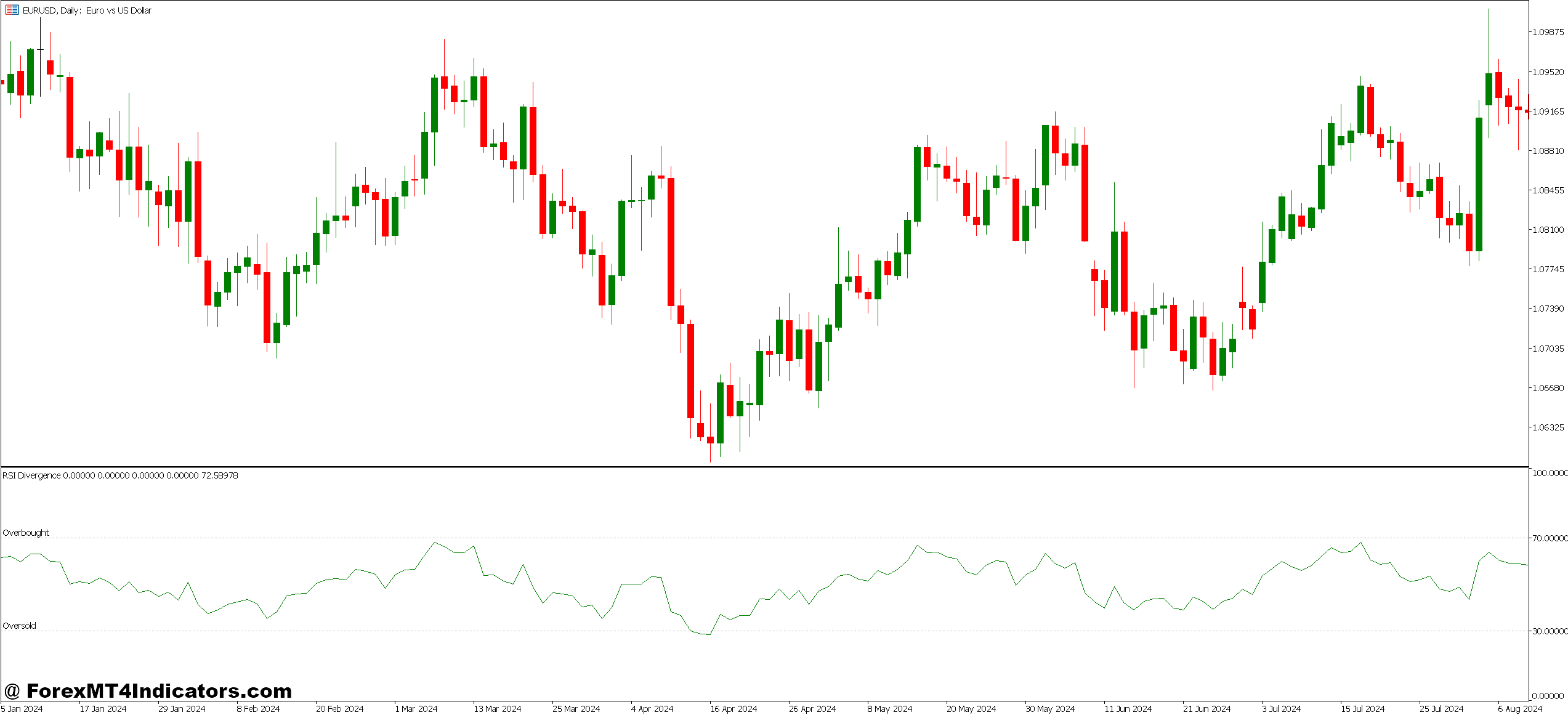

The MT5 divergence indicator solves this downside. It routinely scans charts for these price-momentum discrepancies, highlighting potential reversal factors earlier than they turn out to be apparent. No extra squinting at oscillators or second-guessing what you’re seeing. The indicators seem instantly on the chart, giving merchants an edge in timing entries and exits.

