I get loads individuals asking me what markets I commerce. The brief reply is that I observe a handful of highly-liquid, main markets that present me with the most effective worth motion buying and selling alternatives.

I get loads individuals asking me what markets I commerce. The brief reply is that I observe a handful of highly-liquid, main markets that present me with the most effective worth motion buying and selling alternatives.

A giant drawback that inhibits many merchants’ success is that they’re specializing in too many markets along with all the opposite buying and selling variables they’re overly-focused on. From information occasions to indicators to having 50 totally different charts open in your buying and selling platform, there’s a unending provide of knowledge and variables {that a} dealer can get caught up in making an attempt to digest on a regular basis. It actually is sufficient to drive you mad if you happen to enable it to. So what’s the answer to avoiding this data-driven insanity?

The answer is to scale-back the quantity of knowledge you’re making an attempt to make sense of every day as you analyze the markets. Placing the chances in your favor just isn’t performed by making an attempt to maintain monitor of 30 or 50 totally different markets and frantically scouring all of them for alerts every day. It’s performed by develop into a market specialist; a dealer who has an intimate relationship with small handful of his or her favourite markets…

Observe, in case you are new to Foreign currency trading it’s going to assist if you happen to first undergo my article that outlines what the main foreign exchange forex pairs are in comparison with the minors and exotics.

Why I solely commerce a handful of markets

Simply since you can do one thing doesn’t imply you ought to. You may go attempt to wrestle a Saltwater crocodile, however that doesn’t imply it’s best to. You may eat McDonald’s every single day, however clearly that doesn’t imply it’s best to. You get my level right here I’m certain…

In buying and selling it’s actually no totally different; simply since you can commerce all of the markets supplied by your dealer doesn’t imply you ought to. Regardless of this seemingly apparent reality, many merchants confuse and frustrate themselves on a regular basis by making an attempt to trace and commerce too many markets.

Most merchants have entry to tons of of markets from around the globe. I even have entry to tons of of markets, but I get up every day with a really small variety of charts open on my buying and selling platform. More often than not, I’m centered on 4 to six main forex pairs, a few inventory indexes and some commodities (extra on these later). What I’m actually NOT doing is scrolling by 50 totally different markets and over-loading my mind with pointless bull$%@! that’s simply going to lead to me taking a low-probability commerce that I don’t want or wish to take.

Changing into a specialist in your chosen markets

Specialization is a key element to success out there, in addition to nearly all the pieces else in life (assume docs, legal professionals, entrepreneurs who begin firms, these are all specialists as a result of they know loads about one very particular area, this enables them to command excessive compensation because of this).

You aren’t going to develop into a profitable dealer if you happen to don’t study to concentrate on and grasp one buying and selling technique. It’s additionally going to be practically unattainable so that you can discover constant buying and selling success if you happen to don’t develop into a specialist in a small handful of your favourite markets. You don’t have to observe 100 markets, simply those you concentrate on and are most comfy with, it’s good to develop an intimate relationship with these markets.

I would like you to develop a really shut really feel for the conduct of a small group of main markets, as a result of doing so goes to enhance your buying and selling in additional methods than you would possibly assume:

Creating an intimate relationship with a handful of markets, will enhance your buying and selling by:

- Holding you retain your thoughts clear and clear, and ‘forcing’ self-discipline. In case you’ve solely received XYZ in your market watch checklist then you definately’re naturally going to be extra centered and this may help you in changing into a specialist in these markets in addition to remove numerous pointless / distracting variables out of your buying and selling platform and buying and selling mindset.

- Serving to you keep away from double-risk. You don’t wish to double-up if you happen to see the identical sign on correlated markets (a quite common mistake many newbies make). Typically occasions, even skilled merchants will make the error of coming into a number of trades on the similar time as a result of they see good alerts on many markets / pairs. Specializing in a small handful of markets will assist you to take away the chance of getting tempted into being in too many positions on the similar time, even if you happen to assume you possibly can management the temptation.

- Having much less markets reduces the prospect that you simply’ll be out there an excessive amount of. Limiting your selections reduces the chance of over-trading, and over-trading might be the primary cause most merchants fail to generate profits over the long-run.

- Decreasing your urge to commerce. The much less pairs you take a look at, the much less possible you can be to really feel an ‘urge’ to enter a commerce. Merchants are likely to enter trades far too usually simply as a result of they wish to be out there, not as a result of there’s a top quality worth motion sign current. Specializing in a small handful of main markets will assist you to focus extra on high quality of trades, as a substitute of amount, as I train in my course and members space.

So, what are the markets I commerce?

