-optimization. Spend three hours tweaking settings to perfection on historic knowledge, and also you’ve in all probability curve-fit the indicator to previous value motion. It gained’t maintain up in stay markets. Begin with default settings, commerce them for 2 weeks, then make minor changes based mostly on precise outcomes.

Benefits That Truly Matter

- Consistency in backtesting: Historic outcomes match ahead efficiency as a result of indicators don’t change retroactively. When backtesting reveals 58% win price with 1.8 risk-reward ratio, that knowledge has legitimacy.

- Psychological readability: Figuring out arrows gained’t disappear removes second-guessing. The sign appeared, you took it otherwise you didn’t. No ambiguity about whether or not your entry was “actually” an indicator sign or your creativeness.

- Decreased display screen time: Alerts deal with the monitoring. Set them up, stroll away, return when real alternatives emerge. Significantly precious for merchants with day jobs who can’t watch charts repeatedly.

That mentioned, limitations exist. No indicator catches each transfer. Through the 2023 USD power surge, even stable non repainting arrows missed the preliminary thrust greater on a number of pairs as a result of momentum indicators lagged the breakout. The software identifies potential entries; it doesn’t predict market regime modifications.

How It Compares to Well-liked Alternate options

Commonplace shifting common crossovers don’t repaint however usually lag considerably. By the point the 50 EMA crosses the 200 EMA on the GBP/USD each day chart, the development transfer is half over. Arrow indicators incorporating quicker momentum components catch tendencies earlier.

Oscillator-based methods like Stochastic or RSI present entry indicators however require interpretation. When RSI hits 35, is {that a} purchase sign or only a pause in a downtrend? Arrow indicators resolve for you, eradicating discretionary guesswork (for higher or worse).

Value motion purists may argue that arrows create dependency. There’s fact there. Merchants who rely solely on indicator arrows usually wrestle when market situations shift exterior the indicator’s parameters. The 2020 COVID crash noticed many algorithmic indicators fail spectacularly as a result of volatility spiked past historic norms.

The Actuality Examine Each Dealer Wants

Right here’s the factor: a non repainting arrow indicator is a software, not a cash printer. It removes one drawback (sign repainting) however doesn’t resolve elementary buying and selling challenges like danger administration, place sizing, or buying and selling psychology.

A dealer utilizing this indicator with poor danger administration—risking 5% per commerce with no cease losses—will nonetheless blow their account. The arrows could be correct 60% of the time, however three consecutive losers at 5% every means a 15% drawdown earlier than any wins materialize.

And be careful for distributors claiming “90% accuracy” or “assured earnings.” Any arrow indicator, repainting or not, faces market randomness. Foreign exchange markets whipsaw. Central financial institution bulletins create chaos. Generally value simply does what it needs, indicators be damned.

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings, and previous efficiency by no means ensures future outcomes. Merchants ought to solely danger capital they will afford to lose completely.