Understanding Divergence in Technical Evaluation

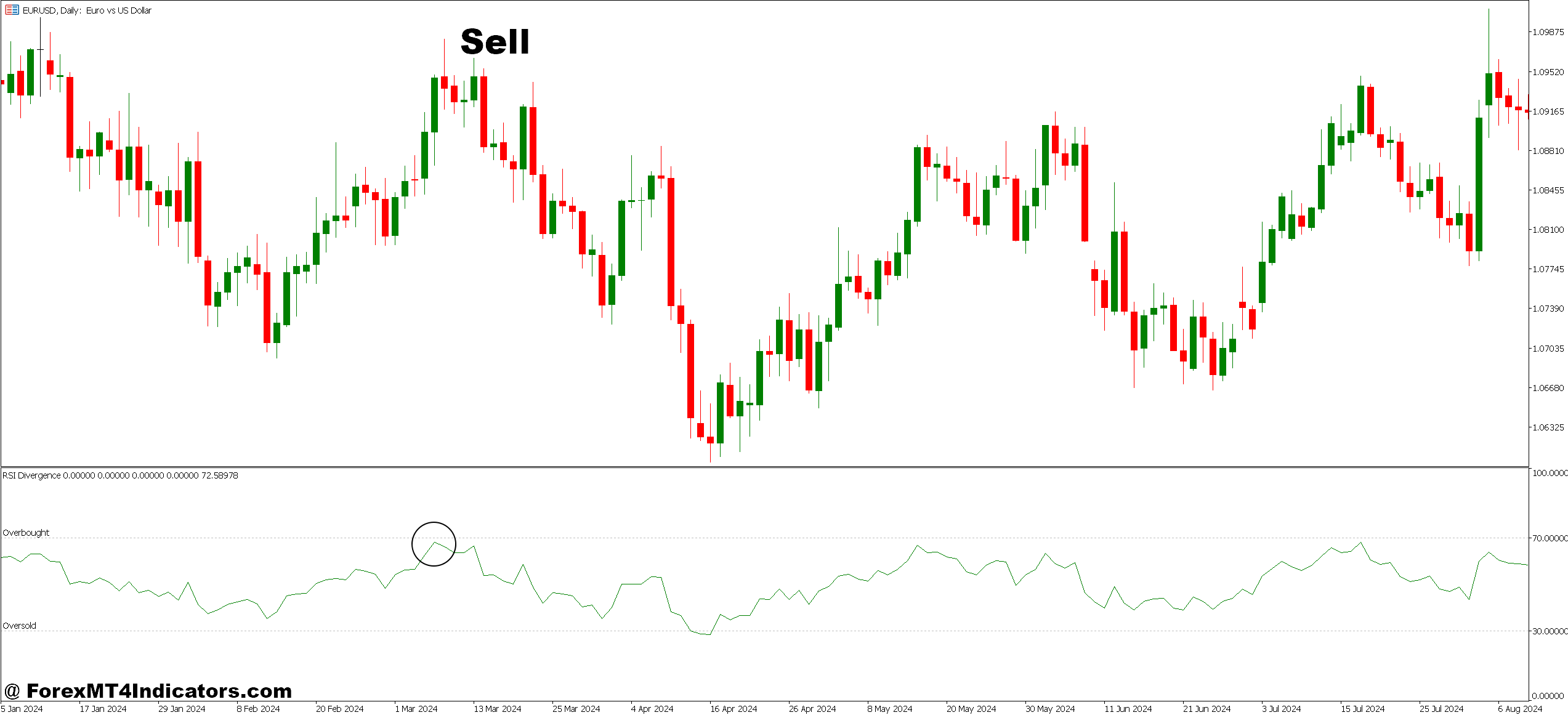

Divergence happens when worth motion and a momentum oscillator transfer in reverse instructions. The MT5 divergence indicator usually works with in style oscillators like RSI, MACD, or Stochastic to establish these mismatches. When EUR/USD hits a better excessive however the RSI makes a decrease excessive, that’s bearish divergence—momentum is weakening regardless of worth pushing larger.

The logic is simple. Value displays what’s occurring. Momentum indicators present the energy behind these strikes. Once they disagree, one thing’s received to offer. Normally, it’s worth that adjusts to match momentum.