I do know what you’re in all probability pondering proper about now: “That is all nice Nial however what markets are YOU truly buying and selling and specializing in every day, that’s what I actually wish to know”. In case you weren’t pondering that, my apologies, however both means right here’s my reply…

I do know what you’re in all probability pondering proper about now: “That is all nice Nial however what markets are YOU truly buying and selling and specializing in every day, that’s what I actually wish to know”. In case you weren’t pondering that, my apologies, however both means right here’s my reply…

In case you observe my members’ commentary it’s no secret that you simply’re solely going to see me discuss a most of about 10 to 12 totally different markets over the interval of any given month. Listed below are these markets:

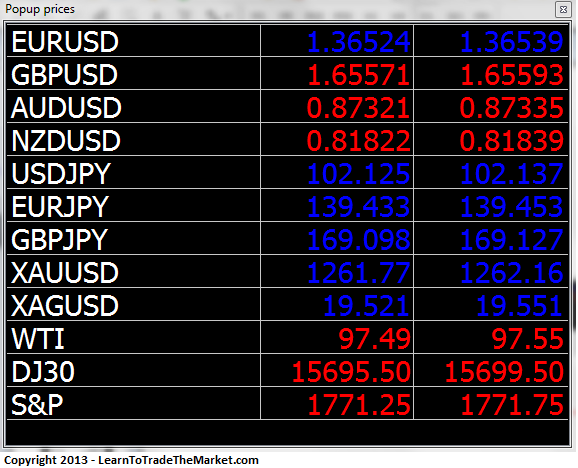

EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY, EUR/JPY, GBP/JPY, Gold / Silver, Oil, Dow index and S&P 500 index

Not solely are these the markets that I focus on probably the most in my members’ commentary every day, they’re additionally those I personally commerce and analyze probably the most, actually, I not often even take a look at another markets in addition to these 12. For an much more centered checklist, I in all probability spend extra time on the EUR/USD, GBP/USD, AUD/USD, GBP/JPY, Gold, Oil and Dow than any of the others, these are my 7 favourite markets. What number of markets are you making an attempt to commerce? In my view, if it’s any greater than 12, it’s means too many. My suggestion is to start out with my checklist of 12 markets right here and decide your 5 to 7 favorites and stick to them; study their conduct intimately and develop into a ‘specialist’ of them.

This text is written utilizing pictures from the buying and selling platform that we use, if you happen to don’t but have that platform you possibly can obtain it right here.

Market correlation and why I actually dislike sure markets

I really feel it’s essential to shortly go over market correlations in addition to clarify why I don’t commerce sure markets as I do know a few of you’ll have questions on these items. Listed below are my solutions:

You might need 20 Foreign exchange pairs in your watch checklist proper now and greater than half of them are correlated (correlation implies that sure markets have a tendency to maneuver in the identical course). I see no cause to observe greater than 3 to five of the key / prime liquid forex pairs, as a result of when you begin including extra, the correlations enhance and that may enhance the chance for doubling up danger as we talked about above, or over-trading. As for inventory indexes, the key indexes to some extent are correlated in order that’s why I primarily stick with the Dow, S&P 500 and my native market.

Listed below are a few of the markets I hate to commerce and why: Of the key forex pairs, I actually don’t ever take a look at or commerce the USD/CHF or USD/CAD, primarily as a result of from my expertise they each are likely to behave in a uneven and erratic vogue. The USD/CHF has a really robust inverse correlation with the EUR/USD, so there actually isn’t any level in taking a look at each of those markets, I want the EUR/USD.

I additionally hate to commerce any of the unique forex pairs, these could be forex pairs that embrace a forex from a creating / rising economic system within the pair. These markets are very erratic and have very large spreads and low liquidity, all unhealthy issues for a dealer.

It’s time to take motion

Now that you recognize what my favourite markets are and why, it’s best to cut back the variety of markets you’re buying and selling, it’s time to take motion. I would like you to de-clutter your quote board after you end studying this lesson, and don’t fear if you happen to assume you don’t understand how, I’m going to indicate you proper now…

In your MetaTrader 4 buying and selling platform:

1) Discover and open the “market watch” window. Beneath is what the market watch window will appear like after you full these 8 steps:

2) It is best to see a display seem with some or the entire markets supplied.

3) Now, proper click on anyplace within the “market watch” window, it’s best to see a menu seem with varied choices.

4) That is the place you possibly can decide and select which forex pairs you observe. It’s possible you’ll wish to first choose “present all” to open all markets after which you possibly can scale them down from there. You will want to first choose a forex pair if you wish to cover it, then proper click on and choose “cover”, it’s going to now disappear out of your market watch menu. (Observe: you probably have an open commerce or chart you can’t cover the quote of the forex pair from the commerce you might be in, it’s good to shut the chart first or wait until your commerce is completed)

5) To reverse this simply click on “present all” and all of the forex pairs will pop again up.

6) You too can simply click on on “symbols” after which undergo and conceal or present which ever forex pairs you need.

7) When you get your watch checklist set, proper click on out there watch window once more and go to “units” and reserve it. It can save you a number of watch lists if you need.

8) Hit F10 and a pop-up worth menu of your at the moment opened watch checklist will seem. It is a helpful little brief lower that you need to use to test the costs of all of the devices in your watch checklist in a short time so that you simply don’t need to have the watch checklist window open on a regular basis. Right here’s what it seems like:

Now you recognize my favourite markets and why I want to concentrate on them. If you wish to find out how I commerce these markets efficiently utilizing easy but efficient worth motion methods, try my worth motion buying and selling course.