Methods to Commerce with Non Repainting Arrow Indicator MT4

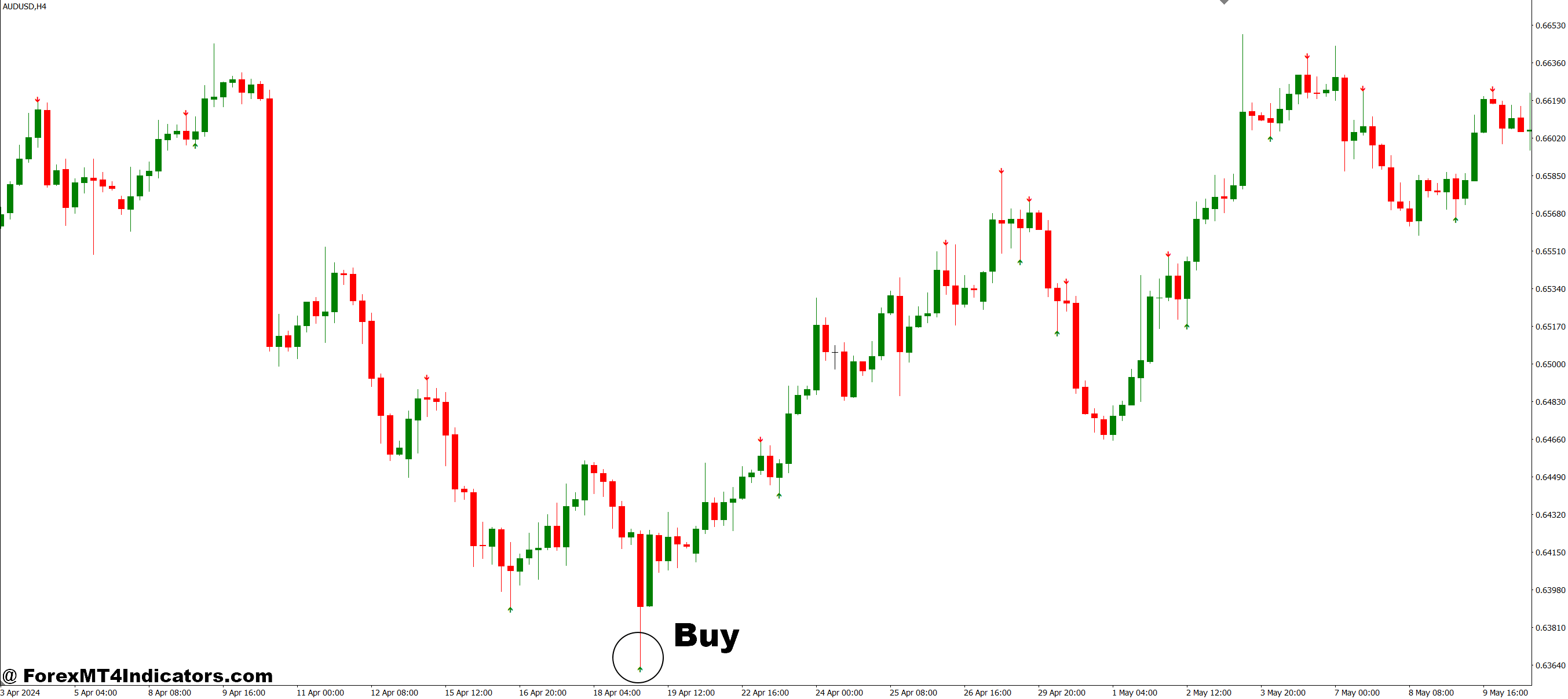

Purchase Entry

- Look forward to candle shut – By no means enter when the arrow first seems on a forming candle. Let the present bar shut fully, then enter on the open of the subsequent candle to keep away from false indicators on EUR/USD or any main pair.

- Affirm the development path – Solely take purchase arrows when the worth is above the 50-period shifting common in your chosen timeframe. A purchase sign at 1.0850 on the EUR/USD 1-hour chart means nothing if the 4-hour development is clearly bearish.

- Examine current assist ranges – Purchase arrows showing inside 10-20 pips of key assist zones carry the next likelihood. If GBP/USD prints a sign at 1.2650 and assist sits at 1.2640, that’s confluence value performing on.

- Set your cease loss 5-10 pips under the arrow candle low – On a 15-minute chart, if the purchase arrow kinds with a low at 1.0835, place your cease at 1.0825. This protects towards fast reversals with out giving the commerce extreme room.

- Threat solely 1-2% per sign – Don’t let a clean-looking arrow tempt you into risking 5% of your account. Even non repainting indicators produce shedding trades 40-45% of the time throughout uneven situations.

- Keep away from arrows throughout main information releases – Skip any purchase sign showing quarter-hour earlier than or after NFP, FOMC, or central financial institution bulletins. Volatility spikes create whipsaws that invalidate technical indicators no matter indicator high quality.

- Goal a minimal 1.5:1 reward-risk ratio – In case your cease is 20 pips, purpose for a minimum of 30 pips revenue. Shopping for arrows on the EUR/USD each day charts can assist 100-150 pip targets, whereas 5-minute indicators hardly ever justify greater than 15-20 pips.

- Skip indicators in tight consolidation ranges – When value has been caught in a 30-pip vary on GBP/USD for the previous 4 hours, that purchase arrow is probably going a lure. Look forward to a transparent breakout first.

Promote Entry

- Affirm candle completion earlier than getting into – The promote arrow should seem on a completely closed bar. Coming into mid-candle on a 4-hour chart means you’re buying and selling a sign that hasn’t been validated but.

- Confirm downtrend alignment – Solely act on promote arrows when value trades under the 50-period MA in your timeframe. A promote sign at 1.0920 on EUR/USD 1-hour is suicide if the each day chart reveals a robust uptrend.

- Search for resistance confluence – Promote arrows inside 10-20 pips of main resistance ranges provide higher odds. If USD/JPY prints a sign at 148.80 and resistance clusters at 149.00, that’s a high-probability brief setup.

- Place stops 5-10 pips above the sign candle excessive – For a promote arrow on GBP/USD 15-minute chart with a excessive at 1.2785, set your cease at 1.2795. Tight sufficient to restrict injury, unfastened sufficient to keep away from random spikes.

- By no means danger greater than 2% on a single arrow – Even the cleanest promote sign can fail when market sentiment shifts. Hold place sizes manageable so three consecutive losses don’t cripple your account.

- Ignore indicators throughout low liquidity classes – Promote arrows showing in the course of the Asian session on EUR/USD usually lack follow-through. The actual strikes occur in the course of the London and New York overlap when quantity helps directional momentum.

- Goal for two:1 minimal reward-risk – If risking 15 pips, goal a minimum of 30 pips. On each day charts, promote indicators on USD/CAD can justify 150-200 pip targets, however 1-minute scalps hardly ever ship greater than 8-10 pips reliably.

- Reject arrows after prolonged downtrends – When GBP/JPY has already dropped 200 pips in two days, that contemporary promote arrow may catch the ultimate 20 pips earlier than a reversal. Look forward to consolidation and a brand new development leg as an alternative.

Conclusion

Check the indicator on a demo account for a minimum of 30 days. Observe each sign: date, pair, timeframe, entry value, cease loss, take revenue, consequence. After 50-100 trades, patterns emerge. Perhaps it performs higher on trending pairs like USD/JPY versus uneven ones like EUR/GBP. Maybe 4-hour indicators outperform 15-minute noise.

Use the arrows as affirmation, not gospel. When your development evaluation says “purchase,” your assist/resistance ranges align, and the arrow agrees—that’s a higher-probability setup. If the arrow says purchase, however all the pieces else screams promote, skip it.

Set reasonable expectations. A win price round 55-60% with correct risk-reward ratios builds accounts steadily. Chasing 80%+ accuracy results in over-optimization and eventual disappointment. Settle for losses as a part of the method. Even the most effective non repainting indicators produce shedding trades—they simply do it actually, with out erasing their errors from historical past.

Really helpful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: VIP90