Right here’s the factor: Not all divergences are created equal. Common divergence indicators potential reversals. Hidden divergence signifies pattern continuation after pullbacks. The MT5 indicator could be configured to identify each sorts, although most merchants deal with common divergence for reversal trades.

The calculation technique will depend on which oscillator the indicator pairs with. For RSI-based divergence, the software compares swing highs and lows within the 14-period RSI towards corresponding worth pivots. It attracts connecting traces routinely when it detects misalignment. Some variations embrace alert capabilities that notify merchants the second divergence varieties.

Actual-World Utility: Buying and selling the Alerts

Testing this indicator on USD/JPY in the course of the March 2024 volatility spike revealed its sensible worth. On the every day chart, the value made a decrease low at 147.20, however the MACD histogram printed a better low. Traditional bullish divergence. Merchants who entered lengthy at that sign caught a 200-pip rally over the subsequent week.

However context issues. That very same setup would’ve failed in a robust downtrend with out extra affirmation. Good merchants mix divergence with help/resistance ranges. When bullish divergence seems at a serious help zone, the likelihood improves dramatically. The indicator identifies the sign; the dealer evaluates whether or not the market construction helps the commerce.

Timeframe choice adjustments the whole lot. On the 15-minute chart, divergence indicators hearth continuously—most end in minor pullbacks or fail. The 4-hour and every day charts produce fewer however higher-quality indicators. A divergence that develops over a number of days carries extra weight than one which varieties in a couple of hours.

One sensible strategy: Use divergence on larger timeframes for course, then drop to decrease timeframes for exact entries. When the every day chart reveals bearish divergence on AUD/USD, look forward to a 1-hour bearish engulfing candle to enter quick. This layered technique reduces false entries.

Customizing Settings for Totally different Markets

Most MT5 divergence indicators enable parameter changes. The pivot sensitivity controls how simply the indicator identifies swing factors. Decrease settings (3-5) mark each minor wiggle as a pivot, creating noise. Increased settings (10-15) solely flag vital swings, lowering false indicators however probably lacking legitimate divergences.

The oscillator interval impacts sign technology, too. A 14-period RSI is commonplace, however shorter durations like 9 create sooner, extra responsive indicators. That works for scalping unstable pairs like GBP/JPY throughout London session hours. Longer durations like 21 or 25, easy out noise, higher suited to swing buying and selling main pairs like EUR/USD.

Alert customization issues for merchants monitoring a number of charts. Set the indicator to set off push notifications when divergence varieties on particular timeframes. This prevents lacking setups whereas specializing in different duties. Some superior variations embrace filters that solely alert when divergence seems close to key worth ranges.

Colour coding helps distinguish sign high quality. Many indicators use totally different colours for normal versus hidden divergence, or for sturdy versus weak indicators primarily based on the divergence angle. Steeper divergence angles usually point out stronger momentum shifts.

Strengths and Trustworthy Limitations

The MT5 divergence indicator excels at figuring out potential reversals earlier than they’re apparent on worth alone. It really works throughout all forex pairs and timeframes, offering constant logic no matter market situations. Automation saves time—no handbook comparability of oscillator peaks and worth pivots required.

That mentioned, divergence is a number one indicator, which suggests early indicators and false positives. Not each divergence results in a reversal. In sturdy trending markets, costs can stay “diverged” for prolonged durations, creating losses for counter-trend merchants. The 2023 USD rally supplied numerous bearish divergence indicators that failed because the greenback stored climbing.

Whipsaws occur, particularly on decrease timeframes. The indicator would possibly sign divergence, worth reverses briefly, then continues the unique course. Cease losses get hit earlier than the precise reversal happens. This frustrates merchants who don’t perceive that divergence indicators likelihood, not certainty.

In contrast to some indicators that can be utilized in isolation, divergence requires context. A divergence sign close to no vital help or resistance degree, with no pattern exhaustion indicators, carries minimal worth. Merchants have to combine worth motion evaluation, market construction, and generally extra indicators for affirmation.

Buying and selling foreign exchange carries substantial danger. No indicator ensures earnings. The MT5 divergence indicator identifies potential setups, however danger administration, place sizing, and market understanding decide long-term success. Relying solely on divergence indicators with no correct technique results in inconsistent outcomes.

How Divergence Compares to Different Reversal Indicators

Candlestick patterns like engulfing candles or capturing stars additionally sign reversals, however they’re reactive—exhibiting what occurred after the reversal begins. Divergence presents warning, giving merchants higher entry factors. The trade-off? Extra false indicators attributable to that main nature.

Transferring common crossovers lag considerably. By the point two MAs cross, a lot of the reversal transfer has already occurred. Divergence can spot exhaustion whereas the pattern continues to be energetic, permitting entries nearer to the turning level with tighter stops.

In comparison with the Relative Energy Index alone, the divergence indicator supplies visible readability. Uncooked RSI requires merchants to manually evaluate peaks and worth motion. The automated drawing of divergence traces and alert capabilities make sample recognition easy, particularly for much less skilled merchants.

Methods to Commerce with MT5 Divergence Indicator

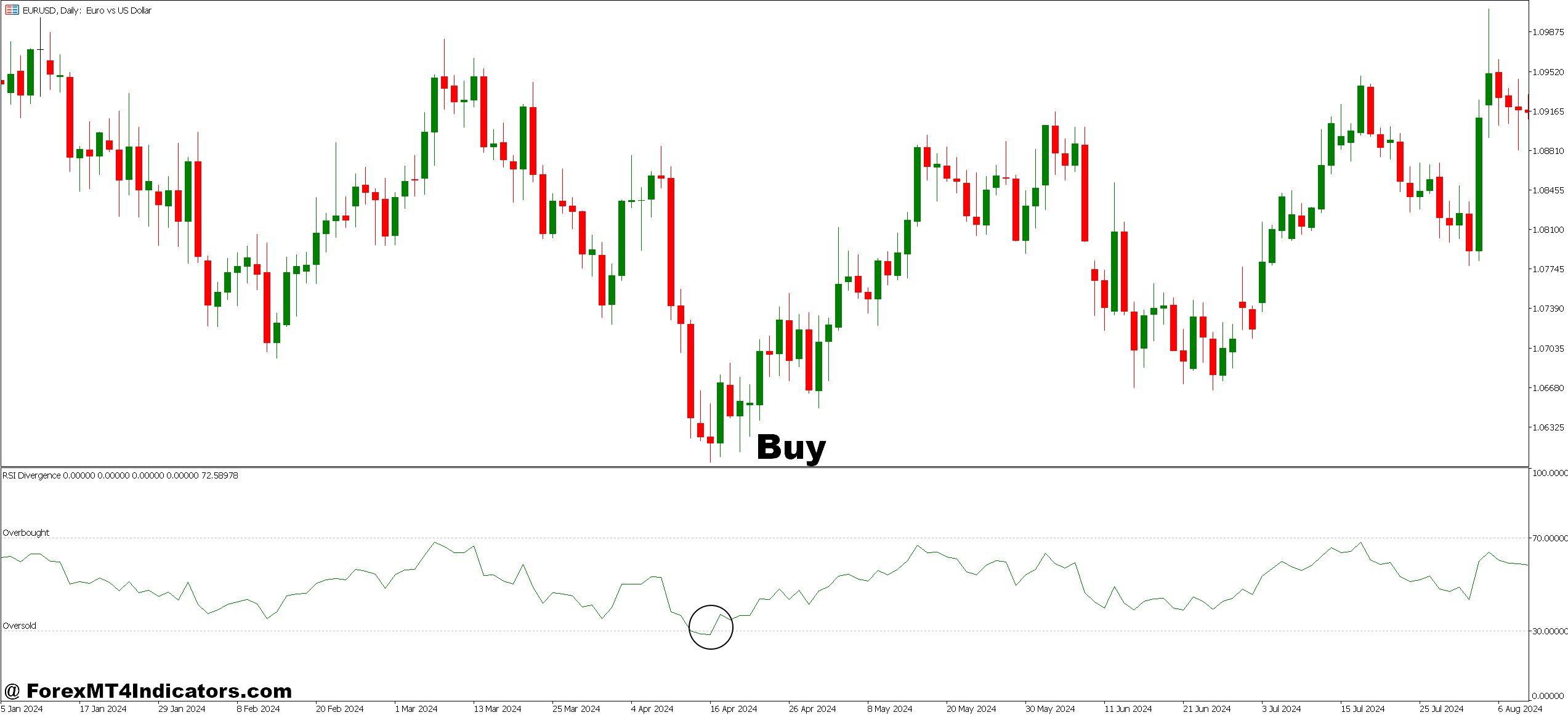

Purchase Entry

- Establish bullish divergence at help – Look ahead to worth to make a decrease low close to a key help degree (like EUR/USD at 1.0500) whereas your oscillator reveals a better low on the 4-hour chart or above.

- Affirm with worth motion – Don’t enter on divergence alone; look forward to a bullish engulfing candle or pin bar to type after the divergence sign earlier than going lengthy.

- Set stops under the swing low – Place your cease loss 10-20 pips under the value low that created the divergence to guard towards false indicators and prolonged strikes.

- Goal 2:1 risk-reward minimal – If risking 30 pips on GBP/USD, intention for at the least 60 pips revenue to the subsequent resistance degree to account for the 40-50% divergence failure fee.

- Keep away from in sturdy downtrends – Skip bullish divergence indicators when worth is under the 200-period transferring common on the every day chart; counter-trend trades fail extra typically in established traits.

- Verify larger timeframe alignment – Solely take 1-hour bullish divergence if the 4-hour or every day chart reveals no conflicting bearish divergence or sturdy downward momentum.

- Danger 1% most per sign – Divergence produces false indicators commonly, so by no means danger greater than 1% of your account on a single setup, no matter how “good” it appears to be like.

- Use hidden divergence for pullback entries – When EUR/USD is in an uptrend and makes a better low with the oscillator exhibiting a decrease low, enter lengthy as this indicators pattern continuation, not reversal.

Promote Entry

- Spot bearish divergence at resistance – Search for worth making a better excessive at a key resistance zone (like GBP/USD at 1.2800) whereas RSI or MACD prints a decrease excessive on 4-hour charts or larger.

- Look ahead to affirmation candle – Enter quick solely after a bearish engulfing, capturing star, or sturdy rejection candle varieties following the divergence sign in your chosen timeframe.

- Place stops above the swing excessive – Set your cease loss 10-20 pips above the value excessive that created the divergence to keep away from getting stopped out by minor fluctuations earlier than the reversal.

- Scale out at key ranges – Take 50% revenue on the first help degree (usually 30-50 pips on majors), then path your cease to breakeven on the remaining place.

- Skip in sturdy uptrends – Ignore bearish divergence when worth is making larger highs above the 200 EMA on every day charts; pattern energy typically overpowers divergence indicators.

- Require a number of timeframe affirmation – In case you see bearish divergence on the 1-hour chart, confirm that the 4-hour chart isn’t exhibiting bullish momentum or opposing divergence patterns.

- Keep away from throughout main information occasions – Don’t take divergence indicators half-hour earlier than or after high-impact information releases like NFP or central financial institution choices; volatility invalidates technical indicators.

- Exit if divergence invalidates – Shut your quick place instantly if worth makes a brand new larger excessive with the oscillator additionally making a better excessive, because the divergence sample has failed.

Making the Indicator Work for You

The MT5 divergence indicator shines when merchants perceive its position: A filter and timing software, not a whole buying and selling system. It identifies the place reversals would possibly happen. Affirmation from worth motion, help/resistance, or pattern evaluation determines which indicators to take.

Begin by backtesting on main pairs throughout totally different market situations. Discover which timeframes produce one of the best risk-reward setups in your buying and selling type. Scalpers would possibly discover the 5-minute chart workable with strict filters, whereas place merchants stick with every day divergences solely.

Mix it with danger administration that accounts for the false sign fee. If divergence indicators win 60% of the time, place sizing and cease placement have to replicate that. Don’t danger greater than 1-2% per commerce no matter how “good” the divergence appears to be like.

In observe, the indicator serves merchants finest as a heads-up system. When it flags divergence on EUR/GBP, that’s a cue to look at worth motion carefully for reversal affirmation. The divergence creates the thesis; worth motion supplies the entry set off. That two-step strategy filters out many dropping trades whereas holding the winners.

Really useful MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90